|

市场调查报告书

商品编码

1636176

中东和非洲电动车用锂离子电池:市场占有率分析、产业趋势和成长预测(2025-2030)Middle East And Africa Lithium-ion Battery For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

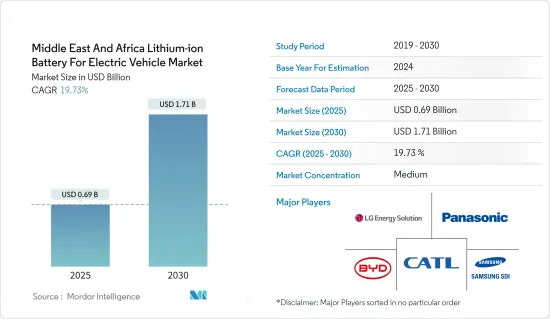

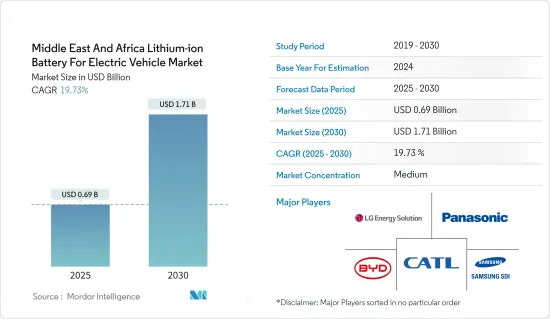

预计2025年中东和非洲电动车用锂离子电池市场规模将达6.9亿美元,2030年将达到17.1亿美元,复合年增长率为19.73%。

主要亮点

- 从中期来看,锂离子电池价格的下降和政府倡议支持的电动车的普及预计将在预测期内推动中东和非洲电动车锂离子电池市场的发展。

- 另一方面,替代电池技术的兴起和原材料供需不匹配可能会阻碍预测期内的市场成长。

- 然而,快速都市化和智慧城市倡议的结合提供了将电动车整合到新的城市移动解决方案中的机会,从而在可能诞生的中东和北非电动车锂离子电池市场创造了巨大的商机。

- 由于阿联酋电动车的普及率不断提高,预计中东和非洲电动车锂离子电池市场将显着成长。

中东和非洲电动车锂离子电池市场趋势

纯电动车 (BEV) 领域推动成长

- 纯电动车(BEV)通常也称为带有马达的电动车。纯电动车是全电动汽车,这意味着它们不包括内燃机 (ICE)、燃料箱或排气管,通常依靠电力进行推进。车辆的能量来自电池组并透过电网充电。纯电动车是零排放车,这意味着它们不会产生传统汽油动力汽车造成的有害废气和空气污染。

- 与欧美、亚洲国家等其他地区相比,中东和非洲(MEA)地区的汽车产业仍属于新兴地区。然而,近年来,由于政府政策、技术进步和环保意识的增强,中东和非洲地区的电动车,特别是纯电动车(BEV)经历了适度增长。

- 根据国际能源总署(IEA)的数据,阿联酋和南非等国家近年来纯电动车销量显着成长。例如,阿联酋的纯电动车销量到2023年将达到约23,000辆,比2022年的约15,000辆成长超过53%。同样,南非纯电动车销量从 2022 年的约 500 辆增至 2023 年约 810 辆。纯电动车的这种成长趋势预计未来将持续,锂离子电池市场的需求预计在预测期内增加。

- 该地区各国政府正在实施政策和奖励,鼓励使用纯电动车。例如,阿拉伯联合大公国 (UAE) 降低了联邦和地方各级的电动车註册费、免费的电动车专用停车位、免费的 salik 标籤,以及透过杜拜水电局 (DEWA) 的公共电动车充电网路免费充电。

- 同样,沙乌地阿拉伯也宣布了开发充电基础设施和促进电动车本地生产的计划,作为其 2030 年愿景计划的一部分。沙乌地阿拉伯也设定了2030年终首都道路上30%的汽车为电动车的目标。这些政策对于减少消费者的前期成本障碍和促进纯电动车的采用至关重要。预计这将为未来几年锂离子电池市场的成长创造有利的环境。

- 最近,沙乌地阿拉伯与一家中国公司签署了一份价值 56 亿美元的合同,将于 2023 年生产电动车。沙乌地阿拉伯打算带领阿拉伯国家扩大与北京的经济联繫。在首都利雅德举行的大型商务会议第一天签署的 100 亿美元投资中,一半以上将投资于汽车开发,其中以有关製造和销售的谅解备忘录 (MoU) 为主。此外,沙乌地阿拉伯也宣布推出名为Shia的国产电动车品牌,目前正在建造的製造工厂预计到2025年将生产电动SUV和轿车。这些发展可能会在预测期内促进锂离子电池等电动车电池的采用。

- 摩洛哥等非洲国家拥有充满活力的汽车製造业,包括雷诺、斯特兰蒂斯等世界知名汽车製造商。该国的目标是到2025年生产各类汽车100万辆。此外,计划到 2030 年电动车占汽车出口量的 60%。但对电池製造的持续投资可能会加速实现这一目标。

- 2024年6月,摩洛哥政府宣布,中国Gothion Hitech计画兴建摩洛哥首座电动车电池超级工厂,总建造成本约13亿美元。 Gothion Hitech 是摩洛哥最新一家投资电动车电池製造的公司,寻求使不断增长的汽车行业适应日益增长的电动车需求。摩洛哥政府和 Gothion Hitech 签署了 Gigafactory 的投资协议,该工厂的初始电池容量将为 20 吉瓦每小时 (GWh)。透过这些努力,该地区有可能在未来几年成为锂离子电池的主要市场。

- 因此,由于上述因素,在预测期内,中东和非洲电动车锂离子电池市场的纯电动车产业可能会显着成长。

阿拉伯联合大公国(UAE)预计将显着成长

- 预计阿拉伯联合大公国(UAE)的电动车锂离子电池在预测期内将显着成长,并引领该地区。这是由于快速工业化、电动车产业的崛起、技术进步以及该国在该地区的战略经济地位等因素所造成的。这些为阿联酋电动车电池的采用和创新创造了良好的条件。

- 近年来,阿联酋电动车(EV)的引进进展迅速。例如,根据国际能源总署(IEA)的数据,阿联酋电动车(包括纯电动车和插电式混合动力车)的总销量将从2022年的约18,900辆成长到2023年的约28,900辆,增幅超过% 。电动车渗透率的扩大预计将有助于电动车市场中锂离子电池的成长。

- 阿联酋还计划到 2050 年,阿联酋道路上 50% 的车辆为电动和混合动力汽车汽车。随着阿联酋大力投资电动车基础设施并推动电动车的采用以应对气候变迁并减少对石化燃料的依赖,对高容量、长寿命电动车电池的需求不断增长。

- 随着电动车电池需求的增加,该国的电池回收也正在取得进展。例如,2023年12月,总部位于印度的LOHUM Cleantech透过与阿联酋能源和基础设施部以及中东部伙伴关係协议,开设了阿联酋第一家电动汽车电池回收工厂,中东永续性和数数位化先驱宣布进入。进军阿联酋市场。该伙伴关係关係考虑了阿联酋的 COP28 议程,并符合阿联酋的 2050 年净零排放战略倡议和循环经济政策,透过面向未来的解决方案支持排放排放交通。该合资企业将在阿联酋建立一个占地 80,000 平方英尺的锂电池回收和再循环设施。该工厂每年将回收 3,000 吨锂离子电池,并将每年 15 MWh 的电池容量重新用于能源储存系统(ESS)。这可能会占目前预期电动车电池管理需求的 80% 以上。

- 除了锂离子电池外,日本的电动车先进电池技术也正在取得进展。例如,2024年4月,美国电池製造商和锂离子电池开发商Statevolt宣布计划于2026年终在阿拉伯联合大公国(UAE)生产固态电池。该公司正准备在哈伊马角建造一座耗资 32 亿美元的超级工厂。该计划年产能高达40GWh,旨在开拓包括非洲和印度在内的中东地区电动车新兴出口市场。这些倡议将使该国能够探索其他电池技术来满足电动车的需求。

- 预计电动车製造业也会快速成长。例如,阿布达比宣布建设计画一座电动车组装设施,每年从工业区生产数千辆汽车,并吸引了智慧电动公司 NWTN,因为它的目标是成为汽车中心。阿布达比哈利工业区 (KIZAD) 透露,到 2022 年,NWTN 将建造一座占地 25,000平方公尺的设施,用于电动车製造、研发和车辆测试。此类倡议可能会吸引和支持该国的锂离子电池市场。

- 因此,考虑到上述因素,预计阿拉伯联合大公国(UAE)的中东和非洲电动车锂离子电池市场在预测期内将显着成长。

中东和非洲电动车锂离子电池产业概况

中东和非洲的电动车锂离子电池市场正在变得半固体。该市场的主要企业包括(排名不分先后)Panasonic Corporation、宁德时代新能源科技有限公司、三星SDI、比亚迪有限公司和LG能源解决方案有限公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 锂离子电池价格下降

- 政府措施支持电动车的扩张

- 抑制因素

- 替代电池技术的兴起

- 原料供需不匹配

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 按车型

- 客车

- 商用车

- 其他(自行车、Scooter等)

- 依推进类型

- 纯电动车(BEV)

- 插电式混合动力汽车(PHEV)

- 混合动力电动车(HEV)

- 按地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业招募策略及SWOT分析

- 公司简介

- Panasonic Corporation

- Samsung SDI Co. Ltd

- Contemporary Amperex Technology Co. Ltd(CATL)

- BYD Company Limited

- LG Energy Solution Ltd

- 其他主要企业名单(公司名称、总部、相关产品/服务、联络资讯等)

- 市场排名分析

第七章 市场机会及未来趋势

- 国内锂离子电池製造能力及联盟必要性

- 快速都市化和智慧城市倡议为将电动车整合到新的城市交通解决方案中提供了机会

简介目录

Product Code: 50002585

The Middle East And Africa Lithium-ion Battery For Electric Vehicle Market size is estimated at USD 0.69 billion in 2025, and is expected to reach USD 1.71 billion by 2030, at a CAGR of 19.73% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices and the increasing adoption of electric vehicles supported by government initiatives are expected to drive the Middle East and African lithium-ion battery for the electric vehicle market during the forecast period.

- On the other hand, the emerging alternative battery technologies and the demand-supply mismatch of raw materials are likely to hinder the market's growth during the forecast period.

- Nevertheless, rapid urbanization, coupled with smart city initiatives, offers the opportunity to integrate EVs into new urban mobility solutions, which will likely create vast opportunities for the Middle East and African lithium-ion batteries for the electric vehicle market.

- United Arab Emirates (UAE) is expected to witness significant growth for the Middle East and African lithium-ion batteries for the electric vehicle market due to the increasing adoption of electric vehicles in the country.

Middle East And Africa Lithium-ion Battery for Electric Vehicle Market Trends

Battery Electric Vehicle (BEV) Segment to Witness Growth

- Battery electric vehicles (BEVs) are also commonly referred to as electric vehicles with an electric motor. BEVs are fully electric vehicles that typically do not include an internal combustion engine (ICE), fuel tank, or exhaust pipe and rely on electricity for propulsion. The vehicle's energy comes from the battery pack, which is recharged from the grid. BEVs are zero-emission vehicles, as they do not generate harmful tailpipe emissions or air pollution hazards caused by traditional gasoline-powered vehicles.

- The automotive industry in the Middle East and Africa (MEA) region is still emerging compared to other parts of the world, such as Western and Asian countries. However, in recent years, EVs, particularly battery electric vehicles (BEVs), in the MEA region have experienced modest growth, driven by a combination of government policies, technological advancements, and growing environmental awareness.

- According to the International Energy Agency (IEA), countries such as the United Arab Emirates and South Africa have recorded notable sales growth of BEV cars over the years. For example, the UAE's BEV car sales stood at around 23,000 units in 2023, recording over 53% from around 15000 units of BEV cars sold in 2022. Similarly, the BEV car sales in South Africa reached around 810 units in 2023, increasing from around 500 BEV cars sold in 2022. Such increasing trends in BEV cars are likely to continue, and the demand for the lithium-ion battery market will increase during the forecast period.

- The governments in the region are implementing policies and incentives to accelerate the adoption of battery-electric vehicles. For example, the United Arab Emirates (UAE) introduced various initiatives, such as reduced registration fees for EVs on both the federal and local levels, dedicated free EV parking spaces, free Salik tag, and free charging through the public EV charging network of the Dubai Electricity and Water Authority (DEWA).

- Similarly, Saudi Arabia has also announced plans to establish charging infrastructure and promote the local manufacturing of electric vehicles as part of its Vision 2030 program. Saudi Arabia has also set a target of ensuring that 30% of the cars on its capital city's roads are electric by the end of 2030. These policies are crucial in reducing the initial cost barrier for consumers and promoting the adoption of BEVs. This, in turn, is expected to create a positive environment for the lithium-ion battery market to grow in the coming years.

- More recently, in 2023, Saudi Arabia signed a USD 5.6 billion deal with a Chinese company to manufacture electric vehicles. The Kingdom intends to lead the Arab world in expanding economic ties with Beijing. The memorandum of understanding (MoU) signed with electric and self-driving car maker Human Horizons on the development, manufacture, and sale of vehicles accounted for over half of the USD 10 billion in investments signed on the first day of a major business conference being held in the capital, Riyadh. In addition, Saudi Arabia has unveiled its homegrown brand of electric cars, called Ceer, which it expects to make electric SUVs and sedans by 2025 through a manufacturing plant that is now under construction. These developments are likely to boost the adoption of EV batteries like lithium-ion batteries during the forecast period.

- African countries like Morocco boast a vibrant vehicle manufacturing industry, including world-renowned car makers such as Renault and Stellantis. The country is targeting the production of one million cars of all types by 2025. In addition, part of the plan is to have EVs represent up to 60% of car exports by 2030. However, the ongoing investments in battery manufacturing could expedite these ambitions.

- In June 2024, the Moroccan government revealed that China's Gotion High Tech plans to build Morocco's first EV battery gigafactory for a total cost of around USD 1.3 billion. Gotion High Tech is the latest company to invest in EV battery manufacturing in Morocco, and it seeks to adapt its growing automotive sector to the rising demand for electric vehicles. The Moroccan government and Gotion High Tech signed an investment deal for the gigafactory, which will have an initial battery capacity of 20 gigawatts per hour (GWh). Such initiatives are likely to make the region a key market for lithium-ion batteries in the coming years.

- Therefore, due to the factors mentioned above, the BEV segment is likely to witness notable growth in the Middle East and African lithium-ion battery for EV market over the forecast period.

United Arab Emirates (UAE) is Expected to Witness Significant Growth

- The lithium-ion batteries for electric vehicles in the United Arab Emirates (UAE) are expected to witness significant growth and lead the region during the forecast period. This is driven by factors like rapid industrialization, the rising EV sector, technological advancements, and the country's strategic economic positioning in the region. These are creating a promising landscape for EV battery adoption and innovation in the UAE.

- In recent years, the UAE has been seeing a rapid adoption of electric vehicles (EVs). For example, according to the International Energy Agency (IEA), the total number of electric vehicle car sales (including BEV and PHEV) in the UAE reached about 28,900 units in 2023, up over 50% from around 18,900 units in 2022. Increasing EV adoption will likely contribute to the growth of lithium-ion batteries in the EV market.

- In addition, the UAE is targeting electric and hybrid vehicles to account for 50% of total vehicles on UAE roads by 2050. As the UAE invests heavily in EV infrastructure and promotes the adoption of EVs to combat climate change and reduce reliance on fossil fuels, the demand for high-capacity and long-lasting EV batteries is on the rise.

- With the growing demand for EV batteries, the country is also seeing progress in battery recycling. For example, in December 2023, India-based LOHUM Cleantech announced its expansion into the UAE market to build the UAE's first EV battery recycling plant through a partnership agreement with the Ministry of Energy & Infrastructure, UAE, and BEEAH, the Middle East's sustainability and digitalization pioneer. The partnership comes with considering UAE's COP28 agenda, aligning with the UAE's Net Zero by 2050 Strategic Initiative and Circular Economy Policy, and supporting emissions-free mobility with future-ready solutions. The venture will entail setting up an 80,000 sq. ft refurbishing and recycling Lithium batteries facility in the UAE. The facility will annually recycle 3000 tons of lithium-ion batteries and repurpose 15 MWh battery capacity into Energy Storage Systems (ESS) per annum. This is likely to account for over 80% of the current expected EV battery management demands.

- Apart from lithium-ion batteries, there is also growing progress in some of the advanced battery technologies for EVs in the country. For example, in April 2024, a US-based battery producer and a lithium-ion battery cell developer, Statevolt, announced plans to manufacture solid-state battery cells in the United Arab Emirates (UAE) by the end of 2026. The company is preparing to build a USD 3.2 billion gigafactory in Ras Al Khaimah. With an annual production capacity of up to 40 GWh, the project aims to tap into the emerging export markets for electric mobility in the Middle East region, including Africa and India. Such efforts are likely to allow the country to explore other battery technologies to cater to the demand for EVs.

- The country is also expected to see a surge in EV manufacturing. For example, Abu Dhabi announced plans to build an EV assembly facility that will manufacture thousands of cars annually from its industrial zone and has brought in smart electric firm NWTN as it looks to become an auto hub. Khalifa Industrial Zone Abu Dhabi (KIZAD) revealed in 2022 that it will construct a 25,000-square-meter facility, which NWTN will operate for the manufacturing, research and development, and vehicle testing of electric vehicles. Such initiatives are likely to attract and support the country's lithium-ion batteries market.

- Therefore, given the above-mentioned factors, the United Arab Emirates (UAE) is expected to witness significant growth in the Middle East and African lithium-ion batteries for the EV market during the forecast period.

Middle East And Africa Lithium-ion Battery For Electric Vehicle Industry Overview

The Middle East and African lithium-ion battery market for electric vehicles is semi-consolidated. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, Samsung SDI Co. Ltd, BYD Company Limited, and LG Energy Solution Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-ion Battery Prices

- 4.5.1.2 Increasing Adoption of Electric Vehicles Supported by Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Emerging Alternative Battery Technologies

- 4.5.2.2 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.1.3 Others (Bikes, Scooters, etc.)

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-In Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Samsung SDI Co. Ltd

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 BYD Company Limited

- 6.3.5 LG Energy Solution Ltd

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Need for Domestic Lithium-ion Battery Manufacturing Capabilities and Collaborations

- 7.2 Rapid Urbanization Coupled with Smart City Initiatives Offers the Opportunity to Integrate EVs into New Urban Mobility Solutions

02-2729-4219

+886-2-2729-4219