|

市场调查报告书

商品编码

1693417

欧洲聚氨酯接着剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Polyurethane Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

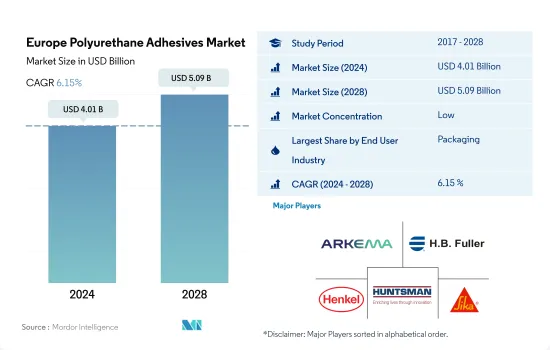

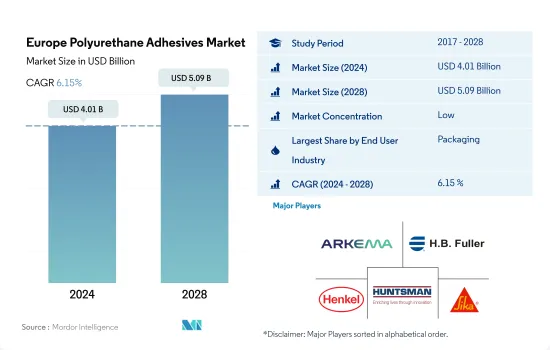

预计 2024 年欧洲聚氨酯接着剂市场规模为 40.1 亿美元,到 2028 年将达到 50.9 亿美元,预测期内(2024-2028 年)的复合年增长率为 6.15%。

新兴建筑和包装终端用途产业预计将推动欧洲聚氨酯接着剂的消费

- 聚氨酯接着剂广泛应用于包装产业,包括食品和饮料包装、容器包装、功能阻隔应用的最终包装以及金属包装。英国是全球最大的包装市场之一。该国的设计改进和技术创新,加上转向使用可回收材料进行包装,预计将为市场成长提供大量机会,为市场上的新产品推出创造机会。英国包装製造业的年营业额为110亿英镑,这可能会推动该地区的包装黏合剂市场的发展。

- 2021年,建筑业对聚氨酯胶粘剂的需求呈指数级增长,这得益于欧盟委员会在2020年聚氨酯接着剂导致的经济放缓后出台的复苏计划,例如“下一代欧盟”计划,该计划向建筑建设产业拨款,使欧洲建筑更加绿色环保,减少资源浪费。 2021 年聚氨酯建筑胶黏剂的整体需求成长在其他欧洲国家地区最高,因为丹麦等北欧国家的建筑产量增加了 17.8%。

- 在欧洲,德国拥有最大的医疗保健产业。据估计,该国每年在医疗卫生方面的支出超过 3,750 亿欧元(不包括健身和保健费用)。在人口变化数位化趋势的推动下,医疗保健支出的持续增长预计将在预测期内推动该地区聚氨酯接着剂市场的发展。

欧洲建筑、包装和汽车产业的蓬勃发展可能会推动未来对聚氨酯接着剂的需求

- 2017年至2021年期间,欧洲地区产生的需求在所有地区中排名第二。由于汽车、航太、建筑等终端用户产业的製造能力强,该地区的黏合剂需求一直占全球需求的 24-25%。采用热熔和水溶性技术的聚氨酯接着剂满足了该地区的大部分需求。

- 2017年至2019年期间,该地区对黏合剂的需求以1.85%的复合年增长率成长。聚氨酯接着剂需求成长放缓的原因是该地区建设活动成长放缓和汽车产量下降。在此期间,这些终端用户产业的需求分别以 0.44% 和 -0.50% 的复合年增长率下降。

- 2020年,营运、劳动力、原材料、供应链和其他领域的限制导致全部区域所有终端用户的需求减少。在该地区所有国家的所有行业中,德国的製鞋业和法国的汽车业受到的打击最为严重,与去年同期相比,出口量分别下降了37.89%和35.94%。

- 预计2021年该地区所有国家对聚氨酯接着剂的需求都将开始復苏,并在2022年超过疫情前的需求水准。义大利的销量增幅最高,与前一年同期比较去年同期成长8.38%。预计这一成长趋势将在预测期内持续下去。预计预测期内全部区域的需求将以 3.83% 的复合年增长率成长。

欧洲聚氨酯接着剂市场趋势

欧洲食品饮料产业蓬勃发展,带动包装产业扩张

- 包装是欧洲地区的关键产业之一。该地区是继亚太地区之后全球第二大包装产品生产地区,约占全球包装产量的24%。德国、俄罗斯、西班牙和英国是欧洲主要的包装产品生产国。受新冠疫情影响,预计2020年包装产量较2019年下降7.14%。今年,多个国家实施了全国封锁,导致该地区的生产设施关闭了三到四个月。

- 俄罗斯是包装产品主要生产国,2021年产量为2.138亿吨,位居欧洲第一。近年来,俄罗斯包装产业的发展很大程度上受到食品和饮料产业快速成长的推动。俄罗斯是全球主要食品出口国,进一步影响包装销售,以满足一系列终端产业对复杂包装的需求。

- 德国是欧洲领先的塑胶包装生产国。 2021年塑胶包装将占包装产量的约79%。塑胶包装行业主要受到国内食品和饮料行业快速成长的推动。由于生活方式更加忙碌、消费能力增强及相关因素,该地区对快速和便携包装产品的需求正在增加。未来几年,这一趋势在欧洲包装产品中将会成长。

新建筑的激增和不断增长的重建需求正在推动该行业的发展

- 受新冠疫情影响,2020年建设业整体收益大幅下降。

- 欧洲建筑业的销售额呈现惊人的成长势头,2021与前一年同期比较率与 2020 年相比最高。这得归功于欧盟委员会的倡议和措施的成功,例如在名为「下一代欧盟」的新冠疫情復苏计划下向所有行业注资 7500 亿欧元。根据欧盟下一代计划,建筑业获得了最大的投资,因为欧洲对建筑的绿色化和数数位化目标导致现有建筑和结构的年度维修增加。

- 根据 EUROCONSTRUCT 报告,在基于欧盟政治区域的细分市场中,中欧和东欧预计将以 6.4% 的复合年增长率增长,其次是西欧,复合年增长率为 6.1%。

- 欧盟和国家层面的政策制定者正在透过各种政策(包括《建筑能源性能指令》)优先考虑新建筑和现有建筑的能源效率。这些政策将在预测期内提高整体建筑收益。

欧洲聚氨酯接着剂产业概况

欧洲聚氨酯接着剂市场分散,前五大公司占25.72%的市占率。该市场的主要企业有:阿科玛集团、HB Fuller 公司、汉高股份公司、亨斯迈国际有限责任公司和西卡股份公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 包装

- 木製品和配件

- 法律规范

- EU

- 俄罗斯

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

- 科技

- 热熔胶

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水

- 国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Beardow Adams

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Jowat SE

- MAPEI SpA

- Sika AG

- Soudal Holding NV

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92476

The Europe Polyurethane Adhesives Market size is estimated at 4.01 billion USD in 2024, and is expected to reach 5.09 billion USD by 2028, growing at a CAGR of 6.15% during the forecast period (2024-2028).

Emerging construction and packaging end-use sector expected to boost the consumption of polyurethane adhesives in Europe

- Polyurethane adhesives are widely used in the packaging industry for food and beverage packaging, container packaging, end-of-line packaging for functional barrier applications, and metal packaging. The United Kingdom is one of the largest packaging markets in the country. The country's designed improvements and innovation, combined with a shifting focus toward the usage of recyclable materials for packaging, are expected to offer numerous opportunities for market growth, thus, creating opportunities for the launch of new products into the market. The UK packaging manufacturing industry records annual sales of GBP 11 billion, which is likely to drive the market for packaging adhesives in the region.

- The demand for polyurethane adhesives in the construction industry grew tremendously in 2021 because of the European Union's Commission's recovery plan post an economic slowdown due to the COVID-19 pandemic in 2020, such as Next Generation EU in which a fund has been allocated for the construction sector to make European buildings environmentally benign and reduce the wastage of resources. The overall growth in demand for polyurethane construction adhesives was the highest in 2021 for the Rest of Europe regional segment because of the Nordic countries, such as Denmark, which witnessed a 17.8% growth in their construction output.

- In Europe, Germany accounts for the largest healthcare industry. The annual expenditure on health in the country is estimated to be more than EUR 375 billion, excluding fitness and wellness. Owing to its demographic changes and digitalization trends, healthcare expenditure is expected to continue rising and drive the polyurethane adhesives market in the region over the forecast period.

Rising construction, packaging and automotive industries in Europe likely to propel the demand for polyurethane adhesives in the future

- In the period 2017 to 2021, the demand generated from the Europe region ranked 2rd among all regions. The share of adhesive demand from this region has consistently occupied 24-25% of the global demand because of the high manufacturing capacity of end-user industries, like automotive, aerospace, building and construction, and other industries in the region. Polyurethane adhesives with hot melt and water-borne technologies generate most of the demand in the region.

- From 2017 to 2019, the demand for adhesives from this region increased with a CAGR of 1.85%. The slow growth in the demand for polyurethane adhesives has resulted in slow growth in construction activities and a decrease in Automotive production in the region. The demand from these end-user industries declined with a CAGR of 0.44% and -0.50%, respectively, during this period.

- In 2020, due to constraints in operations, labor, raw material, supply chain, and other areas, the demand from all end users across the region declined. Among all Industries from all countries in the region, the footwear industry in Germany and the automotive industry in France took the worst hit, declining by 37.89% and 35.94%, respectively, in Y-o-Y volume terms.

- In 2021, the demand for polyurethane adhesives started to recover from all countries in the region and is expected to outgrow pre-pandemic demand volume by 2022. The demand from Italy has witnessed the highest Y-o-Y growth of 8.38% in volume terms. This growth trend is expected to continue during the forecast period. The overall demand from the Europe region is expected to increase with a CAGR of 3.83% during the forecast period.

Europe Polyurethane Adhesives Market Trends

Significant growth of food & beverage industry in Europe to escalate packaging industry

- Packaging is one of the major sectors of Europe region. The region is the second-largest producer of packaging products in the world, which holds about 24% of global packaging production after the Asia-Pacific region. Germany, Russia, Spain, and the United Kingdom are major producers of packaging products in Europe. It is seen that packaging production reduced by 7.14% in 2020 compared to 2019 due to the impact of the COVID-19 pandemic. During the year, a nationwide lockdown imposed by several countries halted the production facilities for three to four months in the region.

- Russia is a leading producer of packaging products producing 213.8 million tons in 2021, which is the highest in Europe. The Russian packaging industry has majorly been driven by the rapid growth of the food and beverages industry in recent years. Russia is a major exporter of food products worldwide, which further influences packaging sales to meet the need for sophisticated packaging across various-end use industries.

- Germany is the major producer of plastic packaging in Europe. Plastic packaging which nearly accounts for around 79% of the packaging produced in 2021. The plastic packaging industry is majorly driven by the rapid growth of the food and beverages industry in the country. With the rise in busier lifestyles, greater spending power, and related factors in the region, the demand for quick and on-the-go packaged products is increasing. This trend will rise in packaging products in the coming years in Europe.

Rapid growth of new construction along with rising need for renovation activities will drive the industry

- The overall revenue of construction showed a steep decrement in 2020 because of the impact of the pandemic situation due to COVID-19, which led to an overall recovery slowdown and social distancing measures on work sites.

- The overall revenue of the construction sector in Europe grew tremendously, with the highest year-on-year growth in 2021 compared to that of 2020 because of the initiatives and measures taken by the EU Commission, such as the infusion of EUR 750 billion for all sectors under the COVID recovery plan named Next Generation EU. Under the Next Generation EU plan, the construction sector received the maximum investment because of the European objective of green and digital transition in buildings which led to growth in the annual renovation rate of existing buildings and structures.

- As per the EUROCONSTRUCT report, among the segments of the European Union based on political geography, Central and Eastern Europe are expected to register a CAGR of 6.4%, followed by Western Europe at a CAGR of 6.1% in 2022-2024.

- The policymakers at European Union and national level are prioritizing the construction of new buildings and conversion of existing buildings to be energy efficient through various policies including Energy Performance of Buildings Directive and others. These policies will lead to an increase in overall revenue for construction in the forecast period.

Europe Polyurethane Adhesives Industry Overview

The Europe Polyurethane Adhesives Market is fragmented, with the top five companies occupying 25.72%. The major players in this market are Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 Russia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Beardow Adams

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Huntsman International LLC

- 6.4.7 Jowat SE

- 6.4.8 MAPEI S.p.A.

- 6.4.9 Sika AG

- 6.4.10 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219