|

市场调查报告书

商品编码

1637739

电子封装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Electronic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

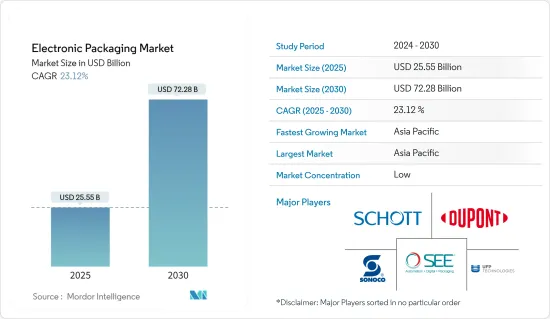

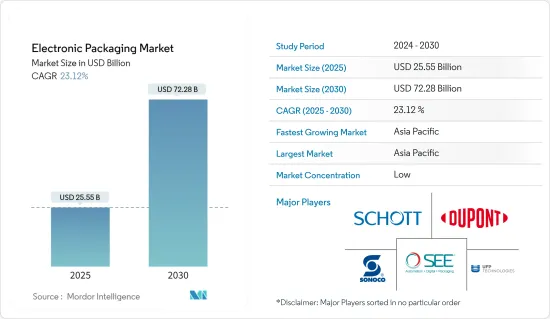

预计2025年电子封装市场规模为255.5亿美元,2030年将达722.8亿美元,预测期间(2025-2030年)复合年增长率为23.12%。

主要亮点

- 随着电视、参与企业、MP3、数位相机等需求的快速成长,电子封装越来越成为大规模生产的首选。物联网和人工智慧的兴起,加上复杂电子产品的激增,正在推动消费性电子和汽车产业的高端应用领域。因此,电子封装领域的先进技术正迅速被采用,以满足这一新兴的需求。

- 销售电子产品的公司认识到它们在塑造消费者选择方面发挥的重要作用,正在稳步将永续性纳入其包装设计中。例如,科技巨头三星已承诺在 2025 年之前在其整个产品线中采用环保材料。这项雄心勃勃的倡议涉及从传统的塑胶包装转向生物分解性或可回收的替代品。这些倡议不仅引起了具有环保意识的消费者的共鸣,而且使该品牌成为环保意识日益增强的市场中负责任的领跑者。

- 数位时代正在重塑包装设计。现代家用电子电器产品包装包括二维码、扩增实境(AR) 介面和近距离场通讯(NFC) 标籤等功能。这些创新正在彻底改变消费者与包装互动的方式。

- 透过将实体包装与数位体验相结合,这些技术增强了用户参与度。例如,透过扫描包装上的二维码,消费者可以被引导至提供详细产品规格、使用者评论或身临其境型虚拟实境演示的网站。这些功能支撑着这些技术在家用电子电器封装市场中日益增长的重要性。

- 汽车产业在市场格局中发挥着主导作用,特别是随着向电动和混合动力汽车的快速过渡。由于这些车辆中广泛使用储存设备、处理器、类比电路和感测器,对电子封装的需求预计将显着增加。

- 根据 IBEF 预测,到 2025 年,印度电动车 (EV) 市场规模可能达到 5,000 亿印度卢比(70.9 亿美元)。此外,根据CEEW能源金融中心的一项研究,到2030年,印度电动车市场规模将达到2,060亿美元。这种乐观的预测预计将进一步提振电子封装市场。

- 儘管COVID-19大流行给许多行业蒙上了阴影,但电子产品包装解决方案和消费性电子产品包装却表现出了韧性。行动电话和电脑产业主要推动家用电子电器包装的需求。儘管面临停产、原材料短缺和供应链中断等挑战,这些产业的产出仍然相对完好。

电子封装市场趋势

航太和国防领域预计将增加电子封装的采用

- 无论是美国、法国、英国等已开发国家,或是俄罗斯、印度、中国等开发中国家,国防预算都在增加。其中许多国家也热衷于出口武器。因此,航太和国防市场的研发投资持续成长。

- 在当今动态的地缘政治气候下,集体防御的重要性怎么强调都不为过。从武器和导引系统到武装车辆及其动力来源,军队和国防部队在保护国家免受外部威胁方面发挥着至关重要的作用。为了维持强大的军事体系,监控部队和军队都必须最大限度地提高效率和效力。

- 印度国防生产部报告显示,2022-23财年国防生产实现历史性里程碑,达1兆印度卢比(约120.5亿美元)。此外,印度的国防电池需求预计将翻一番,从2022年的4吉瓦增加到2030年的10吉瓦。国防生产的持续成长以及国防电池采用的增加是未来几年推动市场成长的前景。

- 海军军舰、舰载卫星通讯通道、武器控制系统和海岸防卫队都依赖先进的电子产品。这些组件需要军用级封装,特别是考虑到湿度和恶劣环境的挑战。这种需求不仅强调了对高品质产品的需求,也刺激了研发投资。

亚太地区市场将实现显着成长

- 在汽车基础设施扩张和电动车销量激增的推动下,预计亚太地区将在预测期内主导市场。由于中产阶级收入的增加和年轻人口的显着增加,汽车行业的需求预计将增长。印度汽车工业商协会(SIAM)的报告显示,2023年印度乘用车产量将达到454万辆,较2022年的365万辆大幅成长,显示该市场未来将稳定成长。

- 中国作为全球公认的电子中心,在电气元件和电子产品的大规模生产方面表现出色,坚持一流的品质、性能和交付基准。这一优势支撑了电子封装市场的强劲成长潜力。

- 中国的工业成长是由不断增长的内需、技术创新和对生产优质产品的承诺所推动的。中国纸和纸板的大规模生产为电子产品包装的销售创造了良好的环境。

- 印度国家投资促进和便利化局(NIPFA)的报告显示,在强有力的政策支持、大量投资和不断增长的电子产品需求的推动下,到2025年,印度电子製造业将增长2200亿美元。

电子封装产业概况

电子封装市场较为分散。微系统几乎应用于每个产业领域,主要领域包括消费性电子、医疗设备、航太和国防以及通讯。主要市场参与企业包括 UFP Technologies、Schott AG、Sealed Air Corporation、DuPont de Nemours Inc. 和 Sonoco Products Company。

- 2023 年 9 月,Sealed Air 与 3D 自动化包装解决方案领先供应商 Spark Technologies 合作。 Sealed Air 将在澳洲、韩国、日本和韩国独家经销 Sparkk Technologies 的 3D CVP 自动化包装解决方案。作为合作伙伴关係的一部分,希悦尔客户将受益于业界领先的自动化包装解决方案,使他们能够简化流程并创造更安全的工作环境。

- 2023 年 11 月,Mondi 宣布将推广纸板包装作为完全可回收和可堆肥的选择,从而引领永续替代方案的发展。该公司采用再生纤维製成的纸板在纸包装实现82.5%的回收率方面发挥着极其重要的作用,这一点在欧洲备受关注。 Mondi 的材料和设计专家致力于白色家电和家用电子电器,正在建立先进的瓦楞纸解决方案来取代 EPS 材料。

- 2023 年 9 月,Schott AG 为航太业推出了新型微电子封装。与由可伐铁镍合金製成的传统电子产品包装相比,该包装旨在延长航空电子设备保护的使用寿命,同时减轻高达 75% 的重量。据说该产品还可以保护敏感电子设备,例如射频设计、直流/直流转换器(DC/DC)、电力储存设备和感测器组件。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- 市场驱动因素

- 加速全球电动车销售

- 透过技术进步提升产品品质

- 市场限制因素

- 电子封装的高成本和缺乏熟练的专业人员是市场成长的挑战

- 技术简介

第五章市场区隔

- 按材质

- 塑胶

- 金属

- 玻璃

- 按最终用户产业

- 消费性电子产品

- 航太/国防

- 车

- 医疗保健

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 公司简介

- SCHOTT AG

- DuPont de Nemours Inc.

- Sealed Air Corporation

- GY Packaging

- UFP Technologies Inc.

- Sonoco Products Company

- Smurfit Kappa Group PLC

- Dunapack Packaging Group

- WestRock Company

- Mondi Group

- Dordan Manufacturing Company

第七章 投资分析

第八章市场的未来

The Electronic Packaging Market size is estimated at USD 25.55 billion in 2025, and is expected to reach USD 72.28 billion by 2030, at a CAGR of 23.12% during the forecast period (2025-2030).

Key Highlights

- As demand surges for TVs, set-top boxes, MP3 players, and digital cameras, electronics packaging is increasingly favored for mass production. The rise of IoT and AI, coupled with the proliferation of intricate electronics, propels the high-end application segment within the consumer electronics and automotive industries. Consequently, to meet this burgeoning demand, advanced technologies for electronics packaging have been swiftly adopted.

- Companies selling electronics are steadily weaving sustainability into their packaging designs, recognizing its pivotal role in shaping consumer choices. For example, tech giant Samsung has committed to integrating eco-friendly materials across its entire product line by 2025. This ambitious move encompasses a shift from conventional plastic packaging to biodegradable or recycled alternatives. Such initiatives not only resonate with eco-conscious consumers but also position the brand as a responsible frontrunner in a market increasingly attuned to environmental issues.

- The digital age is reshaping packaging design. Modern consumer electronics packaging now boasts features like QR codes, augmented reality (AR) interfaces, and NFC (near-field communication) tags. These innovations are revolutionizing consumer interactions with packaging.

- By blending physical packaging with digital experiences, these technologies amplify user engagement. For example, scanning a QR code on a package might lead consumers to a website showcasing detailed product specs, user reviews, or even immersive virtual reality demonstrations. Such capabilities underscore the growing importance of these technologies in the consumer electronics packaging market.

- The automotive industry, particularly with its swift pivot toward electric and hybrid vehicles, plays a dominant role in the market landscape. Given the extensive use of memory devices, processors, analog circuits, and sensors in these vehicles, the demand for electronics packaging is poised for a significant uptick.

- Forecasts from IBEF suggest that the Indian electric vehicles (EV) market could touch INR 50,000 crores (USD 7.09 billion) by 2025. Additionally, insights from a CEEW Centre for Energy Finance study indicate a whopping USD 206 billion opportunity for EVs in India by 2030. Such bullish projections are set to further fuel the electronics packaging market.

- While the COVID-19 pandemic cast a shadow on many industries, electronics packaging solutions and consumer electronics packaging showed resilience. The mobile phone and computer industries primarily drive the demand for consumer electronics packaging. Despite challenges like production halts, raw material shortages, and supply chain disruptions, these industries' output remained relatively unscathed.

Electronic Packaging Market Trends

Aerospace and Defense Segment Expected to Increasingly Adopt Electronics Packaging

- Defense budgets are on the rise in both developed nations, including the United States, France, and the United Kingdom, and in developing nations like Russia, India, and China. Many of these countries are also keen on weapon exports. Consequently, there has been a sustained push for R&D investments in the aerospace and defense market.

- In today's dynamic geopolitical climate, the significance of collective defense cannot be overstated. Military and defense forces, encompassing everything from weapons and guidance systems to armed vehicles and their power sources, play a pivotal role in safeguarding a nation from external threats. To uphold a robust military system, both surveillance and armed forces must function with utmost efficiency and effectiveness.

- As reported by the Department of Defence Production (India), defense production in the Financial Year (FY) 2022-23 achieved a historic milestone, surpassing INR 1 lakh crore (~USD 12.05 billion) for the first time, up from INR 95,000 crore (~USD 11.45 billion) in FY 2021-22. Additionally, India's demand for defense batteries is projected to double, rising from 4 gigawatt hours in 2022 to 10 gigawatt hours by 2030. This consistent uptick in defense production, alongside the growing adoption of defense batteries, is poised to drive market growth over the coming years.

- Naval warships, onboard satellite communication channels, weapon control systems, and coastguards all rely on advanced electronic products. These components necessitate military-grade packaging, especially given the challenges posed by humidity and harsh environments. Such demands not only underscore the need for high-quality products but also fuel investments in R&D.

Asia-Pacific to Experience Significant Market Growth

- During the forecast period, Asia-Pacific is poised to dominate the market, driven by expanding automotive infrastructure and a surge in electric vehicle sales. With rising incomes among the middle-income group and a substantial youth demographic, demand in the automotive industry is set to escalate. The Society of Indian Automobile Manufacturers (SIAM) reported that in 2023, India produced 4.54 million passenger vehicles, a notable rise from 3.65 million units in 2022, signaling robust future market growth.

- China, recognized globally as the electronics hub, excels in mass-producing electrical components and electronic products, adhering to top-notch quality, performance, and delivery benchmarks. This prowess underscores the vast growth potential of the electronics packaging market.

- China's industry growth is fueled by surging domestic demand, technological innovations, and a commitment to producing premium products. Such extensive production of paper and paperboard in China fosters a thriving environment for electronics packaging sales.

- The Indian electronic manufacturing industry, buoyed by strong policy backing, substantial investments, and a rising demand for electronic products, is projected to hit USD 220 billion by 2025, as reported by the National Investment Promotion & Facilitation Agency (NIPFA).

Electronic Packaging Industry Overview

The electronics packaging market is fragmented. Microsystems are used in almost every industry vertical, with some significant sections being consumer electronics, healthcare equipment, aerospace and defense, and communications. The major market players include UFP Technologies, Schott AG, Sealed Air Corporation, DuPont de Nemours Inc., and Sonoco Products Company.

- September 2023: Sealed Air collaborated with Sparck Technologies, a key 3D automated packaging solutions provider. Sealed Air is expected to exclusively distribute Sparck Technologies' 3D CVP automated packaging solutions in Australia, South Korea, Japan, and South Korea. As part of the alliance, Sealed Air's customers will benefit from access to the industry's most advanced automated packaging solutions, allowing them to streamline processes and create a more secure work environment.

- November 2023: Mondi announced that it was leading the charge for sustainable alternatives by promoting corrugated packaging as a fully recyclable and compostable option. The company's corrugated boxes, made from recycled fibers, play a pivotal role in achieving Europe's notable 82.5% recycling rate for paper-based packaging. Committed to circular packaging for white goods and electronics, Mondi's experts in materials and designs are crafting advanced corrugated solutions as substitutes for EPS materials.

- September 2023: Schott AG unveiled new microelectronic packages for the aerospace industry. The packages aim to extend the life of avionics protection while reducing the weight by up to 75% compared to conventional electronics packaging made from Kovar iron-nickel alloy. The products are also said to protect sensitive electronics, such as radio frequency designs, direct current/direct current converters (DC/DC), electrical storage devices, and sensor components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Accelerated Sales of Electrical Automotive Worldwide

- 4.4.2 Technological Advancements Driving Product Quality

- 4.5 Market Restraints

- 4.5.1 High Costs of Electronic Packaging and Lack of Skilled Professionals to Challenge Market Growth

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.2 By End-user Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace and Defense

- 5.2.3 Automotive

- 5.2.4 Healthcare

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SCHOTT AG

- 6.1.2 DuPont de Nemours Inc.

- 6.1.3 Sealed Air Corporation

- 6.1.4 GY Packaging

- 6.1.5 UFP Technologies Inc.

- 6.1.6 Sonoco Products Company

- 6.1.7 Smurfit Kappa Group PLC

- 6.1.8 Dunapack Packaging Group

- 6.1.9 WestRock Company

- 6.1.10 Mondi Group

- 6.1.11 Dordan Manufacturing Company