|

市场调查报告书

商品编码

1636540

法国电动车用镍氢电池:市场占有率分析、产业趋势、成长预测(2025-2030)France Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

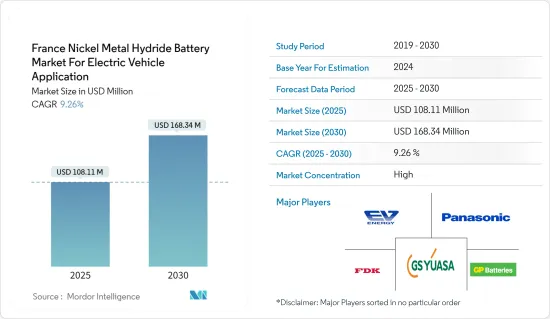

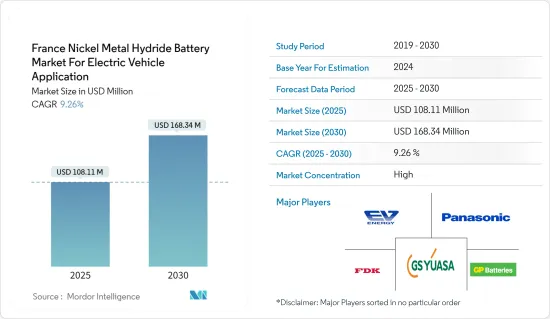

法国电动车镍氢电池市场预计将从2025年的1.0811亿美元成长到2030年的1.6834亿美元,预测期内(2025-2030年)复合年增长率为9.26%。

主要亮点

- 从中期来看,电动车(EV)的普及率不断提高以及锂离子电池的成本效益替代品(尤其是混合动力汽车)预计将在预测期内推动法国电动车镍氢电池市场的需求。预料之中的。

- 同时,镍氢电池市场正面临来自锂离子电池的激烈竞争,锂离子电池具有更高的能量密度且成本不断下降,这可能极大地限制了电动车应用镍氢电池市场的成长。

- 对混合动力汽车技术的持续投资为镍氢电池提供了在未来几年保持在这一利基市场的据点的机会。

法国镍氢电池市场趋势

锂离子技术的优势限制了市场的成长。

- 锂离子电池的能量密度比镍氢电池高得多。这项优势使得电动车 (EV) 一次充电即可行驶更远的距离,使其成为汽车製造商和消费者的关键卖点。考虑到这个范围,焦虑是电动车广泛使用的主要障碍。锂离子电池卓越的能源储存能力,加上重量轻,使其对纯电动车特别有吸引力。

- 锂离子电池的成本一度处于历史高位,但在过去十年中已大幅下降。这种成本的降低得益于生产技术的进步和规模经济的好处。例如,根据彭博社NEF报道,2023年电池价格将降至139美元/kWh,降幅超过13%。随着技术创新和製造水准的提高,电池组价格预计将进一步下降,到2025年达到113美元/度数,到2030年达到80美元/度。

- 由于价格下降,锂离子技术的竞争力变得越来越强。因此,对镍氢电池的需求正在减少。虽然镍氢电池曾经是一种更实惠的选择,但现在它们很难满足消费者对性能值的需求。

- 此外,随着电动车 (EV) 基础设施的发展,锂离子电池的快速充电功能变得越来越重要。在繁忙的城市环境中,消费者和车队营运商都优先考虑快速充电。另一方面,儘管镍氢电池很耐用,但充电时间很慢。对于电动车市场来说,这种时滞不太理想,因为充电速度正成为电动车市场的主要竞争对手。

- 由于其坚固性和长循环寿命,镍氢电池仍在一些混合动力电动车(HEV)中使用,但代表电动车未来的纯电动车(BEV)正在使用锂离子技术。公司正在进行许多计划来增加锂离子电池的产量。

- 例如,2024 年 5 月,法国 Blue Solutions 宣布计划在法国东部建造一座耗资 20 亿欧元(21.7 亿美元)的超级工厂。该工厂将专注于生产先进电池,包括用于电动车的锂离子电池,充电时间可达 20 分钟。预计 2030 年开始生产。这些新兴市场的发展将支持锂离子电池在该地区的普及,并可能暂时抑制电动车用镍氢电池市场的成长。

- 因此,法国镍氢电池在电动车领域的成长主要受到锂离子电池的快速发展和主导地位的限制,锂离子电池具有更好的能量密度、更轻的重量、更快的充电时间和更好的成本竞争。

混合动力电动车推进型细分市场经历了显着成长。

- 用于电动车(EV)应用的镍氢(NiMH)电池市场出现了显着增长,主要由混合动力电动车(HEV)推进领域推动。镍氢电池在功率和能量密度方面具有良好的平衡,非常适合使用内燃机 (ICE) 和马达的混合动力汽车的要求。

- 在日本,向清洁能源的转型正在取得进展,电动车 (EV) 变得越来越重要。近年来,包括混合动力汽车在内的电动车销量在该地区迅速成长。根据欧盟委员会的资料,2024年5月註册量达36,267辆,较2023年5月成长21%。自2024年初以来,道路上已新增约20万辆电动和混合动力汽车,与前一年同期比较成长13.7%。预计全部区域混合动力车销量将大幅成长,从而推动未来几年对镍氢 (NiMH) 电池的需求。

- 此外,主导欧洲环保倡议的法国也为车辆设定了严格的排放目标。由镍氢 (NiMH) 电池驱动的混合动力电动车 (HEV) 是传统内燃机汽车 (ICE) 和纯电动车 (BEV) 之间的重要桥樑,有助于排放碳排放。以减少排放。

- 此外,法国政府对电动车(包括混合动力汽车)的税收优惠和补贴正在推动该领域对镍氢电池的需求。随着国家和整个欧盟对减少温室气体排放的关注,由于排放,消费者越来越倾向于混合动力汽车。

- 例如,2023年,法国政府对购买新型电动或混合动力汽车推出补贴。车辆购买最高价格为 47,000 欧元(约 50,660 美元),含增值税。如果车辆价格在7,000欧元(约7,545美元)至15,400欧元(约16,600美元)之间,补贴将在1,500欧元(约1,615美元)至3,000欧元(约3,230美元)之间。这些津贴预计将为全国范围内采用混合动力电动车创造机会,并在预测期内推动对镍氢(NiMH)电池的需求。

- 因此,法国混合动力汽车领域的显着增长支撑了汽车市场对镍氢电池的需求。

法国镍氢电池产业概况

法国电动车用镍氢电池市场正在变得半固体。市场的主要企业包括(排名不分先后)松下控股公司、Priearth EV Energy、GS Yuasa Corp、GP Batteries International Ltd 和 FDK Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 的扩张

- 相对于锂离子电池的成本优势

- 抑制因素

- 锂离子技术的优点

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 车型

- 客车

- 商用车

- 推进类型

- 纯电动车(BEV)

- 插电式混合动力汽车(PHEV)

- 混合动力电动车(HEV)

- 燃料电池电动车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Panasonic Holdings Corporation

- Primearth EV Energy Co. Ltd

- FDK Corporation

- GP Batteries International Ltd

- GS Yuasa Corp

- Spectrum Brands(Rayovac)

- Lexel Battery(Coslight)

- Hunan Corun New Energy Co., Ltd.

- Huanyu Battery

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 混合动力汽车(HEV) 的扩展

The France Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 108.11 million in 2025 to USD 168.34 million by 2030, at a CAGR of 9.26% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increased adoption of electric vehicles (EV) and the cost-effective alternative to lithium-ion batteries, especially for hybrid vehicles are expected to drive demand in France's nickel metal hydride battery market for electric vehicle application during the forecast period.

- On the other hand, the NiMH battery market faces stiff competition from lithium-ion batteries, which offer higher energy density and have seen decreasing costs that can significantly restrain the growth of the nickel metal hydride battery market for electric vehicle applications.

- Nevertheless, continued investment in hybrid vehicle technologies presents an opportunity for NiMH batteries to maintain a stronghold in this niche market over the coming years.

France Nickel Metal Hydride Battery Market Trends

Dominance of Lithium-Ion Technology Restrain the Market Growth.

- Li-ion batteries boast a notably higher energy density than their NiMH counterparts. This advantage enables electric vehicles (EVs) to cover greater distances on a single charge, a crucial selling point for automakers and consumers. Given that range, anxiety poses a significant hurdle to EV adoption. Li-ion batteries' superior energy storage capacity, combined with their lighter weight, enhances their appeal, particularly for fully electric vehicles.

- Li-ion battery costs, once historically high, have significantly dropped over the past decade. This reduction is attributed to advancements in production techniques and the benefits of economies of scale. For instance, Bloomberg NEF reported that the battery prices declined in 2023 to USD 139 /kWh, a decrease of over 13%. The trajectory of technological innovation and manufacturing enhancements is anticipated to decrease the battery pack prices further, projecting the cost to reach USD 113/kWh in 2025 and USD 80/kWh in 2030.

- As a result of this price decline, Li-ion technology has become increasingly competitive. Consequently, the demand for NiMH batteries has diminished. While NiMH batteries were once the more affordable option, they now find it challenging to match the performance value that consumers seek.

- Further, as the infrastructure for electric vehicles (EVs) evolves, the rapid charging capabilities of Li-ion batteries become increasingly vital. In bustling urban settings, both consumers and fleet operators prioritize swift charging. On the other hand, NiMH batteries, despite their durability, have slower charging times. This lag renders them less ideal for the ongoing EV market, where charging speed is emerging as a critical competitive edge.

- While NiMH batteries are still used in some hybrid electric vehicles (HEVs) due to their robustness and long cycle life, Li-ion technology dominates in battery electric vehicles (BEVs), representing the future of EVs. Companies are initiating numerous projects to increase lithium-ion battery production to fulfill the rising demand for EVs across the region.

- For instance, in May 2024, Blue Solutions, a French company, unveiled plans for a EUR 2 billion (USD 2.17 billion) gigafactory in eastern France. This facility is expected to focus on producing advanced batteries, including lithium-ion batteries for electric vehicles, boasting a rapid 20-minute charging time. Production is slated to commence by 2030. These developments are poised to bolster the adoption of lithium-ion batteries in the region, potentially curbing the growth of the nickel metal hydride battery market for electric vehicle applications in the foreseeable future.

- Hence, the growth of France's NiMH batteries in the EV sector has been restrained primarily by the rapid evolution and dominance of Li-ion batteries, which offer superior energy density, lower weight, faster charging times, and improving cost competitiveness.

Hybrid Electric Vehicles Propulsion Type Segment Witnessed Significant Growth.

- The Nickel Metal Hydride (NiMH) battery market for electric vehicle (EV) applications has seen significant growth, primarily driven by the Hybrid Electric Vehicle (HEV) propulsion segment. NiMH batteries balance power and energy density, aligning perfectly with HEVs' requirements, which utilize an internal combustion engine (ICE) and an electric motor.

- The country is pivoting towards clean energy and placing a heightened emphasis on electric vehicles (EVs). Over recent years, sales of EVs, including hybrids, have surged in the region. Data from the European Commission reveals that in May 2024, registrations reached 36,267, a notable 21% uptick from May 2023. Since the start of 2024, nearly 200,000 new electric and hybrid vehicles have hit the roads, showcasing a 13.7% growth compared to the previous year. The number of hybrid electric vehicle sales is expected to increase significantly across the region and raise the demand for Nickel Metal Hydride (NiMH) batteries in the coming years.

- Further, leading the charge in Europe's environmental initiatives, France has set rigorous vehicle emissions targets. Hybrid Electric Vehicles (HEVs), powered by Nickel-Metal Hydride (NiMH) batteries, serve as a pivotal bridge between conventional Internal Combustion Engine (ICE) vehicles and fully Electric Vehicles (BEVs), aiding France in its quest to shrink its carbon footprint.

- Additionally, the French government's tax incentives and subsidies for electric vehicles, including hybrid vehicles, are boosting the demand for NiMH batteries in this sector. With a focus on reducing greenhouse gases nationally and across the EU, consumers are gravitating towards HEVs, drawn by their lower emissions.

- For instance, in 2023, the French government introduced a grant to purchase new electric or hybrid vehicles. The vehicle's purchase price is capped at EUR 47,000 (approximately USD 50,660), including VAT. For vehicles priced between EUR 7,000 (around USD 7,545) and EUR 15,400 (about USD 16,600), the grant amounts to between EUR 1,500 (roughly USD 1,615) and EUR 3,000 (approximately USD 3,230). Such grants are expected to create opportunities for the adoption of hybrid Electric vehicles across the country and raise the demand for Nickel Metal Hydride (NiMH) batteries during the forecast period.

- Hence, the significant growth of the HEV segment in France has sustained the demand for NiMH batteries in the automotive market.

France Nickel Metal Hydride Battery Industry Overview

France's nickel metal hydride battery market for electric vehicle applications is semi-consolidated. Some of the major players in the market (in no particular order) include Panasonic Holdings Corporation, Primearth EV Energy Co. Ltd, GS Yuasa Corp, GP Batteries International Ltd, and FDK Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Adoption of Electric Vehicle (EV)

- 4.5.1.2 Cost Advantage over Li-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Dominance of Lithium-Ion Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Passenger Vehicles

- 5.1.2 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicles (HEV)

- 5.2.4 Fuel Cell Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 Primearth EV Energy Co. Ltd

- 6.3.3 FDK Corporation

- 6.3.4 GP Batteries International Ltd

- 6.3.5 GS Yuasa Corp

- 6.3.6 Spectrum Brands (Rayovac)

- 6.3.7 Lexel Battery (Coslight)

- 6.3.8 Hunan Corun New Energy Co., Ltd.

- 6.3.9 Huanyu Battery

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Hybrid Electric Vehicles (HEVs)