|

市场调查报告书

商品编码

1636525

德国混合动力电动车电池:市场占有率分析、产业趋势、成长预测(2025-2030)Germany Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

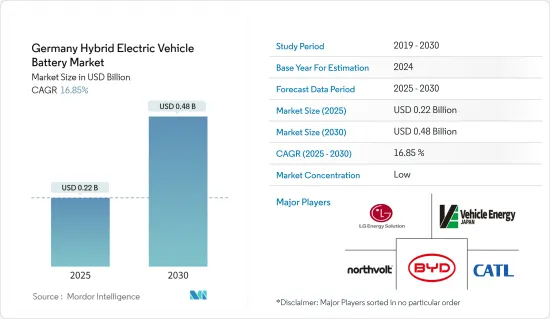

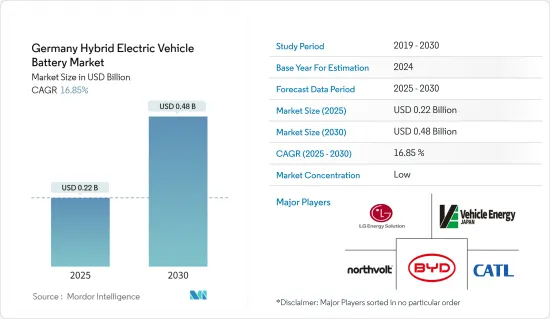

德国混合动力汽车电池市场规模预计2025年为2.2亿美元,2030年将达4.8亿美元,预测期内(2025-2030年)复合年增长率为16.85%。

主要亮点

- 从中期来看,电动车销量增加和锂离子电池成本下降等因素预计将成为预测期内市场最重要的驱动因素之一。

- 同时,对混合动力电动车更换电池高成本的担忧在预测期内对德国混合动力电动车电池市场构成威胁。

- 我们继续努力开发新的电池化学物质,以提供更多的能量和更远的续航里程。预计这一因素将在未来为市场创造一些机会。

德国混合动力汽车电池市场趋势

锂离子电池占市场主导地位

- 德国雄心勃勃的气候变迁目标和汽车产业向电气化的转型,推动锂离子电池领域成为德国不断扩大的混合动力电动车 (HEV) 市场的前沿。在技术创新领先国家、欧洲主要汽车强国之一的德国,作为混合动力汽车能源来源的锂离子电池的需求正在快速增长。

- 汽车製造商越来越多地采用混合动力传动系统,以满足严格的排放法规并满足日益增长的燃油效率要求,而且这一趋势没有放缓的迹象。与竞争电池技术相比,锂离子化学技术因其高能量密度、更长的循环寿命和低自放电率而成为混合动力汽车的主要候选者。

- 技术资料表强调,锂离子电池的比能量密度达到90-190Wh/kg。这项成就值得注意,因为锂离子电池的能量密度约为铅酸电池的2.5倍,而镍氢电池的1.5倍。这些性能优势使得锂离子电池在各种应用中非常偏好。

- 为了加强供应链并减少对亚洲製造商的依赖,大众、宝马、保时捷和戴姆勒等德国汽车巨头正在投资锂离子技术和生产。这项策略导致在德国各地建立了多个电池生产设施,培育了国内锂离子开发和製造的生态系统。

- 2024年7月,德国着名电池製造商瓦尔塔继续与保时捷就可能投资瓦尔塔高容量锂离子部门进行讨论,该部门专门为电动和混合动力汽车设计。两家公司已经达成了一份不具约束力的条款清单,并且正在进行谈判以敲定细节,但瓦尔塔拒绝透露财务细节。此次合作增强了两家公司在电动车领域的能力。

- 为了支持这一势头,德国政府正在推出倡议和资助计划,以支持电池技术的研发并加速混合动力汽车和电动车的普及。这些倡议正在刺激德国混合动力汽车电池市场锂离子部分的快速成长。

- 2023年,德国在永续旅行方面迈出了重大一步,宣布对电动车提供0.5%的税收优惠,对混合动力汽车提供0.25%的税收优惠。价值低于 60,000 欧元的车辆可享 0.25% 的税收折扣。混合动力汽车如果符合 50 克/公里的二氧化碳排放标准且电动行驶里程为 40 公里或以上,则有资格享受这些税收减免。此外,在德国,您可以保留公司汽车的详细日誌并追踪个人使用费用。这些税收优惠将适用于註册车辆,直至 2030 年底,允许电动和混合动力汽车享受通勤和商务减少的课税年终。

- 鑑于这些发展,锂离子电池产业预计将在未来几年引领市场。

混合动力汽车销售的成长推动市场

- 德国混合动力汽车(HEV)的销量迅速成长,大大推动了该国混合动力汽车电池市场的成长。这一势头是由多种因素推动的,包括不断变化的消费者偏好、严格的环境法规以及汽车领域的技术进步。随着德国消费者的环保意识增强并倾向于更省油的选择,对混合动力汽车的需求不断增长正在推动电池市场的发展。

- 根据联邦汽车运输局2024年6月的资料,德国註册了87,970辆混合动力汽车。 SUV 以 23,222 辆的销量位居榜首,这表明消费者对更大、更多功能的车辆的偏好。越野车销售良好,达到 16,519 辆,吸引了富有冒险精神的消费者。紧凑型车型售出 13,758 辆,吸引了注重效率的都市区驾驶员。中产阶级拥有13,136个单位,满足家庭需求。另一方面,小型轿车8,439辆,中上阶层6,705辆,小型车和高阶车型的吸引力凸显。

- 为了满足这种不断增长的需求,德国主要汽车製造商正在扩大其混合动力汽车产品线,包括小型车、豪华轿车和 SUV。车款系列的扩大不仅吸引了更广泛的消费者,而且增强了销量,从而增加了对混合动力汽车电池的需求。

- 随着混合动力传动系统技术的不断创新,汽车製造商正在提高其车辆的性能和效率。这项进步使混合动力车更具吸引力,尤其是对于那些曾经犹豫是否要使用电动车的消费者。

- 例如,在 2024 年 4 月的北京马达上,中国一汽旗下的红旗品牌首次推出了一款电动敞篷车,并推出了多款混合动力原型车。红旗定位豪华车市场,同时也考虑海外出口,将目光投向多个全球市场,其中以德国为重点。该品牌旨在与奥迪、宝马和宾士等豪华汽车巨头正面竞争。

- 随着混合动力汽车销量的成长,德国对电池技术和生产的投资激增。认识到国内优质电池供应的战略需求,汽车製造商和专业电池公司都在积极在全国建立和扩大生产基地。

- 鑑于这些动态,混合动力汽车销量的增加显然将继续推动市场向前发展。

德国混合动力汽车电池产业概况

德国混合动力汽车电池市场呈现半分裂状态。市场的主要企业(排名不分先后)包括 LG Energy Solution、Contemporary Amperex Technology、比亚迪公司、Northvolt AB 和 Vehicle Energy Japan Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 扩大混合动力电动车的销量

- 锂离子电池价格下降

- 抑制因素

- 电池寿命和更换成本

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他的

- 车型

- 客车

- 商用车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- LG Energy Solution

- Contemporary Amperex Technology Co Ltd.

- BYD Company

- Panasonic Holdings Corporation

- Mercedes-Benz Group AG

- Enersys Sarl

- Exide Industries Ltd

- Vehicle Energy Japan Inc.

- Northvolt AB

- Clarios International Inc.

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 持续研究开发新的电池化学物质

简介目录

Product Code: 50003894

The Germany Hybrid Electric Vehicle Battery Market size is estimated at USD 0.22 billion in 2025, and is expected to reach USD 0.48 billion by 2030, at a CAGR of 16.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in electric vehicle sales and the declining cost of lithium-ion batteries are expected to be among the most significant drivers for the market during the forecast period.

- On the other hand, concerns related to the high cost of replacement batteries for hybrid electric vehicles pose a threat to the Germany Hybrid Electric Vehicle Battery Market during the forecast period.

- Nevertheless, continued efforts are being made to develop new battery chemistries for more energy and longer drive range. This factor is expected to create several opportunities for the market in the future.

Germany Hybrid Electric Vehicle Battery Market Trends

Lithium-ion Battery to Dominate the Market

- Germany's ambitious climate goals and the automotive industry's pivot towards electrification have propelled the lithium-ion battery segment to the forefront of the nation's expanding hybrid electric vehicle (HEV) market. As a technological innovator and one of Europe's automotive powerhouses, Germany's appetite for lithium-ion batteries to energize its HEVs has surged.

- With automakers increasingly adopting hybrid powertrains to align with strict emissions standards and cater to a growing demand for fuel efficiency, this momentum shows no signs of waning. Lithium-ion chemistry stands out as the top choice for HEVs, lauded for its high energy density, extended cycle life, and lower self-discharge rate when stacked against competing battery technologies.

- Technical data sheets highlight lithium-ion batteries achieving a specific energy density between 90 to 190 Wh/kg. This achievement is noteworthy, as lithium-ion batteries deliver energy densities nearly 2.5 times that of lead-acid counterparts and over 1.5 times that of NiMH variants. Such performance superiority is driving their rising preference across diverse applications.

- In a bid to fortify their supply chains and lessen reliance on Asian manufacturers, German automotive titans like Volkswagen, BMW, Porsche, and Daimler are pouring investments into lithium-ion technology and production. This strategy has birthed multiple battery production facilities across Germany, nurturing a homegrown ecosystem for lithium-ion development and manufacturing.

- In July 2024, Varta, a prominent German battery manufacturer, revealed ongoing talks with Porsche about a potential stake in Varta's large-format lithium-ion division, specifically designed for electric and hybrid vehicles. The two companies have progressed to a non-binding term sheet, with negotiations in motion to finalize details, though Varta has kept financial specifics under wraps. This partnership is poised to bolster both firms' capabilities in the electric vehicle arena.

- Backing this momentum, the German government has rolled out initiatives and funding programs to champion battery technology R&D and spur the adoption of hybrid and electric vehicles. Such endeavors have catalyzed the swift growth of the lithium-ion segment in Germany's HEV battery landscape.

- In 2023, Germany made notable moves towards sustainable mobility, unveiling tax incentives of 0.5% for electric vehicles and 0.25% for hybrids. Vehicles priced below EUR 60,000 enjoy a 0.25% taxable benefit rate. Hybrids can access these tax perks if they meet a CO2 emission threshold of 50 g/km and boast an electric range of at least 40 km. Additionally, Germany allows a detailed logbook for company vehicles to track private usage costs. These tax advantages extend to vehicles registered until the end of 2030, with electric and hybrid vehicles enjoying reduced taxable mileage rates for commuting and business, echoing the government's broader emission reduction goals.

- Given these developments, the lithium-ion battery segment is poised to lead the market in the coming years.

Growing Hybrid Electric Vehicle Sales to Drive the Market

- In Germany, surging sales of hybrid electric vehicles (HEVs) are significantly fueling the growth of the nation's hybrid electric vehicle battery market. This momentum stems from a blend of factors: shifting consumer preferences, stringent environmental regulations, and technological strides in the automotive realm. As German consumers grow more environmentally conscious and lean towards fuel-efficient options, the heightened demand for HEVs is, in turn, boosting the battery market.

- Data from the Federal Motor Transport Authority in June 2024 revealed that Germany registered 87,970 hybrid vehicles. SUVs led the charge with a notable 23,222 units sold, indicating a consumer preference for larger, versatile vehicles. Off-road vehicles trailed with a strong 16,519 units, appealing to the adventurous. The compact class, selling 13,758 units, attracted urban drivers prioritizing efficiency. The middle class accounted for 13,136 units, catering to family needs. Meanwhile, small cars and upper middle-class vehicles saw sales of 8,439 and 6,705 units, respectively, underscoring the allure of both compact and premium models.

- In response to this burgeoning demand, major German automakers are broadening their hybrid offerings, spanning compact cars, luxury sedans, and SUVs. This expanded model range is not only appealing to a wider consumer base but is also bolstering sales and, consequently, the demand for HEV batteries.

- With ongoing innovations in hybrid powertrain technologies, automakers are enhancing vehicle performance and efficiency. This progress is making HEVs more enticing, especially to consumers who were once hesitant about electrified options.

- For example, at the April 2024 Beijing Motor Show, Hongqi, a brand under China's state-owned FAW, debuted an electric convertible and presented several hybrid prototypes. Targeting the luxury segment and eyeing international exports, Hongqi has set its sights on multiple global markets, with Germany being a primary focus. The brand aims to compete head-to-head with luxury giants like Audi, BMW, and Mercedes.

- As HEV sales climb, Germany is witnessing a surge in investments directed towards battery technology and production. Acknowledging the strategic need for a domestic supply of premium batteries, both automakers and dedicated battery firms are actively setting up and expanding their production bases across the nation.

- Given these dynamics, it's evident that the upswing in hybrid vehicle sales will continue to propel the market forward.

Germany Hybrid Electric Vehicle Battery Industry Overview

The Germany Hybrid Electric Vehicle Battery Market is semi-fragmented. Some of the key players in this market (in no particular order) are LG Energy Solution, Contemporary Amperex Technology Co Ltd., BYD Company, Northvolt AB, and Vehicle Energy Japan Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Hybrid Electric Vehicle Sales

- 4.5.1.2 Decreasing Lithium-ion Battery Price

- 4.5.2 Restraints

- 4.5.2.1 Battery Life and Replacment Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution

- 6.3.2 Contemporary Amperex Technology Co Ltd.

- 6.3.3 BYD Company

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Mercedes-Benz Group AG

- 6.3.6 Enersys Sarl

- 6.3.7 Exide Industries Ltd

- 6.3.8 Vehicle Energy Japan Inc.

- 6.3.9 Northvolt AB

- 6.3.10 Clarios International Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Continued Research and Development In New Battery Chemistries

02-2729-4219

+886-2-2729-4219