|

市场调查报告书

商品编码

1636278

美国电动汽车电池材料:市场占有率分析、产业趋势、成长预测(2025-2030)United States Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

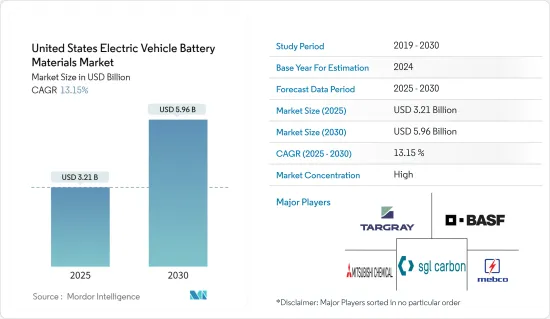

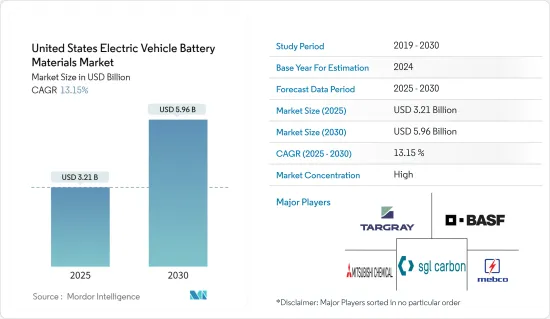

美国电动车电池材料市场规模预计2025年为32.1亿美元,预计2030年将达到59.6亿美元,预测期内(2025-2030年)复合年增长率为13.15%。

主要亮点

- 中期来看,电动车基础设施成长率上升以及政府扶持政策等因素预计将成为预测期内美国电动车电池材料市场最重要的驱动力之一。

- 同时,原料生产短缺正在增加对进口的依赖,对预测期内的美国电动车电池材料市场构成威胁。

- 儘管如此,人们仍在不断努力开发先进的电池技术,预计这将在未来创造多个市场机会。

美国电动车电池材料市场趋势

锂离子电池占市场主导地位

- 随着国际社会加强减少温室气体排放,美国已成为锂离子电池采用和创新的关键参与者,锂离子电池对于电动车的功能和效率至关重要。推动该行业成长的几个关键因素包括政府激励措施、电池技术的进步以及主要汽车製造商的策略性投资。

- 该领域的持续研究和开发显着提高了电池性能、降低了成本并增强了安全措施。这些进步使电池变得更有效率和可靠。因此,该行业有望在未来几年实现显着成长。

- 例如,2023 年 3 月,普渡大学工程师首创了一种专为锂离子电池设计的新型复合材料,其超出了传统固体聚合物电解质 (SPE) 技术设定的安全基准。这种由 Pol 开发的正在申请专利的材料拥有 4.8 伏特的电压窗口、令人难以置信的 2.4*104 微西门子离子电导率以及高达 330°C 的出色热稳定性。值得注意的是,锂离子电池也更能抵抗电池损坏,从而显着提高了整体安全标准。

- 锂离子电池以其能量密度高、循环寿命长、功率输出稳定而着称,是现代电动车的基础。这些电池实现了更长的行驶里程和更快的充电时间,彻底改变了汽车产业。此外,其重量轻有助于提高电动车的整体效率和性能。

- 根据技术资料表,锂离子电池的比能量密度在90至190Wh/kg之间。这是一个重大飞跃,锂离子电池的能量密度约为铅酸电池的2.5倍,是镍氢电池的1.5倍以上。因此,锂离子电池由于其优越的性能在各种应用中越来越受到青睐。

- 政府政策和奖励对锂离子电池产业的发展发挥着重要的推动作用。联邦和州一级的倡议,例如电动车购买税额扣抵和电池研发资助,为市场成长提供了有利的环境。这些政策不仅奖励消费者采用电动车,也鼓励企业投资先进的电池技术和製造能力。

- 因此,考虑到这些情况,锂离子电池领域预计将在预测期内主导市场。

电动车基础设施的扩张推动市场

- 美国各地电动车基础设施的快速扩张将显着提振电动车电池材料市场。都市区、郊区和农村地区充电站的激增不仅加强了物流,而且对增强消费者信心和加速电动车的普及发挥重要作用。

- 美国替代燃料资料中心的资料显示,电动车充电埠显着增加。 2022-2023年期间,这些港口成长了21.6%以上。此外,从2011年到2023年,复合年增长率成长了惊人的300%,凸显了电动车在美国的快速普及。

- 随着充电变得越来越方便和容易,里程焦虑这一潜在电动车购买者的主要障碍已不再那么令人担忧。这些变化创造了更有利于电动车普及的环境。这些基础设施的进步要求电池材料的生产和供应相应增加。锂、钴和镍等关键成分对于确保电动车电池的性能和可靠性至关重要。

- 2023 年 11 月,美国能源局(DOE) 宣布从基础设施法案中拨款高达 35 亿美元。这笔资金对于促进先进电池及其基本材料的国内生产具有战略意义。重点将涵盖电池级加工的关键矿物、前驱材料、组件、电池和电池组製造。这些努力对于加强清洁能源产业的未来至关重要,特别是可再生能源和电动车。

- 充电基础设施的技术创新对于塑造电动车电池材料市场也至关重要。超快充电站、无线充电、V2G技术等突破不仅提升了Vehicle-to-Grid体验,也为电池效能和配置树立了新标竿。

- 例如,超快速充电站需要能够承受更高功率输入和更快充电週期的电池,同时确保长寿命和安全性。这种需求正在推动电池化学和材料科学的持续研究和开发,为先进材料和增强电池设计铺平道路。

- 鑑于这些动态,美国电动车基础设施的扩张可能会在未来几年推动市场发展。

美国电动汽车电池材料产业概况

美国电动车电池材料市场正在变得半固体。该市场的主要企业(排名不分先后)包括Targray Technology International Inc.、 BASF SE、Mitsubishi Chemical Group Corporation、UBE Corporation、Umicore SA等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动汽车基础设施的成长

- 政府扶持政策及政策

- 抑制因素

- 对原料供应的依赖

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 依电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 按材质

- 阴极

- 阳极

- 电解

- 分隔符

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Targray Technology International Inc.

- BASF SE

- Mitsubishi Chemical Group Corporation

- UBE Corporation

- Umicore SA

- Sumitomo Chemical Co., Ltd.

- Nichia Corporation

- ENTEK International LLC

- Arkema SA

- Kureha Corporation

- 其他主要企业名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 电池技术的进步

简介目录

Product Code: 50003565

The United States Electric Vehicle Battery Materials Market size is estimated at USD 3.21 billion in 2025, and is expected to reach USD 5.96 billion by 2030, at a CAGR of 13.15% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in electric vehicle infrastructure and supportive government policies and regulations are expected to be among the most significant drivers for the United States Electric Vehicle Battery Materials Market during the forecast period.

- On the other hand, the lack of raw materials production, leading to heavy reliance on imports, poses a threat to the United States Electric Vehicle Battery Materials Market during the forecast period.

- Nevertheless, continued efforts are being made to develop advanced battery technology, which is expected to create several opportunities for the market in the future.

United States Electric Vehicle Battery Materials Market Trends

Lithium-ion Battery to Dominate the Market

- As the global community intensifies its focus on reducing greenhouse gas emissions, the United States has emerged as a significant player in the adoption and innovation of lithium-ion batteries, which are integral to the functionality and efficiency of electric vehicles. Several key factors, including government incentives, advancements in battery technology, and strategic investments by major automotive manufacturers, fuel this segment's growth.

- Continuous research and development in this sector have significantly enhanced battery performance, reduced costs, and bolstered safety measures. These advancements have made batteries more efficient and reliable. As a result, the sector is poised for substantial growth in the coming years.

- For instance, in March 2023, engineers at Purdue University pioneered a novel composite material designed for lithium-ion batteries, surpassing the safety benchmarks set by conventional solid polymer electrolyte (SPE) technologies. This patent-pending material, developed by Pol, boasts a 4.8-volt voltage window, an impressive ionic conductivity of 2.4*104 micro siemens, and remarkable thermal stability up to 330 degrees Celsius. Notably, it also demonstrates heightened resistance to cell damage, significantly elevating overall safety standards.

- Lithium-ion batteries, known for their high energy density, extended cycle life, and consistent power output, stand as the cornerstone of contemporary electric vehicles. These batteries have revolutionized the automotive industry by enabling longer driving ranges and faster charging times. Additionally, their lightweight nature contributes to the overall efficiency and performance of electric vehicles.

- Technical data sheets reveal that lithium-ion batteries boast a specific energy density ranging from 90 to 190 Wh/kg. This marks a substantial leap, with lithium-ion batteries offering nearly 2.5 times the energy density of lead-acid batteries and over 1.5 times that of NiMH batteries. Consequently, lithium-ion batteries are increasingly preferred in various applications due to their superior performance.

- Government policies and incentives play a crucial role in propelling the lithium-ion battery segment forward. Federal and state-level initiatives, such as tax credits for electric vehicle purchases and funding for battery research and development, provide a conducive environment for market growth. These policies not only incentivize consumers to adopt electric vehicles but also encourage companies to invest in advanced battery technologies and manufacturing capabilities.

- Therefore, cosnidering such scenario, the lithium-ion battery segment is expected to dominate the market during the forecasted period.

Growing Electric Vehicle Infrastructure to Drive the Market

- The rapid expansion of electric vehicle infrastructure across the United States is set to significantly boost the electric vehicle battery materials market. The proliferation of charging stations in urban, suburban, and rural locales not only enhances logistics but also plays a crucial role in bolstering consumer confidence and accelerating electric vehicle adoption.

- Data from the United States Alternative Fuels Data Center reveals a striking increase in electric vehicle charging ports. Between 2022 and 2023, these ports saw a growth of over 21.6%. Furthermore, from 2011 to 2023, the average annual growth rate stood at an impressive 300%, highlighting the surging adoption of electric vehicles in the U.S., a trend further supported by ongoing government initiatives.

- As recharging becomes increasingly convenient and accessible, concerns about range anxiety-a major hurdle for potential electric vehicle buyers-diminish. This shift creates a more conducive environment for electric vehicle adoption. Such infrastructural advancements demand a corresponding increase in the production and supply of battery materials. Key components like lithium, cobalt, and nickel are essential for ensuring the performance and reliability of electric vehicle batteries.

- In a notable move in November 2023, the United States Department of Energy (DOE) announced an allocation of up to USD 3.5 billion from the Infrastructure Law. This funding is strategically directed towards boosting the production of advanced batteries and their essential materials domestically. The focus encompasses battery-grade processed critical minerals, precursor materials, components, and the manufacturing of cells and packs. Such initiatives are crucial for strengthening the future of clean energy sectors, especially in renewable energy and electric vehicles.

- Technological innovations in charging infrastructure are also pivotal in shaping the electric vehicle battery materials market. Breakthroughs like ultra-fast charging stations, wireless charging, and vehicle-to-grid (V2G) technologies not only elevate user experience but also set new benchmarks for battery performance and composition.

- For instance, ultra-fast charging stations demand batteries capable of withstanding higher power inputs and faster charge cycles, all while ensuring longevity and safety. This necessity propels ongoing research and development in battery chemistry and materials science, paving the way for advanced materials and enhanced battery designs.

- Given these dynamics, the expanding electric vehicle infrastructure in the United States. is poised to drive the market in the coming years.

United States Electric Vehicle Battery Materials Industry Overview

The United States Electric Vehicle Battery Materials Market is semi-consolidated. Some of the key players in this market (in no particular order) are Targray Technology International Inc., BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, and Umicore SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Infrastructure

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Targray Technology International Inc.

- 6.3.2 BASF SE

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Umicore SA

- 6.3.6 Sumitomo Chemical Co., Ltd.

- 6.3.7 Nichia Corporation

- 6.3.8 ENTEK International LLC

- 6.3.9 Arkema SA

- 6.3.10 Kureha Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

02-2729-4219

+886-2-2729-4219