|

市场调查报告书

商品编码

1630392

中国数位货运:市场占有率分析、产业趋势与统计、成长预测(2025-2030)China Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

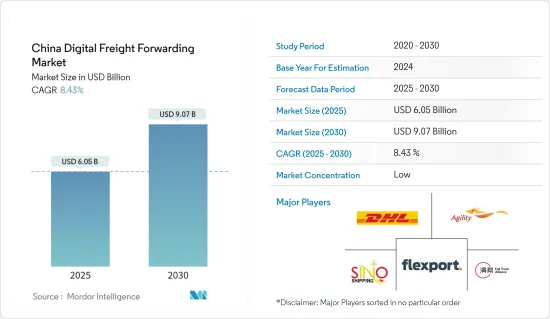

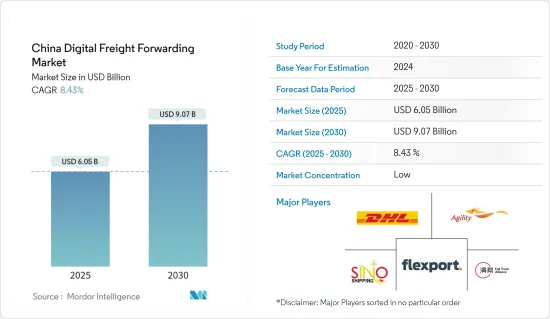

预计2025年中国数位货运市场规模为60.5亿美元,2030年将达90.7亿美元,预测期间(2025-2030年)复合年增长率为8.43%。

中国数位货运市场分析的重点是数位技术的应用,以简化和增强中国境内的传统货运流程。货运代理涉及代表托运人使用海运、空运、铁路和卡车等运输方式组织和促进跨境货物运输。透过采用线上平台、软体和先进的资料分析,中国的数位货运代理正在实现这一流程的现代化并优化运输的各个方面。

正如中国运输部在2023年提到的,近年来,由于电子商务的蓬勃发展以及对即时物流解决方案的需求不断增加,中国数位货运市场经历了显着增长。

根据中国政府预测,2023年,上海、深圳、宁波/舟山将成为全球货柜吞吐量最高的港口,其中上海吞吐量超过3600万标准箱,其次是宁波/舟山,达到3500万标准箱。量超过2700万标准箱。这一激增凸显了中国经济的復苏和港口基础设施的扩张,从而促进了区域和全球贸易。到2023年9月,中国港口总合将超过2.3亿标准箱,与前一年同期比较去年同期成长5.2%。随着中国数位货运市场的扩大,国内外公司正在利用技术来优化业务并降低成本。

中国数位化货运市场趋势

电子商务领域的崛起推动市场

中国电子商务产业的快速成长有多种因素。中国政府推出了一系列加强电子商务和数位经济的措施,特别注重加强网路基础设施和促进创业。

行动技术的进步和广泛的互联网连接使电子商务在中国各地随处可见,消费者和企业主都受益。此外,消费者还可享受支付宝、微信支付等多种行动付款解决方案的便利,促进无缝线上交易。

根据业内专家预测,2023年,中国将占全球货运市场收益的6.0%。展望 2030 年,美国将在收益方面主导全球市场。在亚太地区,到 2030 年,中国的货运市场将在收入方面处于领先地位。印度被认为是亚太地区成长最快的市场,预计到 2030 年估值将达到 177.321 亿美元。

航空货运量的增加预计将推动市场

由于技术进步以及对高效、经济高效的物流解决方案日益增长的需求,中国的数位货运市场正在经历快速转型。在托运人和承运人越来越多地采用数位平台和解决方案的推动下,该市场预计将在未来几年显着成长。

产业专家表示,空运是最快的运输方式之一,非常适合运输时间敏感的货物,例如需要紧急交付的生鲜产品或高价商品。空运在物流的第一个优点就是交货速度。

2023年,中国跨境电商产品进出口值为2.38兆元(3,283亿美元),与前一年同期比较去年同期成长15.6%。根据海关总署统计,光是跨境电商出口产品就达1.83兆元(与前一年同期比较亿美元),年增近20%。

中国数位货运产业概况

本报告重点介绍了在中国数位货运市场中运营的主要企业。市场竞争激烈,没有参与企业占据主要份额。该市场是细分的,预计在预测期内将会成长。中国数位货运代理市场的主要企业包括 DHL、Flexport、Agility Logistics 和 Freightos。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 价值链/供应链分析

- 投资场景洞察

- 深入了解政府法规和倡议

- 线上货运和数位平台的技术发展概述

- 中国电商物流货运概况

- 地缘政治与疫情如何影响市场

第五章市场动态

- 促进因素

- 政府的一带一路倡议

- 5G技术融入货物物流

- 抑制因素

- 物流市场区隔

- 地缘政治贸易壁垒

- 机会

- 碳中和物流目标

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 客户议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第六章 市场细分

- 按运输方式

- 海洋

- 航空

- 路

- 铁路

- 按公司类型

- 小型企业

- 大企业和政府

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Flexport

- Youtrans

- Full Truck Alliance(Manbang group)

- Agility Logistics Pvt. Ltd(Shipa Freight)

- Twill

- Freightos

- DHL Group

- Kuehne+Nagel International AG

- FreightBro

- Cogoport

- SINO SHIPPING

- DB Schenker

- MOOV

- WICE Logistics*

- 其他公司

第八章 市场未来展望

第九章 附录

- 宏观经济指标(GDP 分布,依活动划分)

- 经济统计-交通运输和仓储业对经济的贡献

The China Digital Freight Forwarding Market size is estimated at USD 6.05 billion in 2025, and is expected to reach USD 9.07 billion by 2030, at a CAGR of 8.43% during the forecast period (2025-2030).

The China Digital Freight Forwarding Market Analysis focuses on the application of digital technologies to streamline and enhance the traditional freight forwarding process within China. Freight forwarding involves organizing and facilitating the shipment of goods across international borders on behalf of shippers, utilizing ocean, air, rail, or truck transportation modes. By employing online platforms, software, and advanced data analytics, digital freight forwarders in China are modernizing this process, optimizing various facets of shipping.

In recent years, China's digital freight forwarding market has experienced significant growth, driven by e-commerece boom and incresing demand for real-time logistics solutions as mentioned by the Chinese Ministry of Transport in 2023.

According to the Government of China, in 2023, Shanghai, Shenzhen, and Ningbo-Zhoushan led the world as some of the busiest container ports, with Shanghai processing over 36 million TEUs, closely followed by Ningbo-Zhoushan at 35 million TEUs, and Shenzhen surpassing 27 million TEUs. This surge underscores China's economic recovery and its expanding port infrastructure, bolstering both regional and global trade. By September 2023, Chinese ports collectively managed over 230 million TEUs, reflecting a year-on-year uptick of 5.2%. As China's digital freight forwarding market expands, both domestic and international companies are harnessing technology to optimize operations and curtail costs.

China Digital Freight Forwarding Market Trends

Rise in E-Commerce Sector Driving the Market

Several factors have fueled the rapid growth of China's e-commerce industry. The Chinese government has rolled out a series of policies to bolster e-commerce and the digital economy, with a particular focus on enhancing internet infrastructure and promoting entrepreneurship.

With advancements in mobile technology and widespread internet connectivity, e-commerce has become both available and accessible across China, benefiting consumers and business owners alike. Furthermore, residents enjoy the convenience of diverse mobile payment solutions, such as Alipay and WeChat Pay, facilitating seamless online transactions.

According to industry experts, in 2023, China represented 6.0% of the global freight forwarding market in terms of revenue. Looking ahead to 2030, the U.S. is poised to dominate the global market in terms of revenue. Within the Asia Pacific region, China's freight forwarding market is set to take the lead in revenue by 2030. India, recognized as the fastest-growing market in the Asia Pacific, is on track to achieve a valuation of USD 17,732.1 million by 2030.

Increasing Air Cargo Shipments Expected to Drive the Market

The digital freight forwarding market in China is undergoing rapid transformation, driven by technological advancements and the growing need for efficient and cost-effective logistics solutions. The market is expected to achieve significant growth in the coming years, fueled by the increasing adoption of digital platforms and solutions by both shippers and carriers.

According to industrial experts, air transportation is one of the fastest modes of transportation available, making it ideal for transporting time-sensitive products, such as perishable goods and high-value items requiring urgent delivery. The primary advantage of air transport in logistics is the speed of delivery.

In 2023, China's imports and exports of cross-border e-commerce products were worth CNY 2.38 trillion (USD 328.3 billion), up 15.6 percent year-on-year. Products exported for cross-border e-commerce alone reached CNY 1.83 trillion (USD 0.25 trillion), up nearly 20 percent year-on-year, according to the General Administration of Customs.

China Digital Freight Forwarding Industry Overview

The report covers the major players operating in the Chinese digital freight forwarding market. The market is highly competitive, with none of the players occupying the major share. The market is fragmented, and it is expected to grow during the forecast. The major players in the Chinese digital freight forwarding market include DHL, Flexport, Agility Logistics, and Freightos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Insights on Investment Scenarios

- 4.4 Insights on Government Regulations and Initiatives

- 4.5 Brief on Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding in China

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Government's Belt and Road Initiative

- 5.1.2 Integration of 5G Technology in Freight Logistics

- 5.2 Restraints

- 5.2.1 Fragmentation in the Logistics Market

- 5.2.2 Geopolitical Trade Barriers

- 5.3 Opportunities

- 5.3.1 Carbon-Neutral Logistics Goals

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Customers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Ocean

- 6.1.2 Air

- 6.1.3 Road

- 6.1.4 Rail

- 6.2 By Firm Type

- 6.2.1 SMEs

- 6.2.2 Large Enterprises and Governments

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Youtrans

- 7.2.3 Full Truck Alliance (Manbang group)

- 7.2.4 Agility Logistics Pvt. Ltd (Shipa Freight)

- 7.2.5 Twill

- 7.2.6 Freightos

- 7.2.7 DHL Group

- 7.2.8 Kuehne + Nagel International AG

- 7.2.9 FreightBro

- 7.2.10 Cogoport

- 7.2.11 SINO SHIPPING

- 7.2.12 DB Schenker

- 7.2.13 MOOV

- 7.2.14 WICE Logistics*

- 7.3 Other Companies

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 Economic Statistics - Transport and Storage Sector Contribution to Economy