|

市场调查报告书

商品编码

1636564

西欧电动车 (EV) 充电设备 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Western Europe Electric Vehicle (EV) Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

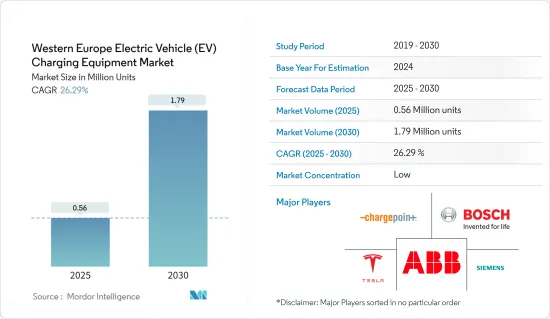

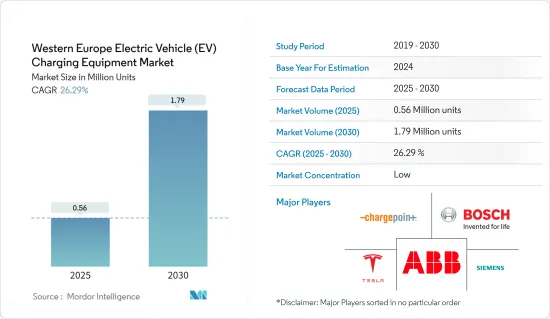

西欧电动车充电设备市场规模预计2025年为56万台,预计2030年将达到179万台,预测期间(2025-2030年)复合年增长率为26.29%。

主要亮点

- 从中期来看,电动车普及率的提高和电动车充电网路的扩大等因素预计将在预测期内推动电动车充电设备市场的发展。

- 另一方面,与充电站安装相关的高安装和维护成本预计将阻碍预测期内的市场成长。

- 电动车充电设备的技术进步预计将在预测期内为西欧电动车充电设备市场创造重大机会。

- 德国因其推出电动车的各种倡议而有望成为该地区的关键国家。

西欧电动车(EV)充电设备市场趋势

公共电动车充电领域占据市场主导地位

- 在电动车采用率增加、政府奖励和对永续交通的承诺的推动下,公共电动车(EV)充电领域出现了显着增长,并在预测期内引领西欧电动车充电设备市场。

- 近年来,西欧国家迅速扩大了公共电动车充电网路。例如,国际能源总署 (IEA) 报告称,到 2023 年,德国和法国等主要西欧国家将分别拥有约 108,000 个和 110,000 个公共电动车充电站。同时,荷兰、瑞士和奥地利等国家分别拥有约 145,800 个、15,800 个和 17,500 个公共电动车充电站。由于这些国家有着雄心勃勃的碳排放目标,支持电动车的基础设施,特别是公共充电站,预计将成为发展重点。

- 随着西方国家扩大公共电动车充电站,对电动车充电设备的需求正在迅速增加。这种扩张对于支持世界向永续交通的转变至关重要。电动车充电设备包括多种促进电动车充电的技术和设备。

- 2024 年 3 月,领先的快速充电技术供应商 Kempower 在德国克莱贝安装了首个公共充电系统。该系统由 Kuster Energy 经营,容量高达 400kW,配备四个带有单一连接电缆的 Kempower 卫星,可实现电动车的快速充电。公共充电基础设施的增加证实了德国对增加电动车采用和减少碳排放的承诺。

- 此外,该地区的一些国家正在积极制定部署电动车(EV)充电站的目标,作为提高电动车采用率和减少温室气体排放努力的一部分。部署电动车充电基础设施对于解决电动车驾驶员的里程焦虑和鼓励更多人转换电动车至关重要。

- 例如,2024 年 4 月,法国国家开发银行的一个部门宣布将与电动车充电设施营运商合作,提供资金,为更换车辆的公司部署约 10,000 个充电点。此外,Bump 的目标是到 2030 年安装 25,000 个充电站,成为为其客户安装充电站的企业充电站和零售连锁店的领导者。该倡议是法国根据全球永续性目标加速电动车普及和减少碳排放努力的一部分。

- 2024年初,法国政府拨款购买1万台电动车充电设备。此外,法国国营电力公司 EDF 将与基础设施公司 Morrison 合作,并在 2030 年在公共停车场建造 8,000 个快速充电站。由于这些努力,预计未来几年对电动车充电设备的需求将大幅成长。

- 在德国,政府正在推动在包括公共场所在内的各个地点安装电动车充电站。这项倡议刺激了对电动车充电设备的需求增加,这对于不断增长的电动车数量至关重要。解决续航里程问题并确保充电站的使用对于鼓励更多德国消费者转向电动车至关重要。

- 例如,2024 年 2 月,欧洲着名电动车充电公司 Fastned 获得批准,在德国高速公路沿线安装 34 个快速充电站。这项措施符合「Deutschlandnetz」竞标,这是加强德国电动车充电基础设施的策略性倡议。 Fastned 的扩充是我们在 2030 年实现在欧洲安装 1,000 个快速充电站的宏伟目标的重要一步。

- 鑑于这些新兴市场趋势,公共电动车充电领域可能会在未来几年引领西欧电动车充电设备市场。

德国可望主导市场

- 德国正在迅速扩大其电动车 (EV) 基础设施,反映出人们对电动车产业的接受度不断提高。据国际能源总署 (IEA) 称,到 2023年终,德国将拥有约 108,000 个公共电动车充电站。其中包括约 21,000 个快速充电设施和约 87,000 个慢速充电设施。具体来说,2023年新增慢充点超过16,000个,快充点超过6000个。

- 德国政府制定了雄心勃勃的计划,目标是到 2030年终在全国安装 100 万个公共充电站。然而,截至2023年下半年,这一目标仅实现了约11%。为了填补这一空白,预计未来几年公共电动车充电站将大幅增加,这表明电动车充电设备市场将快速成长。

- 各国政府正在积极核准在从公共场所到住宅和商业设施的各种地点安装电动车充电设施。这项倡议是为了应对道路上电动车数量的不断增加,并刺激对电动车充电设备的需求。加强电动车充电基础设施对德国至关重要,旨在透过减轻续航里程问题和提高可及性来鼓励更多消费者转向电动车。

- 2024 年 2 月,欧洲着名电动车充电公司 Fastned 获得批准,可在德国高速公路沿线安装 34 个快速充电站。该倡议是 Deutschlandnets竞标的一部分,强调了德国加强其电动车充电基础设施的承诺。 Fastned 的这项倡议是其向 2030 年在欧洲部署 1,000 个快速充电站的宏伟目标迈出的一步。

- 在德国,越来越多的公司正在安装自己的电动车充电中心,这是加强其电动车基础设施并应对快速增长的充电设备需求的策略性尝试。这些枢纽不仅推动了电动车的普及,还在减少碳排放和支持永续交通解决方案方面发挥了作用。

- 2023 年 11 月,梅赛德斯-奔驰在德国曼海姆开设了第一个内部充电中心。该专案符合该汽车製造商的全球目标,即在本世纪末安装超过 2,000 个充电站和 10,000 个快速充电点。

- 德国正在推动在加油站安装电动车充电设备,强调对永续交通的承诺。这项任务不仅促进清洁能源汽车,也解决紧迫的气候变迁问题。

- 2023年9月,德国总理奥拉夫·肖尔茨宣布一项法律,要求80%的加油站配备至少150千瓦的快速充电设备。

- 鑑于这些趋势,随着电动车普及率、投资和政府支持措施的扩大,德国电动车充电设备市场预计将大幅成长。

西欧电动车(EV)充电设备产业概况

西欧的电动车(EV)充电设备市场已缩减一半。市场主要企业包括(排名不分先后)ABB Ltd、Robert Bosch GmbH、ChargePoint Inc.、Siemens AG 和 Tesla Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:台)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 扩大电动车充电网路的倡议

- 抑制因素

- 与安装充电站相关的高安装和维护成本

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 车型

- 纯电动车(BEV)

- 插电式混合动力汽车(PHEV)

- 混合动力电动车(HEV)

- 应用

- 家庭充电

- 职场充电

- 公共充电

- 充电类型

- 交流充电(1 级和 2 级)

- 直流充电

- 地区

- 德国

- 法国

- 荷兰

- 瑞士

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- ABB Ltd

- Robert Bosch GmbH

- Delta Electronics Inc.

- Siemens AG

- Tesla Inc.

- ChargePoint Inc.

- Enphase Energy, Inc.

- Powercharge

- Ampure

- Exicom Tele-Systems Ltd

- Schneider Electric SE

- Eaton Corporation

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 电动车充电设备的技术进步

简介目录

Product Code: 50004070

The Western Europe Electric Vehicle Charging Equipment Market size is estimated at 0.56 million units in 2025, and is expected to reach 1.79 million units by 2030, at a CAGR of 26.29% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing adoption of electric vehicles and the efforts to expand the EV charging networks are expected to drive the EV charging equipment market during the forecast period.

- On the other hand, high installation costs associated with setting up charging stations and maintenance costs are expected to hinder the market's growth during the forecast period.

- Nevertheless, the technological advancements in EV charging Equipment are expected to provide significant opportunities for the Western Europe EV charging equipment market during the forecast period.

- Germany is expected to be a significant country in the region due to its various initiatives for the adoption of electric vehicles.

Western Europe Electric Vehicle (EV) Charging Equipment Market Trends

Public EV Charging Segment to Dominate the Market

- Driven by increasing EV adoption, government incentives, and a commitment to sustainable transportation, the public electric vehicle (EV) charging segment is poised for substantial growth, leading the Western Europe EV charging equipment market during the forecast period.

- In recent years, Western European nations have rapidly expanded their public EV charging networks. For instance, the International Energy Agency (IEA) reported that in 2023, major West European nations like Germany and France boasted around 108,000 and 110,000 public EV charging points, respectively. In contrast, countries like the Netherlands, Switzerland, and Austria had approximately 145,800, 15,800, and 17,500 public EV charging points. With these nations setting ambitious carbon emission reduction targets, the infrastructure supporting EVs, especially public charging stations, is set to be a focal point of development.

- As Western European nations ramp up their public EV charging points, the demand for electric vehicle charging equipment has surged. This expansion is vital for supporting the global shift towards sustainable transportation. Electric vehicle charging equipment includes various technologies and devices that facilitate EV charging.

- In March 2024, Kempower, a leading fast charging technology provider, installed its inaugural public charging systems in Kleve, Germany. Operated by Kuster Energy, the system boasts a capacity of up to 400 kW, featuring four Kempower Satellites with a single connection cable, allowing for swift EV charging. This uptick in public charging infrastructure underscores Germany's dedication to promoting EVs and curbing carbon emissions.

- Moreover, several countries in the region are actively setting targets to deploy electric vehicle (EV) charging stations as part of their efforts to promote the adoption of electric vehicles and reduce greenhouse gas emissions. The deployment of EV charging infrastructure is crucial for addressing range anxiety among EV drivers and encouraging more people to switch to electric vehicles.

- For instance, in April 2024, a unit of France's national development bank announced it had teamed up with an operator of electric vehicle rechargers to finance the deployment of about 10,000 points at enterprises switching their fleets of vehicles. Moreover, Bump aspires to become the leader in corporate charging stations and those deployed by retail chains for use by their clients by installing 25,000 by 2030. This initiative is part of France's efforts to promote the adoption of electric vehicles and reduce carbon emissions in line with global sustainability goals.

- In early 2024, the French government allocated funding for 10,000 electric vehicle chargers. Additionally, EDF, France's state-owned electricity company, partnered with Morrison, an infrastructure firm, to build 8,000 rapid charging stations in public parking lots by 2030. Such initiatives are expected to drive a significant demand for EV charging equipment in the coming years.

- In Germany, the government is facilitating the installation of EV charging sites in various locations, including public spaces. This initiative has spurred a heightened demand for EV charging equipment, essential for the growing electric vehicle population. Addressing range anxiety and ensuring accessibility to charging stations are pivotal for encouraging more consumers in Germany to transition to electric vehicles.

- For instance, in February 2024, Fastned, a prominent European EV charging company, received approval to establish 34 fast-charging sites along Germany's highways. This initiative aligns with the "Deutschlandnetz" tender, a strategic move to bolster Germany's EV charging infrastructure. Fastned's expansion is a significant stride towards its ambitious goal of 1,000 fast charging stations across Europe by 2030.

- Given these developments, the public EV charging segment is set to lead the Western Europe EV charging equipment market in the coming years.

Germany is Expected to Dominate the Market

- Germany has been rapidly expanding its electric vehicle (EV) infrastructure, mirroring the nation's increasing embrace of the EV industry. According to the International Energy Agency (IEA), by the close of 2023, Germany boasted approximately 108,000 publicly available EV charging points. This tally comprised around 21,000 fast chargers and 87,000 slow chargers. Notably, in 2023, Germany added over 16,000 public slow charging points and 6,000 public fast charging points.

- The German government has ambitious plans, targeting the installation of 1 million public charging points nationwide by the end of 2030. Yet, as of late 2023, only about 11% of this target has been met. To bridge this gap, a significant surge in public EV charging points is anticipated in the coming years, signaling a burgeoning market for EV charging equipment.

- The government is actively approving EV charging installations in diverse locations, from public spaces to residential and commercial properties. This initiative has spurred demand for EV charging equipment, catering to the rising number of electric vehicles on the roads. Strengthening the EV charging infrastructure is pivotal for Germany, as it aims to alleviate range anxiety and enhance accessibility, thereby encouraging more consumers to transition to electric vehicles.

- In February 2024, Fastned, a prominent European EV charging firm, received approval to establish 34 fast-charging sites along Germany's highways. This initiative, part of the "Deutschlandnetz" tender, underscores Germany's commitment to bolstering its EV charging infrastructure. Fastned's move is a stride towards its broader ambition of rolling out 1,000 fast charging stations across Europe by 2030.

- Companies in Germany are increasingly setting up their own EV charging hubs, a strategic endeavor to bolster the nation's EV infrastructure and cater to the surging demand for charging equipment. These hubs not only facilitate EV adoption but also play a role in curbing carbon emissions and championing sustainable transport solutions.

- In November 2023, Mercedes-Benz inaugurated its inaugural proprietary charging hub in Mannheim, Germany. This venture aligns with the automaker's global ambition of establishing over 2,000 charging stations by decade's end, featuring upwards of 10,000 fast-charging points.

- Germany is pushing for EV chargers at gas stations, underscoring its commitment to sustainable transport. This mandate not only promotes clean energy vehicles but also addresses pressing climate concerns.

- In September 2023, German Chancellor Olaf Scholz announced a forthcoming law stipulating that 80% of service stations must offer fast-charging options, with a minimum capacity of 150 kilowatts.

- Given these trends, the EV charging equipment market in Germany is poised for substantial growth, aligning with the nation's escalating EV adoption, investments, and supportive government policies.

Western Europe Electric Vehicle (EV) Charging Equipment Industry Overview

The Western Europe electric vehicle (EV) charging equipment market is semi-fragmented. Some of the key players in the market (not in any particular order) include ABB Ltd, Robert Bosch GmbH, ChargePoint Inc., Siemens AG, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in Units, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Efforts to Expand EV Charging Networks

- 4.5.2 Restraints

- 4.5.2.1 High Installation Costs Associated With Setting Up Charging Stations And Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Battery Electric Vehicle (BEV)

- 5.1.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.1.3 Hybrid Electric Vehicle (HEV)

- 5.2 Application

- 5.2.1 Home Charging

- 5.2.2 Workplace Charging

- 5.2.3 Public Charging

- 5.3 Charging Type

- 5.3.1 AC Charging (Level 1 and Level 2)

- 5.3.2 DC Charging

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 Netherlands

- 5.4.4 Switzerland

- 5.4.5 Rest of Western Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Robert Bosch GmbH

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Siemens AG

- 6.3.5 Tesla Inc.

- 6.3.6 ChargePoint Inc.

- 6.3.7 Enphase Energy, Inc.

- 6.3.8 Powercharge

- 6.3.9 Ampure

- 6.3.10 Exicom Tele-Systems Ltd

- 6.3.11 Schneider Electric SE

- 6.3.12 Eaton Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancement in the EV Charging Equipment

02-2729-4219

+886-2-2729-4219