|

市场调查报告书

商品编码

1636182

电动车电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)E-Rickshaw Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

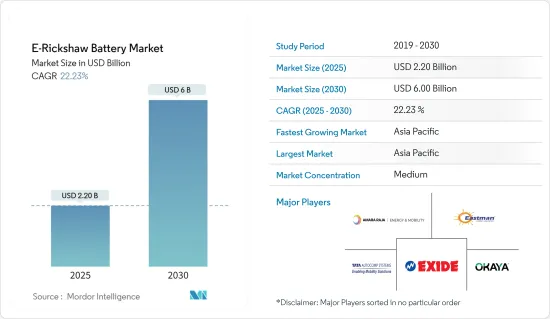

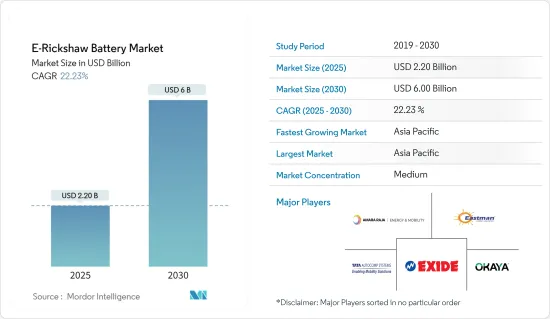

电动车电池市场规模预计到2025年为22亿美元,预计到2030年将达到60亿美元,预测期内(2025-2030年)复合年增长率为22.23%。

主要亮点

- 从中期来看,政府措施将扩大电动人力车的普及,并且由于其运营和维护成本比传统石化燃料驱动的电动人力车更低,因此在预测期内,电动人力车电池预计将变得更受欢迎。市场为驱动。

- 另一方面,充电基础设施的可用性差和电动人力车的行驶范围有限可能会阻碍预测期内电动人力车电池市场的成长。

- 电池技术的不断进步,例如能量密度的提高和电动人力车电池更换基础设施的引入,预计将为电动人力车电池市场提供重大机会。

- 由于越来越多地采用电池驱动车辆,亚太地区预计将成为电动人力车市场的主导区域。

人力车电池市场趋势

锂离子电池成长迅速

- 在各种类型的电池技术中,锂离子电池(LIB)预计将成为预测期内成长最快的电动车电池市场之一。由于其良好的容量重量比,锂离子电池比其他电池类型更受欢迎。推动锂离子电池普及的其他因素包括改进的性能(更长的使用寿命、更少的维护)、更长的保质期和更低的价格。

- 与铅酸电池等其他技术相比,锂离子 (Li-ion) 电池具有多种技术优势。平均而言,锂离子电池的循环寿命超过5000次循环,而铅酸电池的寿命约为400-500次循环。锂离子电池不像铅酸电池需要经常维护或更换。此外,这些电池在整个放电週期中保持电压,使电气元件更有效率、使用寿命更长。

- 近年来,几大锂离子电池製造商一直在投资以获得规模经济,并进行研发活动以提高性能,导致竞争加剧和锂离子电池价格下降。例如,由于技术创新、製造改进和原材料成本降低,锂离子电池的体积加权平均价格已从2013年的780美元/千瓦时大幅下降至2023年的139美元/kWh。 2025 年可能达到约 113 美元/千瓦时,2030 年达到约 80 美元/kWh。这种电池成本下降的趋势很可能使锂离子电池成为未来几年电动车电池市场所有电池中的有利选择。

- 锂离子电池传统上用于行动电话和笔记型电脑等家用电子电器。然而,近年来,由于对环境的影响较小,越来越多的电池被重新设计为电动车(BEV)(包括电动人力车)的动力来源。

- 2023年12月,韩国财政部宣布计画未来5年向锂电池产业提供38兆韩元的政策贷款。该措施将于2024年正式实施。韩国也计划设立1兆韩元的锂电池产业促进基金,并投资736亿韩元用于相关技术的研发。同时,政府决定增加国内锂电池製造所需的关键矿物蕴藏量,并培育电池再利用和回收的生态系统。所有这些预计将提振锂离子电池产业,进而支持电动车电池市场的成长。

- 亚太地区的锂离子电池製造业正在崛起。例如,松下集团于2024年3月宣布,将与印度石油公司(IOCL)组成合资企业,生产圆柱形锂离子电池。集团公司松下能源公司已签署了一份具有约束力的条款清单,并开始与 IOCL 进行讨论,概述建立一家合资企业生产圆柱形锂离子电池的框架。这个概念是基于印度市场对两轮和三轮汽车电池需求的预期成长。

- 2023 年 5 月,Stellantis 与 TotalEnergies 和梅赛德斯-奔驰一起为 Automotive Cells Company (ACC) 位于法国 Billie-Bercleau-Deverin 的电池超级工厂举行了落成仪式。初始产能为 13 吉瓦时 (GWh),预计到 2030 年将增加至 40 吉瓦时 (GWh),提供二氧化碳排放最小的高性能锂离子电池。 Gigafactory 将为 Stellantis 的目标做出贡献,即在 2030 年将欧洲电池产能提高到 250GWh。

- 此外,据能源效率和可再生能源办公室称,政府已宣布将于 2023 年在北美建立电动车电池工厂。该地区的製造能力预计将从 2021 年的 55 吉瓦/年增加到 2030 年的 1,000 GWh/年。大多数筹备中的计划预计将在 2025 年至 2030 年间开始生产。这显示汽车电池市场发展稳健,预计在未来几年支撑电动车电池市场。

- 2024 年 1 月,松下能源宣布更新位于堪萨斯州德索托、耗资 40 亿美元正在兴建的电动车电池工厂。据该公司称,该製造工厂在运作时每秒将生产 66 块锂离子电池。这座占地 470 万平方英尺的电池工厂正在原向日葵陆军弹药厂的旧址上建设,预计将于 2025 年 3 月开始生产。此类锂离子电池的开发预计将在全球范围内继续发展,并支持电动人力车电池市场。

- 由于重量更轻、充电时间更短、充电次数更多、成本更低以及锂离子电池的进步等特点,锂离子电池将成为成长最快的电动车市场,包括电动车电池市场、在预测期内,这可能是一种不断增长的电池类型。

亚太地区预计将主导市场

- 由于几个有吸引力的因素,预计亚太地区将在预测期内主导电动人力车电池市场。例如,在印度、中国和孟加拉等国家,高人口密度和快速都市化增加了对高效且负担得起的交通的需求,而电动人力车近距离一个合适的选择。这种高需求直接转化为电动车电池的强劲市场。

- 该地区各个新兴国家政府对引进电动人力车的支持显而易见。特别是印度等国家已经实施了支持性法规、补贴和奖励,以鼓励使用包括电动人力车在内的电动车,作为对抗污染和减少对石化燃料依赖的更广泛努力的一部分。例如,印度的 FAME(混合动力和电动车的更快采用和製造)计划为包括电动人力车在内的电动车的采用提供了重大奖励。

- 2024年3月,印度重工业部(MHI)宣布了一项倡议,旨在促进两轮和三轮电动车用于商业用途,并为印度电动车的开发和製造提供必要的支持。 (EMPS)已经启动。

- EMPS-2024将于2024年4月1日至2024年7月31日实施,为期四个月。预算为 500 亿印度卢比,用于补贴电动车。两轮电动车最高补助10,000印度卢比,小型三轮电动车最高补贴25,000印度卢比,大型三轮电动车最高补贴50,000印度卢比。三菱重工在销售电动车时向电动车製造商补偿补贴和需求激励,但补贴从最终发票价格中扣除,降低了电动车的购买价格,也让消费者受益。预计此类措施将促进电动人力车及其相关电池在日本的引进。

- 印度道路运输及公路部预计,2023年印度电动三轮车年销售量将超过58.1万辆。国际能源总署(IEA)资料显示,2023年中国和印度合计将占全球电动三轮车销售量的66%。这凸显这些国家可能会在预测期内持续并确认大规模成长。

- 此外,该地区重要的电池製造商正在推动市场成长。 Exide Industries、Amara Raja Batteries 和 Okaya Power 等公司可以轻鬆获得最新的电池技术和创新成果。这些公司也持续投资研发,以提高电池性能、降低成本、延长电动车电池的使用寿命,使其产品对消费者更具吸引力。

- 由于廉价的劳动力和原材料,亚太地区的生产成本较低,因此电动人力车电池的定价具有竞争力。这种成本优势支持了它在不同社会经济阶层的普及,使电动人力车成为许多人经济上可行的解决方案。

- 此外,环保意识的增强和对永续城市交通解决方案的需求将推动市场向前发展。电动人力车为传统自动化电动人力车提供了更环保的替代方案,并满足许多亚太国家的环境目标。因此,在可预见的未来,该地区预计将保持在全球电动车电池市场的主导地位。

- 因此,由于上述因素,预计亚太地区将在预测期内主导电动人力车市场。

电动车电池产业概况

电动车电池市场适度细分。市场上的主要企业(排名不分先后)包括 Exide Industries Ltd、Eastman Auto & Power Ltd、Amara Raja Energy &Mobility Limited、Okaya Power Private Limited 和 TATA AutoComp GY Batteries Pvt.

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 透过政府措施扩大电动人力车的普及

- 营运和维修成本低于传统石化燃料人力车

- 抑制因素

- 充电基础设施不普及且难以接入

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 电池类型

- 铅酸电池

- 锂离子电池

- 其他电池

- 车型

- 客车

- 货车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 奈及利亚

- 卡达

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- Exide Industries Ltd

- Eastman Auto & Power Ltd

- Amara Raja Energy & Mobility Limited

- Okaya EV Pvt. Ltd

- TATA AutoComp GY Batteries Pvt. Ltd

- Microtex Energy Private Limited

- Sparco Batteries Pvt. Ltd

- Gem Batteries Pvt. Ltd

- Alsym Energy Inc.

- 其他知名公司名单(公司名称、总部地点、相关产品及服务、联络等)

- 市场排名分析

第七章 市场机会及未来趋势

- 推出电动三轮车电池更换基础设施

简介目录

Product Code: 50002591

The E-Rickshaw Battery Market size is estimated at USD 2.20 billion in 2025, and is expected to reach USD 6.00 billion by 2030, at a CAGR of 22.23% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of e-rickshaws aided by government initiatives and the lower operational and maintenance costs compared to traditional fossil fuel-powered rickshaws are expected to drive the e-rickshaw battery market during the forecast period.

- On the other hand, the lack of widespread and accessible charging infrastructure and the limited range of e-rickshaws can hinder the growth of the e-rickshaw battery market during the forecast period.

- Ongoing advancements in battery technologies, such as increased energy density and the implementation of battery-swapping infrastructure for e-rickshaw, are likely to create vast opportunities for the e-rickshaw battery market.

- Asia-Pacific is expected to be a dominant region in the e-rickshaw market due to the increasing adoption of battery-powered vehicles.

E-Rickshaw Battery Market Trends

Lithium-ion Battery to be the Fastest Growing

- Among different types of battery technologies, lithium-ion batteries (LIB) are expected to be among the fastest-growing e-rickshaw battery markets during the forecast period. Lithium-ion batteries are gaining more popularity than other battery types due to their favorable capacity-to-weight ratio. Other factors boosting their adoption include better performance (long and low maintenance), better shelf life, and decreasing price.

- Lithium-ion (Li-ion) batteries offer various technical advantages over other technologies, such as lead-acid batteries. On average, Li-ion batteries offer cycles over 5,000 times compared to lead-acid batteries that last around 400-500 times. Li-ion batteries do not require as frequent maintenance and replacement as lead-acid batteries. Furthermore, these batteries maintain their voltage throughout the discharge cycle, allowing more significant and longer-lasting efficiency of electrical components.

- In recent years, several major lithium-ion battery players have been investing to gain economies of scale and R&D activities to enhance their performance, increasing the competition and declining lithium-ion battery prices. For example, due to the improving technological innovations, manufacturing improvements, and declining raw material costs, the volume-weighted average price of lithium-ion batteries decreased considerably from USD 780/kWh in 2013 to USD 139/kWh in 2023. It is likely to reach around USD 113/kWh in 2025 and USD 80/kWh in 2030. Such declining trends in battery costs are likely to make it a lucrative choice among all batteries for the e-rickshaw battery market in the coming years.

- Lithium-ion batteries have traditionally been used in consumer electronic devices like mobile phones, laptops, and others. However, in recent years, they have increasingly been redesigned for use as the power source of choice in electric vehicles (BEVs), including e-rickshaws, in various countries, owing to factors such as low environmental impact.

- In December 2023, South Korea's Ministry of Finance announced plans to provide KRW 38 trillion in policy financing to the lithium battery industry over the next five years. This policy will be formally implemented in 2024. South Korea also plans to establish a KRW 1 trillion lithium battery industry promotion fund and invest KRW 73.6 billion in research and development of related technologies. At the same time, the government decided to increase the critical mineral reserves required for domestic lithium battery manufacturing and cultivate a battery reuse and recycling ecosystem. All these are anticipated to boost the lithium-ion battery industry and, in turn, support the growth of the e-rickshaw batteries market.

- There has been an increasing trend in lithium-ion battery manufacturing in the Asia-Pacific region. For example, in March 2024, Panasonic Group announced it would form a joint venture with Indian Oil Corporation Ltd (IOCL) to manufacture cylindrical lithium-ion batteries. Panasonic Energy, a group firm, signed a binding term sheet and initiated discussions with IOCL to draw a framework for forming a joint venture to manufacture cylindrical lithium-ion batteries. This initiative is driven by the expected expansion of demand for batteries for two and three-wheel vehicles in the Indian market.

- In May 2023, Stellantis, together with TotalEnergies and Mercedes-Benz, celebrated the inauguration of Automotive Cells Company's (ACC) battery gigafactory in Billy-Berclau Douvrin, France, the first of three planned in Europe. With an initial production line capacity of 13 gigawatt-hours (GWh), rising to 40 GWh by 2030, the facility is expected to deliver high-performance lithium-ion batteries with a minimal CO2 footprint. The gigafactory will contribute to Stellantis' goal of increasing battery manufacturing capacity to 250 GWh in Europe by 2030.

- Furthermore, as per the Office of Energy Efficiency and Renewable Energy, in 2023, the government announced the development of electric vehicle battery plants in North America. The region is expected to ramp up manufacturing capacity from 55 gigawatts per year (GWh/year) in 2021 to 1000 GWh/year by 2030. Most of the projects in the pipeline are expected to initiate production between the years 2025 to 2030. This indicates a robust battery market development for automotive applications, which is expected to support the e-rickshaw battery market in the coming years.

- In January 2024, Panasonic Energy announced an update on their USD 4 billion electric vehicle battery plant, still under construction, in De Soto, Kansas. According to the company, the manufacturing facility will produce 66 lithium-ion batteries per second when operating at full capacity. The 4.7 million-square-foot battery plant is still under construction on the former Sunflower Army Ammunition Plant site, and it is expected to begin production in March 2025. Such developments in lithium-ion batteries are anticipated to continue across the globe and support the e-rickshaw battery market.

- Due to properties such as less weight, low charging time, a higher number of charging cycles, declining cost, and the growing progress in lithium-ion batteries, they are likely to be the fastest-growing battery type among electric vehicles, including the e-rickshaw battery market, during the forecast period.

Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is anticipated to dominate the e-rickshaw battery market during the forecast period due to several compelling factors. For example, the high population density and rapid urbanization in countries such as India, China, and Bangladesh are driving the need for efficient and affordable transportation solutions, positioning e-rickshaws as a preferred option for short-distance travel. This high demand directly translates to a robust market for e-rickshaw batteries.

- Various emerging countries in the region are experiencing notable government support for the adoption of e-rickshaws. In particular, countries such as India are implementing supportive regulations, subsidies, and incentives to promote the adoption of electric vehicles, including e-rickshaws, as part of broader efforts to combat pollution and reduce dependency on fossil fuels. For instance, India's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme significantly incentivized the adoption of electric vehicles, including e-rickshaws.

- In March 2024, the Ministry of Heavy Industries (MHI) in India launched the Electric Mobility Promotion Scheme (EMPS) that aims to boost the adoption of two-wheeler and three-wheeler electric vehicles for commercial purposes and provide the necessary support for developing and manufacturing EVs in India.

- The EMPS-2024 is being implemented for four months, from 1 April 2024 to 31 July 2024. It has a budget of INR 500 crore and provides subsidies to EVs. Subsidies of up to INR 10,000 will be provided for each two-wheeler EV, up to INR 25,000 for each small three-wheeler EV, and up to INR 50,000 for each large three-wheeler EV. The MHI will reimburse the subsidies or demand incentives to the EV manufacturers upon the sale of a vehicle, which will also benefit the consumers as the subsidy amount will be deducted from the final invoice price, thus reducing the purchase price of the EVs. Such initiatives are anticipated to boost the country's adoption of e-rickshaws and their relevant batteries.

- As per the Ministry of Road Transport and Highways in India, the annual sales of electric three-wheelers in India stood at over 581 thousand units in 2023. The data from the International Energy Agency (IEA) revealed that together, China and India accounted for 66% of the world's electric three-wheeler sales share in 2023. This highlights that these countries are likely to continue and witness vast growth during the forecast period.

- Moreover, crucial battery manufacturers in the region enhance the market's growth. Companies like Exide Industries, Amara Raja Batteries, and Okaya Power offer easy access to the latest battery technologies and innovations. Besides, these players continuously invest in research and development to improve battery performance, reduce costs, and extend the lifespan of e-rickshaw batteries, making them more attractive to consumers.

- The Asia-Pacific region benefits from lower production costs due to cheaper labor and raw materials, enabling competitive pricing of e-rickshaw batteries. This cost advantage helps drive widespread adoption across different socioeconomic segments, making e-rickshaws an economically viable solution for many.

- Furthermore, the rising environmental awareness and the need for sustainable urban transport solutions propel the market forward. E-rickshaws offer a greener alternative to traditional auto-rickshaws, aligning with the environmental goals of many Asia-Pacific nations. As a result, the region is expected to maintain its leading position in the global e-rickshaw battery market for the foreseeable future.

- Therefore, due to the abovementioned factors, the Asia-Pacific region is expected to dominate the e-rickshaw market during the forecast period.

E-Rickshaw Battery Industry Overview

The e-rickshaw battery market is moderately fragmented. Some key players in the market (not in any particular order) include Exide Industries Ltd, Eastman Auto & Power Ltd, Amara Raja Energy & Mobility Limited, Okaya Power Private Limited, and TATA AutoComp GY Batteries Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of E-Rickshaws Aided By Government Initiatives

- 4.5.1.2 Lower Operational and Maintenance Costs Compared to Traditional Fossil Fuel-powered Rickshaws

- 4.5.2 Restraints

- 4.5.2.1 Lack of Widespread and Accessible Charging Infrastructure and Limited Range of E-rickshaws

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Batteries

- 5.2 Vehicle Type

- 5.2.1 Passenger Carrier

- 5.2.2 Goods Carrier

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Nordic

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Thailand

- 5.3.3.6 Malaysia

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Egypt

- 5.3.4.5 Nigeria

- 5.3.4.6 Qatar

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Exide Industries Ltd

- 6.3.2 Eastman Auto & Power Ltd

- 6.3.3 Amara Raja Energy & Mobility Limited

- 6.3.4 Okaya EV Pvt. Ltd

- 6.3.5 TATA AutoComp GY Batteries Pvt. Ltd

- 6.3.6 Microtex Energy Private Limited

- 6.3.7 Sparco Batteries Pvt. Ltd

- 6.3.8 Gem Batteries Pvt. Ltd

- 6.3.9 Alsym Energy Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Implementation of Battery-swapping Infrastructure for E-rickshaws

02-2729-4219

+886-2-2729-4219