|

市场调查报告书

商品编码

1635467

南美 AUV 和 ROV:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South America AUV & ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

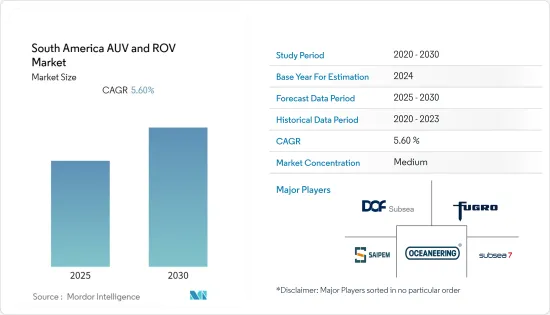

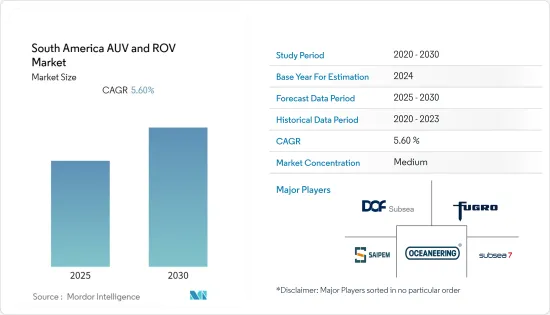

南美 AUV 和 ROV 市场预计在预测期内复合年增长率为 5.6%。

COVID-19 对 2020 年市场产生了负面影响。目前,市场已达到疫情前水准。

主要亮点

- 石油和天然气生产活动的活性化、离岸风力发电行业的成长以及石油和天然气除役活动的增加等各种因素预计将在预测期内推动市场。

- 同时,阿根廷、智利、哥伦比亚和厄瓜多等国计画加强应对气候变迁的力度。预计这些国家未来将禁止海洋探勘活动,进而抑制市场成长。

- 越来越多的深海和超深海发现预计将为南美AUV/ROV市场创造新的商机。

- 在预测期内,由于石油和天然气活动的增加,巴西预计将主导市场。

南美AUV和ROV市场趋势

石油和天然气领域主导市场

- 南美洲拥有丰富的石油和天然气蕴藏量。巴西、哥伦比亚、阿根廷、秘鲁、厄瓜多等地区主要国家对石油产品的依赖程度较高,对石油和天然气的依赖程度不断增加。 2021年,巴西石油产量约298.7万桶/日,哥伦比亚石油产量约73.8万桶/日,阿根廷石油产量约62.7万桶/日。石油天然气工业在国际政治、经济上具有巨大影响力。

- 石油和天然气钻机可在深达两英里的水中作业。许多深水井和管道系统依靠水下航行器进行安装、检查、维修和维护。

- 此外,不利的海底条件常常使监测和部署变得困难,从而带来操作、环境和技术挑战。这些因素正在加速所研究市场中新技术的发展。

- 在过去的几年里,自主水下机器人(AUV)和遥控潜水器(ROV)已经从小众应用的新兴技术发展成为在石油和天然气领域广泛应用的技术。

- 此外,2022 年 8 月,DOF ASA 宣布与巴西国家石油公司签署了在巴西建造三艘船舶的新契约。这些合约价值超过2.53亿美元。这些合约授予 DOF 的巴西子公司 Norskan Offshore Ltda 和 DOF Subsea Brasil Servicos Ltda。

- 此外,2021 年 12 月,挪威海洋勘探承包商 Argeo 为其巴西石油和天然气行业的一个客户签署了一份包括 AUV业务的合约。该计划计划于 2022年终启动。

- 由于上述因素,预计石油和天然气领域将在预测期内主导南美 AUV 和 ROV 市场。

巴西可望主导市场

- 由于工业化和研发投资的不断增加,巴西预计将在预测期内成为 AUV 和 ROV 的最大市场之一。

- 近年来,巴西的天然气产量有所下降,但许多产业对天然气的需求正在增加。截至2021年,巴西天然气产量为243亿立方公尺(bcm)。需求的成长导致越来越多地使用 AUV 和 ROV 来检测和绘製全国各地的天然气蕴藏量。

- 此外,Petroleo Brasileiro SA 计划在 2021 年至 2025 年间在巴西投资约 550 亿美元。在总投资中,84%将分配给石油和天然气勘探和生产(E&P),约7%将分配给精製。剩余的9%预计将分配给行销、物流和其他领域。在勘探开发投资约460亿美元中,盐层下资产投资约占320亿美元,占70%。这显示巴西海上石油油气资产中的AUV和ROV市场预计在预测期内将大幅成长。

- 此外,2022 年 9 月,Oceaneering International Inc. 宣布其海底机器人部门获得了一份为期两年的服务合同,以支持巴西海岸附近的 Petrobras计划。计划的范围包括提供两台 Millennium Plus 工作级 ROV、每台 ROV 的专用工具套件、测量设备和人员。

- 因此,正如上述几点所反映的那样,巴西预计在预测期内将主导南美AUV和ROV市场。

南美洲AUV和ROV产业概况

南美 AUV 和 ROV 市场因其性质而适度细分。市场主要企业包括 DOF Subsea AS、Fugro NV、Subsea 7 SA、Saipem SpA、Oceaneering International Inc.

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按车型

- ROV

- AUV

- 按最终用户使用情况

- 石油和天然气

- 防御

- 研究

- 其他的

- 按地区

- 阿根廷

- 巴西

- 智利

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- DOF Subsea AS

- Fugro NV

- Subsea 7 SA

- Saipem SpA

- Oceaneering International Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 92803

The South America AUV & ROV Market is expected to register a CAGR of 5.6% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Various factors, such as rising oil and gas production activities, growing offshore wind power industry, and increasing oil and gas decommissioning activities, are expected to drive the market during the forecast period.

- On the other hand, countries like Argentina, Chile, Colombia, and Ecuador are planning to increase their focus on climate change. These countries are expected to ban offshore exploration activities in the future, thereby restraining market growth.

- Nevertheless, the rising deepwater and ultra-deepwater discoveries are expected to open up new opportunities for the South American AUV and ROV market.

- During the forecast period, Brazil is expected to dominate the market due to the country's increasing oil and gas activities.

South America AUV & ROV Market Trends

Oil and Gas Segment to Dominate the Market

- South America is rich in oil and gas reserves. Its dependence on oil and gas is increasing as major countries in the region, such as Brazil, Colombia, Argentina, Peru, and Ecuador, rely heavily on petroleum-based products. In 2021, Brazil's oil production was approximately 2987 thousand barrels per day, Colombia's oil production was about 738 thousand barrels per day, and Argentina's oil production was about 627 thousand barrels per day. The oil and gas industry displays immense influence in international politics and economics.

- Oil and gas drilling rigs may operate in water depths of two miles. Many deepwater wells and pipeline systems rely on underwater vehicles to help perform installations, inspections, repairs, and maintenance.

- Also, monitoring and deployment are often challenging in adverse subsea conditions, creating operational, environmental, and technical challenges. These factors have accelerated the development of new technologies in the market studied.

- Over the past few years, Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROV) have evolved from emerging technology with niche uses to having extensive applications in the oil and gas sector.

- Moreover, in August 2022, DOF ASA announced securing new contracts for three of its vessels in Brazil with Petrobras. These deals were worth more than USD 253 million. The contracts were awarded to DOF's Brazilian subsidiaries, Norskan Offshore Ltda. and DOF Subsea Brasil Servicos Ltda.

- Furthermore, in December 2021, Argeo, a Norwegian marine survey contractor, signed an agreement comprising AUV work for one of its customers in the Brazilian oil and gas sector. The project was scheduled to commence by the end of 2022.

- Owing to the above-stated factors, the oil and gas segment is expected to dominate the South American AUV and ROV market during the forecast period.

Brazil Expected to Dominate the Market

- Due to increasing industrialization and investments in research and development, Brazil is expected to be one of the largest markets for AUVs and ROVs during the forecast period.

- Although Brazil's natural gas production has been stagnant in recent years, the demand for natural gas is growing from numerous industries. As of 2021, natural gas production in Brazil accounted for 24.3 billion cubic meters (bcm). The growing demand is culminating in the rise in the utilization of AUVs and ROVs for detecting and mapping gas reserves across the country.

- Moreover, Petroleo Brasileiro SA plans to invest approximately USD 55 billion in Brazil from 2021 to 2025. Of this total investment, 84% is allocated to oil and gas exploration and production (E&P) and approximately 7% to refining. The remaining 9% is expected to be accounted for marketing, logistics, and others. The investment of around USD 46 billion in E&P involves approximately USD 32 billion, i.e., 70%, in pre-salt assets. This indicates that the market for AUV and ROV in Brazil's offshore oil and gas assets is expected to increase significantly during the forecast period.

- Furthermore, in September 2022, Oceaneering International Inc. announced that its subsea robotics segment was awarded a two-year service contract to support Petrobras projects off the coast of Brazil. The project's scope included providing two millennium-plus work-class ROVs, complete specialized tooling packages for each ROV, and survey equipment and personnel.

- Hence, as the points mentioned above reflect, Brazil is expected to dominate the South American AUV and ROV Market during the forecast period.

South America AUV & ROV Industry Overview

The South American AUV and ROV market is moderately fragmented in nature. Some of the key players in the market include DOF Subsea AS, Fugro NV, Subsea 7 SA, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Recent Trends And Developments

- 4.4 Government Policies And Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 By End-user Application

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Research

- 5.2.4 Other End-user Applications

- 5.3 By Geography

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Colombia

- 5.3.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1 DOF Subsea AS

- 6.3.2 Fugro NV

- 6.3.3 Subsea 7 SA

- 6.3.4 Saipem SpA

- 6.3.5 Oceaneering International Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219