|

市场调查报告书

商品编码

1636542

义大利电动车用镍氢电池:市场占有率分析、产业趋势、成长预测(2025-2030)Italy Nickel Metal Hydride Battery For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

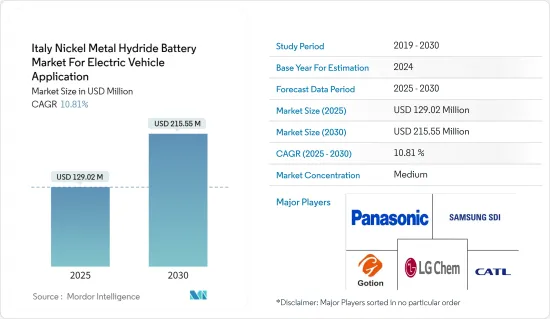

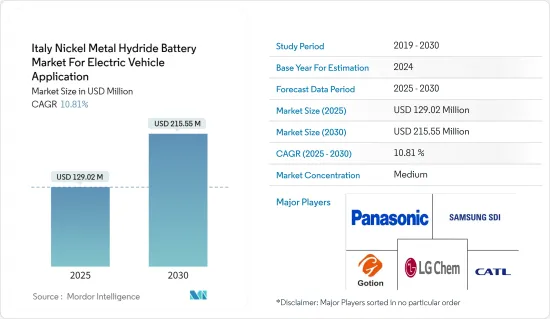

义大利电动车镍氢电池市场预计将从2025年的1.2902亿美元成长到2030年的2.1555亿美元,预测期间(2025-2030年)复合年增长率为10.81%。

主要亮点

- 从中期来看,政府对电动车的激励措施、电动车的普及、技术进步以及减少碳排放的环境法规预计将在预测期内推动市场发展。

- 相反,来自锂离子电池等替代技术的竞争预计将在预测期内阻碍市场。

- 义大利电动和混合动力汽车市场的扩张为镍氢电池带来了重大成长机会。

义大利镍氢电池市场趋势

混合动力汽车预计将显着成长

- 义大利汽车市场对混合动力电动车 (HEV) 的采用显着增加,丰田Corolla等车型越来越受欢迎。这一趋势反映了向绿色汽车的转变,并得到了义大利改善电动车基础设施和为电动车提供奖励的承诺的支持。

- 混合动力汽车结合了内燃机和电力推进,有望提高燃油效率并减少排放气体。这些车辆对于义大利减少碳排放和转向更永续的交通选择的策略至关重要。

- 例如,在义大利,混合动力车新註册数量从 2022 年的 454,989 辆大幅增加到 2023 年的 575,480 辆。这相当于约 26.5% 的成长率,凸显了混合动力车采用率的稳健上升趋势。这一激增的背后是政府的奖励和日益增强的环保意识,使混合动力汽车成为义大利消费者越来越受欢迎的选择。

- 由于混合动力汽车註册数量大幅增加,对镍氢(NiMH)电池的需求预计将增加,因为它们通常用于混合动力汽车。这一趋势凸显了镍氢电池在支持义大利向更永续的交通选择过渡的重要性。

- 2024年5月,Stellantis宣布计画在义大利生产菲亚特500e和吉普指南针混合动力汽车。 500e混合动力汽车将于 2026 年第一季在都灵的 Mirafiori 工厂开始生产,而 Jeep 指南针混合动力汽车将在 Melfi 工厂生产。此外,菲亚特熊猫在义大利的生产将持续到2029年。此举的重点是促进电动车的本地生产。

- 综上所述,义大利的混合动力电动车(HEV)预计将大幅成长,并推动镍氢电池市场。

政府的奖励措施和法规可望推动市场

- 义大利在引进电动车方面取得了巨大进展,基础设施已到位,人们的兴趣也在增加。 Enel X 等公司在扩展充电网路方面处于领先地位。这一势头正在帮助义大利拥抱更永续的未来。

- 在欧洲,电动车销量大幅成长,从2022年的270万辆增加到2023年的320万辆。这相当于约 18.5% 的成长率,凸显了电动车在整个非洲大陆的日益普及和渗透。

- 2024 年 1 月,义大利经济发展部长阿道夫·乌尔索 (Adolfo Urso) 宣布了新的生态奖励措施,以鼓励电动和混合动力汽车的普及。这些经济奖励旨在缓解消费者转型,并鼓励更多义大利人选择电动车而不是传统汽油车。

- 例如,2024年6月,义大利电动车註册数量大幅增加,证明了EcoBonus激励措施的有效性。新註册电动车数量为13,285辆,较2023年6月成长115.8%,凸显了支持电动车推广的奖励的有效性。

- 义大利将在未来四到八年内从 83% 的内燃机汽车 (ICE) 转向各种电池电动车 (BEV)、混合动力电动车 (HEV) 和插电式混合动力电动车 (PHEV)。转向新的组合了。这项转变旨在遏制二氧化碳排放,并利用义大利的电动车环境和适度的电力排放係数。这一演变的核心是镍氢电池,它是混合动力汽车的主要产品。

- 鑑于这些发展,政府对电动车的激励措施预计将提振义大利镍氢电池市场。

义大利镍氢电池产业概况

义大利电动车用镍氢电池市场温和。该市场的主要企业包括(排名不分先后)Panasonic控股、三星SDI、LG化学、国轩高科和宁德时代新能源科技。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府奖励和法规

- 电动车 (EV) 需求增加

- 抑制因素

- 与替代技术的竞争

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 推进类型

- 电池电动车

- 油电混合车

- 插电式混合动力电动车

- 燃料电池电动车

- 车型

- 客车

- 商用车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- Contemporary Amperex Technology Co Ltd.

- Gotion High Tech Co Ltd

- LG Chem Ltd.

- BYD Company

- Toyota Motor Corp

- FDK Corporation

- 其他知名公司名单

- 市场排名分析

第七章市场机会与未来趋势

- 扩大义大利电动和混合动力汽车市场

简介目录

Product Code: 50004012

The Italy Nickel Metal Hydride Battery Market For Electric Vehicle Application Industry is expected to grow from USD 129.02 million in 2025 to USD 215.55 million by 2030, at a CAGR of 10.81% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, supporting government incentives for electric vehicles, the surge in electric vehicles, technological advancements, and environmental regulations on reducing carbon emissions will likely drive the market during the forecast period.

- Conversely, competition from alternative technologies like lithium-ion batteries is expected to hinder the market during the forecast period.

- Nevertheless, Italy's expanding market for electric and hybrid vehicles presents a significant growth opportunity for nickel metal hydride battery batteries.

Italy Nickel Metal Hydride Battery Market Trends

Hybrid Electric Vehicles are Expected to Witness Significant Growth

- Italy's vehicle market is seeing a notable increase in the adoption of hybrid electric vehicles (HEVs), with models like the Toyota Corolla gaining popularity. This trend reflects a shift towards more environmentally friendly cars, supported by Italy's commitment to improving EV infrastructure and providing incentives for electric mobility.

- HEVs, which meld internal combustion engines with electric propulsion, promise better fuel efficiency and reduced emissions. These vehicles are pivotal in Italy's strategy to reduce carbon emissions and transition to more sustainable transportation.

- For instance, in Italy, the number of new registrations for HEVs increased significantly from 454,989 in 2022 to 575,480 in 2023. This represents a growth rate of approximately 26.5 percent, highlighting a solid upward trend in adopting HEVs. This surge is driven by government incentives and growing environmental awareness, making HEVs an increasingly popular choice among Italian consumers.

- Due to this significant increase in HEV registrations, the demand for nickel metal hydride (NiMH) batteries is expected to rise, as they are commonly used in hybrid vehicles. This trend underscores the importance of NiMH batteries in supporting Italy's transition to more sustainable transportation options.

- In May 2024, Stellantis announced plans to produce hybrid versions of the Fiat 500e and Jeep Compass in Italy. Production of the hybrid 500e will start in Q1 2026 at the Mirafiori plant in Turin, while the hybrid Jeep Compass will be made at the Melfi plant. Additionally, the production of Fiat Panda in Italy will continue until 2029. This move focuses on enhancing the local production of electric vehicles.

- Given the above points, Italy's hybrid electric vehicles (HEVs) are expected to grow significantly and drive the nickel hydride battery market.

Government Incentives and Regulations are expected to Drive the Market

- Italy is making significant progress in adopting electric vehicles, with growing infrastructure and increasing interest. Companies like Enel X are leading the way in expanding charging networks. This momentum is helping Italy embrace a more sustainable future.

- In Europe, electric car sales have grown significantly, increasing from 2.7 million units in 2022 to 3.2 million in 2023. This represents a growth rate of approximately 18.5 percent, highlighting the rising popularity and adoption of electric vehicles across the continent.

- In January 2024, Italy's Minister of Economic Development, Adolfo Urso, unveiled new Ecobonus incentives to accelerate the adoption of electric and hybrid vehicles. These financial incentives are designed to ease the transition for consumers, encouraging more Italians to choose electric cars over traditional gas-powered ones.

- For instance, the impact of the Ecobonus incentives was evident in June 2024, when Italy saw a remarkable surge in electric vehicle registrations. With 13,285 new total electric vehicles registered, this marked a 115.8 percent increase from June 2023, highlighting the effectiveness of the incentives in boosting EV adoption.

- Italy is poised to transition from a landscape dominated by 83% internal combustion engine (ICE) vehicles to a diverse mix of battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs) over the next 4-8 years. This shift aims to curtail CO2 emissions and capitalize on Italy's conducive EV environment and its moderate electricity emission factor. Central to this evolution are nickel-metal hydride batteries, a staple in HEVs.

- Given the dynamics, government incentives for electric vehicles are expected to boost Italy's nickel-metal hydride battery market.

Italy Nickel Metal Hydride Battery Industry Overview

Italy's nickel metal hydride battery market for electric vehicles is moderate. Some of the key players in the market (in no particular order) include Panasonic Holdings Corporation, Samsung SDI Co. Ltd., LG Chem Ltd., Gotion High Tech Co Ltd, and Contemporary Amperex Technology Co Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Incentives and Regulations

- 4.5.1.2 Rising in demand for Electric Vehicles (EVs)

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Propulsion Type

- 5.1.1 Battery Electric Vehicles

- 5.1.2 Hybrid Electric Vehicles

- 5.1.3 Plug-in Hybrid Electric Vehicles

- 5.1.4 Fuel Cell Electric Vehicles

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 Samsung SDI Co. Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd.

- 6.3.4 Gotion High Tech Co Ltd,

- 6.3.5 LG Chem Ltd.

- 6.3.6 BYD Company

- 6.3.7 Toyota Motor Corp

- 6.3.8 FDK Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Italy's Expanding Market for Electric and Hybrid Vehicles

02-2729-4219

+886-2-2729-4219