|

市场调查报告书

商品编码

1636530

东南亚国协混合动力汽车电池:市场占有率分析、产业趋势与成长预测(2025-2030)ASEAN Countries Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

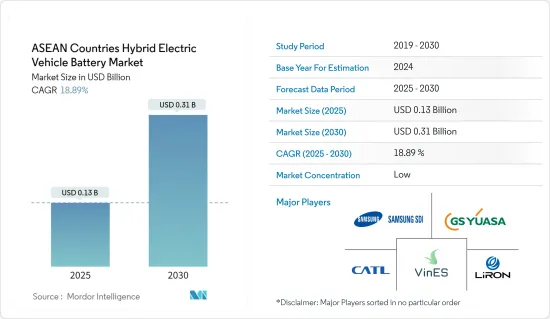

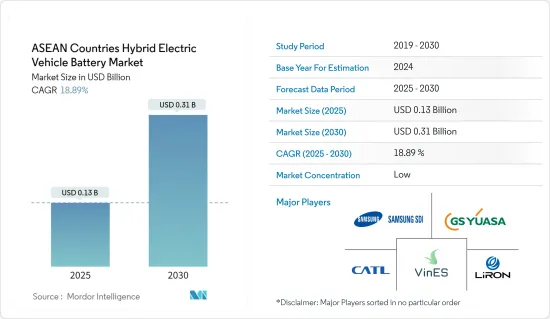

预计2025年东南亚国协混合动力汽车电池市场规模将达1.3亿美元,2030年将达3.1亿美元,预测期间(2025-2030年)复合年增长率为18.89%。

主要亮点

- 从中期来看,锂离子电池价格的下降和电动车渗透率的提高预计将在预测期内推动东南亚国协混合动力电动车电池市场的需求。

- 另一方面,原材料供需不匹配预计将阻碍预测期内的市场成长。

- 电池技术的进步以及汽车製造商和电池製造商之间的合作预计将为未来东南亚国协的混合动力电动车电池市场创造重大机会。

- 泰国尤其脱颖而出,在致力于增加电动车在汽车产业的普及的推动下,预计将显着成长。

东南亚国协混合动力汽车电池市场趋势

乘用车板块实现大幅成长

- 东协(东南亚国家联盟)国家准备实现混合动力电动车(HEV)电池市场的显着成长,特别是乘用车电池。这种快速增长的推动因素包括电动车 (EV) 的日益普及、政府支持清洁能源的倡议以及消费者对环境问题意识的不断增强。近年来,印尼、马来西亚、泰国、越南和菲律宾等国家已成为电动车领域的关键参与企业。

- 东协汽车联合会(AAF)资料显示,2023年东协地区乘用车产量为274.8万辆,比2022年的266.5万辆成长3.11%。 2022年产量约221.2万辆,2023年产量228.3万辆,成长3.21%。值得注意的是,印尼、马来西亚和泰国占该地区乘用车产量的83%以上。

- 展望未来,政府推动电动车采用的措施预计将促进该地区乘用车的成长,这也将推动对混合动力汽车电池的需求。由于政府的支持措施,泰国、印尼、新加坡、马来西亚和菲律宾等国家预计电动车将迅速普及。例如,菲律宾的目标是到 2030 年电动车占所有车辆的 21%,到 2040 年达到 50%。除其他福利外,菲律宾电动车协会 (EVAP) 大胆地将其电动车普及率目标从 2030 年的 30 万辆提高到 100 万辆,提高了行业奖励、监管透明度和对电动车优势的认识,我期待这一增长。

- 印尼的野心同样引人注目,该国的目标是到 2025 年电动车占汽车销量的 20%,到 2030 年国内电动车产量达到 60 万辆。这些目标包括电动车供应链中的各种里程碑,包括销售、生产和充电基础设施,所有这些都将推动混合动力汽车电池的成长。

- 2024 年初,泰国电动车委员会批准了 EV 3.5 包装,这是一项为期四年(2024-2027 年)的倡议,旨在加速电动车行业的发展并吸引对当地核准的投资。这项全面的一揽子计画不仅旨在振兴整个电动车生态系统,还包括针对车型和电池容量的电动车购买的政府补贴,为混合动力汽车电池市场创造了有利的环境。

- 2023年,菲律宾能源部(DOE)宣布计画在2040年拥有630万辆电动车(EV),目标是占道路交通量的50%。这一雄心勃勃的目标也将透过安装约 147,000 个电动车充电站来实现。美国能源部的近期目标包括 2028 年部署 245 万辆电动车、摩托车和巴士。如此大规模的计画证实了乘用车领域电池市场的快速成长,并将进一步支撑HEV电池市场的成长。

- 鑑于这些动态,乘用车领域预计在未来几年将显着成长。

泰国正在经历显着的成长

- 泰国是汽车领域的投资目的地。 50年来,泰国已从一个简单的汽车零件组装国家发展成为东南亚首屈一指的汽车生产和出口中心。随着汽车製造商投资的增加,泰国的电池产业有望稳定成长,特别是随着包括混合动力汽车在内的电动车 (EV) 产量的激增。

- 根据泰国电动车协会(EVAT)的报告,2023年泰国新登记的混合动力电动车(HEV)约为85,069辆,与前一年同期比较大幅增加32%。此外,到2024年2月底,新註册的混合动力汽车数量将达到约26,134辆,支援泰国电池的快速成长和不断增长的需求。

- 电动车(尤其是混合动力车)的快速成长得益于政府对购买者的激励措施和对製造商的支持措施。例如,泰国推出了国产电动车购买补贴计划,凸显其成为东南亚电动车生产中心的雄心。 EV3.5 计画的有效期为 2024 年至 2027 年,为每辆车提供 50,000泰铢(1,397.02 美元)至 100,000泰铢(2,794.04 美元)的补贴,以培育电动汽车显汽车的承诺。

- 泰国的目标是到 2030 年电动车占汽车销售量的 30%。这项雄心壮志和目前的努力使泰国成为未来混合动力汽车电池(尤其是锂离子电池)的中心,为电池製造商创造了巨大的机会。

- 为了实现这一愿景,许多电池製造商正在增加在泰国的产能。例如,2024年3月,BMW集团在泰国举行了「Gen-5」高压电池製造工厂的奠基仪式。这座占地4000平方公尺的电池组装厂位于东海岸罗勇府,併入宝马现有的汽车工厂。随着BMW准备在 2025 年底在罗勇工厂推出电动车,新的电池组装将在将进口电池转换为高压电池模组方面发挥至关重要的作用。据称,宝马已在该合资企业中投资了超过 4,500 万美元。

- 鑑于这些发展,预计泰国将在预测期内引领东协地区的混合动力汽车电池市场。

东南亚国协混合动力汽车电池产业概况

东南亚国协的混合动力汽车电池已减少一半。市场主要企业(排名不分先后)包括三星 SDI、VinES Energy Solutions Joint Stock Company、Contemporary Amperex Technology (CATL)、LiRON LIB Power Pte Ltd 和 GS Yuasa Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 锂离子电池价格下降

- 电动车的扩张

- 抑制因素

- 原料供需不匹配

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他电池类型

- 车型

- 客车

- 商用车

- 地区

- 泰国

- 印尼

- 菲律宾

- 马来西亚

- 越南

- 其他东南亚国协

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- Contemporary Amperex Technology Co. Ltd(CATL)

- LG Energy Solution Ltd.

- LiRON LIB Power Pte Ltd

- GS Yuasa Corporation

- VinES Energy Solutions Joint Stock Company

- SVOLT Energy Technology Co., Ltd.

- Energy Absolute Public Company Limited

- 其他知名公司名单(公司名称、总部地点、相关产品及服务、联络等)

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池技术的技术进步

The ASEAN Countries Hybrid Electric Vehicle Battery Market size is estimated at USD 0.13 billion in 2025, and is expected to reach USD 0.31 billion by 2030, at a CAGR of 18.89% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, and growing adoption of electric vehicles are expected to drive the demand for the ASEAN countries hybrid electric vehicle battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the technological advancements in battery technologies and the automaker-battery manufacturer collaborations are expected to create vast opportunities for ASEAN countries hybrid electric vehicle battery market in the future.

- Particularly, Thailand stands out, anticipating notable growth, driven by its commitment to amplifying the electric vehicle's presence in its automotive sector.

ASEAN Countries Hybrid Electric Vehicle Battery Market Trends

Passenger Vehicle Segment to Witness Significant Growth

- The ASEAN (Association of Southeast Asian Nations) countries are poised for significant growth in the market for hybrid electric vehicle (HEV) batteries, especially for passenger vehicles. This surge is driven by the increasing adoption of electric vehicles (EVs), government initiatives championing clean energy, and heightened consumer awareness of environmental concerns. In recent years, nations like Indonesia, Malaysia, Thailand, Vietnam, and the Philippines have emerged as pivotal players in the EV landscape.

- Data from the ASEAN Automotive Federation (AAF) reveals that the ASEAN region produced 2.748 million passenger vehicles in 2023, marking a 3.11% rise from 2.665 million in 2022. In 2022, production was approximately 2.212 million units, and the 2023 figure of 2.283 million units represents a 3.21% uptick. Notably, Indonesia, Malaysia, and Thailand collectively accounted for over 83% of the region's passenger vehicle output.

- Looking ahead, the region's growth in passenger vehicles is anticipated to be bolstered by government initiatives promoting electric vehicle adoption, subsequently driving demand for HEV batteries. Countries like Thailand, Indonesia, Singapore, Malaysia, and the Philippines are set to experience swift EV adoption, thanks to supportive government measures. For instance, the Philippines aims for EVs to constitute 21% of its total vehicles by 2030 and 50% by 2040. Additionally, the Electric Vehicle Association of the Philippines (EVAP) has upped its e-vehicle adoption target from 300,000 units in 2030 to a bold 1.0 million, banking on sector incentives, clearer regulations, and rising EV benefits awareness.

- Indonesia's ambitions are equally pronounced, targeting 20% EV representation in car sales by 2025 and a goal of 600,000 domestically produced EVs by 2030. These targets encompass various milestones in the EV supply chain, including sales, production, and charging infrastructure, all of which are set to spur HEV battery growth.

- In early 2024, Thailand's EV Board greenlit the EV 3.5 package, a four-year initiative (2024-2027) aimed at propelling the EV industry's momentum and attracting investments in local manufacturing. This comprehensive package not only seeks to invigorate the entire EV ecosystem but also includes government subsidies for EV purchases, tailored to vehicle types and battery capacities, fostering a conducive environment for the HEV battery market.

- In 2023, the Philippines' Department of Energy (DOE) unveiled plans to have 6.3 million electric vehicles (EVs) by 2040, targeting 50% of the road traffic. This ambitious goal is complemented by the installation of approximately 147,000 EV charging stations. The DOE's immediate objective includes deploying 2.45 million electric cars, motorcycles, and buses by 2028. Such expansive plans underscore the burgeoning battery market within the passenger vehicle segment, further propelling the HEV battery market's growth.

- Given these dynamics, the passenger vehicle segment is set for substantial growth in the coming years.

Thailand to Witness a Significant Growth

- Thailand stands out as a prime destination for investments in the automobile sector. Over the past five decades, Thailand has evolved from merely assembling auto components to becoming Southeast Asia's foremost automotive production and export hub. With rising investments from automakers, Thailand's battery industry is poised for steady growth, especially with the surge in electric vehicle (EV) production, including hybrids.

- As reported by the Electric Vehicle Association of Thailand (EVAT), Thailand registered approximately 85,069 new hybrid electric vehicles (HEVs) in 2023, marking a significant 32% increase from the previous year. Furthermore, by the end of February 2024, new HEV registrations reached around 26,134 units, underscoring the rapid growth and heightened demand for batteries in the nation.

- The surge in EV adoption, particularly HEVs, can be attributed to government incentives for buyers and supportive measures for manufacturers. For instance, Thailand's introduction of a purchase subsidy scheme for domestically produced EVs underscores its ambition to be Southeast Asia's EV production hub. The EV3.5 scheme, active from 2024 to 2027, offers subsidies between THB 50,000 (USD 1,397.02) and THB 100,000 (USD 2,794.04) per vehicle, highlighting the government's dedication to nurturing the EV sector and drawing in foreign investments.

- Thailand aims to have EVs make up 30% of all vehicle sales by 2030. This ambition, coupled with current initiatives, positions Thailand as a future hub for HEV batteries, especially lithium-ion types, presenting vast opportunities for battery manufacturers.

- In line with this vision, numerous battery manufacturers are ramping up their production capabilities in Thailand. For instance, in March 2024, BMW Group broke ground on its 'Gen-5' high-voltage battery manufacturing facility in Thailand. Situated in Rayong, on the eastern coast, the 4,000 square meter battery assembly is integrated into BMW's existing car plant. As BMW gears up to launch EVs from this Rayong facility in the latter half of 2025, the new battery assembly line will play a pivotal role, converting imported battery cells into modules for high-voltage batteries. BMW has reportedly invested over USD 45 million in this venture.

- Given these developments, Thailand is poised to lead the HEV battery market in the ASEAN region during the forecast period.

ASEAN Countries Hybrid Electric Vehicle Battery Industry Overview

The ASEAN Countries Hybrid Electric Vehicle Battery is semi-fragmented. Some of the key players in the market (not in any particular order) include Samsung SDI Co. Ltd., VinES Energy Solutions Joint Stock Company, Contemporary Amperex Technology Co. Ltd (CATL), LiRON LIB Power Pte Ltd and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-Ion Battery Prices

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others Battery Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Thailand

- 5.3.2 Indonesia

- 5.3.3 Philippines

- 5.3.4 Malaysia

- 5.3.5 Vietnam

- 5.3.6 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Samsung SDI Co., Ltd.

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 LG Energy Solution Ltd.

- 6.3.5 LiRON LIB Power Pte Ltd

- 6.3.6 GS Yuasa Corporation

- 6.3.7 VinES Energy Solutions Joint Stock Company

- 6.3.8 SVOLT Energy Technology Co., Ltd.

- 6.3.9 Energy Absolute Public Company Limited.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Technologies