|

市场调查报告书

商品编码

1639433

中东和非洲聚氨酯(PU)黏合剂市场占有率分析、产业趋势和成长预测(2025-2030)MEA Polyurethane (PU) Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

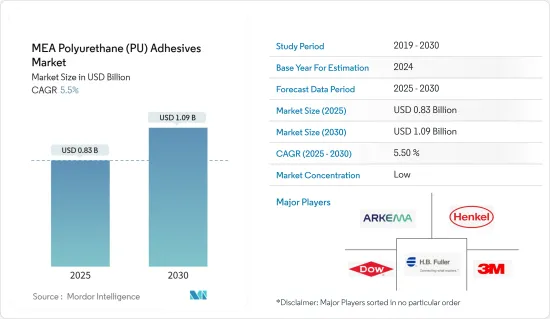

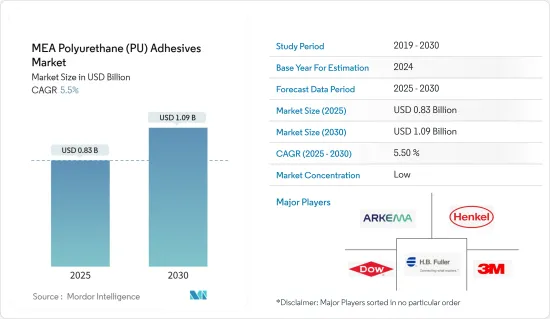

中东和非洲聚氨酯接着剂市场规模预计到2025年为8.3亿美元,预计到2030年将达到10.9亿美元,预测期内(2025-2030年)复合年增长率为5.5%。

COVID-19 的爆发对市场产生了负面影响。多个工业计划的暂停或放缓、行动限制、生产停工和劳动力短缺都降低了聚氨酯(PU)黏合剂市场的成长。然而,由于建筑、包装、医疗保健和汽车等各种最终用途行业的消费增加,该数字在 2021 年大幅反弹。

主要亮点

- 短期内,建筑业和医疗基础设施的需求不断增长是推动所研究市场成长的关键因素之一。

- 相反,有关挥发性有机化合物排放的严格环境法规预计将阻碍市场成长。

- 然而,向生物基黏合剂的转变以及对製造轻质产品的日益关注可能会为聚氨酯黏合剂市场提供机会。

- 沙乌地阿拉伯在中东和非洲聚氨酯黏合剂市场占据主导地位,并将在预测期内表现出最高的复合年增长率。

中东和非洲聚氨酯(PU)胶合剂市场趋势

建筑业主导市场

- 在最终用户产业中,建筑领域主导着该地区的聚氨酯黏合剂消费。

- PU 黏合剂具有快速固化和低强度特性,使其成为木工和其他建筑应用的理想选择。 PU 黏合剂列出了将建筑材料连接在一起所需的高强度。

- 此外,这种材料在产品组装黏合剂方面用途广泛。适用于塑胶、玻璃、PVF、铝、不銹钢等金属,无论黏合基材的韧性为何。

- 沙乌地阿拉伯、科威特、卡达、阿拉伯联合大公国和埃及等国的建筑投资和建设活动呈现强劲成长。例如,科威特2035年愿景的可持续生活环境轴有五个支柱,其中最突出的是透过有计划的方式为公民提供住宅护理。这将确保透过价值约 32.2 亿韩元(105 亿美元)的五个计划供应 65,500 套住宅,最后一个计划将于 2029 年完工。

- 如果这些计划得到实施,该州将满足目前 91,000 套住宅需求的约 72%。住宅护理计划的第一个计划以贾比尔艾哈迈德市的科威特 2035(新科威特)倡议为中心,完成率为 95%,并将于 2022年终完成。第二个计划是Al Mutraa,完工率为64%,预计于2023年终完工。

- 第三个计划位于South Abdullah Al Mubarak郊区,完工率为72%,预计于2025年终完工。第四个计划是South Sabah Al Ahmad,完工率约14%,目前仍处于初步阶段,预计2029年完工。 South Saad Al Abdullah 计画仍处于初步阶段,完工率为 13%,预计将于 2029 年完工。因此,科威特的住宅建设不断增加,科威特聚氨酯(PU)黏合剂市场的需求预计将增加。

- 因此,这些国家建筑业的成长前景预计将带动该地区PU胶黏剂的消费。

沙乌地阿拉伯主导市场

- 沙乌地阿拉伯在中东和非洲聚氨酯(PU)黏合剂市场中占有最大份额。随着该国对建筑、医疗基础设施和汽车轮毂开发的投资增加,预计在整个预测期内,对聚氨酯 (PU) 黏合剂的需求将增加。人口和可支配收入的成长增加了对更高品质住宅建设开发的需求。

- 由于「2030 年愿景」、「NTP2020」以及正在进行的几项石油多元化改革,沙乌地阿拉伯的建筑市场预计将出现显着增长并提供丰厚的潜力。 2030 年愿景、NTP2020、私营部门投资促进和正在进行的改革预计将成为预测期内沙乌地阿拉伯建筑业聚氨酯接着剂市场的成长动力。

- 此外,根据“2030 年愿景”,到 2030 年,沙乌地阿拉伯将开设 80 家新酒店,拥有超过 11,000 间豪华客房。因此,饭店建筑投资将增加,聚氨酯(PU)黏合剂市场需求预计。

- 沙乌地阿拉伯经济正进入后石油时代,目前正在兴建的特大城市将为未来提供成长动力。据业内人士透露,沙乌地阿拉伯正在施工的建设计划超过5,200个,总成本达8,190亿美元。这些计划约占波湾合作理事会(GCC) 正在进行的计划总数的 35%。

- 沙乌地阿拉伯的主要城市建设计划包括阿卜杜拉国王安全综合体(五期)和大清真寺(圣地Haram扩建)。这些项目每项价值 213 亿美元,由麦加市政和农村事务部开发。

- 沙乌地阿拉伯的顶级建筑计划包括 Neom、红海计划、Qiddiya 娱乐城、Amaala、让·努维尔位于 Al-Ula 的 Sharaan 度假村、麦加大清真寺第三次扩建、吉达塔、住宅部的Sakani Homes、Jabal Omar、Al Widyan、利雅德地铁等还包括利雅德快速公车系统、法赫德国王医疗城扩建工程、阿卜杜拉·本·阿卜杜勒阿齐兹国王医疗综合体、萨勒曼国王能源公园(Spark)、沙乌地阿美公司的Beri和Marjan 以及Hanaji - 还包括太阳能公园、Dumat Al Jandal 风能。

- 沙乌地阿拉伯的 Amid Vision 2030 是一项由大型企划支持的重大发展计划,这些计画将发展该国的基础设施。 2030 年愿景的重点是解决环境问题、提高公民的生活品质和创造强大的经济,旨在带来改变。 《2030 年愿景》和相应的国家转型计划(NTP)的推出增加了医疗保健、教育和基础设施等多个领域的投资。

- 沙乌地阿拉伯已经启动了许多住宅和商业计划,预计该国的建设活动将会增加。这些计划包括耗资5000亿美元的未来特大城市Neom计划和红海计划一期(计划于2022年竣工),其中包括横跨五个岛屿的14家豪华和超豪华酒店,总合3000间客房)等。它还包括两个内陆度假村:Qiddi 娱乐城、豪华健康目的地 Amaala、让·努维尔 (Jean Nouvel) 位于欧拉 (Al-Ula) 的度假村 Sharaan,以及住宅部的Sakani 住宅和吉达塔( Jeddah Tower)。

- 据海湾理事会公司称,沙乌地阿拉伯计划投资664.9亿美元用于卫生设施,预计到2030年私营部门的参与将增加65%。

- 沙乌地阿拉伯致力于将自己打造成中东新的汽车中心。沙乌地阿拉伯是汽车和汽车零件进口大国,目前正在寻求吸引目标商标产品製造商( OEM )在沙乌地阿拉伯设立生产工厂,以发展该国的汽车工业。例如,雷诺、标緻和大众等多家原始设备製造商(OEM)已经在摩洛哥设立了工厂,各大汽车製造商也将摩洛哥视为一个具有成本效益的国家。

- 沙乌地阿拉伯的医疗保健产业占海湾合作委员会地区最大的支出,推动了对更多医院和长期照护中心的需求。沙乌地阿拉伯政府的目标是到2030年将私部门的贡献从40%提高到65%,并计划将290家医院和2,300家初级卫生中心私有化。

- 因此,所有这些趋势预计将在预测期内推动该国聚氨酯接着剂市场的消费。

中东和非洲聚氨酯(PU)胶黏剂产业概况

中东和非洲聚氨酯(PU)黏合剂市场高度细分。该市场的主要企业包括(排名不分先后)3M、Arkema、Dow、HB Fuller 和 Henkel AG &Co.KGaA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业强劲成长

- 医疗基础设施的成长

- 其他司机

- 抑制因素

- 关于VOC排放的严格环境法规

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 树脂型

- 热固性

- 热塑性塑料

- 科技

- 水性的

- 溶剂型

- 热熔胶

- 其他的

- 最终用户产业

- 汽车和航太

- 建筑/施工

- 电力/电子

- 鞋类和皮革

- 医疗保健

- 包装

- 其他的

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 埃及

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema

- Avery Dennison Corporation

- Dow

- Dymax

- Franklin International

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- ITW Performance Polymers

- Jowat AG

- MAPEI SpA

- Sika AG

- Wacker Chemie AG

第七章 市场机会及未来趋势

- 转向生物基黏合剂

- 日益关注轻量化产品製造

The MEA Polyurethane Adhesives Market size is estimated at USD 0.83 billion in 2025, and is expected to reach USD 1.09 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

The COVID-19 outbreak negatively impacted the market. Stoppage or slowdown of several industrial projects, movement restrictions, production halts, and labour shortages led to a decline in the polyurethane (PU) adhesives market growth. However, it recovered significantly in 2021, owing to rising consumption from various end-use industries, including building and construction, packaging, healthcare, and automotive.

Key Highlights

- Over the short term, increasing demand from the construction industry and healthcare infrastructure are some of the major factors driving the studied market's growth.

- Conversely, stringent environmental regulations regarding VOC emissions are expected to hinder the studied market's growth.

- However, shifting focus towards bio-based adhesives and growing inclination towards manufacturing lightweight products will likely offer opportunities for the PU adhesives market.

- Saudi Arabia dominates the Middle East and Africa PU adhesives market and will also witness the highest CAGR during the forecast period.

MEA Polyurethane (PU) Adhesives Market Trends

Building and Construction Industry Dominates the Market

- Among end-user industries, the building and construction segment dominates the consumption of PU adhesives in the region.

- PU adhesives include rapid curing and low-strength properties, making them an excellent choice for woodworking and other construction applications. They provide the high strength required to hold construction materials together.

- Besides, this material is versatile when it comes to product assembly adhesives. It suits plastics, glass, PVFs, aluminum, stainless steel, and other metals, regardless of the toughness of bond substrates.

- Countries such as Saudi Arabia, Kuwait, Qatar, United Arab Emirates, and Egypt is witnessing strong growth in construction investments and activities. For instance, the sustainable living environment axis in Kuwait Vision 2035 includes five pillars, the most prominent of which is to provide housing care to citizens through what is planned. It is to ensure the provision of 65.5 thousand housing units through five projects costing about KWD 3.22 billion (USD 10.5 billion), the last of which ends by 2029.

- When these projects are implemented, the state will meet approximately 72% of the current housing requests, which are 91,000. The first project of the residential care plan revolves around the vision of Kuwait 2035 (New Kuwait) in the city of Jaber Al-Ahmad, which includes a completion rate of 95% and will complete at the end of 2022. The second project is in Al-Mutla'a, with a completion rate of 64%, to be completed by the end of 2023.

- The third project is in the suburb of South Abdullah Al-Mubarak, which contains a completion rate of 72% and will be completed by the end of 2025. The completion rate in the fourth project, the South Sabah Al-Ahmad, is about 14%, as it is still in the preparation stage and is expected to be completed in 2029. This south of Saad Al-Abdullah includes a completion rate of 13% as it is still in its preparatory phase and ends in 2029. Therefore, the growing residential housing construction in Kuwait is expected to create an upside demand for Kuwait's polyurethane(PU) adhesives market.

- Hence, the growth prospects for the construction industry in such countries are expected to propel the consumption of PU adhesives in the region.

Saudi Arabia to Dominate the Market

- Saudi Arabia holds the largest Middle East and African market share for polyurethane (PU) adhesives. The demand for polyurethane (PU) adhesives is expected to rise throughout the forecast period due to rising investments in construction, healthcare infrastructure, and the efforts to develop automotive hubs in the country. The rise in the population and disposable income increased the demand for better-quality residential building development.

- The Saudi Arabian construction market is expected to witness significant growth and offer lucrative potential due to its Vision 2030, NTP 2020, and several ongoing reforms to diversify away from oil. Vision 2030, NTP 2020, the private sector investment boost, and the ongoing reforms are expected to be the growth drivers for the Saudi polyurethane adhesives market from the country's construction industry during the forecasted period.

- Moreover, under Vision 2030, 80 new hotels with more than 11,000 luxurious rooms will be opened across Saudi Arabia by 2030. Therefore, increasing investments in the construction of hotels is expected to create demand for the polyurethane (PU) adhesives market.

- The country's economy is entering a post-oil era in which the kingdom's mega-cities, which are under construction, will provide future growth. According to industry sources, more than 5,200 construction projects are ongoing in Saudi Arabia at a value of USD 819 billion. These projects account for approximately 35% of the total value of active projects across the Gulf Cooperation Council (GCC).

- Some major urban construction projects in Saudi Arabia include the King Abdullah Security Compounds (Phase 5) and the Grand Mosque (Holy Haram Mosque expansion). Each of these is valued at USD 21.3 billion and developed by the Ministry of Municipalities and Rural Affairs in Makkah.

- The top construction projects in Saudi Arabia include Neom, the Red Sea Project, Qiddiya entertainment city, Amaala, Jean Nouvel's Sharaan resort in Al-Ula, Makkah Grand Mosque - Third Expansion, Jeddah Tower, Ministry of Housing's Sakani Homes, Jabal Omar, Al Widyan, and Riyadh Metro. It also includes Riyadh Rapid Bus Transit System, King Fahd Medical City Expansion, King Abdullah Bin Abdulaziz Medical Complexes, King Salman Energy Park (Spark), Saudi Aramco's Berri and Marjan, Hanergy Solar Park, Dumat Al Jandal Wind Power Plant, Saudi Aramco-Total's PIB factory, and Pan-Asia bottling facility.

- Saudi Arabia's Amid Vision 2030 is a significant development plan supported by megaprojects to grow the nation's infrastructure. With an emphasis on environmental commitments, enhancing citizen quality of life, and creating a strong economy, Vision 2030 aspires to bring about change. Investments in several fields, including healthcare, education, and infrastructure, expanded due to the introduction of Vision 2030 and the corresponding National Transformation Plan (NTP).

- Many residential and commercial projects are being launched in Saudi Arabia, which is anticipated to increase the country's construction activity. Some of these projects are the USD 500 billion futuristic mega-city "Neom" project and the Red Sea Project Phase 1 (due for completion in 2022), which includes 14 luxurious and hyper-luxury hotels that may total 3,000 rooms spread across five islands. It also includes two inland resorts, Qiddi Entertainment City, Amaala - the luxurious wellness tourism destination, Jean Nouvel's Sharaan resort in Al-Ula, the Ministry of Housing's Sakani homes, and Jeddah Tower.

- According to the Gulf Council Corporation, Saudi Arabia planned to invest USD 66.49 billion in healthcare facilities, with help from the private sector, whose participation is expected to rise by 65% by 2030.

- Saudi Arabia is focusing on establishing itself as the new automotive hub in the Middle East. Though the country is a large importer of vehicles and auto parts, it is now trying to attract original equipment manufacturers (OEMs) to open their production plants in the kingdom to develop the domestic auto industry. For instance, several OEM manufacturers such as Renault, Peugeot, and Volkswagen already set up units in Morocco, and major automotive manufacturers see Morocco as a cost-effective country.

- The healthcare industry in Saudi Arabia accounts for the largest expenditure in the GCC region, and there is a rising demand for increasing hospital and long-term care centers. Saudi Arabian Government aims to increase private sector contribution from 40% to 65% by 2030, targeting the privatization of 290 hospitals and 2,300 primary health centers.

- Hence, all such trends are expected to drive the consumption of the polyurethane adhesives market in the country during the forecast period.

MEA Polyurethane (PU) Adhesives Industry Overview

The Middle East and African polyurethane (PU) adhesives market is highly fragmented. Some of the major players in the market include 3M, Arkema, Dow, H.B. Fuller, and Henkel AG & Co. KGaA, amongst others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Growth of Construction Industry

- 4.1.2 Growing Healthcare Infrastructure

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin Type

- 5.1.1 Thermoset

- 5.1.2 Thermoplastic

- 5.2 Technology

- 5.2.1 Water Borne

- 5.2.2 Solvent-borne

- 5.2.3 Hot Melt

- 5.2.4 Other Technologies

- 5.3 End-user Industry

- 5.3.1 Automotive and Aerospace

- 5.3.2 Building and Construction

- 5.3.3 Electrical and Electronics

- 5.3.4 Footwear and Leather

- 5.3.5 Healthcare

- 5.3.6 Packaging

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 South Africa

- 5.4.5 Egypt

- 5.4.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Dow

- 6.4.5 Dymax

- 6.4.6 Franklin International

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 ITW Performance Polymers

- 6.4.11 Jowat AG

- 6.4.12 MAPEI S.p.A.

- 6.4.13 Sika AG

- 6.4.14 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards Bio-Based Adhesives

- 7.2 Growing Inclination Towards Manufacturing of Lightweight Products