|

市场调查报告书

商品编码

1629771

製造业中的企业移动性:市场占有率分析、产业趋势与成长预测(2025-2030)Enterprise Mobility in Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

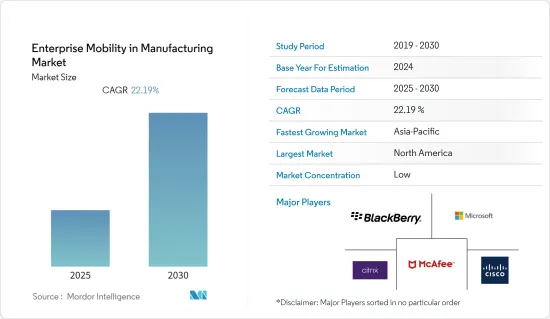

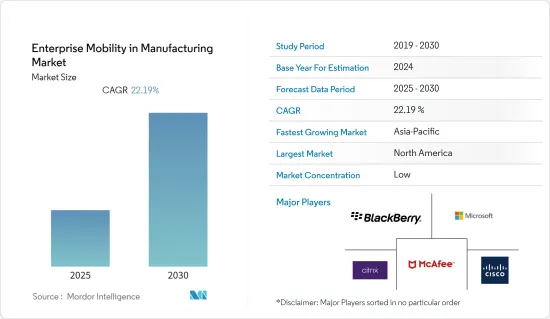

预计製造业企业移动市场在预测期间内复合年增长率为22.19%

主要亮点

- 对改善业务流程的需求导致製造业越来越多地采用企业行动解决方案来提高生产力和品质。移动性是这项发展的关键因素,因此行动技术被用于工业流程并正在改变产业。

- 在製造业中,行动应用程式被用作行销工具来扩大公司的基本客群,并用作客自订企业应用程式来改善内部流程和员工沟通。这些计划有助于提高产量、降低成本、提高效率和客户服务。在过去的二十年里,世界的数位连结取得了巨大的发展,每年都达到新的水平。

- 此外,物联网 (IIoT) 正在加速製造业中的企业行动使用案例。物联网设备自动处理仓库、库存和开发週期监控。 IIoT 利用机器对机器 (M2M) 连接、工业巨量资料分析和网路安全等技术,为使用者提供无与伦比的效率和效能。因此,人们在生产车间的互动和行为方式正在改变。

- 但是,所有行动管道都必须具有适当的身份验证和适当层级的公司网路管治。在某些情况下,可能还需要维护不同的使用者身分。使用个人设备时,必须保护企业应用程式以避免资料外洩。因此,安全漏洞将限制市场扩张。

- 鑑于 COVID-19 在全球的传播,雇主被迫为其员工提供远端工作机会,以便在远离公司基础设施的地方履行业务。许多公司也设立了BYOD计划,让员工可以使用自己的设备进行业务,以在疫情危机期间保持业务连续性。拥有远端员工的公司可以确保员工在家工作时能够存取有效工作所需的公司资源和设备。这些因素鼓励大型企业利用製造业企业行动管理工具。

製造企业行动市场趋势

物联网 (IIoT) 加速市场使用案例

- 随着製造业进入第四次工业革命,实施支援物联网的企业移动性已成为一种要求,而不是一种选择。连结的行动装置可协助生产商在其设施中收集和分析资料,从而实现灵活高效的流程,以公平的价格生产优质的产品。

- 此外,工业IoT设备可以向工厂技术人员发出停机、故障、意外异常等警报,透过减少机器停机时间来提高吞吐量。工业物联网设备在製造业中提供的这些优势可能会在预测期内推动市场成长。

- 此外,利用物联网为企业量身打造的行动解决方案可以帮助企业主监控和管理地上和地下的业务。这些解决方案还可以优化各种流程,以提高产量和效率。按时完成任务还可以提高生产力。

- 此外,预计未来五年自主机器人的使用将显着增加工业物联网,特别是在涉及低价值、潜在危险或高风险业务的供应链活动中。例如,製造、组装和仓储已经严重依赖自主机器人。自主机器人可能会继续在这些供应链领域扩张,从而释放人类劳动力,从事更具策略性、无风险和高价值的工作。

- 例如,根据IFR统计,去年中国引进工业机器人约243,530台,与前一年同期比较成长44.95%。工业机器人的大幅成长可能会推动工业物联网的成长,从而带动市场成长。

亚太地区实现显着成长

- 由于人工智慧、巨量资料等技术复杂的解决方案的接受度不断提高,以及亚太地区全部区域对云端基础设施的采用,亚太地区对 BYOD 以及企业行动解决方案和服务的需求进一步增强。

- 工业 4.0 的结果是,各组织的製造流程中越来越多地使用物联网和行动装置等行动技术。除了密切关注製成品的供需之外,该公司还部署复杂的应用程式。因此,可以消除供需之间的不平衡,同时降低成本并提高效率。您可以使用 EMM 软体评估工业应用,并确保收集的资源可供存取。

- 此外,在未来几年,由于各行业的 IT 投资增加以及数位化、智慧城市和智慧国家等众多政府计划,亚太地区的 BYOD 和商务行动市场预计将扩大。

- COVID-19 的爆发影响了该地区的众多工业部门。该地区的製造公司预计将增加对新企业行动技术的需求,以支持在家工作的趋势并确保公司的最佳产出。电子商务行业的快速扩张和整个零售业的数位化预计将推动市场成长。此外,随着公司采用企业移动性解决方案,供应链生产力也不断提高。

製造业企业旅游产业概况

製造业企业行动市场较为分散,大多数公司提供跨所有产业(包括製造业)的企业行动解决方案。供应商正在发布最新版本的行动软体,以跟上工业 4.0 等最新技术的发展。市场上的一些主要企业包括 Blackberry Limited、Cisco Systems, Inc.、Citrix Systems, Inc.、Microsoft Corporation、McAfee, LLC 等。

2023 年 1 月,全球软体和技术服务供应商 Crave-InfoTech 发布了 cMaintenance,这是一款由 SAP 业务技术平台 (BTP) 提供支援的新产品。该产品适合将工业 4.0、製程自动化、企业移动性和预测性维护引入製造业。它是跨平台的,可以在线上和离线工作,并且与 Windows、Apple iOS 和 Android 相容。

2022 年 9 月,塔塔咨询服务公司发布了 TCS 行动云端套件。 TCS Mobility Cloud Suite 是一款全面的云端支援套件,可协助汽车零件製造商和製造商应对快速的市场变化并加速生态系统发展。由于数位技术的发展、消费者期望的提高、汽车的电气化以及供应链的持续中断以及对永续性的需求,汽车製造商和供应商被要求改变合作方式以加速发展,行业内的传统分工正在变得模糊。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业物联网 (IIoT) 带来使用案例增加

- BYOD 概念的采用率有所提高

- 市场限制因素

- 製造供应商之间的安全漏洞正在阻碍市场成长。

- 政府法规和基础建设发展构成市场挑战

第六章 市场细分

- 按设备

- 智慧型手机

- 笔记型电脑

- 药片

- 按发展

- 本地

- 云

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Blackberry Limited

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- McAfee, LLC

- Microsoft Corporation

- MobileIron, Inc.

- Oracle Corporation

- SAP SE

- Broadcom Inc.(Symantec Corporation)

- Infosys Limited

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Tylr Mobile, Inc.

- VMware, Inc.

- Workspot, Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Enterprise Mobility in Manufacturing Market is expected to register a CAGR of 22.19% during the forecast period.

Key Highlights

- Due to the demand for business process improvement, the manufacturing sector has increasingly implemented Enterprise Mobility solutions that allow manufacturers to raise their productivity and quality. Mobile technology is being used in industrial processes, transforming the industry because mobility is a crucial factor in this development.

- Mobile apps are being utilized in the manufacturing sector as a marketing tool to broaden the company's customer base and custom enterprise apps to improve internal processes and staff communication. These programs contribute to higher production, cost-cutting, efficiency improvement, and customer service. The last two decades have seen remarkable growth in worldwide digital connection, which has reached new dimensions every year.

- Further, the Industrial Internet of Things (IIoT) has accelerated enterprise mobility use cases in the manufacturing sector. IoT devices automatically handle warehouses, inventory, and development cycle monitoring. The IIoT offers its users uncompromised levels of efficiency and performance with the aid of technologies like Machine-to-Machine (M2M) connectivity, industrial Big Data analytics, and cybersecurity. As a result, this is altering how individuals interact and conduct themselves in a manufacturing setting.

- However, all mobile channels must have the proper authentication in place, and appropriate levels of corporate network governance must be in place. In some circumstances, it will also require the maintenance of various user identities. Data leakage must be avoided by securing enterprise apps when utilizing personal devices. As a result, a security vulnerability limits market expansion.

- Employers were compelled to give their staff members access to remote work opportunities to conduct business away from the corporate infrastructure concerning the global transmission of COVID-19. Many companies have also created a BYOD scheme that permits staff to use their own devices for work amid this pandemic crisis to maintain company continuity. Companies who use a remote workforce may be ensured their workers have access to company resources while working from home and the necessary equipment to be efficient. These elements encouraged big businesses to use enterprise mobility management tools in the manufacturing sector.

Enterprise Mobility in Manufacturing Market Trends

Industrial Internet of Things (IIoT) has Accelerated the Use-cases in the Market

- The manufacturing sector has entered the fourth industrial revolution, making the deployment of IoT-enabled corporate mobility more of a requirement than a choice. The linked mobile device aids producers in collecting and analyzing data across equipment, enabling flexible and efficient processes to produce high-quality products at reasonable prices.

- Further, Industrial IoT devices may alert factory technicians about downtime, breakdowns, unforeseen anomalies, etc., which can boost throughput by lowering machine downtime. Such benefits offered by IIoT devices in the manufacturing sector may drive market growth in the forecast period.

- Moreover, IoT-powered customized mobility solutions for enterprises may help business owners monitor and manage operations on and off the ground. These solutions can also optimize various processes to raise output and efficiency. Meeting deadlines can also benefit from increased productivity.

- Furthermore, autonomous robot usage is anticipated to increase IIoT significantly over the next five years, especially in supply chain activities that include low-value, potentially hazardous, or high-risk duties. For instance, manufacturing, final assembly, and warehousing are already heavily reliant on autonomous robots. Autonomous robots will probably continue to expand in these supply chain sectors in the future, freeing up human labor for more strategic, risk-free, and valuable jobs.

- For instance, according to IFR, industrial robots in China were recorded to be around 243,530 units last year, a 44.95% rise in the installations compared to the previous year. The significant increase in industrial robots could drive the IIoT growth, thereby responsible for the market growth.

Asia-Pacific to Witness the Significant Growth Rates

- The need for BYOD & business mobility solutions and services throughout the region is being further driven by the increased acceptance of technologically sophisticated solutions like artificial intelligence, big data, etc., along with the adoption of cloud infrastructure across various Asia-Pacific countries.

- The usage of mobile technologies, such as IoT and mobile devices, in manufacturing processes across organizations has increased as a result of Industry 4.0. Companies deploy sophisticated apps in addition to keeping an eye on supply and demand for the created goods. As a result, they can close the supply-demand imbalance while also cutting costs and increasing efficiency. They can assess the industrial application with the aid of the EMM software and guarantee that the resources they have gathered are accessible.

- Additionally, it is expected that in the upcoming years, the Asia-Pacific BYOD & business mobility market will increase due to growing IT investment across various industries and numerous government programs, including digitalization, smart cities, and smart nations.

- The COVID-19 epidemic has impacted numerous regional industry sectors. Manufacturing enterprises in the region are anticipated to boost demand for new enterprise mobility technologies in order to support the work-from-home trend and guarantee optimum company outputs. The rapid expansion of the e-commerce industry and digitalization across the retail sector would fuel market growth. Furthermore, the supply chain's productivity is being increased by businesses employing corporate mobility solutions.

Enterprise Mobility in Manufacturing Industry Overview

The Enterprise Mobility in Manufacturing Market is fragmented, with most players providing enterprise mobility solutions across all sectors, including manufacturing. Vendors are releasing the latest versions of mobility software to keep up with the latest technological developments, such as Industry 4.0. Some significant players in the market include Blackberry Limited, Cisco Systems, Inc., Citrix Systems, Inc., Microsoft Corporation, McAfee, LLC, etc.

In January 2023, Crave-InfoTech, a global provider of software and technology services, announced cMaintenance, a new product driven by the SAP Business Technology Platform (BTP). This product is suitable for bringing Industry 4.0, Process Automation, Enterprise Mobility, and Predictive Maintenance to the manufacturing sector. It is cross-platform, works online or offline, and is compatible with Windows, Apple iOS, and Android.

In September 2022, Tata Consultancy Services introduced TCS Mobility Cloud Suite, a comprehensive toolkit of cloud-enabled software that will assist automotive suppliers and manufacturers in adjusting to the swift changes in their market and accelerating the growth of their ecosystems. The traditional divisions within the industry are becoming more ambiguous as a result of the development of digital technologies, rising consumer expectations, and the electrification of vehicles, not to mention the ongoing disruptions to the supply chain and the need for sustainability, which are requiring automakers and suppliers to change how they collaborate to hasten the automotive enterprise transformation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Industrial Internet of Things (IIoT) has Accelerated the Use-cases in the Market

- 5.1.2 Increasing Implementation of the BYOD Concept

- 5.2 Market Restraints

- 5.2.1 Security Vulnerability for Manufacturing Vendors is Discouraging the Market Growth.

- 5.2.2 Government Regulations and Infrastructure Maintenance act as Market Challenges

6 MARKET SEGMENTATION

- 6.1 By Device

- 6.1.1 Smartphones

- 6.1.2 Laptops

- 6.1.3 Tablets

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blackberry Limited

- 7.1.2 Cisco Systems, Inc.

- 7.1.3 Citrix Systems, Inc.

- 7.1.4 McAfee, LLC

- 7.1.5 Microsoft Corporation

- 7.1.6 MobileIron, Inc.

- 7.1.7 Oracle Corporation

- 7.1.8 SAP SE

- 7.1.9 Broadcom Inc. (Symantec Corporation)

- 7.1.10 Infosys Limited

- 7.1.11 TATA Consultancy Services Limited

- 7.1.12 Tech Mahindra Limited

- 7.1.13 Tylr Mobile, Inc.

- 7.1.14 VMware, Inc.

- 7.1.15 Workspot, Inc.