|

市场调查报告书

商品编码

1635477

亚太地区 AUV 和 ROV:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia-Pacific AUV and ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

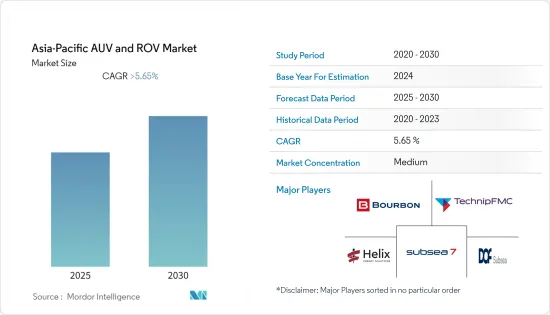

预计亚太地区 AUV 和 ROV 市场在预测期内的复合年增长率将超过 5.65%。

COVID-19 对 2020 年市场产生了负面影响。目前市场已达到疫情前的水准。

主要亮点

- 从长远来看,市场将受到海上石油和天然气探勘活动活性化以及离岸风力发电能力增加的推动。

- 另一方面,由于石化燃料的使用增加而造成的环境破坏日益严重,导致亚太地区禁止海上石油和天然气探勘。因此,预计市场在预测期内将放缓。

- AUV 和 ROV 市场的技术进步预计很快就会在亚太地区创造巨大的机会。

- 由于中国在国防领域以及 AUV 和 ROV 的研发方面投入巨资,预计将在预测期内主导市场。

亚太地区AUV和ROV市场趋势

ROV车型预计将大幅成长

- 远端操作水下机器人 (ROV) 是一种代表拴在 ROV 上的地面人员在水下执行功能的机器人。 ROV的主要功能包括设备维修、通讯分析、疏浚/挖沟、电缆安装、潜水员观察、平台检查、管道检查、测量、钻井支援、施工支援、碎片清除、呼叫操作、平台清洁和海底安装。 、物体定位和恢復等等。

- ROV 非常复杂,服务于各个领域,包括搜救、军事、水产养殖、休閒、发现、石油和天然气工业、海上能源、水下基础设施和航运。

- 亚太地区石油产量大幅下降(由于 COVID-19 大流行),从 2019 年的 764.2 万桶/日降至 2021 年的约 733.5 万桶/日。由于从 2021 年中期开始,石油和天然气上游产业的持续活动以及即将进行的计划投资的增加,产量可能会增加。因此,ROV的需求预计在预测期内将会增加。

- 此外,ROV还具有在极端深度作业的优势,可以长时间停留在水下。即使在干扰一般驾驶的恶劣条件下,也可以准确地完成重复性任务。 ROV 的体积也比载人车辆小。它也相对便宜。

- EyeROV是印度最大、发展最快的国防技术新兴企业之一,旨在提供水下检测产品和解决方案服务。该公司已经推出了 EyeROV TUNA,被认为是印度第一款商用水下无人机/远程操作车辆(ROV)。该ROV可以对桥樑、水坝、港口、海上结构、船体、管道和其他关键水下结构进行超过1000小时的水下检查。

- ROV技术也正在影响印度海上石油和天然气产业,过去几年平均海上钻井深度缓慢增加。例如,2021年5月袭击印度西海岸的飓风「陶克特」直接袭击了ONGC在阿拉伯海的海上设施,造成基础设施严重损坏,造成三艘驳船和一艘钻井船漂流。飓风发生后,ONGC立即派遣OSV利用ROV对这些海上设施进行监测和维修。 ROV 即使在危险情况下也能远端运作的能力预计将成为预测期内推动市场的关键因素。

- 因此,基于上述因素,预计亚太地区AUV和ROV市场对ROV车辆类型的需求将在预测期内显着成长。

中国主导市场

- 中国是世界主要能源进口国和消费国之一。该国大力投资各种产业,包括海底探勘、石油和天然气、可再生能源和国防能力。所有这些行业对 AUV 和 ROV 都有很高的需求,

- 海龙是中国的一款ROV,潜水深度可达3500公尺。海龙号是中国的遥控潜水器,可以潜入3500公尺的深度,用于各种水下作业,从石油平台维修到打捞和救援任务。

- 中国海军也大力投资ROV和AUV技术,特别是发展南海侦察能力。随着中国寻求在南海地区及其他地区维护其军事优势,对近海 ROV 和 AUV 服务的需求预计将在预测期内增加。

- 随着中国国内能源消费快速扩张,国内油气产量大幅增加,海上中游活动大幅增加。例如,液体总消费量已从 2011 年的每天 9,680 桶大幅增加到 2021 年的每天约 15,520 桶。

- 此外,2021年11月,中国国营石油公司中海油宣布其位于南海东部的陆丰海上油田已开始生产。主要生产设备为两座钻井生产平台及一套海底生产系统。

- 同样,2021年1月,中海油安装了全球首个10万吨级深海半潜式生产储存平台「深海一号」。该平台由中国建造,将用于开发陵水天然气田。南海平均深度为1,450公尺。这些关键基础设施的开发需要最尖端科技来勘探、监测和维护关键的碳氢化合物资产,例如深水钻探平臺和管道。

- 因此,基于上述因素,预计中国将在预测期内主导亚太AUV和ROV市场。

亚太地区 AUV 和 ROV 产业概况

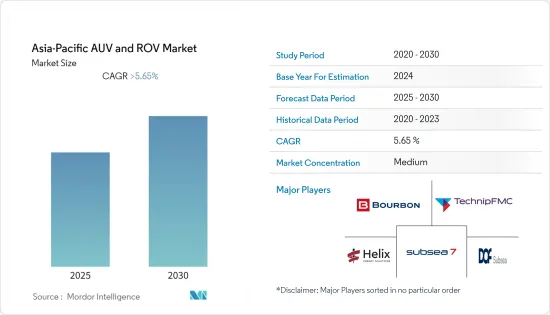

亚太地区 AUV 和 ROV 市场适度整合。市场的主要企业包括(排名不分先后)DOF Subsea AS、Helix Energy Solutions Group Inc.、TechnipFMC PLC、Bourbon Offshore 和 Subsea 7 SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2027年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按车型

- ROV

- AUV

- 按车辆类别

- 工作班

- 观察班

- 按用途

- 石油和天然气

- 防御

- 其他的

- 按活动

- 钻探和开发

- 建造

- 检查/维修/保养

- 退休

- 其他活动类型

- 按地区

- 中国

- 印度

- 日本

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

DOF 海底 AS

- Helix Energy Solutions Group Inc.

- TechnipFMC PLC

- Bourbon Offshore

- Subsea 7 SA

- Saipem SpA

第七章市场机会与未来趋势

简介目录

Product Code: 92828

The Asia-Pacific AUV and ROV Market is expected to register a CAGR of greater than 5.65% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently, the market has reached the pre-pandemic level.

Key Highlights

- Over the long term, the major driving factors of the market are increasing offshore oil and gas exploration activities along with growing offshore wind energy installations.

- On the flip side, increasing environmental damage due to the increasing use of fossil fuels has led to the banning of offshore oil and gas exploration in the Asia-Pacific region. This is expected to slow down the market during the forecast period.

- Nevertheless, technological advancements in the AUV and ROV market are expected to create enormous opportunities for the Asia-Pacific region soon.

- China is expected to dominate the market during the forecast period, as it has heavily invested in its defense sector and the R&D of AUVs and ROVs.

APAC AUV & ROV Market Trends

ROV Vehicle Type Expected to Witness Significant Growth

- Remotely-operated underwater vehicles (ROVs) are robots that complete functions underwater on behalf of a crew on the surface, with whom the ROV is tethered. Some of the significant functions of ROV include equipment repair, scientific analysis, dredging/trenching, cable-laying, diver observation, platform inspection, pipeline inspection, surveys, drilling support, construction support, debris removal, call-out work, platform cleaning, subsea installations, telecommunications support, and object location and recovery.

- ROVs are incredibly complex and serve various sectors, such as search and rescue, military, aquaculture, recreation, discovery, oil and gas industry, offshore energy, submerged infrastructure, and shipping.

- Oil production in the Asia-Pacific has decreased significantly (due to the COVID-19 pandemic) from 7642 thousand barrels per day in 2019 to about 7335 thousand barrels per day in 2021. The production is likely to increase due to the ongoing activities in the oil and gas upstream sector since mid-2021, along with the increasing investments due to upcoming projects. Thus, the demand for ROVs during the forecast period is expected to increase.

- Furthermore, ROVs offer the advantage of being operated at extreme depths and can remain underwater for extended periods. Repeated tasks can be completed accurately and under harsh conditions that hamper general driving conditions. Also, ROVs are less bulky compared to human-crewed vehicles. They are also relatively inexpensive.

- EyeROV is one of India's largest and fastest-growing defense tech startups aimed at providing products and solutions services for underwater inspections. The company has already launched the EyeROV TUNA, recognized as India's First Commercial Underwater Drone/Remotely Operated Vehicle (ROV). The ROV can complete over 1000+ hours of operation doing an underwater inspection of bridges, dams, ports, offshore structures, ship hulls, pipelines, and other critical underwater structures.

- ROV technology has also impacted India's offshore oil and gas industry, where the average offshore drilling depth has been rising slowly over the past few years. For instance, in May 2021, when cyclone Tauktae struck the western coast of India, it hit ONGC's offshore installations in the Arabian Sea, resulting in immense infrastructural damage, causing three barges and one drillship to go adrift. In the aftermath of the cyclone, ONGC dispatched OSVs to monitor and repair these offshore installations, which were conducted using ROVs. The capability of ROVs to function remotely in dangerous situations is expected to be a significant factor driving the market during the forecast period.

- Therefore, based on the above-mentioned factors, the ROV vehicle type is expected to witness significant demand in the Asia-Pacific AUV and ROV market during the forecast period.

China to Dominate the Market

- China is one of the leading energy importers and consumers globally. The country has been investing heavily in various industries, such as sub-sea exploration and research, oil and gas, renewables, and defense capabilities. All these industries have a high demand for AUV and ROV,

- Sea dragons are a class of Chinese ROVs capable of diving to a depth of 3,500 meters. They are used to perform various underwater tasks ranging from oil platform service to salvage and rescue missions.

- The Chinese navy has also invested heavily in ROV and AUV technology to develop reconnaissance capabilities, especially in the South China Sea. As China tries to assert its military dominance over the South China Sea region and beyond, the demand for offshore ROV and AUV services is expected to rise over the forecast period.

- As China's domestic energy consumption has grown rapidly, it has increased its domestic hydrocarbon production considerably, leading to a significant rise in offshore upstream and midstream activities. For instance, total liquid consumption has increased significantly from 9.68 thousand barrels per day in 2011 to about 15.52 thousand barrels per day in 2021.

- Furthermore, in November 2021, the Chinese national oil company CNOOC declared that it had started production from Lufeng offshore oil fields in the eastern part of the South China Sea. The main production facilities include two drilling production platforms and one subsea production system.

- Similarly, in January 2021, CNOOC installed the world's first 100,000-ton deep-water semi-submersible production and storage platform, Deep Sea-1. The platform was built by China and will be used to develop the Lingshui gas field. It has an average water depth of 1,450 meters in the South China sea. Such significant infrastructure developments mandate cutting-edge technology for surveying, monitoring, and maintaining critical hydrocarbon assets, such as drilling platforms and pipelines in deep waters, which is expected to increase the demand for offshore AUV and ROV services in the region during the forecast period.

- Therefore, based on the above factors, China is expected to dominate the AUV and ROV market in the Asia-Pacific region during the forecast period.

APAC AUV & ROV Industry Overview

The Asia-Pacific AUV and ROV market is moderately consolidated. Some of the major players in the market (in no particular order) include DOF Subsea AS, Helix Energy Solutions Group Inc., TechnipFMC PLC, Bourbon Offshore, and Subsea 7 SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Million, Till 2027

- 4.3 Recent Trends And Developments

- 4.4 Government Policies And Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 By Vehicle Class

- 5.2.1 Work Class Vehicle

- 5.2.2 Observatory Class Vehicle

- 5.3 By Application

- 5.3.1 Oil and Gas

- 5.3.2 Defense

- 5.3.3 Other Application Type

- 5.4 By Activity

- 5.4.1 Drilling and Development

- 5.4.2 Construction

- 5.4.3 Inspection, Repair, and Maintenance

- 5.4.4 Decommisioning

- 5.4.5 Other Activity Type

- 5.5 By Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1

DOF Subsea AS

- 6.3.2 Helix Energy Solutions Group Inc.

- 6.3.3 TechnipFMC PLC

- 6.3.4 Bourbon Offshore

- 6.3.5 Subsea 7 SA

- 6.3.6 Saipem SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219