|

市场调查报告书

商品编码

1639453

亚太惯性系统市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia-Pacific Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

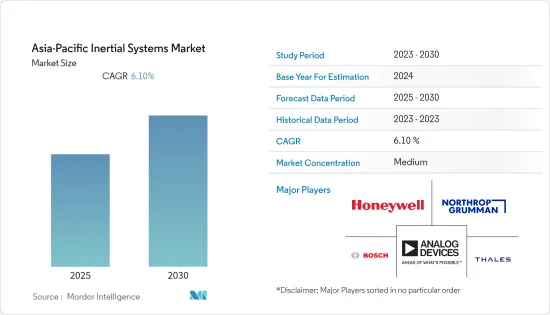

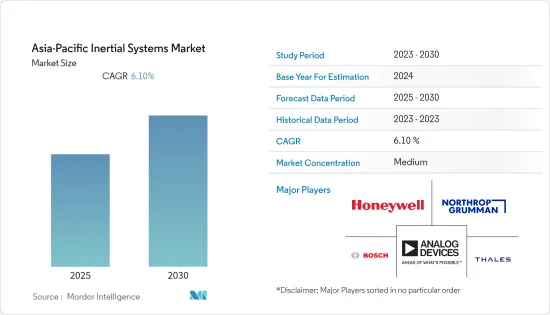

预计预测期内亚太惯性系统市场复合年增长率为 6.1%。

主要亮点

- 亚太地区是世界上最大的製造商和出口商的所在地。此外,印尼、中国、日本和印度等国家也是工业强国。国家公司和国际组织在这些国家设有大型工厂,用于出口和国内消费。随着该地区经济的成长,来自世界各地的新公司都希望在那里投资。工厂在生产线上运作更多的机器以提高生产速度和效率。

- 全球生活方式的进步导致了对更舒适设备的需求,而运动感应技术以及惯性感测器的广泛使用是这一市场的主要驱动力。

- 此外,预计这项技术将决定未来几年的趋势。无人驾驶汽车在各种民用和国防应用中的空前崛起,推动了对包括惯性感测器在内的复杂导航系统的需求。技术发展使得感测器变得更加普及且价格更加实惠。

- GPS/INS 和 GNSS/INS 等导航系统的日益集成,增加了比传统导航系统更强大的功能,并推动了惯性系统市场的发展。近年来,国防和民用领域对无人机(UAV)、自主水下航行器(AUV)和远程操作车辆(ROV)等无人驾驶车辆的需求大幅增加,刺激了亚太地区的成长。导航系统市场的成长。

- 由于政府关闭和多项规章制度,COVID-19 对全球各市场产生了重大影响。随着该地区各政府放宽先前製定的规则和法规,市场已恢復稳定。终端用户市场销售额正在成长,预计在预测期内将继续成长,从而推动市场发展。

亚太惯性系统市场趋势

精密驱动市场需求不断成长

- 高精度、高可靠性是此导航系统的主要特点。惯性导航系统相对于其他导航系统的优点在于,它们较少依赖外部辅助来选择运动物体的旋转和加速度。这些系统利用陀螺仪、加速计和磁力计的混合物来确定车辆或移动物体的向量变数。

- 导航系统天然适合于挑战区域中车辆的综合导航、控制和引导。与GPS和其他导航系统不同,惯性系统即使在恶劣的条件下也能保持其性能。惯性测量单元 (IMU) 非常适合估算导航系统的几个指标。这些系统还能免受辐射和干扰问题的影响。与万向节系统相比,捷联惯性系统是惯性导航系统的较好选择。由于它整合了 MEMS 技术,因此还具有成本效益。

- 随着人工智慧和机器学习等先进技术被广泛应用,透过感测器技术远端控制的先进无人驾驶汽车变得越来越普遍。因此,战术级装备的高度和方向等正确的定位参数在当前情况下变得至关重要。

- 惯性导航系统广泛应用于民航机、无人机、军事和防御单位,是导航和控制系统不可或缺的一部分。此外,随着系统的处理能力逐渐提高,它们也能够与其他导航系统互动。一些惯性系统,例如磁力仪,主要与其他惯性系统结合使用,以确定磁场的方向或存在。

- IMU 和 AHRS 等多轴系统用于确定移动车辆的高度、位置、加速度和速度。惯性系统利用加速计、陀螺仪和磁力计的组合,非常适合为导航系统提供高精度。

- 乘用车广泛依赖导航系统,该地区对导航系统的需求一直很大。根据OICA(国际汽车製造商组织)预测,2021年包括中东在内的亚太地区乘用车销量将在3,400万辆左右,其中中国销量将超过2,100万辆。该地区的销售额预计将增加并推动市场发展。

军事应用的增加和 MEMS 的扩张可能会推动市场

- 印度陆军最近获得了自主研发的「丹努什」迫击炮系统。武器配备惯性导航系统,可引导飞弹距离炮位最远 36 公里。新技术还包括自动放置和基于 GPS 的枪支记录。大炮利用其能力来计算弹道并测量其所装备的弹的速度。热成像、摄影机和雷射测距仪等技术对于改进惯性系统至关重要。

- IMU 在军事行动中的使用,尤其是无人机(UAV),正在激励各公司为这项技术创造先进的解决方案。因此,下一代 IMU 目前在市场上占据主导地位。

- 惯性导引系统几乎适用于所有军用飞弹和精确导引炸弹,使这些武器能够在飞行过程中准确瞄准目标并设定航向。惯性导引利用灵敏的测量感测器根据飞弹离开已知位置后的加速度来决定飞弹的位置。民航机使用环形雷射陀螺仪进行惯性导航。这比洲际弹道飞弹使用的机械系统精度较低,但仍能在一定程度上确定准确位置。

- 亚太地区军事衝突频繁。该地区领土争端频繁,促使各国购买最新的巡航飞弹以加强安全。新兴国家不断增加的军事开支有助于现代巡航飞弹系统的开发和采购,推动该产业的发展。

- 印度和巴基斯坦继续设计飞弹运载系统和核武。印度、巴基斯坦和中国之间日益激烈的竞争推动了三国采购和开发飞机、潜艇、火炮和飞弹系统等先进军事战术。

- 根据斯德哥尔摩国际和平研究所预测,2021年东亚地区军费将达4,110亿美元,仅次于北美。其中,南亚支出951亿美元,东南亚支出431亿美元,大洋洲支出353亿美元,中亚支出18亿美元。

亚太惯性系统产业概况

由于存在多种惯性系统解决方案提供商,亚太地区惯性系统市场相当分散。然而,供应商始终致力于扩大其产品范围,以提高其知名度和存在感。此外,公司正在透过建立策略伙伴关係和进行收购来获得市场吸引力并增加市场占有率。

- 2022 年 7 月-Honeywell与韩华系统宣布,双方已签署谅解备忘录,合作扩大韩国的无人机系统 (UAS) 和城市空中交通 (UAM) 技术。韩华系统成立于韩国,在资讯基础设施和国防电子领域提供卓越的智慧技术。Honeywell是领先的 UAS/UAM 技术供应商,提供一系列即用型技术,帮助客户打造更永续的航空业未来。根据谅解备忘录的条款,两家公司将探索各种混合动力推进解决方案,以应用Honeywell和韩华系统不断扩大的、具有竞争力的 UAM 平台组合,这些平台旨在支持 UAS/UAM 市场。

- 2022 年 11 月 - GAMECO 与泰雷兹签署了工业合作协议,以进一步开展 MRO 活动的合作。泰雷兹将继续为 GAMECO 提供飞机维护、航空物资采购和销售、技术文件和测试程序集 (TPS) 的支援。透过此协议,双方将保持合作势头,以创新的产品、解决方案和优质的服务助力中国民航市场高品质发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- MEMS技术的出现

- 倾向国防和航太

- 导航系统的技术进步

- 市场限制

- 操作复杂,维护成本高

第六章 市场细分

- 按应用

- 民航

- 防御

- 家用电子电器

- 车

- 能源和基础设施

- 医疗

- 其他用途

- 按组件

- 加速计

- 陀螺仪

- IMU

- 磁力仪

- 姿态航向导航系统

- 其他组件

第七章 竞争格局

- 公司简介

- Honeywell Aerospace Inc.

- Northrop Grumman Corporation

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Thales Group

- Rockwell Collins Inc.

- Moog Inc.

- Fairchild Semiconductor(ON Semiconductors)

- VectorNav Technologies

- STMicroelectronics NV

- Safran Group(SAGEM)

- InvenSense Inc.

- Meggitt PLC

8.供应商市场占有率分析

- 供应商地位分析(惯性系统)

- 供应商市场占有率(高端惯性系统)

- 供应商市场占有率(MEMS 产业)

第九章投资分析

第十章 市场潜力

简介目录

Product Code: 49995

The Asia-Pacific Inertial Systems Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- Asia-Pacific is home to the largest manufacturers and exporters of goods in the world. Also, countries like Indonesia, China, Japan, and India are the big powerhouses of industries. Domestic players and international organizations have large factories for exports and self-consumption in these countries. With the economy growing in this region, new companies from various parts of the world are looking to invest. Factories are operating more machines in the production lines to improve the speed and efficiency of production.

- The progress of the worldwide lifestyle has resulted in the requirement for equipment with greater comfort, allowing motion-sensing technology that broadly uses inertial sensors, which has become a key driving factor in this market.

- Further, it is anticipated to define the trend for the upcoming few years. The unprecedented increase in unmanned vehicles across different civilian and defense applications has raised the demand for complex navigational systems, including inertial sensors. Technological development has made sensors available and affordable, making their usage abundant in day-to-day devices.

- The growing integration of navigation systems such as GPS/INS and GNSS/INS added greater performance features than the traditional navigation system, thus, driving the inertial system market. In recent years, a substantial rise in demand for unmanned vehicles such as unmanned aerial vehicles (UAV), autonomous underwater vehicles (AUV), and remotely operated vehicles (ROV) across diverse applications in both defense and civilian applications fuelled the growth of the Asia-Pacific inertial navigation system market.

- COVID-19 significantly impacted various global markets due to lockdowns and multiple rules and regulations imposed by the government. The market returned to stability as the government in the regions eased the rules and regulations set earlier. The sales of the end-user market grew, which is anticipated to continue growing over the forecast period and drive the market.

APAC Inertial Systems Market Trends

Increasing Demand for Accuracy to Drive the Market

- High levels of precision and dependability are the major features of navigational systems. Inertial navigational systems have a different advantage over other navigation systems in terms of their shortage of reliance on exterior aids to choose the rotation and acceleration of a moving object. These systems utilize a mixture of gyroscopes, accelerometers, and magnetometers to specify the vector variables of a vehicle or a moving object.

- Navigational systems are naturally suited for integrated navigation, control, and guidance of vehicles in challenging areas. Unlike GPS and other navigation systems, inertial systems can maintain performance even under challenging conditions. Inertial measurement units (IMU) are well-fitted to estimate several metrics for navigational systems. These systems stay unchanged by radiation and jamming problems. Strapdown inertial systems find better usage in inertial navigation systems than gimbaled systems, as they are strapped to the moving object and offer more reliability and performance. They offer cost-effectiveness as they are integrated with MEMS techniques.

- As advanced technologies like AI and machine learning become more broadly adopted, advanced robotics cars remotely controlled through sensor technology are becoming more common. As a result, correct position parameters, such as height and orientation of tactical-grade equipment, are essential in the current scenario.

- Inertial navigation systems are available for commercial use in private aircraft, UAVs, and military and defense units and constitute an integral part of navigational control systems. They can also interact with other navigational systems due to gradual advancements in the system's processing power. Several inertial systems, like magnetometers, are primarily used to specify the orientation and existence of a magnetic field in conjunction with other inertial systems.

- Multi-axis systems such as IMUs and AHRS are operated to determine moving objects' altitude, position, acceleration, and velocity. Inertial systems are perfect for delivering high accuracy in navigational systems by utilizing a mixture of accelerometers, gyroscopes, and magnetometers.

- Passenger cars are widely dependent on navigation systems, which are in constant demand in the region. According to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2021, the Asia-Pacific region sold approximately 34 million passenger cars, including in the Middle East, of which China sold more than 21 million. The numbers are anticipated to increase in the region and drive the market.

Rising Military Applications and Expansions of MEMS May Drive the Market

- An indigenous mortar system, Dhanush, is a recent addition to the Indian army. The weapons have an inertial navigation system that directs missiles nearly 36 km away from the guns' placements. The new technology also includes auto-laying and GPS-based gun recording. The cannon calculates ballistics and measures onboard velocity through its features. Technologies like thermal imaging, cameras, and a laser range finder are crucial to inertial systems' improvement.

- IMUs in military operations, especially in unmanned aerial vehicles (UAVs), have stimulated companies to create advanced solutions for this technology. As a result, next-generation IMUs are primarily available on the market today.

- Inertial guidance systems are operated in almost every missile and precision-guided bomb in the military, which enables these weapons to target and precisely set their course in flight. Inertial guidance utilizes sensitive measurement sensors to measure the missile's location based on the acceleration applied after it vacates a known site. Commercial aircraft employ inertial navigation with a ring laser gyroscope, which is less exact than the mechanical systems used in ICBMs but still delivers a precise, somewhat fix on location.

- Military clashes are frequent in the Asia-Pacific region. The region's rising frequency of territorial conflicts has encouraged countries to purchase modern cruise missiles to strengthen their security. The evolution of military expenditures in different countries in the region has assisted the development and procurement of modern cruise missile systems, driving the industry forward.

- India and Pakistan continue to design their missile delivery systems and nuclear arsenals. The growing obstruction relationship between India, Pakistan, and China boosts the procurement and development of advanced military strategies such as airplanes, submarines, artillery, and missile systems, among other things.

- According to the SIPRI (Stockholm International Peace Research Institute), in 2021, the military spending of East Asia amounted to USD 411 billion, second to North America. South Asia, Southeast Asia, Oceania, and Central Asia spent USD 95.10 billion, USD 43.10 billion, USD 35.30 billion, and USD 1.80 billion, respectively.

APAC Inertial Systems Industry Overview

The Asia-Pacific inertial systems market is moderately fragmented due to the presence of different inertial systems solution providers. However, the vendors consistently focus on product expansions to improve their visibility and presence. The companies are also adopting strategic partnerships and acquisitions to gain market traction and increase their market share.

- July 2022 - Honeywell and Hanwha Systems announced the signing of an MOU to partner on unmanned aerial systems (UAS) and urban air mobility (UAM) technology expansion in South Korea. Established in South Korea, Hanwha Systems delivers distinguished smart technologies in information infrastructure and defense electronics. Honeywell is a major provider of UAS/UAM technology, providing a wide variety of ready-now technologies and assisting customers in building a more sustainable future for aviation. Under the terms of the MOU, the companies will investigate different hybrid propulsion solutions for applying Honeywell and Hanwha Systems' UAM platform extended portfolio of competitive offerings developed to help the UAS/UAM market.

- November 2022 - GAMECO and Thales signed an industrial collaboration agreement for further cooperation in MRO activities. Thales will continue to assist GAMECO in aircraft maintenance, the procurement distribution of aviation supplies, and technical documentation and Test Program Sets (TPS). Both companies, with this agreement, will maintain the collaboration momentum in contributing to the high-quality development of the Chinese civil aviation market with innovative products, solutions, and quality services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Inclination Toward Defense and Aerospace

- 5.1.3 Technological Advancements in Navigation Systems

- 5.2 Market Restraints

- 5.2.1 Operational Complexity and High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Civil Aviation

- 6.1.2 Defense

- 6.1.3 Consumer Electronics

- 6.1.4 Automotive

- 6.1.5 Energy and Infrastructure

- 6.1.6 Medical

- 6.1.7 Other Applications

- 6.2 By Component

- 6.2.1 Accelerometer

- 6.2.2 Gyroscope

- 6.2.3 IMU

- 6.2.4 Magnetometer

- 6.2.5 Attitude Heading and Navigation System

- 6.2.6 Other Components

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell Aerospace Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Analog Devices Inc.

- 7.1.5 Thales Group

- 7.1.6 Rockwell Collins Inc.

- 7.1.7 Moog Inc.

- 7.1.8 Fairchild Semiconductor (ON Semiconductors)

- 7.1.9 VectorNav Technologies

- 7.1.10 STMicroelectronics NV

- 7.1.11 Safran Group (SAGEM)

- 7.1.12 InvenSense Inc.

- 7.1.13 Meggitt PLC

8 Vendor Market Share Analysis

- 8.1 Vendor Positing Analysis (Inertial Systems)

- 8.2 Vendor Market Share (High-end Inertial Systems)

- 8.3 Vendor Market Share (MEMS Industry)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219