|

市场调查报告书

商品编码

1851929

聚氨酯(PU)黏合剂在电子产品中的应用:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Polyurethane (PU) Adhesives In Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

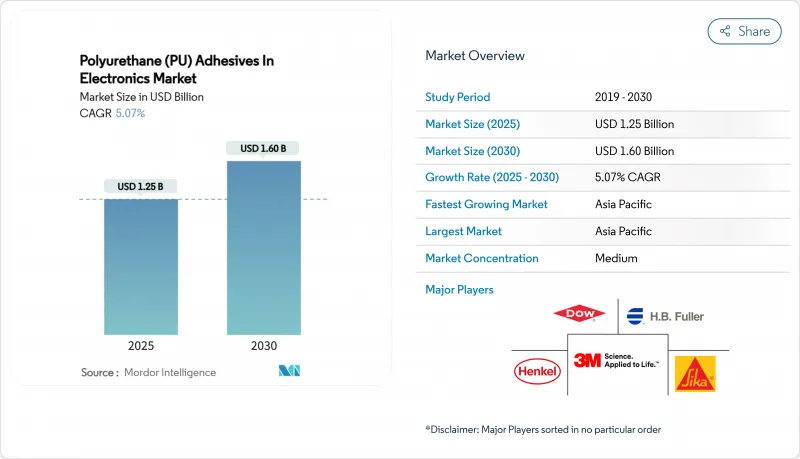

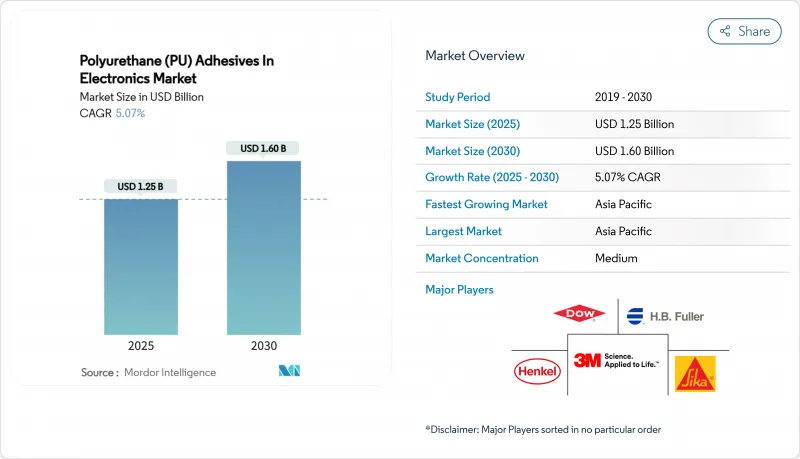

预计到 2025 年,电子产业聚氨酯接着剂市场规模将达到 12.5 亿美元,到 2030 年将达到 16 亿美元,预测期(2025-2030 年)复合年增长率为 5.07%。

这一稳步增长的驱动力来自高性能粘合材料在电动汽车电池组中日益增长的重要性、消费电子设备的持续小型化以及支持低排放气体化学品的日益严格的安全法规。供应商优先考虑快速固化、精密点胶技术,以缩短生产节拍时间,尤其是在亚洲的大批量生产工厂。随着设计人员面临功率模组和汽车逆变器中不断提高的功率密度,对导热和紫外光固化化学品的投资正在加速。儘管多元醇和二异氰酸酯的成本波动仍然是一个不利因素,但下游强劲的需求(主要来自柔性混合电子产品)维持了整体成长动能。

全球电子产业聚氨酯(PU)黏合剂市场趋势及洞察

消费性电子设备小型化推动了对低黏度灌封胶的需求

穿戴式装置、耳机和物联网感测器的尺寸不断缩小,留给机械紧固件的空间越来越少。因此,设计人员开始采用超低黏度聚氨酯配方(<1000 cPs),这种配方可以无空隙地流入 150 μm 的缝隙中。这些材料可以封装易碎晶片,抑制振动,并能承受 -55 度C至 100 度C 的热循环,Protabic 的 PNU-46202 系列产品证明了这一点。元件数量的大幅减少降低了组装成本,从而增强了电子市场对高性能灌封剂的需求,尤其是在聚氨酯接着剂领域。亚洲的组装组装商正在大力指定使用能够提高一次产量比率并减少返工的新型材料。中期来看,扩增实境(AR) 头戴装置的日益普及预计将显着推动复合年增长率 (CAGR) 的成长。

导热聚氨酯基电动汽车电池热感间隙填充剂

电池组的能量容量如今可达100千瓦时,因此防止热失控成为设计中的重中之重。导热聚氨酯接着剂能够散热并同时实现电绝缘,在一次点胶过程中即可完成两项重要功能。陶氏化学的奈米碳管增强配方导热係数高达5 W/m*K,收缩率低于0.5%,有效降低了电池组应力,延长了循环寿命。随着电动车的普及,一级供应商已签署多年供货协议,这必将推动电子聚氨酯接着剂市场最快成长。

全球范围内加强对挥发性有机化合物和异氰酸酯暴露的监管

美国环保署 (EPA) 和 REACH 法规目前将室内甲醛浓度限制在 0.062 mg/m³,并强制要求操作员接受二异氰酸酯处理的训练。规模较小的电子製造服务 (EMS) 公司面临超过 25 万美元的合规投资,用于烟雾抽排和认证,这迫使它们转向其他化学方法。针对不同司法管辖区的不同产品规格 (SKU) 增加了库存成本,并延缓了新产品的上市。虽然主要供应商已经推出了低等级单体,但六到九个月的认证週期限制了电子市场聚氨酯接着剂的近期订单订单。

细分市场分析

预计到2024年,表面固化聚氨酯配方将占总收入的64.26%,并在2030年之前以5.49%的复合年增长率进一步巩固其市场地位。这一领先地位清晰地表明,随着组装停留时间从几分钟缩短到几秒钟,聚氨酯接着剂在电子市场中受益匪浅。许多契约製造製造商现在运作线上紫外光固化隧道,可在不到两秒的时间内固化50微米厚的黏合层,从而将週期时间缩短近30%。快速固化能力还透过最大限度地减少固定装置,简化了高密度基板的自动化点胶过程。

导电和导热型产品完善了产品组合。解决诸如LED阵列中的散热和相机模组中的接地路径等关键难题,虽然产量有所下降,但利润率高于平均水平。结合紫外光引发和二次湿气固化的混合双固化化学技术可解决阴影区域接缝问题,从而扩大聚氨酯接着剂在电子市场中的份额。新兴的热激活产品目前仍处于小众市场,但在无法承受高峰值照度的可折迭显示器领域,其应用日益受到关注。

电子业聚氨酯接着剂市场报告按产品类型(导电聚氨酯黏合剂、导热聚氨酯黏合剂及其他)、应用领域(表面黏着技术、三防胶、导线固定、灌封、封装及其他)和地区(亚太地区、北美地区、欧洲地区、南美地区、中东和非洲)进行细分。市场预测以美元计价。

区域分析

在中国无与伦比的印刷电路板、智慧型手机和电动车电池生产能力的引领下,亚太地区将在2024年占据主导地位,收入份额高达73.05%。深圳和上海的工厂正在使用高通量紫外线固化材料,这些材料可在输送机式紫外线LED灯下于三秒内完成固化,进一步巩固了其区域规模优势。韩国半导体工厂则在导热聚氨酯界面材料的消耗方面处于领先地位,这些材料能够支援高达450W的晶片热通量密度。

在北美,密西根州、田纳西州和安大略省的电动车电池生产推动了对2W/m*K间隙填充剂的需求,而华盛顿州和德克萨斯州的航太主要企业则指定使用低密度合成聚氨酯灌封化合物,以减轻卫星控制板的重量。更严格的法规、美国环保署(EPA)的挥发性有机化合物(VOC)限值以及美国职业安全与健康管理局(OSHA)规定的暴露阈值,使得水性分散体越来越受欢迎,这促使当地的化合物生产商能够及早转型,从而在电子聚氨酯接着剂市场占据更大的份额。

欧洲呈现均衡成长,这与汽车电气化目标密切相关。德国高端汽车产业越来越多地采用聚氨酯结构材料来增强电池机壳的抗衝击性,而REACH法规附件XVII对游离单体二异氰酸酯的限制正促使汽车製造商转向使用新型微排放化学品。由亚洲电子製造服务(EMS)製造商供应的波兰和匈牙利新兴丛集,将推动东欧地区在2030年前的消费量成长。中东/非洲和南美洲仍在发展中,但一家越南支持的非洲合资企业不断扩大的行动电话组装预示着该地区将迎来长期成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 消费性电子设备小型化推动了对低黏度聚氨酯灌封胶的需求

- 基于导热聚氨酯的电动车电池热感间隙填充材料

- 推动水性低VOC PU分散体的环保措施。

- 柔性混合电子装置需要可拉伸、自修復的聚氨酯黏合剂。

- 需要低释气PU晶片贴装的高温SiC功率模组

- 市场限制

- 全球范围内加强对挥发性有机化合物/异氰酸酯暴露的监管

- 多元醇和二异氰酸酯价格波动会对利润率造成压力。

- 硅烷封端预聚物在穿戴式装置领域的崛起

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 导电聚氨酯胶黏剂

- 导热聚氨酯黏合剂

- UV固化聚氨酯黏合剂

- 其他产品类型

- 透过使用

- 表面黏着技术

- 三防胶

- 金属丝钉合

- 盆栽

- 封装

- 其他应用(显示器贴合与光学组件、电池组件等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- BASF

- Covestro AG

- DELO Industrie

- Dow

- Dymax

- Epic Resins

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huitian New Materials

- Huntsman International LLC.

- INTERTRONICS

- ITW Performance Polymers

- Kangda New Materials(Group)Co., Ltd

- Master Bond

- Parker Hannifin Corp

- Permabond

- Sika AG

第七章 市场机会与未来展望

The Polyurethane Adhesives In Electronics Market size is estimated at USD 1.25 billion in 2025, and is expected to reach USD 1.60 billion by 2030, at a CAGR of 5.07% during the forecast period (2025-2030).

This steady expansion rests on the growing importance of high-performance bonding materials for electric-vehicle (EV) battery packs, the continuing miniaturization of consumer devices, and stricter safety regulations that favor low-emission chemistries. Vendors are prioritizing rapid-cure, precision-dispense technologies that help shrink production tact times, especially in high-volume Asian factories. Investments in thermally conductive and UV-curing chemistries are accelerating as designers confront higher power densities in power modules and automotive inverters. Cost volatility for polyols and diisocyanates remains a headwind, yet strong downstream demand, particularly from flexible-hybrid electronics, keeps overall momentum positive.

Global Polyurethane (PU) Adhesives In Electronics Market Trends and Insights

Miniaturization of Consumer Devices Boosting Demand for Low-Viscosity Potting Adhesives

Wearables, hearables, and IoT sensors continue to shrink, leaving little room for mechanical fasteners. Designers therefore rely on ultra-low-viscosity polyurethane formulations, often below 1,000 cPs, that flow into 150 µm gaps without void creation. These materials encapsulate fragile chips, mitigate vibration, and survive -55 °C to 100 °C thermal cycles, as demonstrated by Protavic's PNU-46202 series. Sharp reductions in part counts cut assembly costs, which reinforces demand for high-function potting chemistries across the polyurethane adhesives in the electronics market. Asian outsourced-assembly providers are specifying the new grades in volume because they enhance first-pass yields and reduce rework. Over the medium term, growing adoption in augmented-reality headsets will magnify the positive CAGR contribution.

EV Battery Thermal-Gap Fillers Based on Thermally Conductive Polyurethane

Battery packs now carry up to 100 kWh of energy, making thermal runaway avoidance a design priority. Thermally conductive polyurethane adhesives dissipate heat while electrically insulating cells, combining two critical functions in a single dispense step. Dow's carbon-nanotube-enhanced formulations achieve 5 W/m*K conductivity with sub-0.5% shrinkage, reducing pack stresses and extending cycle life. As EV adoption accelerates, tier-one suppliers are locking in multiyear supply contracts, ensuring that this driver delivers the highest incremental growth within the polyurethane adhesives in electronics market.

VOC and Isocyanate Exposure Regulations Tightening Globally

EPA and REACH frameworks now cap indoor formaldehyde at 0.062 mg/m3 and mandate operator training for diisocyanate handling. Smaller EMS companies face compliance investments topping USD 250,000 for fume extraction and certification, pushing them toward alternative chemistries. Separate SKUs for different jurisdictions raise inventory costs, slowing new-product introductions. Although major suppliers are unveiling low-monomer grades, qualification cycles stretch six to nine months, dampening near-term orders in the polyurethane adhesives in the electronics market.

Other drivers and restraints analyzed in the detailed report include:

- Environmental Push Toward Water-Borne, Low-VOC Polyurethane Dispersions

- Flexible-Hybrid Electronics Needing Stretchable, Self-Healing Bonds

- Polyol and Diisocyanate Price Volatility Pressuring Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surface-flash curing polyurethane formulations commanded 64.26% revenue in 2024, a position they are set to strengthen by expanding at 5.49% CAGR to 2030. This leadership underscores how the polyurethane adhesives in the electronics market benefit when assembly lines slash dwell times from minutes to seconds. Many contract manufacturers now operate inline UV tunnels that cure 50 µm bond lines in under two seconds, delivering cycle-time savings near 30%. The rapid-cure feature also minimizes fixturing, which simplifies automated dispensing on densely populated boards.

Electrically conductive and thermally conductive variants round out the portfolio. Although they trail in volume, they capture above-average margins by solving mission-critical challenges such as thermal spreading in LED arrays or grounding paths in camera modules. Hybrid dual-cure chemistries that combine UV initiation with secondary moisture curing address shadowed joints, broadening the reachable share of the polyurethane adhesives in the electronics market. Emerging heat-activated products remain niche but draw interest in foldable displays that cannot tolerate high peak irradiance.

The Polyurethane Adhesives in Electronics Report is Segmented by Product Type (Electrically Conductive PU Adhesive, Thermally Conductive PU Adhesive, and More), Application (Surface Mounting, Conformal Coatings, Wire Tacking, Potting, Encapsulation, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 73.05% revenue share in 2024 on the back of China's unmatched PCB, smartphone, and EV-battery output. Factory clusters in Shenzhen and Shanghai consume high-throughput UV grades that cure under conveyor-belt UV LEDs in less than three seconds, reinforcing regional scale advantages. South Korea's semiconductor fabs drive consumption of thermally conductive polyurethane interfaces that cope with 450 W chip heat-flux densities.

North America is buoyed by EV battery production in Michigan, Tennessee, and Ontario, which is fueling orders for 2 W/m*K gap fillers, while aerospace primes in Washington and Texas specify low-density syntactic polyurethane potting compounds that shave grams from satellite control boards. Regulatory rigor, EPA VOC limits, and OSHA-dictated exposure thresholds make water-borne dispersions more popular, positioning local formulators that pivot early for share gains in the polyurethane adhesives in electronics market.

Europe shows balanced growth tied to automotive electrification targets. The German premium-car segment increasingly specifies polyurethane structurals that provide impact resistance for battery enclosures. Meanwhile, REACH Annex XVII limits on free monomer diisocyanates push OEMs to new micro-emission chemistries. Emerging clusters in Poland and Hungary, supplied by Asian EMS players, are likely to raise Eastern European consumption through 2030. Middle-East and Africa, and South America remain nascent, but rising handset assembly in Vietnam-backed African ventures hints at longer-term upside.

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- BASF

- Covestro AG

- DELO Industrie

- Dow

- Dymax

- Epic Resins

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huitian New Materials

- Huntsman International LLC.

- INTERTRONICS

- ITW Performance Polymers

- Kangda New Materials (Group) Co., Ltd

- Master Bond

- Parker Hannifin Corp

- Permabond

- Sika AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Miniaturization of Consumer Devices Boosting Demand for Low-Viscosity PU Potting Adhesives

- 4.2.2 EV Battery Thermal-Gap Fillers Based on Thermally Conductive PU

- 4.2.3 Environmental Push toward Water-Borne, Low-VOC PU Dispersions

- 4.2.4 Flexible Hybrid Electronics Needing Stretchable, Self-Healing PU Bonds

- 4.2.5 High-Temperature SiC Power Modules Requiring Low-Outgassing PU Die-Attach

- 4.3 Market Restraints

- 4.3.1 VOC/Isocyanate Exposure Regulations Tightening Globally

- 4.3.2 Polyol and Diisocyanate Price Volatility Pressuring Margins

- 4.3.3 Rise of Silane-Terminated Prepolymer Alternatives in Wearables

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Electrically Conductive PU Adhesive

- 5.1.2 Thermally Conductive PU Adhesive

- 5.1.3 UV Curing PU Adhesive

- 5.1.4 Other Product Types

- 5.2 By Application

- 5.2.1 Surface Mounting

- 5.2.2 Conformal Coatings

- 5.2.3 Wire Tacking

- 5.2.4 Potting

- 5.2.5 Encapsulation

- 5.2.6 Other Applications (Display Bonding and Optical Assemblies, Battery Assembly, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF

- 6.4.6 Covestro AG

- 6.4.7 DELO Industrie

- 6.4.8 Dow

- 6.4.9 Dymax

- 6.4.10 Epic Resins

- 6.4.11 H.B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Huitian New Materials

- 6.4.14 Huntsman International LLC.

- 6.4.15 INTERTRONICS

- 6.4.16 ITW Performance Polymers

- 6.4.17 Kangda New Materials (Group) Co., Ltd

- 6.4.18 Master Bond

- 6.4.19 Parker Hannifin Corp

- 6.4.20 Permabond

- 6.4.21 Sika AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment