|

市场调查报告书

商品编码

1692574

聚氨酯接着剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Polyurethane Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

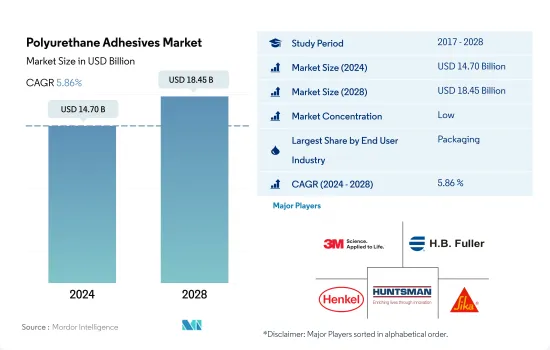

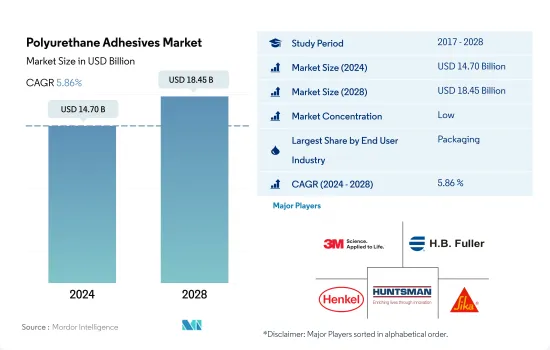

聚氨酯接着剂市场规模预计在 2024 年为 147 亿美元,预计到 2028 年将达到 184.5 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.86%。

建筑和包装终端使用行业的成长预计将推动全球聚氨酯接着剂消费的成长

- 聚氨酯接着剂广泛应用于包装产业。聚氨酯接着剂用于食品和饮料包装、容器包装、功能性阻隔应用的生产线末端包装以及金属包装。此外,根据包装和加工技术协会发布的一份报告,受人口增长、对永续性的日益关注、发展中地区消费能力的提高以及对智慧包装的需求不断增长等因素推动,全球包装行业规模预计将从 2016 年的 368 亿美元增长至 2021 年的 422 亿美元。

- 同样,建筑和施工领域在全球聚氨酯接着剂市场中占有第二大份额。聚氨酯接着剂具有良好的内聚力、附着力、弹性、高黏结强度、柔韧性和基材的高弹性模量。根据联合国的数据,全球约有 50% 的人口居住在都市区,预计到 2030 年将达到 60%。经济和人口成长的速度必须与商业、住宅和机构建设的需求相符。到 2030 年,全球约 40% 的人口可能需要住宅,平均每天需要超过 96,150 套住房。因此,未来几年建设活动的增加可能会推动聚氨酯接着剂市场的发展。

- 聚氨酯接着剂广泛应用于电子、电气设备的製造。预计全球整体电子和家用电器行业的复合年增长率将分别达到 2.51% 和 5.77%,从而导致预测期内(2022-2028 年)对聚氨酯接着剂的需求增加。

北美、欧洲和亚太地区投资和重建资金的增加预计将推动聚氨酯接着剂在全球各个终端用途领域的使用

- 由于存在大量建筑和包装活动、汽车、医疗设备、航太工业和其他成熟的终端用户行业的生产能力,亚太地区在整个研究期间占据了聚氨酯接着剂需求的最大份额。中国是全球最大的建筑和汽车市场,满足了亚太地区高达58%的需求。

- 2017年至2019年,聚氨酯接着剂的需求一直低迷。这是由于欧洲和亚太地区的成长放缓。全球主要终端用户产业建筑业和汽车业的需求下降限制了聚氨酯接着剂需求的整体成长。在此期间,这些产业的需求分别以-0.05%和-1.79%的复合年增长率下降。

- 2020年,新冠疫情导致所有终端用户产业对聚氨酯接着剂的需求下降。在南非和巴西等一些国家,建设活动被视为必不可少的,并允许在疫情期间进行。这些因素减轻了全球影响,将2020年的降幅限制在8.96%。

- 由于美国、澳洲、欧盟国家等的纾困措施和支持计划,需求将在 2021 年开始復苏,预计这一成长趋势将在整个预测期内持续下去。预计欧洲、南美和亚太地区的投资和预算分配增加将成为这一成长的主要驱动力。

全球聚氨酯接着剂市场趋势

开发中国家电子商务产业的快速成长增强了该产业

- 2020 年伊始,包装产业出现了几个长期趋势,推动需求成长。随着经济活动转向应对 COVID-19 疫情带来的挑战,包装产业成长加速。该行业的强劲表现得益于食品饮料和医疗保健等主要终端市场的收益成长和扩张,同时也显示了该行业在更广泛的经济不确定时期的整体稳定性。

- 2021 年,由于买家和卖家在疫情导致交易几乎停滞之后急切地重返市场,包装行业的併购活动激增。疫情期间包装公司的强劲表现强化了这样一种观念:包装产业在整体市场动盪期间提供了稳定性。疫情也增强了现有的顺风因素,例如电子商务的快速扩张以及品牌所有者采用包装来在超级市场货架上区分其产品,为该行业更强劲的长期增长奠定了基础。

- 截至目前,可溶解包装、节省空间包装和智慧包装是包装产业出现的一些创新。采用可食用包装是一种有趣且创新的替代方案,它有可能减少对石化燃料的依赖并显着减少碳足迹,并且由于其永续性而在整个食品行业中变得越来越普遍。这些因素为食品和饮料包装行业创造了成长机会,并有望在预测期内推动包装行业的成长。

建筑业蓬勃发展,住宅和基础建设不断增长

- 建设产业呈现稳定成长,2017 年至 2019 年的复合年增长率为 2.6%。这一成长受到全球经济活动好转和独栋住宅需求增加的推动。 2020年,新冠疫情对全球建筑建设产业产生了重大影响。劳动力供应限制、建筑融资和供应链中断以及经济不确定性对全球建设产业产生了负面影响。

- 虽然2021年呈现正成长,但疫情对供应链的衝击导致原物料价格上涨,仍在困扰产业。不过,由于建筑业对一个国家的经济影响重大,北美和亚太国家都透过提供支持计画来重新启动经济週期。支持计划包括澳大利亚的HomeBuilder计划和欧盟国家的经济復苏计划。

- 亚太地区是建设活动最多的地区,预计到 2028 年仍将是最大的建筑市场,这得益于其庞大的人口、不断加快的都市化进程以及中国、印度、日本、印尼和韩国等国家对基础设施建设的投资不断增加。

- 预计在预测期内,对绿色建筑的日益重视和减少全球建设活动排放的努力将带来更永续的营运程序。例如,法国已累计75亿欧元用于建设产业转型为低碳能源经济。

聚氨酯接着剂产业概况

聚氨酯接着剂市场分散,前五大公司占18.76%的市占率。该市场的主要企业有:3M、HB Fuller Company、Henkel AG & Co. KGaA、Huntsman International LLC 和 Sika AG(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 包装

- 木製品和配件

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 印尼

- 日本

- 马来西亚

- 墨西哥

- 俄罗斯

- 沙乌地阿拉伯

- 新加坡

- 南非

- 韩国

- 泰国

- 美国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

- 科技

- 热熔胶

- 反应性

- 溶剂型

- 紫外线固化胶合剂

- 水

- 地区

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Beijing Comens New Materials Co., Ltd.

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hubei Huitian New Materials Co. Ltd

- Huntsman International LLC

- Jowat SE

- Kangda New Materials(Group)Co., Ltd.

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92411

The Polyurethane Adhesives Market size is estimated at 14.70 billion USD in 2024, and is expected to reach 18.45 billion USD by 2028, growing at a CAGR of 5.86% during the forecast period (2024-2028).

Emerging construction and packaging end-use sector expected to boost the consumption of polyurethane adhesives, globally

- Polyurethane adhesives are widely used in the packaging industry. Polyurethane adhesives are used in food and beverage packaging, container packaging, end-of-line packaging for functional barrier applications, and metal packaging. Additionally, according to a report published by the Association for Packaging and Processing Technologies, growth in the global packaging industry reached USD 42.2 billion in 2021, which increased from USD 36.8 billion in 2016, owing to the increasing population, growing sustainability concerns, more spending power in developing regions, the rising demand for smart packaging, and others.

- Similarly, the building and construction segment occupies the second-highest share in the global polyurethane adhesives market. Polyurethane adhesives offer good cohesion, adhesion and elasticity, high cohesive strength, flexibility, and high elastic modulus of the substrate. According to the United Nations (UN), around 50% of the global population resides in urban cities, which is projected to touch 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for commercial, residential, and institutional construction activities. By 2030, around 40% of the global population is likely to need housing at the rate of over 96,150 houses per day. Thus, rising construction activities are likely to drive the market for polyurethane adhesives in the upcoming years.

- Polyurethane adhesives are widely used in electronics and electrical equipment manufacturing. The electronics and household appliances industries are expected to record a CAGR of 2.51% and 5.77%, respectively, globally, which will lead to an increase in demand for polyurethane adhesives during the forecast period (2022-2028).

Increased investments and recovery funds in North America, Europe and Asia-Pacific, projected to raise the global utilization of polyurethane adhesives in various end-use sectors

- The Asia Pacific has occupied the largest share of the demand for polyurethane adhesives throughout the entire study period because of the large number of construction and packaging activities, Automotive, Medical devices, and aerospace production capacities, and other well-established end-user industries in the region. China is the largest construction and automotive market globally and generates up to 58% of the demand from the Asia Pacific region.

- During 2017-19 the demand for polyurethane adhesives has been sluggish. This is because of slow growth in Europe and the Asia Pacific regions. The global decline in the demand from construction and automotive end-user industries, which are among the major end-user industries, has restricted the overall growth of polyurethane adhesives demand. The demand from these industries declined with CAGRs of -0.05% and -1.79% during this period.

- In 2020, the demand for polyurethane adhesives from all end-user industries declined because of the covid-19 pandemic. In some countries like South Africa, and Brazil among others construction activities were deemed essential and were allowed to operate during the pandemic. Factors like these have cushioned the global impact restricting the decline to 8.96% in 2020.

- In 2021, due to the relief packages and support schemes in countries like the United States, Australia, and countries in the EU among others, the demand started to recover and this growth trend is expected to continue throughout the forecast period. Increased investments and budget allotments witnessed in countries of Europe, South America, and the Asia Pacific regions are expected to be major driving factors for this growth.

Global Polyurethane Adhesives Market Trends

Fast paced growth of e-commerce industry in developing nations to augment the industry

- In 2020, the packaging industry started with multiple long-term trends driving higher demand, and growth accelerated as economic activity switched to address the challenges posed by the COVID-19 pandemic. The industry's robust performance supported rising revenues and the expansion of important end markets such as food and beverage and healthcare and also demonstrated the industry's general stability during a period of overall economic uncertainty.

- Packaging M&A activities soared in 2021, as buyers and sellers enthusiastically returned to the market after deal-making almost ceased during the pandemic in 2020. During the pandemic, the strong performance of packaging companies reinforced the idea that the industry offers stability during moments of general market turbulence. The pandemic also strengthened previously existing tailwinds, including rapid e-commerce expansion and brand owners employing packaging to differentiate their products on supermarket shelves, positioning the sector for stronger long-term growth.

- As of now, dissolvable packaging, space-saving packaging, and smart packaging are a few innovations that have come up in the packaging industry. The adoption of edible packaging, an interesting and innovative alternative that alleviates the reliance on fossil fuels and has the potential to significantly decrease the carbon footprint, is now becoming popular across the food industry owing to its sustainability. These factors have created a growth opportunity for the packaging industry in the food and beverage sector, which is expected to boost the packaging industry's growth during the forecast period.

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Polyurethane Adhesives Industry Overview

The Polyurethane Adhesives Market is fragmented, with the top five companies occupying 18.76%. The major players in this market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 Singapore

- 5.3.1.8 South Korea

- 5.3.1.9 Thailand

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Middle East & Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 South Africa

- 5.3.3.3 Rest of Middle East & Africa

- 5.3.4 North America

- 5.3.4.1 Canada

- 5.3.4.2 Mexico

- 5.3.4.3 United States

- 5.3.4.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Beijing Comens New Materials Co., Ltd.

- 6.4.4 Dow

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Hubei Huitian New Materials Co. Ltd

- 6.4.8 Huntsman International LLC

- 6.4.9 Jowat SE

- 6.4.10 Kangda New Materials (Group) Co., Ltd.

- 6.4.11 MAPEI S.p.A.

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd.

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219