|

市场调查报告书

商品编码

1636570

东协电动车镍氢电池:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

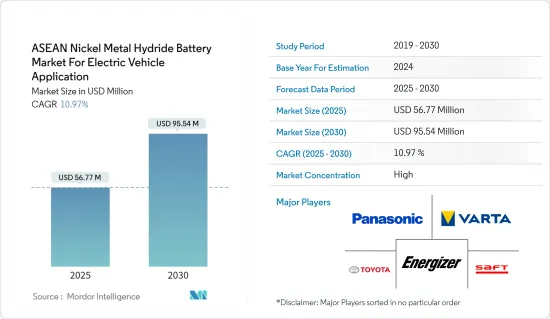

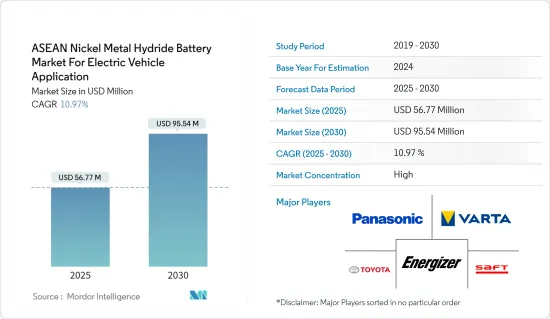

东协电动车镍氢电池市场预计将从 2025 年的 5,677 万美元成长到 2030 年的 9,554 万美元,预测期内(2025-2030 年)的复合年增长率为 10.97%。

主要亮点

- 从中期来看,预计电动车(EV)需求成长和政府支持措施等因素将在预测期内推动市场发展。

- 然而,预测期内锂离子电池的竞争预计将阻碍市场成长。

- 然而,预计未来几年技术进步将为市场创造巨大的商机。

东协镍氢电池市场趋势

电动车需求不断成长

- 在亚洲,对电动车(EV),尤其是混合动力电动车(HEV)的需求正在迅速增长,推动了镍氢电池市场的发展。随着汽车产业转向环保解决方案,包括混合动力汽车在内的电动车的采用正在增加,直接推动了对镍氢电池的需求。

- HEV 青睐镍氢电池,因为它们经济实惠、经久耐用并且在各种温度范围内性能稳定。这使得镍氢电池特别适合在电动和传统内燃机之间取得平衡的市场。

- 2024年8月1日,马来亚投资银行报告称,东南亚国协的电动车销量正在大幅成长。 2024 年上半年,新加坡的电动车註册量激增 218%,达到 6,019 辆,超过了 2023 年的销售量。马来西亚也体现了这一趋势,成长了 142%,达到 10,663 辆。同时,印尼和越南等国家正迅速普及电动车。

- 例如,印尼 2023 年的电动车销量为 17,062 辆,与前一年同期比较增长 65.2%。同时,泰国的销量更是令人印象深刻,成长了8倍,达到76,000辆,占汽车总销量的12%。

- 政府奖励正在推动电动车市场的成长。马来西亚已取消电动车的进口税和销售税,并为电动车充电设备提供特殊的税收减免。同时,印尼不仅提供税收优惠,而且还积极寻求外商投资以促进其电动车产业的发展。这些措施营造了一种鼓励广泛采用电动车(包括依赖镍氢电池的混合动力汽车)的氛围。

- 在东南亚,包括插混合动力汽车在内的乘用车电动车销量将在 2023 年超过 153,500 辆,其中泰国、马来西亚和菲律宾的贡献最为显着。越南的电动车发展之路仍处于起步阶段,预计 2023 年电动车销量将达到 15,700 辆左右,但发展轨迹令人乐观。随着该市场的蓬勃发展,采用镍氢电池的混合动力汽车很可能继续在汽车领域发挥关键作用。

- 综上所述,在政府扶持政策、快速成长的市场需求以及印尼、泰国和马来西亚等国强劲的销售推动下,亚洲电动车的普及速度加快,这清楚地表明了镍氢电池越来越受欢迎电池。

印尼有望垄断

- 印尼的镍氢 (NiMH) 电池市场呈现强劲成长,尤其是在电动车 (EV) 应用方面。这种快速成长的主要驱动力是四轮(4W)和两轮(2W)电动车的普及率不断提高。

- 2023 年,印尼四轮车总销量为 1,005,802 辆,其中电动车 12,248 辆。这比 2022 年有所增加,当时电动车销量为 1,048,040 辆,其中售出 8,562 辆。 2023 年的数据显示人们对电动车的兴趣日益浓厚。为了支持这一趋势,政府预测四轮驱动电动车的销量将激增,到 2024 年将达到 50,000 辆。比亚迪、现代和 VinFast 等全球汽车製造商也持这种乐观态度,他们密切关注着印尼的电动车市场,并暗示将把重点转向为当地市场提供低成本电动车。

- 除了 4W 车辆领域之外,印尼的 2W(两轮车)电动车领域也显示出显着的成长。 2023年电动Scooter销量将达到62,409辆,较前一年的17,198辆大幅成长。

- 除了本田和雅迪等全球企业外,Viar 和 Gesits 等本土企业也纷纷加入这一潮流。他们的许多电动Scooter在设计时都考虑到了印尼繁华的城市景观。认识到这一潜力,印尼政府设定了一个雄心勃勃的目标,到 2024 年实现 150,000 辆 4W 和 2W 电动车。

- 镍氢电池产业将受益于 4W 和 2W 电动车需求的不断增长,尤其是在印尼等快速成长的市场。由于政府支持政策、电动车基础设施蓬勃发展以及国内外製造商产量增加等因素,预计镍氢电池的需求将在短期内成长。

东协镍氢电池产业概况

东协电动车镍氢电池市场正在变得半固体。主要参与者包括 VARTA AG、松下控股公司、Energizer CA、Saft 和丰田汽车公司(不分先后顺序)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电动车需求不断成长

- 政府支持措施

- 限制因素

- 与锂离子电池的竞争

- 驱动程式

- 供应链分析

- PESTLE分析

- 投资分析

第五章 市场区隔

- 依推进类型

- 纯电动车

- 油电混合车

- 插电式电动车

- 燃料电池电动车

- 按车型

- 搭乘用车

- 商用车

- 按地区

- 印尼

- 泰国

- 菲律宾

- 马来西亚

- 越南

- 其他东南亚国协

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- VARTA AG

- Energizer CA

- Panasonic Holdings Corporation

- Toyota Motor Corp

- Saft

- FDK Corporation

- BYD Company

- Saft Group

- 其他主要企业名单

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 技术进步

简介目录

Product Code: 50004107

The ASEAN Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 56.77 million in 2025 to USD 95.54 million by 2030, at a CAGR of 10.97% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing demand for electric vehicles (EVs) and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, competition from lithium-ion batteries is likely to hinder the market growth during the forecast period.

- Nevertheless, technological advancements are expected to provide significant opportunities for the market in the coming years.

ASEAN Nickel Metal Hydride Battery Market Trends

Growing demand for Electric Vehicles (EVs)

- Asia's surging demand for electric vehicles (EVs), especially hybrid electric vehicles (HEVs), is propelling the Nickel-Metal Hydride (NiMH) battery market. As the automotive sector pivots towards eco-friendly solutions, the rising embrace of EVs, hybrids included, is directly boosting the demand for NiMH batteries.

- HEVs favor these batteries for their cost-efficiency, durability, and consistent performance across varied temperatures. This makes NiMH batteries particularly suited for markets still balancing between electric and traditional combustion engines.

- On August 1, 2024, Maybank Investment Bank reported that EV sales in ASEAN nations have seen a notable uptick. Singapore's electric vehicle registrations soared by 218% in H1 2024, hitting 6,019 units and eclipsing the entirety of 2023's sales. Malaysia mirrored this trend with a 142% rise, totaling 10,663 units. Meanwhile, nations like Indonesia and Vietnam are swiftly broadening their EV landscapes.

- For instance, Indonesia recorded 17,062 EV sales in 2023, marking a 65.2% year-on-year growth. Thailand's sales, however, were even more impressive, surging nearly eight-fold to 76,000 units, constituting 12% of the total vehicle sales.

- Government incentives bolster this EV market growth. Malaysia has abolished import and sales taxes on EVs and provides extra tax breaks for EV charging setups. Indonesia, on the other hand, is not only offering tax perks but is also actively seeking foreign investments to bolster its EV sector. Such measures cultivate a conducive atmosphere for the uptake of electric vehicles, hybrids included, which depend on NiMH batteries.

- Southeast Asia witnessed sales of over 153,500 passenger EVs in 2023, encompassing plug-in hybrids, with notable contributions from Thailand, Malaysia, and the Philippines. Vietnam, still nascent in its EV journey, recorded around 15,700 electric car sales in 2023, but the trajectory looks promising. As this market burgeons, hybrid vehicles powered by NiMH batteries will continue to play a pivotal role in the automotive scene.

- In summary, Asia's escalating embrace of electric vehicles, spurred by supportive government measures, burgeoning market appetite, and robust sales in nations like Indonesia, Thailand, and Malaysia, is a significant catalyst for the NiMH battery market's expansion in EV applications.

Indonesia is Expected to Dominate

- Indonesia's market for Nickel-Metal Hydride (NiMH) batteries, particularly for Electric Vehicle (EV) applications, is witnessing robust growth. This surge is primarily fueled by the rising adoption of electric vehicles, both four-wheeled (4W) and two-wheeled (2W).

- In 2023, Indonesia recorded total sales of 1,005,802 for 4W vehicles, out of which 12,248 were EVs. This marks an uptick from 2022, where 8,562 EVs were sold from a total of 1,048,040 vehicle sales. The 2023 figures underscore a burgeoning interest in electric mobility. Bolstering this trend, the government projects a leap in 4W EV sales, forecasting them to hit 50,000 units in 2024. This optimism is echoed by global automotive giants like BYD, Hyundai, and VinFast, all of whom are zeroing in on Indonesia's EV landscape, hinting at a pivot towards more budget-friendly EVs for the local market.

- Beyond the realm of 4W vehicles, Indonesia's 2W (two-wheeler) EV segment is also witnessing a notable upswing. In 2023, sales of electric scooters reached 62,409, a substantial rise from the previous year's 17,198, especially when juxtaposed against the total of 6,236,992 two-wheeler sales.

- Local entities such as Viar and Gesits, alongside global names like Honda and Yadea, are capitalizing on this momentum. Many of their electric scooters are designed with Indonesia's bustling urban landscape in mind. The Indonesian government, recognizing this potential, has set a bold target of 150,000 units for both 4W and 2W EVs in 2024.

- With the escalating demand for both 4W and 2W EVs, especially in burgeoning markets like Indonesia, the NiMH battery sector stands to benefit. Factors such as supportive government policies, the burgeoning EV infrastructure, and ramped-up production from both local and international manufacturers are set to bolster the demand for NiMH batteries in the foreseeable future.

ASEAN Nickel Metal Hydride Battery Industry Overview

The ASEAN nickel metal hydride battery market For electric vehicle application is semi-consolidated. Some of the major players include (not in particular order) VARTA AG, Panasonic Holdings Corporation, Energizer CA, Saft, and Toyota Motor Corp, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing demand for Electric Vehicles (EV)

- 4.5.1.2 Supportive government initiatives

- 4.5.2 Restraints

- 4.5.2.1 Competition from lithium-ion batteries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-In Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Philippines

- 5.3.4 Malaysia

- 5.3.5 Vietnam

- 5.3.6 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 VARTA AG

- 6.3.2 Energizer CA

- 6.3.3 Panasonic Holdings Corporation

- 6.3.4 Toyota Motor Corp

- 6.3.5 Saft

- 6.3.6 FDK Corporation

- 6.3.7 BYD Company

- 6.3.8 Saft Group

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

02-2729-4219

+886-2-2729-4219