|

市场调查报告书

商品编码

1636518

南美混合电动汽车电池:市场占有率分析、行业趋势和成长预测(2025-2030)South America Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

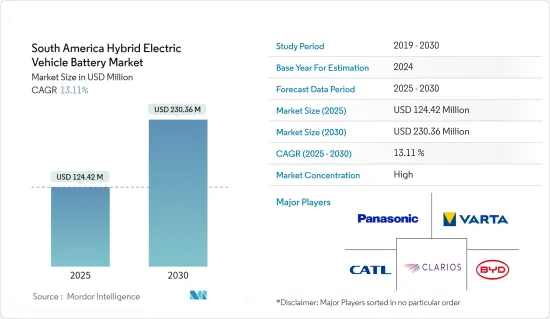

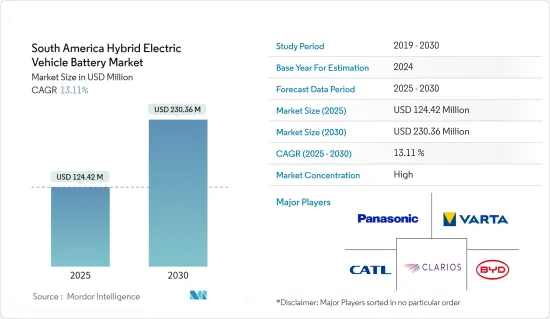

南美混合动力汽车电池市场规模预计2025年为1.2442亿美元,2030年将达到2.3036亿美元,预测期内(2025-2030年)复合年增长率为13.11%。

主要亮点

- 从中期来看,由于各种政府支持计划,电动车的日益普及预计将在预测期内推动南美混合动力电动车电池市场的需求。

- 同时,原材料供需不匹配预计将阻碍预测期内的市场成长。

- 然而,电动车中固态电池的采用以及汽车製造商和电池製造商之间的合作预计将为未来南美洲混合动力汽车电池市场创造重大机会。

- 由于政府努力增加电动车数量以抑制排放气体,预计巴西将实现强劲成长。

南美洲混合动力汽车电池市场趋势

锂离子电池实现显着成长

- 预计在预测期内,锂离子电池将主导南美洲混合动力汽车电池市场。锂离子电池因其良好的容量重量比、优异的性能(长寿命、最少的维护等)、令人印象深刻的保质期以及出色的较低价格而越来越受欢迎并超越其他类型的电池。

- 与传统铅酸电池相比,锂离子(Li-ion)电池显示出明显的技术优势。锂离子电池通常可持续超过 5,000 次循环,而铅酸电池则为 400-500 次循环。此外,锂离子电池需要较少的维护和更换。它还在整个放电週期中保持恆定电压,这有助于延长电气元件的使用寿命。

- 近年来,产业龙头企业加大投入,提升锂离子电池效能,并专注于规模经济与研发。这种竞争的加剧大大降低了锂离子电池的价格。由于技术进步、製造优化以及原材料成本降低,锂离子电池的平均价格已从2013年的780美元/千瓦时暴跌至2023年的139美元/千瓦时。预计 2025 年将进一步降至 113 美元/千瓦时左右,2030 年将进一步降至 80 美元/千瓦时左右。这种电池成本降低的趋势可能会使锂离子电池成为电动车(EV)产业(包括混合动力电动车)所有电池中的首选。

- 儘管南美洲的锂离子电池製造业仍处于起步阶段,但该大陆丰富的重要原材料蕴藏量和不同终端用户不断增长的需求表明市场正在迅速扩张。

- 例如,南美洲拥有丰富的锂蕴藏量,这是锂离子电池的基础。该地区被称为“锂三角”,包括阿根廷、玻利维亚和智利,这三个国家的锂储量合计占全球已探明锂蕴藏量的一半以上。由于阿塔卡马沙漠存在富含锂的滷水矿床,智利成为主要生产国。玻利维亚乌尤尼盐沼蕴藏量大量锂储量,但面临采矿挑战。这些国家共同构成全球锂离子电池生产供应链不可或缺的一部分。

- 根据美国地质调查局的数据,2023 年锂产量值得注意:智利将生产约 44,000 吨,阿根廷将生产 9,600 吨,巴西将生产 4,900 吨。这一总合凸显了南美洲在全球锂格局中的关键作用。

- 南美国家正加强深化对电动车供应链的参与。阿根廷、智利、玻利维亚和巴西等国家正在将更多开采的锂转化为电池化学品,最终,我们正在製定一项转向电池和电动车的策略。然而,这些合作努力并没有延伸到调整生产或价格。

- 根据智利经济发展机构 CORFO 报道,2023 年 4 月,中国领先的电动车製造商比亚迪宣布计划斥资 2.9 亿美元在智利安託法加斯塔地区建设一座锂阴极工厂。预计此类投资将在未来几年内激增。

- 2023 年中期,阿根廷政府宣布了建造首家锂离子电池工厂的计画。该工厂将使用美国主要矿业公司 Livent Corporation 在当地采购和加工的碳酸锂。该工厂由国有 YPF 子公司 YPF Tecnologia (Y-TEC) 建造,标誌着阿根廷丰富锂蕴藏量增值的倡议。该公司将投资700万美元,目标年产能13MWh,固定式蓄电池1000个。此外,我们正在努力促进与寻求生产锂离子电池的当地公司的技术转移。

- 由于锂离子电池重量轻、充电快、充电週期长、成本低、锂蕴藏量丰富等优点,预计未来几年将快速成长。

巴西正在经历显着的成长

- 巴西预计在不久的将来成为南美洲混合动力车(HEV)电池市场的主导者。这种快速成长的主要原因是包括电动车在内的各个领域对电池的需求不断增加。此外,巴西蓬勃发展的电动车产业得到了政府支持措施和技术进步的支持。

- 最近,由于政府的激励措施,电动车在巴西的普及迅速推进。巴西电动车销量从 2022 年的 18,500 辆大幅增加到 2023 年的约 52,000 辆,证明了这一势头。电动车销量的激增将在未来几年加强电池混合动力汽车市场。

- 从2024年1月开始,巴西将对进口100%电动车(EV)征收10%的课税,7月税率将升至18%,2026年7月将升至35%。对此,多家中国汽车製造商正在活性化本土投资。特别是,比亚迪正在建立一个生产基地,计划于2024年底至2025年初投产,而长城汽车的工厂计划于2024年开始运作。这些措施可望加强巴西国内电动车製造,进而增强对混合动力汽车电池的需求。

- 巴西正在积极努力遏制碳排放并减少对石化燃料的依赖,这反映了全球趋势。为了鼓励向电动车的转变,各国政府正在推出各种补贴和奖励。 2023 年底启动的绿色出行创新计画将在 2024 年至 2028 年间为开拓低排放气体交通技术的公司提供价值超过 190 亿巴西雷亚尔的税收优惠,这证明了我们的承诺。这些努力将促进包括混合动力汽车在内的电动车的发展,并振兴混合动力汽车电池市场。

- 巴西电池原料的进步将加强混合动力汽车电池供应链。例如,2024 年 5 月,着名锂供应商 AMG Critical Materials 宣布计划扩大在巴西的采矿业务。该公司的锂精矿厂目前年产能为9万吨,但计画在2024年第四季达到年产13万吨的满载。

- 另一项重大倡议是,当地矿业营业单位Sigma Lithium 在国家开发银行的支持下于 2024 年 2 月宣布投资 9,940 万美元。 Sigma 位于米纳斯吉拉斯州的第二家工厂的目标是将年产量提高近一倍,达到 51 万吨。这些发展将加强巴西的锂离子电池供应链。

- 鑑于这些动态,巴西混合动力汽车电池市场可能在未来几年大幅成长。

南美洲混合动力汽车电池产业概况

南美洲混合动力汽车电池市场正走向半固体。该市场的主要企业包括(排名不分先后)松下控股公司、Clarios(原江森自控国际有限公司)、VARTA AG、宁德时代新能源科技有限公司和比亚迪有限公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 有利的政府政策

- 电动车的扩张

- 抑制因素

- 原料供需不匹配

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 依电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他的

- 按车型分类

- 客车

- 商用车

- 按地区

- 巴西

- 哥伦比亚

- 阿根廷

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Contemporary Amperex Technology Co. Limited

- Clarios(Formerly Johnson Controls International PLC)

- LG Energy Solutions Ltd

- VARTA AG

- Panasonic Holdings Corporation

- Duracell Inc.

- 其他知名企业名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电动车采用固态电池

简介目录

Product Code: 50003886

The South America Hybrid Electric Vehicle Battery Market size is estimated at USD 124.42 million in 2025, and is expected to reach USD 230.36 million by 2030, at a CAGR of 13.11% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles due to various supportive government schemes is expected to drive the demand for the South American hybrid electric vehicle battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the adoption of solid-state batteries for electric vehicles and automaker-battery manufacturer collaborations are expected to create vast opportunities for the South American hybrid electric battery market in the future.

- Brazil is poised for substantial growth, driven by government initiatives aimed at increasing the number of electric vehicles to curb emissions.

South America Hybrid Electric Vehicle Battery Market Trends

Lithium-ion Batteries to Witness Significant Growth

- During the forecast period, lithium-ion batteries are poised to dominate the South American hybrid electric vehicle battery market. Their rising popularity, outpacing other battery types, can be attributed to a favorable capacity-to-weight ratio, superior performance (including extended life and minimal maintenance), an impressive shelf life, and a notable decrease in price.

- When compared to traditional lead-acid batteries, lithium-ion (Li-ion) batteries showcase distinct technical advantages. Li-ion batteries typically offer over 5,000 cycles, a stark contrast to the 400-500 cycles of lead-acid counterparts. Moreover, Li-ion batteries demand less frequent maintenance and replacement. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for electrical components.

- In recent years, major industry players have ramped up investments, focusing on economies of scale and R&D to boost lithium-ion battery performance. This surge in competition has led to a notable drop in lithium-ion battery prices. Due to technological advancements, manufacturing optimizations, and falling raw material costs, the average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further dip to approximately USD 113/kWh by 2025 and USD 80/kWh by 2030. Such declining trends in battery costs are likely to make it a lucrative choice among all batteries in the electric vehicle (EV) industry, including hybrid EVs.

- While the lithium-ion battery manufacturing industry in South America is still in its nascent stages, the continent's rich reserves of essential raw materials and the surging demand from diverse end-users signal a rapid market expansion.

- For instance, South America boasts vast lithium reserves, a cornerstone for lithium-ion batteries. The region, often dubbed the Lithium Triangle, encompasses Argentina, Bolivia, and Chile, collectively housing over half of the globe's known lithium reserves. Chile stands out as the primary producer, thanks to its extensive lithium-rich brine deposits in the Atacama Desert. Bolivia, with its massive lithium reserves in Salar de Uyuni, faces extraction challenges, while Argentina's Puna region salt flats also play a significant role. Together, these nations are integral to the global lithium-ion battery production supply chain.

- According to the US Geological Survey, in 2023, lithium production figures were notable: Chile produced around 44,000 metric tons, Argentina contributed 9,600 metric tons, and Brazil added 4,900 metric tons. This combined output underscores South America's pivotal role in the global lithium landscape.

- South American countries are intensifying efforts to deepen their involvement in the electric vehicle supply chain. By capitalizing on their mineral wealth, boosting processing capacities, and eyeing vehicle manufacturing, nations like Argentina, Chile, Bolivia, and Brazil are strategizing to convert more mined lithium into battery chemicals and eventually into batteries and EVs. However, these collaborative efforts don't extend to production or pricing coordination.

- In April 2023, BYD Co Ltd, China's leading electric vehicle manufacturer, announced plans for a USD 290 million lithium cathode factory in Chile's Antofagasta region, as reported by Chile's economic development agency, CORFO. Such investments are expected to proliferate in the coming years.

- In mid-2023, the Argentinean government revealed plans for its inaugural lithium-ion battery plant. This facility will utilize lithium carbonate sourced and processed locally by US mining giant Livent Corporation. Constructed by YPF Tecnologia (Y-TEC), a subsidiary of the state-owned YPF, the plant signifies Argentina's move to add value to its rich lithium reserves. With a USD 7 million investment, the facility aims for an annual production capacity of 13MWh, translating to 1,000 stationary energy storage batteries. Additionally, it seeks to foster technology transfer with local firms eyeing lithium-ion battery production.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, decreasing costs, and the region's abundant lithium reserves, lithium-ion batteries are set for rapid growth in the coming years.

Brazil to Witness Significant Growth

- Brazil is poised to emerge as a dominant player in the South American hybrid electric vehicle (HEV) battery market in the near future. This surge is primarily fueled by the escalating demand for batteries across diverse sectors, notably electric mobility. Furthermore, the country's burgeoning EV industry is bolstered by supportive government initiatives and technological strides.

- Recently, Brazil has seen a swift uptick in EV adoption, thanks to government-backed incentives. Illustrating this momentum, Brazil's EV car sales soared to approximately 52,000 units in 2023, a substantial leap from 18,500 units in 2022. This surge in EV sales is set to bolster batteries for the HEV market in the years ahead.

- Starting in January 2024, Brazil imposed a 10% tax on imported 100% electric vehicles (EVs), with plans to escalate this to 18% in July and a steep 35% by July 2026. In response, several Chinese automakers are ramping up local investments. Notably, BYD is establishing a manufacturing complex, eyeing production by late 2024 or early 2025, while Great Wall Motor's plant is set to commence operations in 2024. Such moves are poised to bolster Brazil's domestic EV manufacturing and, consequently, the demand for HEV batteries.

- Echoing a global trend, Brazil is actively working to curb carbon emissions and lessen its fossil fuel reliance. To facilitate this shift towards electric mobility, the government has rolled out various subsidies and incentives. A testament to this commitment is the Green Mobility and Innovation Programme launched in late 2023, offering over BRA 19 billion in tax incentives from 2024 to 2028 for companies pioneering low-emission transport technologies. Such endeavors are set to propel the EV landscape, including HEVs, thereby invigorating the HEV battery market.

- Brazil's advancements in battery raw materials are poised to fortify its HEV battery supply chain. For instance, in May 2024, AMG Critical Materials, a prominent lithium supplier, unveiled plans to expand its mining operations in Brazil. Their lithium concentrate plant, currently ramping up from 90,000 mt/year, is on track to hit a full capacity of 130,000 mt/year by Q4 2024.

- In another significant move, Sigma Lithium, a local mining entity, declared a USD 99.4 million investment in February 2024, with backing from the National Development Bank. Sigma's second plant in Minas Gerais aims to nearly double its output to 510,000 metric tons annually. Such developments are set to bolster Brazil's lithium-ion battery supply chain.

- Given these dynamics, Brazil's HEV battery market is on the brink of substantial growth in the forthcoming years.

South America Hybrid Electric Vehicle Battery Industry Overview

The South America hybrid electric vehicle battery market is semi-consolidated. Some of the key players in the market (not in any particular order) include Panasonic Holdings Corporation, Clarios (Formerly Johnson Controls International PLC), VARTA AG, Contemporary Amperex Technology Co. Limited, and BYD Company Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Favourable Government Policies

- 4.5.1.2 Growing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Colombia

- 5.3.3 Argentina

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Clarios (Formerly Johnson Controls International PLC)

- 6.3.4 LG Energy Solutions Ltd

- 6.3.5 VARTA AG

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 Duracell Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-State Batteries for Electric Vehicles

02-2729-4219

+886-2-2729-4219