|

市场调查报告书

商品编码

1636522

印度混合电动汽车电池 -市场占有率分析、行业趋势和统计、成长预测(2025-2030)India Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

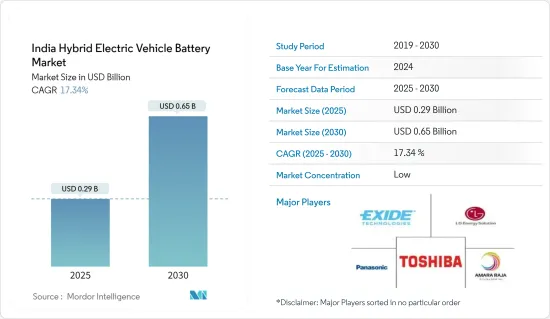

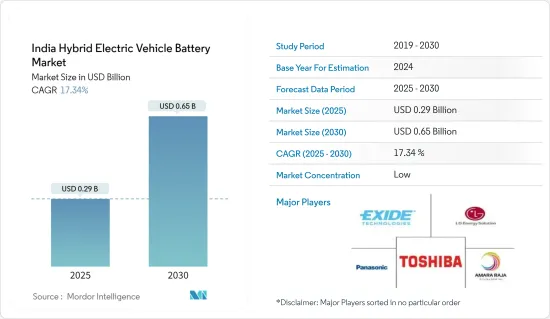

印度混合动力汽车电池市场规模预计到2025年为2.9亿美元,到2030年将达到6.5亿美元,预测期内(2025-2030年)复合年增长率为17.34%。

主要亮点

- 从中期来看,电动车(EV)普及率的提高和锂离子电池价格的下降预计将在预测期内推动混合动力电动车电池的需求。

- 另一方面,蕴藏量短缺可能会显着抑制混合动力汽车电池市场的成长。

- 电池材料的技术进步,例如提高能量密度、缩短充电时间、提高安全性和延长使用寿命,预计将在不久的将来为混合动力电动车电池市场的参与企业提供重大机会。

印度混合动力汽车电池市场趋势

锂离子电池类型主导市场

- 全印度锂离子电动车电池市场呈现出充满机会与挑战的迷人景象。由于其良好的容量重量比,锂离子二次电池比其他电池技术更受欢迎。推动锂离子二次电池普及的其他因素包括改进的性能(更长的使用寿命、更少的维护)、更长的保质期和更低的价格。

- 锂离子电池的价格通常高于其他电池。然而,市场上的主要企业正在进行投资以获得规模经济和研发活动,以提高性能、加剧竞争并导致锂离子电池的价格下降。

- 2023年,电池价格将大幅下降,稳定在139美元/kWh。随着技术创新和製造流程的不断改进,预计2025年将达到113美元/kWh,2030年将达到80美元/kWh。

- 鑑于日益增长的环境问题,印度政府正在积极支持电动车。热衷于实现净零碳排放的印度政府认识到锂将在增强电动车的储存能力方面发挥关键作用。最近,全国各地都发现了锂离子矿区,显示该地区价格有下降的潜力。

- 2023 年 2 月,印度地质调查局 (GSI) 宣布查谟和克什米尔 Salal-Haimana 地区的锂蕴藏量估计为 590 万吨。鑑于锂是有色金属并且对于电池能源储存和电动车应用非常重要,这项发现使锂离子电池生产能够扩大规模并满足对混合动力汽车电池的即时激增的需求。

- 此外,印度政府的倡议对于塑造锂离子和混合动力电动车 (HEV) 电池的采用轨迹至关重要。透过各种倡议,政府不仅增强了对锂离子电池的需求,而且在全国各地大力推广电动车。

- 为了证明这些努力,印度政府在 2023 年制定了雄心勃勃的目标,即到 2030 年使 30% 的私家车销量、70% 的商用车以及 80% 的两轮和三轮车电动化。为了进一步奖励这种转变,推出了每千瓦时 10,000 印度卢比(120 美元)至 15,000 印度卢比(180 美元)的补贴。诸如此类的积极倡议不仅将加速电动车的生产,还将扩大未来几年对锂离子电池的需求。

- 鑑于如此一致的努力和投资,电动车产量在预测期内似乎不可避免地会激增,对锂离子电池的需求也将随之激增。

乘用车细分市场将显着成长

- 印度汽车工业正在经历一个变革时期期,重点是电动和混合动力汽车汽车(EV 和 HEV)。在追求永续交通和政府对电动车的支持的推动下,这些汽车电池正在开发和生产。

- 近年来,该地区乘用车(包括混合动力汽车)的销量迅速成长。例如,根据印度汽车工业商协会(SIAM)的资料,2023年印度乘用车销量为4,218万辆,较2022年成长10.7%。混合动力乘用车是这一数字的主要贡献者,由于该地区需求的不断增长,其销量呈现显着增长,并且这一趋势预计将持续下去。

- 此外,消费者对永续和先进移动出行的需求不断增长,促使汽车製造商投资纯电动车 (BEV) 生产。共用和自主电动车解决方案市场的快速成长进一步强化了这种需求。

- 例如,2024年7月,Ola Electric宣布投资1亿美元,在印度泰米尔纳德邦建立超级工厂。该工厂将生产国产锂离子电池。到明年初,Ola Electric 计划放弃目前在韩国和中国的供应商,并在其车辆中使用自己的电池。这些措施将提高电动车和混合动力乘用车锂离子电池的产量,从而增加该地区对混合动力电池的需求。

- 此外,印度政府也透过各种措施积极支持电动和混合动力汽车,以减少污染和减少对石化燃料的依赖。例如,混合动力汽车和电动车的快速采用和製造(FAME)计划为製造商和消费者提供补贴和奖励,创造有利于电动车普及的氛围。

- 对此,北方邦政府已于2024年7月免除混合动力汽车的道路税。该措施旨在促进清洁汽车的普及,减少传统汽油和柴油汽车对环境的影响。这些措施预计将增加混合动力乘用车的普及性和对混合动力电池的需求。

- 这些发展凸显了混合动力汽车电池解决方案对于乘用车的可行性和重要性,并表明印度在不久的将来对混合动力汽车电池的强劲需求。

印度混合动力汽车电池产业概况

印度混合动力汽车电池市场呈现半瓜分状态。主要企业(排名不分先后)包括 LG Energy Solution Ltd、东芝公司、松下控股公司、Exide Industries Ltd 和 Amara Raja Batteries Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他的

- 车型

- 客车

- 商用车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- LG Energy Solution Ltd

- Amara Raja Batteries Ltd

- Toshiba Corporation

- Panasonic Holdings Corporation

- Exide Industries Ltd

- Bharat Electronics Limited(BEL)

- Exicom Tele-Systems Limited

- iPower Batteries Pvt. Ltd

- Okaya Power Group

- Contemporary Amperex Technology Co. Limited

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池材料技术进步

简介目录

Product Code: 50003891

The India Hybrid Electric Vehicle Battery Market size is estimated at USD 0.29 billion in 2025, and is expected to reach USD 0.65 billion by 2030, at a CAGR of 17.34% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising adoption of electric vehicles (EV) and declining lithium-ion battery prices are expected to drive the demand for hybrid electric vehicle batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the hybrid electric vehicle battery market.

- Nevertheless, technological advancements in battery materials like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for hybrid electric vehicle battery market players in the near future.

India Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion electric vehicle battery market across India presents a fascinating landscape of opportunities and challenges. Due to their favorable capacity-to-weight ratio, lithium-ion rechargeable batteries are gaining more popularity than other battery technologies. Other factors boosting their adoption include better performance (long life and low maintenance), better shelf life, and decreasing price.

- The price of lithium-ion batteries is usually higher than that of other batteries. However, major players across the market have been investing to gain economies of scale and R&D activities to enhance their performance, increasing the competition and, in turn, resulting in declining prices of lithium-ion batteries.

- In 2023, battery prices saw a notable dip, settling at USD 139/kWh-a reduction exceeding 13%. With ongoing technological innovations and manufacturing refinements, projections suggest a continued decline, eyeing USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- In response to escalating environmental concerns, the Indian government is fervently championing electric vehicles. With a keen eye on achieving net-zero carbon emissions, the government recognizes lithium's pivotal role in bolstering EV storage capacities. Recent discoveries of lithium-ion fields across the nation further bolster the optimism, hinting at potential price reductions in the region.

- Highlighting these discoveries, February 2023 saw the Geological Survey of India (GSI) unveil lithium reserves, estimated at 5.9 million tonnes, in the Salal-Haimana region of Jammu and Kashmir. Given lithium's non-ferrous nature and its criticality in battery energy storage and EV applications, this find is poised to amplify lithium-ion battery production, catering to the surging demand for hybrid vehicle batteries in the foreseeable future.

- Moreover, Indian government policies are pivotal in shaping the trajectory of lithium-ion and hybrid electric vehicle (HEV) battery adoption. Through a slew of initiatives, the government has not only bolstered the demand for lithium-ion batteries but has also fervently promoted EVs nationwide.

- As a testament to these efforts, the Indian government, in 2023, set ambitious targets: aiming for EVs to constitute 30% of private car sales, 70% of commercial vehicles, and a staggering 80% of two and three-wheelers by 2030. To further incentivize this shift, subsidies ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180) have been introduced. Such proactive measures are poised to not only accelerate EV production but also amplify the demand for lithium-ion batteries in the coming years.

- Given these concerted efforts and investments, a surge in EV production and a corresponding rise in lithium-ion battery demand seem inevitable in the forecast period.

Passengers Cars Segment to Witness Significant Growth

- India's automotive industry is undergoing a transformation, with a pronounced emphasis on electric and hybrid vehicles (EVs and HEVs). The nation is advancing in the development and production of batteries for these vehicles, spurred by the quest for sustainable transportation and the government's endorsement of electric mobility.

- Sales of passenger cars, hybrids included, have surged in the region over recent years. For instance, data from the Society of Indian Automobile Manufacturers (SIAM) reveals that in 2023, India sold 42.18 million passenger vehicles, marking a 10.7% uptick from 2022. This figure prominently features hybrid passenger cars, whose sales have seen a notable rise and are poised to continue this trajectory, given the escalating demand in the region.

- Moreover, a heightened consumer appetite for sustainable and advanced mobility is prompting automakers to channel investments into Battery Electric Vehicle (BEV) production. This demand is further bolstered by a burgeoning market for shared and autonomous electric mobility solutions.

- For instance, in July 2024, Ola Electric unveiled a USD 100 million investment as the first phase in establishing its gigafactory in Tamil Nadu, India. This facility is set to manufacture indigenous lithium-ion batteries. Ola Electric plans to utilize these in-house battery cells for its vehicles by early next year, moving away from its current suppliers in Korea and China. Such a move is poised to expedite lithium-ion battery production for EVs and hybrid passenger vehicles, amplifying the demand for hybrid batteries in the region.

- Furthermore, the Indian government is actively championing electric and hybrid vehicles through various initiatives, targeting pollution reduction and diminished fossil fuel reliance. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, for instance, offers subsidies and incentives to both manufacturers and consumers, cultivating a conducive atmosphere for EV uptake.

- In a related move, the Uttar Pradesh government in July 2024, waived road tax on hybrid cars. This initiative is designed to spur clean vehicle adoption and mitigate the environmental repercussions of conventional gasoline and diesel cars. Such measures are anticipated to bolster the popularity of hybrid passenger cars and subsequently, the demand for hybrid batteries.

- These developments underscore the viability and significance of HEV battery solutions for passenger vehicles, suggesting a robust demand for HEV batteries in the nation in the near future.

India Hybrid Electric Vehicle Battery Industry Overview

The Indian Hybrid Electric Vehicle battery market is semi-fragmented. Some of the key players (not in particular order) are LG Energy Solution Ltd, Toshiba Corporation, Panasonic Holdings Corporation, Exide Industries Ltd, Amara Raja Batteries Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution Ltd

- 6.3.2 Amara Raja Batteries Ltd

- 6.3.3 Toshiba Corporation

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Exide Industries Ltd

- 6.3.6 Bharat Electronics Limited (BEL)

- 6.3.7 Exicom Tele-Systems Limited

- 6.3.8 iPower Batteries Pvt. Ltd

- 6.3.9 Okaya Power Group

- 6.3.10 Contemporary Amperex Technology Co. Limited

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219