|

市场调查报告书

商品编码

1628794

银行业的企业流动性 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Enterprise Mobility in Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

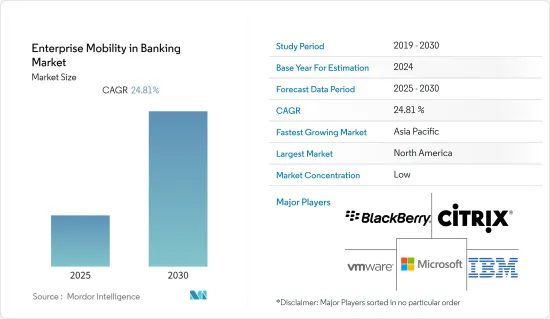

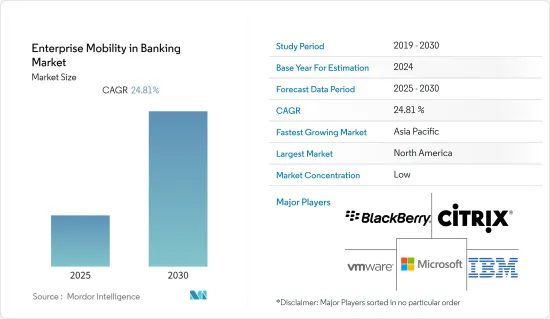

业务企业行动市场预估预测期间内复合年增长率为24.81%

主要亮点

- 行动装置几乎无所不在,并且在企业中表现出类似的趋势。因此,透过适当的控制,企业有望从行动机会中受益,同时确保敏感资料和设备的保护。例如,EMM 实务可确保公司的应用程式、内容和装置完全整合并安全使用,包括安全存取机制。

- 银行和盟友正在朝着允许 BYOD 的方向发展,并要求 EMM 来确保金融交易的资料安全和监管合规性。 macOS、Windows 10 等多种作业系统以及加固设备和物联网 (IoT) 的激增正在扩大行动硬体领域,并使企业能够专注于 EMM。

- 此外,银行业需要一个适当的系统来管理设备的整体库存并追踪设备是否在线上或离线。银行主要需要追踪现场负责人使用的所有行动设备,并确保员工有效地使用它们。无意中使用您的装置观看不相关的影片、玩游戏或安装应用程式可能会降低您的工作效率。

- 此外,冠状病毒的爆发为大多数企业带来了不可预测的全球局势。银行业需要让员工能够远距业务。对促进不间断服务连续性的数位基础设施的需求不断增长,预计将创造对产业行动解决方案的需求。

- 然而,动员的重大挑战和障碍之一是成本高昂。即使采用 BYOD 解决方案,预算也必须涵盖整合、开发、通讯等等。此外,将新的行动应用程式和技术整合到现有基础设施中既昂贵又耗时。

银行业企业行动市场趋势

网路攻击的增加推动市场成长

- 资料外洩会导致成本飙升和有价值的客户资讯遗失。根据去年的X-Force威胁情报指数,X-Force处理的攻击中有22.4%针对金融和保险业,其中70%针对银行。因此,在去年的X-Force行业排名中,金融保险业排名第二。网路攻击者正在攻击金融服务业,寻找获取经济利益最简单的方法。

- 此外,根据思科 2022 年 12 月发布的最新版年度安全成果报告,62% 的受访组织表示,他们在过去两年中经历过影响业务的安全事件,网路安全弹性已成为企业保护的首要任务。使自己免受迅速扩大的威胁。

- 为了保护其 IT 系统、保护敏感的客户资料并遵守政府法规,公共和私人金融机构正在专注于实施最新技术来防止网路攻击。此外,客户期望的提高、技术力的提高和监管要求正在推动银行机构采取主动的安全措施。

- 此外,科技渗透率的提高,加上行动银行和网路银行等数位管道,正在推动客户选择银行服务。银行越来越需要利用高阶身份验证和存取控制流程

北美实现显着成长

- 预计北美将在银行业企业行动市场中占据重要份额,银行采用率的提高和大型供应商的存在是推动该地区市场成长的关键因素。

- 在美国,智慧型手机和平板装置的普及率正在不断提高,BYOD措施很可能会在企业间推广。

- 根据身分盗窃资源中心 (ITRC) 的数据,去年上半年美国发生了 817 起资料外洩事件。这是因为它是骇客可以攻击以闯入公司係统的最脆弱端点。随着最终用户意识的不断增强,预计在预测期内,该国对行动化运营服务的需求将会增加。

- 此外,北美地区尤其是美国的网路攻击正在迅速增加。网路攻击空前高涨,很大程度上是由于该地区行动装置的激增。据 IBM 称,去年美国资料外洩的平均成本为 944 万美元,高于 2021 年的 905 万美元。

银行业 企业移动 产业概况

银行企业行动市场较为分散,许多现有和新参与企业都在本地或透过云端提供行动解决方案。大多数都专注于智慧型手机相关服务。

2022 年 5 月,GEMx Technologies 宣布与 HokuApps 建立合作伙伴关係,在 COVID-19 大流行后加速向数位钱包的过渡。这种合作关係将使我们能够建立企业网路解决方案,以数位化和整合银行和金融服务工作流程,改善客户体验,并为企业提供轻鬆的付款体验。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估 COVID-19 对产业的影响

- 市场驱动因素

- 行动装置日益成为存取网际网路、公司资料和各种其他资讯的首选媒介

- BYOD 趋势不断成长

- 市场问题

- 实施成本高且缺乏员工认可

第五章市场区隔

- 按类型

- 解决方案

- 设备管理

- 存取管理

- 应用程式管理

- 其他解决方案

- 服务

- 解决方案

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争状况

- 公司简介

- BlackBerry Limited

- VMware Inc.

- Citrix Systems Inc.

- IBM Corporation

- Microsoft Corporation

- Mobile Iron Inc.

- Accenture Plc

- Newgen Software Technologies Limited

- Infosys Limited

- HCL Technologies

第七章供应商市场占有率分析

第八章投资分析

第九章 市场未来展望

The Enterprise Mobility in Banking Market is expected to register a CAGR of 24.81% during the forecast period.

Key Highlights

- Mobile devices are almost ubiquitous and are displaying similar trends across enterprises. Thus, deploying appropriate controls in companies is expected to benefit them from mobility opportunities while ensuring that sensitive data and devices are safeguarded. For instance, an EMM policy ensures that the enterprise's application, content, and device are fully integrated and safe to use, including secure access mechanisms.

- The banks and allies are pivoting to allow BYOD and require EMM for secure data and regulatory compliance for their financial exchanges. With the proliferation of multiple OS, like macOS, Windows 10, and ruggedized devices, along with the Internet of Things (IoT), the mobile hardware context enlarges, enabling enterprises to focus on EMM.

- Further, the banking industry needs a proper system to manage the overall inventory of devices and track whether the devices are online or offline. Banks primarily need to keep track of all their mobile devices used in the field by the salesforce and ensure that the employees are using them effectively. Any unintended use of the devices, such as watching non-related videos, playing games, or installing any app, can lead to a loss of productivity.

- Additionally, the coronavirus outbreak caused an unpredictable worldwide situation for most businesses. Banks needed to enable their employees to operate remotely in the banking industry immediately. The rising need for digital infrastructure to facilitate the continuation of uninterrupted services is expected to create a demand for mobility solutions in the industry.

- However, one of the critical challenges and barriers to entry for mobilization is the high cost. Even with BYOD solutions, the budget still has to cover integration, development, telecom, and many others. Also, integrating new mobile apps and technologies into the existing infrastructure can be expensive and time-consuming.

Banking Enterprise Mobility Market Trends

Increase in Cyber Attacks to Drive Market Growth

- Data breaches lead to an exponential cost rise and the loss of valuable customer information. According to the X-Force Threat Intelligence Index of last year, 22.4% of attacks that X-Force addressed targeted financial and insurance businesses, out of which 70% of attacks were on banks. Thus, financial and insurance businesses were second in X-Force's industry rankings in the previous year. In pursuit of the most straightforward path possible to financial gain, cyber attackers attack the financial services industry.

- Moreover, according to the latest edition of Cisco's annual Security Outcomes Report launched in December 2022, cybersecurity resilience is a foremost priority for companies as they look to protect against a rapidly growing threat landscape as 62 percent of organizations surveyed stated they had experienced a security event that impacted business in the past two years.

- To secure their IT systems, secure customer vital data, and comply with government regulations, public and private banking institutes are focused on executing the latest technology to prevent cyber attacks. Additionally, with higher customer expectations, rising technological capabilities, and regulatory requirements, banking institutions are driven to adopt a proactive approach to security.

- Further, the growing technological penetration, coupled with digital channels, such as mobile banking and internet banking, are becoming customers' preferred choice for banking services. There is a greater need for banks to leverage advanced authentication and access control processes.

North America to Witness Significant Growth

- North America is expected to hold a significant share of enterprise mobility in the banking market, with the increasing adoption among banks and the presence of major vendors acting as the primary factors driving the market growth in the region.

- The penetration of smartphones and tablets is rising in the United States, which will likely propel the BYOD policy across enterprises.

- According to the Identity Theft Resource Center (ITRC), the number of data compromises in the United States witnessed 817 cases in the first half of the last year. These incidents have created a positive demand for enterprise mobility management in the country, especially for mobile security, as they are the most vulnerable endpoints a hacker can attack to gain entry into an enterprise system. With growing awareness among the end-users, the demand for managed mobility services in the country is expected to increase over the forecast period.

- Moreover, cyber attacks in the North American region, especially in the United States, are rising rapidly. They have reached an all-time high, primarily owing to the rapidly increasing number of mobile devices in the region. According to IBM, the average cost of a data violation in the United States amounted to USD 9.44 million in the last year, up from USD 9.05 million in 2021.

Banking Enterprise Mobility Industry Overview

The market for enterprise mobility for banking is fragmented, with many existing and new players offering mobility solutions through on-premise or cloud. The majority are focused on smartphone-related services.

In May 2022, GEMx Technologies announced its partnership with HokuApps to promote the shift to digital wallets after the COVID-19 pandemic. The partnership would enable digitizing and integrating banking and financial service workflows by creating an enterprise web solution to create easy payment experiences for businesses while improving customer experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of COVID-19 Impact on the Industry

- 4.4 Market Drivers

- 4.4.1 Growth of Mobile Devices as the Preferred Medium of Accessing Internet, Enterprise Data, and Various Other Information

- 4.4.2 Rising Trend of BYOD

- 4.5 Market Challenges

- 4.5.1 High Cost of Implementation, Coupled with Lack of Acceptability Among Employees

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solutions

- 5.1.1.1 Device Management

- 5.1.1.2 Access Management

- 5.1.1.3 Application Management

- 5.1.1.4 Other Solutions

- 5.1.2 Services

- 5.1.1 Solutions

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BlackBerry Limited

- 6.1.2 VMware Inc.

- 6.1.3 Citrix Systems Inc.

- 6.1.4 IBM Corporation

- 6.1.5 Microsoft Corporation

- 6.1.6 Mobile Iron Inc.

- 6.1.7 Accenture Plc

- 6.1.8 Newgen Software Technologies Limited

- 6.1.9 Infosys Limited

- 6.1.10 HCL Technologies