|

市场调查报告书

商品编码

1636523

中国混合动力汽车电池市场:份额分析、产业趋势/统计、成长预测(2025-2030)China Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

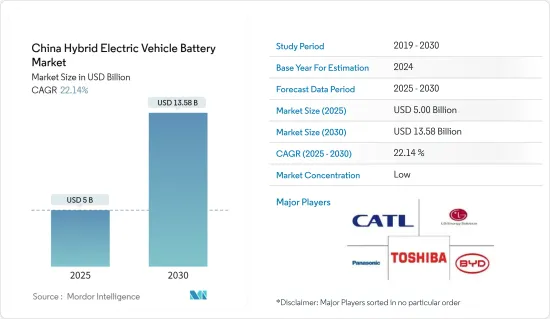

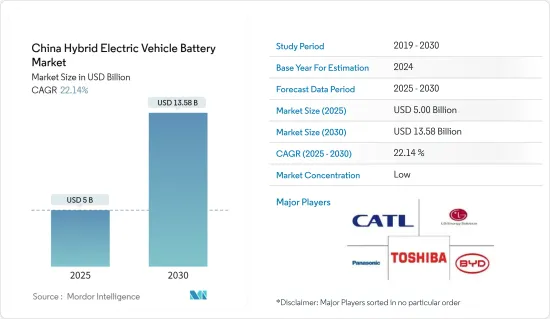

预计2025年中国混合动力汽车电池市场规模将达50亿美元,2030年将达135.8亿美元,预测期间(2025-2030年)复合年增长率为22.14%。

主要亮点

- 从中期来看,电动车(EV)普及率的提高和锂离子电池价格的下降预计将在预测期内推动混合动力电动车电池的需求。

- 另一方面,电池电动车和插电式混合动力电动车等替代技术的出现预计将阻碍电池市场的发展。

- 电池材料的技术进步,例如提高能量密度、缩短充电时间、提高安全性和延长使用寿命,预计将在不久的将来为混合动力电动车电池市场的参与企业提供重大机会。

中国混合动力汽车电池市场趋势

锂离子电池类型主导市场

- 中国锂离子混合动力汽车电池市场是一个充满活力的市场,机会与挑战并存。由于其良好的容量重量比,锂离子混合动力电动车电池比其他电池技术更受欢迎。优越的性能(特别是长寿命和低维护)、长寿命和较低的价格等优点进一步推动了锂离子电池的采用。

- 锂离子电池历来比同类产品昂贵,但市场领导者正在加大投资。对实现规模经济和加强研发力度的关注加剧了竞争并压低了锂离子电池的价格。

- 2023年,电池价格将大幅下降,稳定在139美元/kWh。随着技术创新和製造流程的持续改进,预计电价将进一步下降,目标是 2025 年达到 113 美元/千瓦时,2030 年达到 80 美元/度。

- 此外,电池技术在能量密度、充电速度和寿命方面的不断进步正在推动锂离子电池在全国混合动力电动车中的采用。中国正在大力投资先进电池技术,旨在延长电池寿命并成为混合动力电动车的冠军。

- 例如,2024 年 5 月,中国累计60 亿元人民币(8.45 亿美元)的巨额预算来开拓下一代电池技术,重点是电动和混合动力汽车。固态电池(ASSB)是传统锂离子电池的演变,具有更高的安全性(降低火灾和爆炸的风险)和卓越的能量密度。此类创新将增强对先进锂离子电池的需求,并刺激对混合动力电动车的需求。

- 此外,锂离子电池价格暴跌、需求激增以及中国各地新生产设施的建立相互动态,正在重塑能源和汽车格局。

- 到 2023 年,中国企业将越来越多地整合其供应链,以确保从锂和钴等原材料的提取到最终电池生产的持续供应和成本效率。这种趋势可能会在未来几年发展。

- 在这些发展的支持下,混合动力电动车的产量预计将在预测期内激增,对锂离子电池的需求预计也将相应增加。

乘用车板块实现大幅成长

- 由于消费者对环境问题的认识不断提高以及对省油车的需求不断增加,乘用混合动力汽车市场正在经历强劲增长。与传统汽油动力汽车相比,混合动力汽车结合了内燃机和马达,具有卓越的燃油效率并减少了排放气体。

- 此外,随着电动车(EV)的采用迅速增加,对混合动力电动车(HEV)(包括乘用车)的需求也在增加。例如,根据国际能源总署(IEA)的报告,2023年国内电动车销量将达到约810万辆,较2022年成长37.2%。随着政府推出多项倡议来促进混合动力汽车的销售和需求,未来几年的销售量将会增加。

- 中国正透过多项政府措施促进混合动力电动车(HEV)的采用,包括乘用车。这些措施符合应对空气污染和减少对石化燃料依赖的更大挑战。

- 例如,2023 年,政府推出了一项报废计划,奖励驾驶员用电动或插电式混合动力汽车更换老化的内燃机汽车 (ICE)。该计划为购买新电动车或插电式混合动力汽车提供最高 10,000 元人民币(约 1,375 美元)的财务支持。预计这些发展将在预测期内增加该地区对混合动力乘用车的需求,从而增加对混合动力汽车电池的需求。

- 此外,中国政府积极支持混合动力汽车和电动车的电池技术、电力传动系统以及其他关键零件的研发。透过与研究机构合作并激励私人公司,政府旨在快速实现技术突破。

- 例如,2024年6月,中国工业和资讯化部宣布了锂离子电池产业的新指南。该指南旨在提高行业地位,以应对汽车,特别是混合动力电动车的快速成长。这些积极措施预计将在不久的将来加强混合动力乘用车市场并增加对混合动力电池的需求。

- 此类计划的进展凸显了乘用车混合动力电池解决方案的可行性和重要性,并表明明年全国对混合动力电池的需求将激增。

中国混合动力汽车电池产业概况

中国混合动力汽车电池市场处于半瓜分状态。主要企业(排名不分先后)包括LG能源解决方案有限公司、东芝公司、松下控股公司、比亚迪公司、宁德时代新能源科技有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 替代电动车技术的可能性

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他的

- 车型

- 客车

- 商用车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- Contemporary Amperex Technology Co. Limited

- LG Energy Solution Ltd

- Panasonic Holdings Corporation

- Toshiba Corporation

- Duracell Inc.

- Okaya Power Group

- Guoxuan High-Tech Co., Ltd

- Clarios

- EVE Energy Co., Ltd.

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池材料技术进步

简介目录

Product Code: 50003892

The China Hybrid Electric Vehicle Battery Market size is estimated at USD 5.00 billion in 2025, and is expected to reach USD 13.58 billion by 2030, at a CAGR of 22.14% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising adoption of electric vehicles (EV) and declining lithium-ion battery prices are expected to drive the demand for hybrid electric vehicle batteries during the forecast period.

- On the other hand, the availability of alternate technology like battery electric vehicles and plug-in hybrid electric vehicles are likely to hinder the battery market.

- Nevertheless, technological advancements in battery materials like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for hybrid electric vehicle battery market players in the near future.

China Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- China's lithium-ion hybrid electric vehicle battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion hybrid EV batteries are outpacing other battery technologies in popularity, thanks to their favorable capacity-to-weight ratio. Their adoption is further fueled by advantages like superior performance (notably long life and low maintenance), an extended shelf life, and declining prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been ramping up investments. Their focus on achieving economies of scale and bolstering R&D efforts has intensified competition, subsequently driving down lithium-ion battery prices.

- In 2023, battery prices saw a notable dip, settling at USD 139/kWh-a drop exceeding 13%. With ongoing technological innovations and manufacturing refinements, projections suggest a further decline: targeting USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- Moreover, relentless advancements in battery technology-spanning energy density, charging speed, and lifespan-are propelling the adoption of lithium-ion batteries in hybrid EVs nationwide. China is heavily investing in battery tech advancements, aiming to prolong battery life and champion hybrid EVs.

- For example, in May 2024, China earmarked a substantial 6 billion yuan (USD 845 million) for pioneering next-gen battery tech, with a spotlight on electric and hybrid vehicles. Solid-state batteries (ASSBs), an evolution of traditional lithium-ion batteries, boast enhanced safety (lower fire/explosion risk) and superior energy density. Such innovations are poised to bolster the demand for advanced lithium-ion batteries, subsequently fueling hybrid EV demand.

- Additionally, the intertwined dynamics of plummeting lithium-ion battery prices, surging demand, and the establishment of new production facilities across China are reshaping the energy and automotive landscapes.

- By 2023, Chinese firms are increasingly consolidating their supply chains-from extracting raw materials like lithium and cobalt to the final battery production-ensuring consistent supply and cost-effectiveness. This trend is set to gain momentum in the coming years.

- Given these developments, the forecast period anticipates a surge in hybrid EV production and a corresponding uptick in lithium-ion battery demand.

Passengers Cars Segment to Witness Significant Growth

- Driven by heightened consumer awareness of environmental concerns and a growing demand for fuel-efficient vehicles, the passenger hybrid car segment is witnessing robust growth. Hybrid cars, which merge an internal combustion engine with an electric motor, boast superior fuel efficiency and reduced emissions when stacked against traditional gasoline-powered vehicles.

- Moreover, as the adoption of electric vehicles (EVs) surges, so does the demand for hybrid electric vehicles (HEVs), encompassing passenger cars. For example, the International Energy Agency (IEA) reported that in 2023, EV sales in the country reached approximately 8.1 million, marking a 37.2% uptick from 2022. With the government rolling out multiple initiatives to bolster the sales and demand for hybrid cars, this sales trajectory is poised to ascend in the forthcoming years.

- China is championing the adoption of hybrid electric vehicles (HEVs), including passenger cars, through a slew of government initiatives. These measures align with a larger agenda to combat air pollution and curtail reliance on fossil fuels.

- As a case in point, in 2023, the government rolled out a scrappage scheme incentivizing drivers to swap their aging internal combustion engine (ICE) vehicles for newer electric or plug-in hybrid models. This initiative offers buyers a financial boost of up to 10,000 yuan (approximately USD 1,375) when acquiring a new EV or plug-in hybrid. Such moves are set to amplify the demand for hybrid passenger cars in the region and subsequently, the need for HEV batteries during the forecast period.

- Moreover, the Chinese government is actively backing research and development in battery technology, electric drivetrains, and other pivotal components for hybrid and electric vehicles. By partnering with research institutions and motivating private enterprises, the government aims to fast-track technological breakthroughs.

- For instance, in June 2024, China's Ministry of Industry and Information Technology unveiled fresh directives for the lithium-ion battery sector. These guidelines seek to elevate the industry, ensuring it aligns with the swift growth in sectors like automobiles, particularly those involving hybrid electric vehicles. Such proactive measures are anticipated to bolster the hybrid passenger car market and escalate the demand for hybrid batteries in the near future.

- These project advancements underscore the viability and significance of HEV battery solutions for passenger vehicles, hinting at a burgeoning demand for HEV batteries nationwide in the upcoming year.

China Hybrid Electric Vehicle Battery Industry Overview

The China Hybrid Electric Vehicle battery market is semi-fragmented. Some of the key players (not in particular order) are LG Energy Solution Ltd, Toshiba Corporation, Panasonic Holdings Corporation, BYD Company, Contemporary Amperex Technology Co. Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Avalibility of Alternate Electric Vehicle Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 LG Energy Solution Ltd

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Toshiba Corporation

- 6.3.6 Duracell Inc.

- 6.3.7 Okaya Power Group

- 6.3.8 Guoxuan High-Tech Co., Ltd

- 6.3.9 Clarios

- 6.3.10 EVE Energy Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219