|

市场调查报告书

商品编码

1640360

陆地应用中的惯性系统:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Inertial Systems in Land-based Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

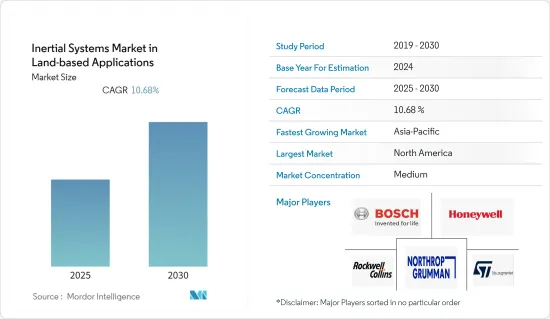

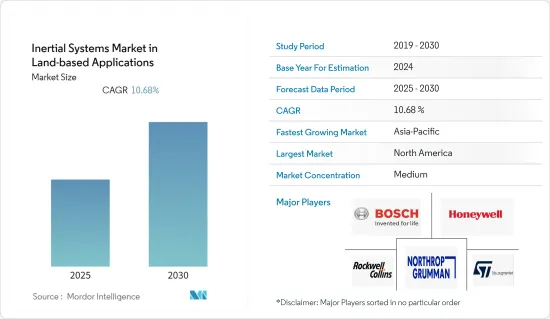

预测期内,陆地应用惯性系统市场预计将以 10.68% 的复合年增长率成长。

微机电系统 (MEMS) 技术的出现使得感测器和半导体领域的机械和电子机械元件透过微製造和微加工技术得以小型化。因此,MEMS有望成为未来导航系统不可争议的一部分,推动惯性系统市场的成长。

此外,高阶惯性系统由配备高性能感测器(陀螺仪、地磁感测器、加速感应器)的IMU组成,透过相对运动提供有关周围环境的高精度资讯。因此,对导航系统更高精度的需求日益增加,从而推动了对先进惯性系统的需求。

此外,这些惯性系统越来越多地被应用于深海钻井平台来执行先进的操作。 Sonardyne International 开发了一种新型 DP-INS(惯性导航系统),该系统结合了长基线、极短基线 (LUSBL) 定位技术的互补属性与 Lodestar AHRS/INS 平台的高精度惯性测量。陀螺仪感测器是一种用于侦测高度角和角速度的惯性感测器。它具有体积小、功耗低、重量轻、成本低、可量产等特点,因此比传统陀螺仪更广泛的采用。

此外,由于新冠疫情,中国已停止包括半导体产业在内的所有主要生产活动。预计这将对2020年全球工业惯性系统市场的供应链产生重大影响,此后市场可望復苏。中国的生产中断可能会对全球企业以及电子价值链上下游产生重大影响,并直接衝击感测器市场。

陆地应用惯性系统的市场趋势

精度需求不断成长推动市场

高精度和高可靠性是导航系统最重要的特性。惯性导航系统与其他形式的导航系统相比具有明显的优势,因为它们不依赖外部辅助来确定运动物体的旋转和加速度。这些系统使用陀螺仪、加速计和磁力计的组合来确定车辆或移动物体的向量变数。

导航系统本质上适合用于具有挑战性的环境中车辆的综合导航、控制和引导。与GPS和其他导航系统不同,惯性系统即使在恶劣的条件下也能保持其性能。惯性测量单元 (IMU) 非常适合导航系统计算多个指标。这些系统不受辐射和干扰的影响。惯性导航系统比万向节系统更常使用捷联繫统。此外,由于采用了 MEMS 技术,因此它还具有成本效益。

随着人工智慧和机器学习等先进技术得到越来越广泛的应用,可使用感测器技术进行远端控制的先进无人驾驶汽车变得越来越普遍。无人水下航行器、无人飞行器和无人地面航行器都正在采用这项新技术。因此,战术级装备的高度和方向等精确的位置参数在当今的战斗场景中至关重要。

惯性导航系统目前已商业性民航机、无人机、军事和防御部队使用。惯性导航系统是导航和控制系统不可或缺的一部分,随着系统处理能力的不断提高,能够与其他导航系统互动。某些形式的惯性系统,例如磁力仪,广泛与其他形式的惯性系统结合使用,以确定方向和磁场的存在。

北美占有最大市场占有率

由于领先的 MEMS 供应商的存在,该地区很可能成为技术创新的源头,因此预计会占据相当大的市场占有率。北美是世界上最大的海上油气通讯市场之一。预计美国新发现的页岩资源和加拿大石油和天然气计划的增加将推动该地区对通讯设备的需求。

美国内政部 (DoI) 计划允许在约 90% 的外大陆棚(OCS) 面积上进行近海勘探。该地区的石油和天然气产业预计将在2019-2024年国家外大陆棚石油和天然气租赁计画(国家OCS计画)下创造新的机会。

此外,无人机数量的不断增长和国防支出的增加是美国大量采用这些系统的主要原因。此外,根据美国高级研究计划局(DARPA)的美国,美国国防部正在向美国提供先进工具,以扩大水下感测器的覆盖范围和有效性。 ),以帮助其潜艇探测并攻击敌方潜艇。因此,政府措施和研发支出预计将进一步刺激该地区的市场成长。

陆地应用惯性系统产业概况

由于有各种惯性系统解决方案供应商,陆地应用惯性系统市场的竞争格局相当分散。然而,供应商始终专注于产品开发,以提高其知名度和全球影响力。此外,各公司正在建立策略联盟和进行收购以获得市场吸引力并扩大市场份额。

2021年10月,美国从诺斯罗普·格鲁曼公司接受了第500套WSN-7环形雷射陀螺仪惯性导航系统(INS)。诺斯罗普·格鲁曼公司继续为美国和北约在世界各地的水面和潜艇海军资产提供支持,这些资产分布在美国舰队的各个角落。

2021年4月,惯性实验室宣布发布其下一代GPS辅助系统:INS-DH- OEM、IMU-NAV-100和INS-U。这些 INS 适用于无人机、直升机和机载光达勘测。其中包括MEMS加速计和MEMS陀螺仪。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- MEMS技术的出现

- 基于运动感应的应用日益增多

- 市场限制

- 积分漂移误差

第六章 市场细分

- 按组件

- 加速计

- IMU

- 陀螺仪

- 磁力仪

- 姿势航向

- 参考系统

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Honeywell International Inc.

- Northrop Grumman Corporation

- Rockwell Collins

- Bosch Sensortec GmbH

- ST Microelectronics

- Safran Group

- SBG Systems

- Raytheon Anschtz GmbH

- KVH Industries Inc.

- Silicon Sensing Systems Ltd

- Vector NAV

第八章投资分析

第九章:未来展望

The Inertial Systems Market in Land-based Applications Industry is expected to register a CAGR of 10.68% during the forecast period.

The emergence of Micro Electro Mechanical Systems (MEMS) technology resulted in the miniaturization of mechanical and electro-mechanical elements in the field of sensors and semiconductors through the use of micro-fabrication and micro-machining techniques. Hence, MEMS has become an indisputable part of future navigation systems and is expected to propel the inertial systems market's growth.

Additionally, high-end inertial systems are comprised of IMU with high-performance sensors (gyroscopes, magnetometers, accelerometers), which provide high accuracy information about the surrounding environment through relative movement. Hence, the need for higher accuracy in navigation systems is increasing, thus, increasing the demand for advanced inertial systems.

Moreover, these inertial systems are increasingly used in deep-water drilling units for advanced operations. Sonardyne International came up with a new DP-INS (inertial navigation system) that combined the complementary characteristics of its long and ultra-short baseline (LUSBL) positioning technology with high-integrity inertial measurements from its Lodestar AHRS/INS platform. Further, a gyroscope is a kind of inertial sensor used to detect the altitude angle and angular rate. Characteristics such as small size, low power consumption, lightweight, low cost, and the possibility of batch fabrication drive their adoption over conventional gyroscopes.

Further, due to the COVID-19 pandemic, China has stopped all major production activities, including its semiconductor industry. This is expected to significantly influence the global industrial inertial systems market supply chain in 2020, and the market is expected to pick up afterward. Disruption in China may significantly impact companies worldwide and up and down the electronics value chain, directly impacting the sensor market.

Land-based Applications Inertial Systems Market Trends

Increasing Demand for Accuracy to Drive the Market

A high level of accuracy and reliability is a navigational system's prime feature. Inertial navigational systems have a distinct advantage over other forms of navigation systems in terms of their lack of dependence on external aids to determine the rotation and acceleration of a moving object. These systems use a combination of gyroscopes, accelerometers, and magnetometers to determine the vector variables of a vehicle or a moving object.

Navigational systems are inherently suited for use in integrated navigation, control, and guidance of vehicles in challenging environs. Unlike GPS and other navigation systems, inertial systems can retain their performance even under challenging conditions. Inertial measurement units (IMU) are well suited for navigational systems to calculate several metrics. These systems remain unaffected by radiation and jamming problems. Strapdown inertial systems find more usage in inertial navigation systems than gimbaled systems, as they are strapped to the moving object and offer better reliability and performance. Moreover, they provide cost-effectiveness as they are incorporated with MEMS techniques.

As advanced technologies such as AI and Machine Learning become more widely adopted, advanced robotic cars that can be controlled remotely via sensor technology are becoming more common. Unmanned Underwater Vehicles, Unmanned Aerial Vehicles, and Unmanned Ground Vehicles are all being updated owing to this new technology. As a result, accurate position parameters, such as altitude and orientation of tactical grade equipment, are important in today's battle scenario.

Inertial navigation systems are now being made available for commercial use in private aircraft, UAVs, military, and defense units. They form an integral part of the navigational control systems and can interact with other navigational systems due to incremental advancements in the processing ability of the systems. Several forms of inertial systems like magnetometers are widely used for determining the orientation and presence of a magnetic field in conjunction with other forms of inertial systems.

North America to Hold the Largest Market Share

The presence of prominent vendors offering MEMS in the region is likely to emerge as a source for innovation, and it is estimated to hold a significant market share. North America is one of the largest markets for offshore oil and gas communication globally. New-found shale resources in the US and an increasing number of oil and gas projects in Canada are expected to drive the demand for communication equipment in the region.

The US Department of the Interior (DoI) plans to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf (OCS) acreage. The region's oil and gas sector is expected to create new opportunities under the National Outer Continental Shelf Oil and Gas Leasing Program (National OCS Program) for 2019-2024.

Moreover, the rising number of unmanned aerial vehicles and rising defense spending are the key reasons for the high adoption of these systems in the US. Besides, under the US Defense Advanced Research Projects Agency (DARPA) program, to provide the US Navy with advanced tools to expand the reach and effectiveness of its underwater sensors, the US defense sector has invested in the development of small unmanned underwater vehicles (UUV) to help US submarines detect and engage adversary submarines. Hence, government initiatives and spending on R&D are expected to further stimulate the growth of the market in the region.

Land-based Applications Inertial Systems Industry Overview

The competitive landscape of the inertial systems market in land-based applications is fragmented moderately due to the presence of various inertial systems solution providers. However, vendors are consistently focusing on product development to enhance their visibility and global presence. Companies are also undergoing strategic partnerships and acquisitions to gain traction and increase their market share.

In October 2021, the US Navy received the 500th WSN-7 ring laser gyroscope inertial navigation system (INS) from Northrop Grumman Corporation. Northrop Grumman continues to support the US and NATO surface and submarine naval assets worldwide, with installations across the US Navy Fleet.

In April 2021, Inertial Labs announced the release of INS-DH-OEM, IMU-NAV-100, and INS-U, the next generation of GPS-assisted systems. These INS are intended for use with UAVs, helicopters, and LiDAR surveys from the air. MEMS accelerometers and MEMS gyroscopes are among them.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Increasing Applications Based on Motion Sensing

- 5.2 Market Restraints

- 5.2.1 Integration Drift Error

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Accelerometers

- 6.1.2 IMUs

- 6.1.3 Gyroscopes

- 6.1.4 Magnetometers

- 6.1.5 Attitude Heading

- 6.1.6 Reference Systems

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Rockwell Collins

- 7.1.4 Bosch Sensortec GmbH

- 7.1.5 ST Microelectronics

- 7.1.6 Safran Group

- 7.1.7 SBG Systems

- 7.1.8 Raytheon Anschtz GmbH

- 7.1.9 KVH Industries Inc.

- 7.1.10 Silicon Sensing Systems Ltd

- 7.1.11 Vector NAV