|

市场调查报告书

商品编码

1637847

亚太零售分析:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Retail Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

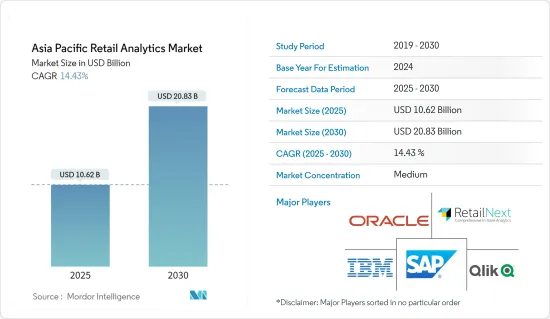

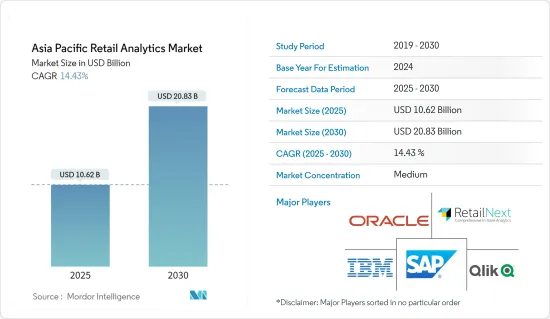

亚太地区零售分析市场规模预计在 2025 年为 106.2 亿美元,预计到 2030 年将达到 208.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.43%。

主要亮点

- 随着零售商大量使用物联网并快速采用分析工具,市场正在迅速扩张。

- 零售分析提供对存量基准、供应链动态、消费者需求、销售等的资料,这对于行销和采购决策至关重要。零售分析是对零售业务产生的资料的分析,以做出提高盈利的商业决策。供需资料分析可用于维持采购水准和行销决策。

- 这包括提供见解以了解和改善零售业务、销售趋势、消费行为和整体业务绩效。当今的消费者对零售业有着很高的标准,因此公司需要透过全通路提案、可操作的步骤和对新趋势的快速调整来满足日益增长的需求。所有这些活动都需要零售分析。随着中国、日本、印度和其他新兴国家建立更多的零售店,市场预计将会扩大。

- 例如,Reliance Retail 于 2023 年 2 月宣布计划明年开设多家 Gap 商店,着眼于该国的中高端服装市场。 Reliance Retail 去年收购了美国休閒服饰品牌 Gap 的印度分销权。总体而言,该零售商计划明年开设 50分店新店。此类分店可能会推动对零售分析解决方案的需求。

- 分析可以帮助零售商做出更好的行销决策,改善业务流程,并透过确定需要改进和优化的领域提供更好的整体客户体验。随着零售业在各国的快速扩张,该领域对分析解决方案的需求预计将会增加。例如,日本2023年2月零售额较上年同期成长6.6%,超过市场预期的5.8%的增幅,且高于1月修正后的5%的增幅。零售额连续12个月成长,为2021年5月以来的最快增幅。

- 此外,零售业越来越多地采用工业 4.0,这对市场扩张做出了巨大贡献。由于智慧型手机和电子商务的日益普及,零售分析市场正在扩大。预测期内,收入水准的提高、政府对巨量资料和分析的支出以及对自动化零售服务的需求也有望推动区域零售分析市场的发展。

- 零售分析市场的成长在很大程度上受到与零售分析工具相关的安装、维护、测试、授权和其他技术人事费用所需的高额资本支出的限制。此外,非正规零售业取得技术的机会有限以及预算紧张也是影响市场的因素。

亚太零售分析市场趋势

解决方案部门预计将占据主要市场占有率

- 随着零售业竞争日益激烈,优化业务流程和满足客户期望变得非常重要。每一步都涉及实施资料分析解决方案。客户热图还可用于优化优惠和产品展示。此外,零售业对云端服务的日益采用可能很快就会为亚太地区的零售分析市场创造机会。

- 此外,资料管理解决方案预计将主导该地区的零售分析领域。资料在零售业中最常用的使用方式之一是进行个人化行销。如果零售商更关注资料管理方面,他们的努力就可以显着改善。例如,将第三方资料新增至第一方资讯可以实现更精准的客户定位。

- 此外,资料管理解决方案在零售和电子商务领域变得越来越重要。技术的进步和丰富的资讯使得企业能够利用资料来改善业务并提供更好的客户服务。更好的资料管理可以汇集和建立原本庞大且难以管理的资料集,从而提高整个零售流程的可视性。

- 推动亚太地区零售分析产业发展的因素之一是资料分析解决方案。资料分析正在成为零售领域的一项改变游戏规则的技术,为零售企业提供强大的工具来简化流程、改善客户体验并增加销售额。资料分析允许零售商透过分析客户资料(例如购买历史、浏览行为和社交媒体互动)来创建个人化的推荐、优惠和促销。

- 亚太地区的零售业正在不断变化,资料分析将对零售业未来的发展产生重大影响。此外,零售额的成长和零售业数位化的不断提高,正在推动亚太地区新兴经济体零售商采用零售分析解决方案。例如,根据印度零售协会(RAI)的资料,2021年2月至2022年2月,全印度零售业的销售额成长率为10%。同样,北印度 2021 年 2 月至 2022 年 2 月的销售成长率为 17%,西印度的销售成长率为 16%。

日本可望成为亚太零售分析市场的主要动力

- 由于零售额成长和技术进步以及零售业对资料分析的需求不断增加,日本的零售分析市场将在未来几年实现显着成长。此外,中国零售业正在进行的数位转型为未来几年零售分析解决方案的采用提供了巨大的成长机会。

- 此外,零售分析可以显着增强您的行销策略。它可以透过收集有关您目前和过去客户的位置、年龄、偏好、购买模式和其他重要因素的资讯来识别您的理想客户,从而帮助您锁定客户。更好的资料管理可以充分发挥资料的潜力,在许多方面改善零售业务并增强零售商电子商务网站的功能。这将有助于预测期内日本对零售分析解决方案的需求增加。

- 此外,即时分析、人工智慧和机器学习等解决方案预计在未来将变得更加重要。它们帮助零售商增加销售额、简化行销计划并为客户提供无缝体验。预计这些解决方案将作为资料分析解决方案的一部分被零售企业更广泛地使用。

- 此外,随着日本零售业零售额不断成长,越来越多的零售公司和组织(如便利商店和超级市场)采用零售分析解决方案,需求预计将快速成长。例如,根据经济产业省的资料,日本零售业的销售额超过150兆日圆(103.5兆美元),其中超级市场的独立店销售额为15.15兆日圆(10.45兆美元)。最大份额。其次是便利商店,销售额为 12.2 兆日圆(8.41 兆美元)。

亚太零售分析产业概况

亚太地区零售自动化市场处于半整合状态,由少数大型企业主导。该市场的主要参与企业包括Oracle、IBM、SAP SE、Zoho、Adobe Systems Incorporated 等。这些公司透过收购、产品推出和合作等各种策略倡议不断扩大其市场影响力,从而为市场成长做出了重大贡献。以下是该领域的一些最新进展:

2022 年 11 月,Qlik 宣布推出一款名为「Qlik Cloud Data Integration」的创新产品。此企业整合平台即服务 (eiPaaS) 旨在为您的企业资料策略提供支援。我们透过建立即时资料整合结构将所有企业应用程式和资料来源连接到云端来实现这一点。透过利用云端的强大功能在不同的资料来源、目标和目的地之间建立即时资料连接,Qlik Cloud Data Integration 可让企业的每个成员都满怀信心地做出资料主导的决策。

2022年3月,知名企业资料管理供应商Informatica宣布推出其「智慧资料管理云端」(IDMC)首个专注于零售业的版本。这个专门建构的平台名为“零售智慧数据管理云端”,将利用 Informatica 支援机器学习的工具来编目、提取、整合和准备资料,以供分析和 AI 应用程式使用。这种客製化解决方案满足并增强了零售企业的特定资料管理需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 买家的议价能力

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 更重视预测分析

- 资料量持续成长

- 销售额预测需求不断增加

- 市场限制

- 缺乏新兴地区的公众意识和专业知识

- 标准化和整合问题

第六章 市场细分

- 依部署方式

- 本地

- 一经请求

- 按类型

- 解决方案(分析、视觉化工具、资料管理等)

- 服务(整合、支援和咨询)

- 按模组类型

- 策略与规划(宏观趋势、关键绩效指标、价值分析)

- 行销(定价、忠诚度、細項分析)

- 财务管理(会计管理)

- 商店营运(诈欺侦测、劳动力分析)

- 商品行销(产品组合优化、购物者路径分析)

- 供应链管理(库存、供应商、供需模型)

- 其他模组类型

- 依业务类型

- 中小型企业

- 大型组织

- 按地区

- 中国

- 印度

- 日本

- 韩国

第七章 竞争格局

- 公司简介

- SAP SE

- Oracle Corporation

- Qlik Technologies, Inc.

- Zoho Corporation

- IBM Corporation

- Retail Next, Inc.

- Alteryx, Inc.

- Tableau Software, Inc.

- Adobe Systems Incorporated

- Microstrategy, Inc.

- Prevedere Software, Inc.

- Targit

- Pentaho Corporation

- ZAP Business Intelligence

- Fuzzy Logix

第八章投资分析

第九章 市场机会与未来趋势

The Asia Pacific Retail Analytics Market size is estimated at USD 10.62 billion in 2025, and is expected to reach USD 20.83 billion by 2030, at a CAGR of 14.43% during the forecast period (2025-2030).

Key Highlights

- The market is expanding quickly due to retailers using the Internet of Things more frequently and adopting analytics tools faster.

- Retail analytics provides analytical data on inventory levels, supply chain movement, consumer demand, sales, etc., essential for marketing and procurement decisions. Retail analytics is the analysis of data generated by retail operations to make business decisions that drive profitability. Data analytics on supply and demand can be applied to maintain procurement levels and make marketing decisions.

- This includes offering insights to comprehend and improve the retail business's operational procedures, sales trends, consumer behavior, and overall performance. Because of consumers' high standards for retail today, companies must satisfy these growing demands with tailored omnichannel offers, practical procedures, and prompt adjustments to emerging trends. All of these activities require retail analytics. The market is expected to expand as more retail establishments open in countries such as China, Japan, India, and other developing nations.

- For instance, Reliance Retail announced in February 2023 that it planned to open multiple Gap stores next year with an eye toward the country's mid-premium apparel market. Reliance Retail acquired the rights to sell American casual wear brand Gap in India last year. The retailer plans to open 50 new locations overall in the upcoming year. The opening of such stores will increase demand for retail analytical solutions.

- Analytics can help retailers make better marketing decisions, improve business processes, and provide better overall customer experiences by identifying areas for improvement and optimization. The demand for analytical solutions in the sector is anticipated to increase with the rapid expansion of the retail industry across all countries. For instance, retail sales in Japan rose by 6.6% YoY in February 2023, exceeding market expectations of 5.8% and accelerating from a revised 5% growth in January. Retail trade increased for the 12th month, running the fastest since May 2021.

- Additionally, the retail sector's growing adoption of Industry 4.0 has significantly aided the market's expansion. The market for retail analytics is expanding due to the rising popularity of smartphones and e-commerce. During the forecast period, it is also anticipated that increasing income levels, government spending on big data and analytics, and demand for automated retail-based services will stimulate the regional retail analytics market.

- Retail analytics market growth is significantly constrained by the high capital expenditures required for installation, maintenance, testing, licensing, and other technical labor costs associated with retail analytics tools. Another factor impacting the market is the unorganized retail sectors' limited access to technology and tight budgets.

APAC Retail Analytics Market Trends

Solutions Segment is Anticipated to Hold Major Market Share

- The retail industry is becoming more competitive, so optimizing business processes and satisfying customer expectations is crucial. Every step includes the implementation of data analytical solutions. Customer heat mapping can also be used to optimize offers and product placement. Additionally, the retail industry's growing use of cloud services will soon open up opportunities in the Asia Pacific retail analytics market.

- Moreover, data management solutions are anticipated to dominate the region's retail analytic sector. One of the ways data is used in retail most frequently is for personalized marketing. If retailers focused more on the management side of data, their efforts could be significantly improved. For instance, adding data from third-party sources to their first-party information can help them target customers more precisely.

- Furthermore, the importance of data management solutions has grown within the retail and e-commerce sectors. Businesses can use data to enhance operations and provide better customer service as a result of the development of technology and the abundance of information now at their disposal. Better data management increases visibility across retail processes by compiling and structuring otherwise enormous, unmanageable data sets.

- One of the factors propelling the Asia-Pacific retail analytic industry is data analytical solutions. Data analytics has emerged as a game-changing technology in the retail sector that gives retailers strong tools to streamline their processes, enhance customer experiences, and boost sales. Retailers can use data analytics to create individualized recommendations, offers, and promotions by analyzing customer data such as purchase history, browsing behavior, and social media interactions.

- The retail sector in Asia-Pacific is constantly changing, and data analytics significantly impacts how retail will develop in the future. Moreover, the growth in retail sales coupled with increasing digitization in the retail sector is driving the adoption of retail analytics solutions among retail businesses in the emerging countries in Asia Pacific. For instance, according to the data from the Retailers Association of India (RAI), Pan India sales growth in the retail industry from February 2021 to February 2022 was 10%. Similarly, the sales growth in North India and Western India was 17% and 16% from February 2021 to February 2022.

Japan is Expected to Witness Significant Traction in APAC Retail Analytics Market

- The retail analytics market in Japan is analyzed to witness substantial growth in the coming years owing to the growth in retail sales and technological advancements in the retail sector coupled with the growing demand for data analytics in retail businesses. Moreover, the growing digital transformation in the country's retail sector is further offering substantial growth opportunities for the adoption of retail analytics solutions in the coming years.

- Additionally, retail analytics can significantly enhance marketing strategies. It can assist in customer targeting by identifying the ideal customer using information gathered on the location, age, preferences, buying patterns, and other significant factors of current and previous customers. Better data management will unlock data's full potential, improving retail operations on many fronts and enhancing the functionality of retailers' e-commerce sites. Thus propelling the demand for retail analytics solutions in Japan over the forecast period.

- Furthermore, it is anticipated that in the future, solutions like real-time analytics, artificial intelligence, and machine learning will become even more significant. These can aid retailers in increasing sales, streamlining their marketing plans, and giving customers a seamless experience. These solutions are anticipated to be used more frequently in retail businesses as part of data analytics solutions.

- Moreover, the demand is expected to grow at a rapid pace as more retail businesses and organizations, such as convenience stores, supermarkets, etc., adopt retail analytics solutions owing to growth in retail sales in the Japanese retail industry. For instance, according to the data from METI (Japan), the sales value of the retail industry in Japan exceeded JPY 150 trillion (USD 103.5 Trillion), out of which supermarkets accounted for the largest share of JPY 15.15 trillion (USD 10.45 trillion) as a standalone store type. Convenience stores followed as the second strongest retail type, with the sales of goods and services generating JPY 12.2 trillion (USD 8.41 trillion).

APAC Retail Analytics Industry Overview

The Asia Pacific Retail Automation Market exhibits semiconsolidated, with several major players dominating the industry. Key participants in this market include Oracle, IBM, SAP SE, Zoho, and Adobe Systems Incorporated, among others. These companies are continuously fortifying their market presence through various strategic initiatives, including acquisitions, product launches, and partnerships, which significantly contribute to the market's growth. Here are some recent developments within this sector:

In November 2022, Qlik introduced a transformative product known as "Qlik Cloud Data Integration." This Enterprise Integration Platform as a Service (eiPaaS) offering is designed to empower enterprise data strategies. It achieves this by creating a real-time data integration fabric connecting all enterprise applications and data sources to the cloud. By harnessing the capabilities of the cloud and establishing real-time data connections between diverse data sources, targets, and destinations, Qlik Cloud Data Integration enables all members of the enterprise to make data-driven decisions with confidence.

In March 2022, Informatica, a renowned enterprise data management vendor, unveiled the first retail-specific version of its "Intelligent Data Management Cloud" (IDMC). This specialized platform, known as "Intelligent Data Management Cloud for Retail," leverages Informatica's suite of machine learning-powered tools to assist retailers in cataloging, ingesting, integrating, and preparing data for use in analytical and AI applications. This tailored solution caters to the unique data management needs of the retail sector, further enhancing its capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining power of Buyers

- 4.2.2 Bargaining power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Bargaining power of Buyers

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Predictive Analysis

- 5.1.2 Sustained increase in volume of data

- 5.1.3 Growing demand for sales forecasting

- 5.2 Market Restraints

- 5.2.1 Lack of general awareness and expertise in emerging regions

- 5.2.2 Standardization and Integration issues

6 MARKET SEGMENTATION

- 6.1 By Mode of Deployment

- 6.1.1 On-Premise

- 6.1.2 On-Demand

- 6.2 By Type

- 6.2.1 Solutions (Analytics, Visualization Tools, Data Management, etc.)

- 6.2.2 Services (Integration, Support & Consulting)

- 6.3 By Module Type

- 6.3.1 Strategy & Planning (Macro Trends, KPI, Value Analysis)

- 6.3.2 Marketing (Pricing, Loyalty and Segment Analysis)

- 6.3.3 Financial Management (Accounts Management)

- 6.3.4 Store Operations (Fraud Detection, Workforce Analytics)

- 6.3.5 Merchandising (Assortment Optimization, Shopper Path Analytics)

- 6.3.6 Supply Chain Management (Inventory, Vendor and Supply-Demand Modelling)

- 6.3.7 Other Module Types

- 6.4 By Business Type

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large-scale Organizations

- 6.5 Geography

- 6.5.1 China

- 6.5.2 India

- 6.5.3 Japan

- 6.5.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 Qlik Technologies, Inc.

- 7.1.4 Zoho Corporation

- 7.1.5 IBM Corporation

- 7.1.6 Retail Next, Inc.

- 7.1.7 Alteryx, Inc.

- 7.1.8 Tableau Software, Inc.

- 7.1.9 Adobe Systems Incorporated

- 7.1.10 Microstrategy, Inc.

- 7.1.11 Prevedere Software, Inc.

- 7.1.12 Targit

- 7.1.13 Pentaho Corporation

- 7.1.14 ZAP Business Intelligence

- 7.1.15 Fuzzy Logix