|

市场调查报告书

商品编码

1629790

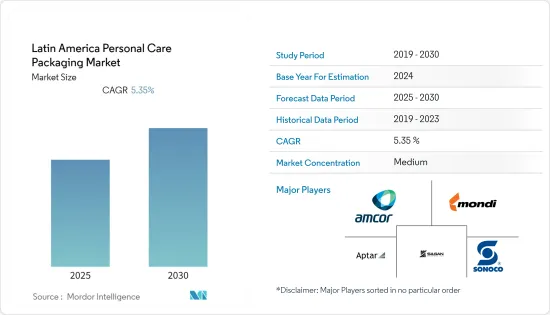

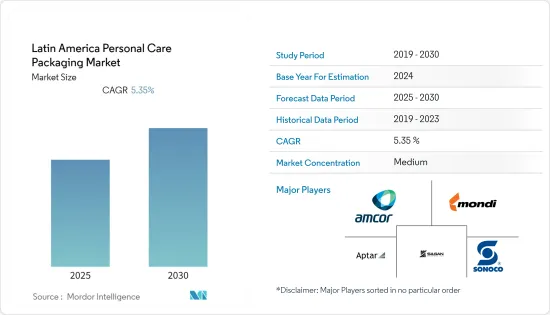

拉丁美洲个人护理包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Latin America Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

拉丁美洲个人护理包装市场预计在预测期内复合年增长率为 5.35%

主要亮点

- 独立、无包装的商店预计将成为跨行业零售市场的驱动力之一。品牌应该有简单的品牌名称和有吸引力的店内补充机会。这改善了品牌形象并增加了消费者对提供永续产品包装解决方案的品牌的兴趣。

- 预计将推动市场扩张的一个关键行业趋势是越来越多地使用纸管来包装个人保养用品。例如,去年10月,欧莱雅和化妆品包装企业Alvea宣布推出首款纸质化妆品管。在预期期间,此类尖端包装解决方案的即将推出预计将有助于市场成长。

- 进入市场的供应商正在透过制定应对气候变迁的策略和减少包装对环境的影响来发挥作用。在过去的十年中,公众对塑胶使用有害影响的认识迅速提高。拉丁美洲各国政府所进行的一系列公共宣传活动和措施提高了公众的意识。

- COVID-19 的爆发进一步影响供应商从根本上改变其品牌 ID 验证,而推动提供永续包装解决方案进一步增加了研发和製造的投资。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

拉丁美洲个人护理包装市场趋势

预计护肤市场将显着成长

- 市面上各种护肤品的供应商提供时尚的乳液瓶、带有奢华细节的乳霜罐以及带有施用器的包装管。更先进的无气点胶系统、滴管施用器和点胶盖为特定产品提供了解决方案。例如,最大的化妆品包装批发商之一 Alvea Packaging 生产管用软型螺旋盖。这款化妆品帽是所有护肤产品的理想解决方案,帽子的圆形边缘传达了配方的柔软性。

- 此外,真空护肤包装和3D列印技术等技术进步正在推动护肤包装的销售。烫金箔印刷和柔印胶印等先进且流行的印刷技术使製造商能够为化妆品品牌提供创新且引人注目的护肤包装,进一步扩大个人护理包装市场。

- 欧莱雅2021年市场占有率大幅扩大,在智利、墨西哥和巴西表现优异。电子商务和线下销售都对成长做出了贡献。该集团的品牌利用「Buen Fin」和「黑色星期五」等重要线上活动,透过有针对性的活化来欢迎顾客进入商店,同时保持数位参与和线上活化。

巴西市场预计将显着成长

- 巴西向阿根廷、哥伦比亚和智利出口香水、化妆品和沐浴产品,从法国、阿根廷和美国进口化妆品。巴西製成品仍依赖进口。为此,巴西政府开征进口税,促进生产在地化,Alvea等主要企业都着力实现化妆品包装的在地化。

- 此外,SEBRAE for Micro and Small Enterprises 指出,巴西男性化妆品市场在过去五年中成长了两倍。预计这将推动专为男性设计的包装模组的进一步成长。

- 环保措施的投资也很活跃。数百万雷亚尔将投资于自然资源管理、自然保护以及环保产品和工艺的研发,例如在包装中使用绿色塑胶以及天然成分和自然资产的供应商、合作伙伴和社区的发展。

- 此外,市场也确认了製造业的投资活动。例如,去年初,法国香精香料集团Robertet投资916万美元在圣保罗兴建工厂。透过这项业务,该公司希望将其在圣保罗的生产和储存能力增加两倍。该团队使公司能够提高生产力并进一步推动包装需求。

拉丁美洲个人护理包装产业概况

拉丁美洲个人护理市场与许多地区参与企业的竞争适中。创新产品正在推动市场,每个供应商都在技术创新上进行投资。主要参与企业包括 Amcor Ltd、Mondi Group、Aptar Group 和 Sonoco。

2022 年 9 月 - Smurfit Kappa 宣布收购巴西 PaperBox,扩大在拉丁美洲的业务。此次收购将加强我们在该国的足迹,提高我们的製造能力,使我们能够抓住新的机会并与客户建立新的关係。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对个人护理包装市场的影响

- 市场驱动因素

- 随着可支配收入的增加,个人保健产品的消费增加

- 越来越注重创新和有吸引力的包装

- 市场限制因素

- 新包装解决方案的研发和製造成本较高

第五章市场区隔

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸

- 按包装类型

- 塑胶瓶/容器

- 玻璃瓶/容器

- 金属容器

- 折迭式纸盒

- 瓦楞纸箱

- 管和棒

- 盖子与封口装置

- 泵浦和分配器

- 软质塑胶包装

- 其他的

- 依产品类型

- 口腔护理

- 头髮护理

- 彩妆品

- 护肤

- 男士美容

- 除臭剂

- 其他的

- 按国家/地区

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

第六章 竞争状况

- 公司简介

- Amcor Ltd.

- Mondi Group

- AptarGroup

- Silgan Holdings

- Sonoco

- RPC Group Plc(Berry Global Group INC.)

- Cosmopal Ltd

- Gerresheimer AG

第七章 投资分析

第八章市场的未来

The Latin America Personal Care Packaging Market is expected to register a CAGR of 5.35% during the forecast period.

Key Highlights

- Independent packaging-free stores are expected to be one of the driving factors in the retail market across the industry. Brands are expected to create simple branded and engaging refill opportunities in the store. This enhances the brand image and attracts consumers increasingly leaning toward brands that offer sustainable product packaging solutions.

- A significant industry trend anticipated to support market expansion is the expanding usage of paper-based tubes for the packaging of personal care goods. For instance, in October last year, L'Oreal and the cosmetic packaging business Albea announced the introduction of the first paper-based cosmetic tube. Over the anticipated period, market growth will be aided by the impending launch of such a cutting-edge packaging solution.

- Market Vendors are attempting to make a difference by developing a strategy to combat climate change and reduce packaging's environmental impact. Since the last decade, awareness among the population regarding the harmful effects of plastic usage has been growing drastically. Many public campaigns and initiatives by the Latin American governments have increased awareness among the public.

- The outbreak of COVID-19 has further influenced the vendors to make drastic changes to their brand identity, and the push towards offering sustainable packaging solutions further increases their investments in R&D and manufacturing. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

Latin America Personal Care Packaging Market Trends

Skin Care Expected to Witness Significant Growth in the Market

- Suppliers of different skincare products in the market offer stylish bottles for lotions, jars with luxe details for creams, and tubes equipped with applicators for packaging. More advanced airless dispensing systems, dropper applicators, and dispensing caps provide solutions for specific products. For instance, Albea packaging, one of the largest cosmetic packaging wholesalers, makes soft-shaped screw caps for tubes. This cosmetic cap is the ideal solution for all skincare products and communicates the softness of the formula due to the rounded edges of the cap.

- Furthermore, technological encroachments, such as airless skincare packaging and 3-D printing technology, are driving skincare packaging sales. Advanced and trending printing technologies, such as hot-stamp foil printing and flexo-offset printing, enable manufacturers to offer innovative and eye-catching skincare packaging for cosmetic brands, further growing the personal care packaging market.

- L'Oreal increased its market share significantly in FY 2021, performing remarkably well in Chile, Mexico, and Brazil. E-commerce and offline sales both contributed to growth. The Group's brands welcomed customers back to their stores with targeted activation while maintaining their digital engagement and online activation, utilizing important online events like Buen Fin and Black Friday.

Brazil Expected to Witness Significant Growth in the Market

- Brazil exports perfumery, cosmetics, and bath products to Argentina, Colombia, and Chile and imports cosmetics from France, Argentina, and the United States. The country remains dependent on imports for finished products. This has led the Brazilian government to introduce import taxes to localize production, and Companies like Albea are focusing on localizing their cosmetic packaging activities.

- Further, SEBRAE for Micro and Small Enterprises stated that Brazil's men's cosmetics market has tripled in the past five years. This is expected to facilitate further growth of packaging modules designed exclusively for men.

- There are multiple investments in environmental policies. Millions of Reals are invested in natural resource management, nature conservation, and the R&D of environmentally friendly products and processes, such as using green plastic in the packaging and developing supplier partner communities of natural ingredients and assets.

- Moreover, the market is also witnessing manufacturing investment activities. For instance, early last year, the French group of fragrances and aromas, Robertet, invested USD 9.16 million in constructing a unit in Sao Paulo. With its operation, the company is looking to triple its production and storage capacity in the country. The team allowed the company to increase its productivity and further drive demand for packaging.

Latin America Personal Care Packaging Industry Overview

The Latin America Personal Care Market is moderately competitive, with many regional players. Innovation drives the market in product offerings, and each vendor invests in innovation. Key players include Amcor Ltd, Mondi Group, Aptar Group, and Sonoco.

September 2022 - Smurfit Kappa announced Latin American expansion with the PaperBox acquisition in Brazil. This acquisition will strengthen their footprint in the nation, increase manufacturing capacity, and enable them to seize new possibilities and build new relationships with clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID -19 on the Personal Care Packaging Market

- 4.5 Market Drivers

- 4.5.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 4.5.2 Growing Focus on Innovative and Attractive Packaging

- 4.6 Market Restraints

- 4.6.1 High Costs of R&D and Manufacturing of New Packaging Solution

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper

- 5.2 By Packaging Type

- 5.2.1 Plastic Bottles and Containers

- 5.2.2 Glass Bottles and Containers

- 5.2.3 Metal Containers

- 5.2.4 Folding Cartons

- 5.2.5 Corrugated Boxes

- 5.2.6 Tube and Stick

- 5.2.7 Caps and Closures

- 5.2.8 Pump and Dispenser

- 5.2.9 Flexible Plastic Packaging

- 5.2.10 Other Packaging Types

- 5.3 By Product Type

- 5.3.1 Oral Care

- 5.3.2 Hair Care

- 5.3.3 Color Cosmetics

- 5.3.4 Skin Care

- 5.3.5 Men's Grooming

- 5.3.6 Deodorants

- 5.3.7 Other Products Types

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Mondi Group

- 6.1.3 AptarGroup

- 6.1.4 Silgan Holdings

- 6.1.5 Sonoco

- 6.1.6 RPC Group Plc (Berry Global Group INC.)

- 6.1.7 Cosmopal Ltd

- 6.1.8 Gerresheimer AG