|

市场调查报告书

商品编码

1635468

中东和非洲的 AUV 和 ROV:市场占有率分析、行业趋势、统计和成长预测(2025-2030 年)Middle-East and Africa AUV & ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

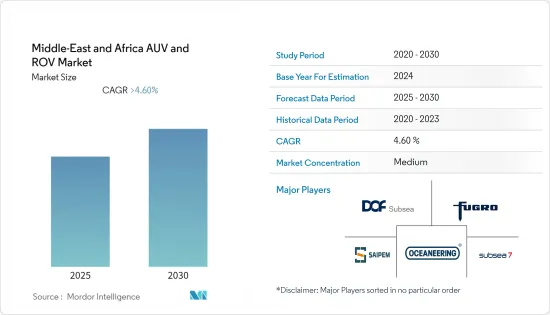

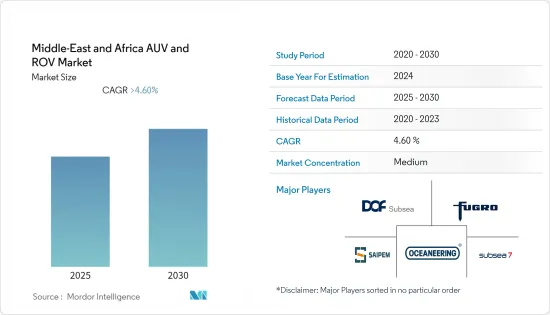

中东和非洲的 AUV 和 ROV 市场预计在预测期内复合年增长率将超过 4.6%。

COVID-19大流行对2020年的市场产生了负面影响。目前市场处于大流行前的水平。

主要亮点

- 在沙乌地阿拉伯、阿拉伯联合大公国、阿曼、加纳和象牙海岸共和国等中东和非洲国家,石油和天然气生产活动的增加以及石油和天然气退役活动的增加预计将在预测期内推动市场。

- 同时,波斯湾盆地海上钻机数量和海上油气活动的下降预计将抑制市场。

- 持续进行的深水和超深水石油和天然气发现以及页岩气探勘预计将在预测期内为中东和非洲 AUV 和 ROV 市场提供巨大机会。

- 随着全国石油和天然气活动的增加,沙乌地阿拉伯预计将在预测期内主导市场。

中东和非洲AUV和ROV市场趋势

石油和天然气领域预计将主导市场

- 中东和非洲是世界重要地区,已探明天然气田蕴藏量。该地区科威特、沙乌地阿拉伯、伊朗、卡达、奈及利亚、喀麦隆和阿拉伯联合大公国的海上蕴藏量仍未开发,所有这些国家都计划进行大规模石油开发。

- 截至2021年,中东石油总产量已达2,815.6万桶/日。随着世界能源需求的快速成长,海上石油生产已成为一种有吸引力的能源来源。因此,地区实力雄厚的国家都将重点放在海上油气天然气田的探勘和生产。

- 例如,今年,阿布达比国家石油公司(ADNOC)启动了工程、采购、施工和安装合约竞标程序,以进一步开发巨型下札库姆海上油田。该油田的开发将包括多项服务,包括基础设施、海底管线和海底系统的建设。所有这些服务都需要 ROV 或 AUV 进行安装和监控。

- 此外,2022 年 6 月,沙乌地阿拉伯阿卜杜拉国王科技大学 (KAUST) 宣布与远洋自主水下和水面机器人 (AUV) 製造服务供应商Ocean Aero 达成新的合作协议。 Ocean Aero 和 Shelf Subsea 旨在将 AUV 引入沙乌地阿拉伯,并加强 KAUST 对红海的研究。

- 此外,从2021年到2025年,中东地区已核准了超过77个上游计划,非洲地区已批准了27个上游项目。这些计划大多是海上油田计划,需要 ROV 和 AUV 来提供各种服务。预计这将在预测期内推动受调查市场的发展。

- 因此,石油和天然气领域预计将在预测期内主导市场。

沙乌地阿拉伯可望主导市场

- 沙乌地阿拉伯拥有丰富的石油和天然气蕴藏量。该地区拥有最发达的石油和天然气工业之一,其中波斯湾的巨大蕴藏量是主要焦点。随着钻井深度逐年增加,技术可采蕴藏量也大幅增加,导致投资增加。

- ROV 和 AUV 技术变得越来越便宜。因此,沙乌地阿拉伯石油和天然气生产商正在投资 ROV 和 AUV 服务,用于海底资产和海面资料收集以及日常维护作业。儘管 ROV 和 AUV 的初始成本比潜水作业更高,但完成相同工作量所需的时间更少,从而降低了整体计划营运成本。

- 沙乌地阿拉伯正在扩大其现有的石油和天然气田。主要扩建计划包括贝里油田和马里安油田。贝里油田部分位于沙乌地阿拉伯东海岸陆上,部分位于海上。贝里增产计画 (BIP) 正在进行扩建,到 2023 年,原油产能将翻一番,达到 50 万桶/日。该计划计划明年运作,预计投资60亿美元。该计划预计将推动 ROV 和 AUV 市场的未来需求。截至2021年,沙乌地阿拉伯的原油产量约为10,954(1,000桶/天)。

- 此外,2021 年 12 月,Fugro NV 在沙乌地阿拉伯海岸部署了两个新的自主环境登陆器,以收集红海深处偏远地区的海洋学资料。该计划旨在支持沙乌地阿拉伯 2030 年愿景。

- 此外,2022 年 9 月,沙乌地阿拉伯政府宣布计画采购中国先进的隐形 AUV,用于石油、天然气和国防行动。

- 因此,鑑于上述几点,预计沙乌地阿拉伯在预测期内将主导中东和非洲AUV和ROV市场。

中东和非洲 AUV 和 ROV 产业概况

中东和非洲 AUV 和 ROV 市场因其性质而适度细分。市场的主要企业包括(排名不分先后)DOF Subsea AS、Fugro NV、Subsea 7 SA、Saipem SpA 和 Oceaneering International Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 政府法规和措施

- 最新趋势和发展

- 市场动态

- 促进因素

- 抑制因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按车型

- ROV

- AUV

- 最终用户使用情况

- 石油和天然气

- 防御

- 研究

- 其他最终用户用途

- 按地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- DOF Subsea AS

- Fugro NV

- Subsea 7 SA

- Saipem SpA

- Oceaneering International Inc.

第七章 市场机会及未来趋势

简介目录

Product Code: 92804

The Middle-East and Africa AUV & ROV Market is expected to register a CAGR of greater than 4.6% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Rising oil and gas production activities, along with increasing oil and gas decommissioning activities in various Middle Eastern and African countries, such as Saudi Arabia, United Arab Emirates, Oman, Ghana, and Ivory Coast, are expected to drive the market during the forecast period.

- On the other hand, the declining number of offshore rigs and offshore oil and gas activities in the Persian Gulf Basin is expected to restrain the market.

- Nevertheless, the ongoing deepwater and ultra-deepwater oil and gas discoveries and shale gas explorations are expected to create enormous opportunities for the Middle East and Africa AUV and ROV market during the forecast period.

- Due to increasing oil and gas activities across the country, Saudi Arabia is expected to dominate the market during the forecast period.

MEA AUV & ROV Market Trends

Oil and Gas Segment is Expected to Dominate the Market

- The Middle East and Africa are significant regions of proven oil and gas field reserves worldwide. The region's offshore reserves remain underdeveloped in Kuwait, Saudi Arabia, Iran, Qatar, Nigeria, Cameroon, and the United Arab Emirates, all of which have significant field developments in trains.

- As of 2021, the total oil production in the Middle East reached 28,156 thousand barrels daily. With the rapidly increasing global energy needs, offshore oil production has become an attractive energy source. Therefore, countries with significant regional players are focusing on exploring and producing offshore oil and gas fields.

- For instance, this year, Abu Dhabi National Oil Company (ADNOC) kicked off a bid process for engineering, procurement, construction, and installation contract for further development at its giant Lower Zakum offshore oilfield. The development of the field includes several services, such as the construction of infrastructure, subsea pipelines, and subsea systems. All these services require ROV and AUV for installation and monitoring.

- Moreover, in June 2022, Saudi's King Abdullah University of Science and Technology (KAUST) announced a new collaboration agreement with Ocean Aero, a manufacturer and service provider of ocean-going Autonomous Underwater and Surface Vehicles (AUVs). Ocean Aero and Shelf Subsea aim to bring the AUVs into Saudi Arabia, enhancing KAUST research on the Red Sea.

- Furthermore, as of 2021-2025, there are more than 77 approved upstream projects in the Middle East and 27 approved upstream projects in the African region. Most of these projects are offshore field projects requiring ROVs and AUVs for various services. This, in turn, is expected to drive the market studied during the forecast period.

- Therefore, the oil and gas segment is expected to dominate the market during the forecast period.

Saudi Arabia is Expected to Dominate the Market

- Saudi Arabia is rich in oil and gas reserves. The region has one of the most well-developed oil and gas industries, with the primary areas of focus being the vast reserves in the Persian Gulf. As drilling depths have increased over the years, the volume of technically recoverable reserves has increased significantly, which has attracted growing investments.

- ROV and AUV technologies have become increasingly affordable. Therefore, oil and gas producers in Saudi Arabia have invested in ROV and AUV services for obtaining data and carrying out routine maintenance work on subsea assets and surfaces. Despite higher upfront costs than those of the diving crews, ROVs and AUVs need less time to complete the same amount of work, reducing overall project OPEX.

- Saudi Arabia is in the process of expanding its existing oil & gas fields. Major expansion projects include the Berri field and the Marjan Oil field. The Berri field is located partly onshore and partly offshore on the east coast of Saudi Arabia. It is being expanded under the Berri Increment Program (BIP) to double its crude oil production capacity to 500,000 barrels per day by 2023. The project is scheduled to commission next year, with an estimated investment of USD 6 billion. It is expected to drive future demand for the ROV and AUV market. As of 2021, Saudi Arabia had crude oil production of about 10,954 in thousand barrels per day.

- Moreover, in December 2021, Fugro NV deployed two new autonomous environmental landers off the coast of Saudi Arabia to collect oceanographic data in deep remote areas of the Red Sea. The project aims to support Saudi Vision 2030.

- Furthermore, in September 2022, the Government of Saudi Arabia announced its plan to procure highly advanced stealth Chinese AUVs for oil and gas and defense operations.

- Therefore, owing to the above points, Saudi Arabia is expected to dominate the Middle East and Africa AUV & ROV market during the forecast period.

MEA AUV & ROV Industry Overview

The Middle East and Africa AUV & ROV market is moderately fragmented in nature. Some of the market's key players (in no particular order) include DOF Subsea AS, Fugro NV, Subsea 7 SA, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope Of The Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size And Demand Forecast In USD Billion, Till 2027

- 4.3 Government Policies And Regulations

- 4.4 Recent Trends And Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 End-user Application

- 5.2.1 Oil and Gas

- 5.2.2 Defense

- 5.2.3 Research

- 5.2.4 Other End-user Applications

- 5.3 By Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 South Africa

- 5.3.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, And Agreements

- 6.2 Strategies Adopted By Leading Players

- 6.3 Company Profiles

- 6.3.1 DOF Subsea AS

- 6.3.2 Fugro NV

- 6.3.3 Subsea 7 SA

- 6.3.4 Saipem SpA

- 6.3.5 Oceaneering International Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219