|

市场调查报告书

商品编码

1640683

企业行动安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Enterprise Mobility Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

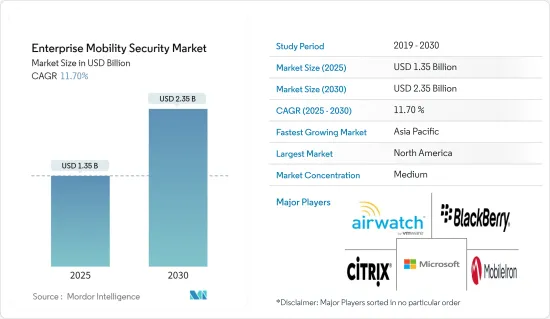

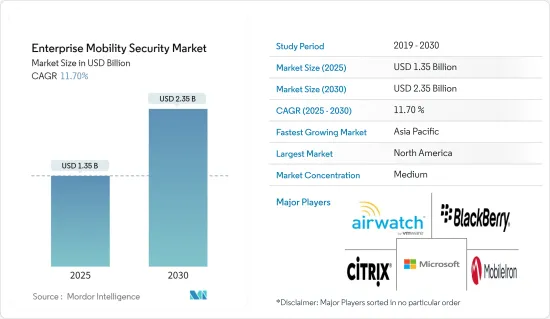

企业行动安全市场规模在 2025 年估计为 13.5 亿美元,预计到 2030 年将达到 23.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.7%。

企业移动性或业务移动性是指公司间的移动性,它提供远端工作选项,允许个人行动/笔记型电脑设备用于业务目的,并有效利用云端技术进行资料存取。

主要亮点

- 云端基础的服务为供应商提供了巨大的优势,因为它们允许他们根据用户数量灵活地提供解决方案并在不中断服务的情况下进行更新。由于很难从一个解决方案提供者转换到另一个解决方案提供商,因此此类解决方案对新客户的竞争非常激烈。建立可支援的基础设施需要花费大量的时间和成本。

- 受访的供应商为其解决方案提供跨平台支持,以满足企业支援员工使用的多种设备的需求。 Android、Windows、iOS、macOS 和 Samsung Knox 是部分支援的平台。 EMS 提供统一的启动器来存取您的所有应用程式、安全的浏览器、电子邮件、日历、联络人和卡片、个人设备上的单独公司 ID、安全的即时通讯软体、安全的笔记以及安全的云端存储,提供以下任何或所有这些服务(包括存取受保护的文件)可以提供安全的业务生产力。

- 在现代工作空间中,自带设备 (BYOD) 和行动场景变得越来越重要,EMS 可协助 IT 管理员应对资料保护和风险管理的挑战。此外,5G的引进预计将进一步改变企业移动格局。因为5G可以让远距工作更快、更容易。 5G 预计将提供更可靠的体验,并为企业及其员工提供更大的灵活性。

- 由于许多企业仍在运行旧版作业系统,供应商面临市场挑战。这些挑战迫使市场参与者提供对旧版本作业系统的支持,作为切换到新平台的一次性成本,导致多家供应商以最低成本提供解决方案。

- COVID-19 的蔓延增加了对 EMS 解决方案的需求。据 Owl Labs 称,全球约有 16% 的公司实行完全远距办公,而 40% 的公司则提供办公室内办公和远距办公相结合的方式,这符合许多员工的喜好。随着企业接受在家工作文化,这一数字预计很快就会上升。

企业行动安全市场趋势

银行/保险业占主要市场占有率

- 银行和保险服务正在经历数位化、网路服务和国际贸易推动的业务转型,需要快速缓解。银行、金融服务和保险 (BFSI) 已经从客户访问分行发展到银行在客户家中提供服务。 BFSI 储存其客户和业务合作伙伴的敏感财务和资料,并使用这些数据提供服务。这导致了世界各地金融机构面临安全漏洞的威胁。例如,2022年8月,根据印度政府统计,印度银行共通报248起资料外洩事件,其中私人银行205起,公共服务银行资料。

- 随着银行生态系统的变化,负责人需要在行动中存取核心服务并利用公共网路连接服务来创造独特的用户体验。预测期内,区块链和语音命令整合等新兴技术有望成为 BFSI 的主流,而多因素身份验证有望成为该细分市场的常态。

- 金融机构正在透过其 EMS 采用现代网路安全方法:零信任模型。透过采用这种模式,银行可以自信地支持加强其安全态势的努力并为其员工和客户提供灵活性。

- 引入 EMS 主要是为了满足 BFSI 领域的安全合规性需求。例如,装置配置可协助 BFSI 组织远端配置行动装置并提供对公司资料资源和企业应用程式的存取。 BFSI 应用程式将包括资产管理、房屋抵押贷款、保险等工具,员工需要透过银行外的平板电脑存取金融应用程式来与客户联繫。

- 市场区隔机会主要在于小型银行和合作银行,这些银行仍有数位化和推出此类服务的空间。视讯银行服务的出现有望为企业级银行和保险业务创造机会。

亚太地区将经历最高成长

- 亚太地区由许多新兴经济体组成,该地区各行业数位化趋势日益增强,为企业行动安全市场创造了机会。这是由于智慧型手机、笔记型电脑和平板电脑等行动装置在服务中的使用越来越多,从而带来了业务流程的数位化和分散化,从而带来了灵活性。

- 此外,根据联合国2022年8月发布的《亚太数位转型报告》,过去五年来,行动产业每年都在服务、基础设施和其他进步方面进行投资。其中对亚太地区的投资超过4000亿美元。因此,亚太各国之间以及与亚太地区其他国家之间的联繫日益紧密,从而促进了该地区的市场成长。

- 亚太地区,尤其是中国和印度的公司正在采用 BYOD 来提高员工满意度和生产力。高速网路的兴起和智慧型手机的普及正在推动亚太地区行动资料使用量的快速成长。

- 银行正在实施远距工作工具,以便员工在家工作。金融服务供应商正在推出直播活动,从实体客户活动转变为虚拟客户活动,远端服务的线上培训也在增加。然而,这种情况预计会增加对行动安全服务的需求。

- 5G在政府管理中的应用将支持更聪明的公共、城市和公共机构的发展。各国央行正在使用区块链等底层技术,并支持其使用以鼓励进一步创新。 5G和AI正在推动各行各业的进步。政府可以透过实施智慧交通技术和连网汽车来提高交通运输的效率。数位连结性也为社会帮助他人开启了全新的方式。采用智慧技术的趋势增加了该地区的安全漏洞风险,为该地区各个终端用户行业的企业行动安全市场创造了机会。

企业行动安全产业概况

企业行动安全市场需要变得更有凝聚力。企业对行动安全意识的不断提高,促使市场参与者采取併购、合作和新产品等策略性倡议。市场的一些最新趋势:

2022年10月,领先的行动安全和预防资料外泄独立软体供应商SyncDog Inc.宣布与3Eye Technologies建立合作伙伴关係,为公司的行动和云端策略提供更具创新性和复杂性的产品,以加速发展。透过此次合作,ThinkDog 将利用 3Eye Technologies 的销售能力扩大其市场影响力并与新商业市场和国家的更多客户互动。

2022 年 8 月,爱尔兰行动和云端安全公司 CWSI 收购了 mobco,这是一家总部位于比利时迪尔贝克和卢森堡卡佩伦的现代工作场所和行动公司。透过此次收购,Mobco 的客户将能够获得 CWSI 广泛的技术资源和专业知识,包括由 CWSI 的 Microsoft Gold Security 能力支援的 Microsoft Security Specialty Practice 和 Microsoft Intelligent Security Association 会员资格。

2022 年 7 月,专注于 Apple 的行动供应商 Jamf 与微软的企业行动安全合作,为使用具有企业应用程式的 Mac 提供 Mac 安全性。这些合作关係使企业能够验证使用者凭证,并确保在允许存取之前使用 Microsoft EMS 和 Jamf Mac 管理对 Mac 进行管理并使其合规。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对企业行动安全市场的影响评估

第五章 市场区隔

- 按设备

- 智慧型手机

- 笔记型电脑

- 药片

- 按最终用户

- 银行/保险

- 卫生保健

- 资讯科技和电讯

- 政府

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Blackberry Limited

- MobileIron

- AirWatch

- Citrix Systems Inc.

- Microsoft Corporation

- Cisco Systems Inc.

- McAfee LLC

- Symantec Corporation

- SAP SE

- Oracle Corporation

- Honeywell International Inc.

- IBM Corporation

第七章投资分析

第八章 市场机会与未来趋势

The Enterprise Mobility Security Market size is estimated at USD 1.35 billion in 2025, and is expected to reach USD 2.35 billion by 2030, at a CAGR of 11.7% during the forecast period (2025-2030).

Enterprise mobility or business mobility is recognized as the growing trend among businesses to offer remote working options, which also allows the use of personal mobile/laptop devices for business purposes and makes efficient and effective use of cloud technology for data access.

Key Highlights

- The enterprise's adoption of cloud-based services has been a massive enabler for vendors, as this provides the flexibility of delivering solutions that can be offered based on the number of users and can also be updated without disrupting the services while doing so. Since these solutions are difficult to switch from one solution provider to another, the competition in getting new customers is high. It requires a considerable amount of time and money to create an infrastructure that can be supported.

- The vendors in the market studied offer cross-platform support for their solutions to address the need of enterprises to support multiple device types used by their employees. Android, Windows, iOS, macOS, and Samsung Knox are a few such platforms that are supported. The EMS can provide secure business productivity by providing either or all these services, such as a unified launcher to access all apps, secure browser, email, calendar, contacts or cards, separate corporate identity on personal devices, secure instant messaging, secure notes, and access to cloud-stored files.

- In a modern workspace, where bring-your-own-device (BYOD) and mobility scenarios are gaining increased significance, EMS helps IT administrators meet the challenges of data protection and risk management. Additionally, the introduction of 5G is expected to shape the landscape of enterprise mobility further. This is because 5G will be able to make remote work faster and easier. It will provide a more reliable experience and will also offer businesses and their employees greater flexibility.

- Market vendors face challenges in the market as multiple enterprises have legacy OS still functional in their enterprises. Such challenges make it necessary for the market players to provide support for older versions of OS as a one-time switch cost to a new platform, making it a complicated option for multiple vendors to offer solutions with minimum price.

- The spread of COVID-19 increased the demand for EMS solutions. According to Owl Labs, about 16% of global companies are fully remote, whereas 40% offer in-office and remote work, which is in line with what most employees prefer. This number is expected to increase soon as companies embrace the work-from-home culture.

Enterprise Mobility Security Market Trends

Banking/Insurance Industry to Hold Significant Market Share

- Banking/insurance services have been experiencing a business transition with digitization, internet services, and international transactions require fast redressal. Banking, financial services, and insurance (BFSI) have evolved from being a service that requests the customers to visit for the service to a bank that reaches customers at their homes. BFSI stores critical financial and personal data of the customer and clients and uses them to provide services. This creates a threat for security breaches across financial institutes of many countries worldwide. For instance, in August 2022, according to the government of India, the country reported 248 successful data breaches in the banks, out of which Private sector banks reported 205 data breaches, while PSBs reported 41.

- With the changing banking ecosystem, the banking officers need to access the core services on the move and use public network connectivity services to create a unique user experience. Emerging technologies, such as blockchain and voice command integration, are expected to emerge as mainstream for the BFSI over the forecast period, with multi-factor authentication becoming a norm in the market segment.

- Financial institutions employ a modern cybersecurity approach, the Zero Trust model through EMS. Adopting this model can help banks strengthen their security posture, so they can confidently support initiatives that give employees and customers more flexibility.

- The adoption of EMS has been majorly driven owing to the need to meet security compliance in the BFSI sector. Device provisioning, for instance, aids the BFSI organizations in remotely configuring mobile devices and providing access to corporate data resources and enterprise apps. BFSI apps include tools, such as wealth management, mortgages, and insurance, which the employees need to access financial apps through the tablets outside the banks to connect to the customers, which requires EMS software for security purposes, hence driving the market.

- The market segment's opportunity is majorly in the small-scale and cooperative banks, which still have the scope for digitization and adoption of such services. The emergence of video-based banking services is expected to create an opportunity for enterprise-level banking and insurance businesses.

Asia-Pacific to Witness the Highest Growth

- The Asia-pacific region consists of many emerging economies, and increasing digitalization trends across industries in the region is creating an opportunity for the Enterprise mobility security market because due to digitalization and decentralization of business process for flexibility, the usage of many mobile devices such as smartphones, laptops, and tablets are increasing in the services.

- Additionally, according to the Asia-Pacific digital transformation report published in August 2022 by the United Nations, the mobile industry has made yearly investments in services, infrastructure, and other advancements over the past five years. More than USD 400 billion of this total was invested in Asia and the Pacific. As a result, the countries of the Asia-Pacific are becoming more connected to one another and to the rest of the globe, which is fuelling the market growth in the region.

- Companies in the Asia-Pacific region are embracing BYOD to increase employee satisfaction and productivity, especially in China and India. The growth in high-speed network coverage and smartphone adoption leads to a surge in the use of mobile data in Asia-Pacific.

- Banks have activated remote working tools, allowing their employees to work from home. Financial service providers have deployed live-stream events moving from physical to virtual customer events, and online training for remote servicing is picking up. However, these kinds of scenarios are expected to increase the demand for mobility security services.

- The adoption of 5G in government administration supports the development of smarter utilities, cities, and public safety agencies. Central banks are using the underlying technologies, such as blockchain, and they support the use of technology to encourage further innovation. Due to 5G and AI, every industry is evolving; the government can increase its transportation productivity by implementing smart transportation technologies and connected vehicles. Digital connections have also given society a whole new way to help people. This trend of adoption of smart technology increases the risk of security breaches in the region, which is creating an opportunity for the enterprise mobility security market across various end-user industries in the region.

Enterprise Mobility Security Industry Overview

The enterprise mobile security market needs to be more cohesive. Players in the market adopt strategic initiatives such as mergers and acquisitions, partnerships, and new product offerings due to increasing awareness regarding mobility security among enterprises. Some of the recent developments in the market are:

In October 2022, SyncDog Inc, the leading Independent Software Vendor for mobile security and data loss prevention, announced a partnership with 3Eye Technologies to accelerate the development of a more innovative, more complex product for its mobility and cloud strategy. SyncDog would leverage 3Eye Technologies' distribution capabilities through these partnerships to build upon its growing market presence and engage with more customers across new commercial markets and nations.

In August 2022, CWSI, a mobile and cloud security company in Ireland, acquired mobco, a modern workplace and mobility firm located in Dilbeek, Belgium, and Capellen, Luxembourg. Due to the acquisition, the customers of mobco would have access to the extensive technical resources and expertise of CWSI, including its dedicated Microsoft Security Practice, which has been supported by CWSI's Microsoft Gold Security competency and membership in the Microsoft Intelligent Security Association.

In July 2022, Jamf, an Apple-focused mobility provider, partnered with Microsoft's enterprise mobility security to offer Mac security for using Macs in Enterprise applications. Due to these partnerships, organizations could verify user credentials and check the Mac has been managed and compliant using Microsoft EMS and Jamf Mac management before allowing access.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of COVID-19 Impact on the Enterprise Mobility Security Market

5 MARKET SEGMENTATION

- 5.1 By Device

- 5.1.1 Smartphones

- 5.1.2 Laptops

- 5.1.3 Tablets

- 5.2 By End-User

- 5.2.1 Banking/Insurance

- 5.2.2 Healthcare

- 5.2.3 IT and Telecom

- 5.2.4 Government

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Blackberry Limited

- 6.1.2 MobileIron

- 6.1.3 AirWatch

- 6.1.4 Citrix Systems Inc.

- 6.1.5 Microsoft Corporation

- 6.1.6 Cisco Systems Inc.

- 6.1.7 McAfee LLC

- 6.1.8 Symantec Corporation

- 6.1.9 SAP SE

- 6.1.10 Oracle Corporation

- 6.1.11 Honeywell International Inc.

- 6.1.12 IBM Corporation