|

市场调查报告书

商品编码

1640490

欧洲惯性系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

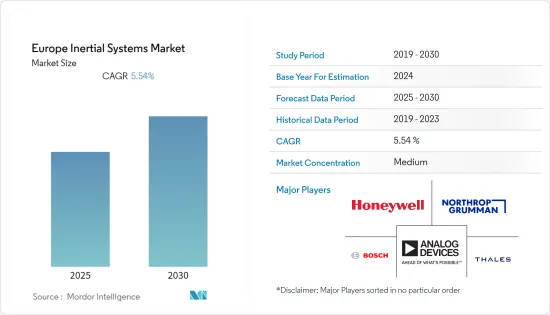

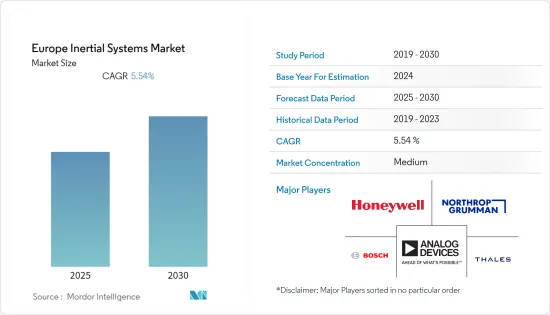

预计预测期内欧洲惯性系统市场复合年增长率将达到 5.54%。

主要亮点

- 据欧洲汽车工业协会 (ACEA) 称,欧盟每年生产约 1,290 万辆汽车。汽车工业是欧洲最大的工业之一。汽车产业的这一领域正在发生许多创新。惯性感测器如今已成为汽车必不可少的零件。它用于各种系统,从 ABS 到安全气囊展开甚至防盗功能。该地区汽车工业的成长预计将促进惯性系统市场的成长。

- 世界各地生活方式的进步对于更易于使用的设备的需求日益增长。这使得开发充分利用惯性感测器的运动感应技术成为可能。这是该市场的关键驱动力,并可能在未来几年对市场的定义发挥关键作用。

- 此外,该地区民用和国防等各种应用中无人驾驶汽车的空前增长也推动了对包括惯性感测器在内的复杂导航系统的需求。科技的快速进步使得感测器变得更加容易取得且价格更实惠,从而被广泛应用于日常设备中。

- 然而,惯性导航系统(INS)故障率高,维修成本高,导致系统维护成本高。这些因素可能会限制市场成长。

- 新冠疫情对该地区的航太和国防工业带来了重大影响,民航业的许多公司在疫情爆发的最初几个月因停工而经历了生产中断和需求放缓。然而,疫情后国防和航太工业的成长倾向,加上导航系统的技术进步,预计将为未来几年的市场带来光明的前景。

欧洲惯性系统市场趋势

国防部门预计将占据很大市场

- 惯性系统利用加速计、陀螺仪或磁力计的输出来测量安装在一轴、两轴或三轴上的物体的运动和方向。这些输出可用于各种战术性和防御应用,包括位置追踪和导航。

- 此外,配备 IMU 的 INS 构成了许多军用车辆的导航和控制主干,包括载人飞机、飞弹和潜艇。在国防应用中,IMU 可用于稳定和控制应用,例如飞机飞行表面、天线和武器平台以及摄影机和感测器万向架。

- 此外,该地区不断增加的国防费用也产生了巨大的市场需求。例如,根据欧洲防务局(EDA)发布的年度国防资料报告,2021年欧洲国防费用创下历史新高,与前一年同期比较增长6%,连续第七年增长。

- 作为英国武器领域研究框架(WSRF) 的一部分,柯林斯航空航太公司也将于2022 年9 月获得数百万英镑的拨款,用于开发导航级惯性测量单元(IMU),供未来复杂的武器平台使用。

- Collins 正在与国防科学技术实验室 (DSTL) 合作,使用微电子机械系统 (MEMS) 技术开发战术级或「A 级」IMU,以支援英国国防部 (MOD) 的一项倡议。 。这种基于MEMS 的新型IMU 可用于各种多域平台的导引和导航,同时比RLG(环形雷射陀螺仪)和FOG(光纤陀螺仪)解决方案更小、成本更低,并能确保所需的性能。

MEMS技术的出现推动市场

- 惯性系统的大规模部署在很大程度上受到其体积大、成本高的限制。本世纪初以来,惯性系统製造技术发生了模式转移。

- 微机电系统 (MEMS) 技术的出现使得感测器和半导体等机械和电子机械元件能够透过微製造和微加工技术实现小型化。 MEMS 现在已成为未来导航系统的基本组成部分。

- 推动该技术发展的原因是契约製造製造商面临越来越大的压力,要求其将惯性系统小型化以适应更广泛的应用。透过在小型单元中提供增强的功能,MEMS 在便携式设备的快速普及中发挥了重要作用。惯性 MEMS 市场预测表明,未来几年惯性 MEMS 设备的数量将大幅增加。

- MEMS 技术的进步不仅限于小众或研究级应用;一些商业级惯性系统也已进入市场。这些设备与 GPS 辅助设备集成,提供全面的导航解决方案。

- 此外,该地区对电动车的需求正在激增,为市场创造了巨大的商机,因为基于 MEMS 的感测器对于电动车越来越重要。惯性感测器是电动汽车行业最常用的感测器之一。基于 MEMS 的加速计可以测量电动车的静态或动态振动加速度。类似地,基于 MEMS 的陀螺仪使用振动物体来识别角度的变化。

欧洲惯性系统产业概况

由于存在多种惯性系统解决方案供应商,欧洲惯性系统市场相当分散。然而,供应商一直专注于产品开发,以提高其知名度和存在感。此外,各公司正在建立策略联盟和进行收购以获得市场吸引力并扩大市场占有率。

- 2022 年 7 月-Honeywell和 Civitanavi Systems 宣布合作开发用于商业和国防应用的惯性测量单元 (IMU)、姿态和航向参考系统以及惯性导航系统。

- 2022 年 5 月 - ADI 公司 (ADI) 推出一款 3 轴 MEMS加速计,专为各种医疗保健和工业应用而设计,包括生命体征监测、助听器和运动测量设备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- MEMS技术的出现

- 国防和航太的成长趋势

- 导航系统的技术进步

- 市场限制

- 操作复杂,维护成本高

第六章 市场细分

- 按应用

- 民航

- 防御

- 消费性电子产品

- 车

- 能源基础设施

- 医疗

- 其他用途

- 按组件

- 加速计

- 陀螺仪

- IMU

- 磁力仪

- 姿态航向导航系统

- 其他组件

第七章 竞争格局

- 公司简介

- Honeywell Aerospace Inc.

- Northrop Grumman Corporation

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Thales Group

- Rockwell Collins Inc.

- Moog Inc.

- Fairchild Semiconductor(ON Semiconductors)

- VectorNav Technologies

- STMicroelectronics NV

- Safran Group(SAGEM)

- InvenSense Inc

- Meggitt PLC

8.供应商市场占有率分析

- 供应商地位分析(惯性系统)

- 供应商市场占有率(高端惯性系统)

- 供应商市场占有率(MEMS 产业)

第九章投资分析

第十章 市场潜力

简介目录

Product Code: 53635

The Europe Inertial Systems Market is expected to register a CAGR of 5.54% during the forecast period.

Key Highlights

- According to the ACEA, around 12.9 million motor vehicles are manufactured in the European Union annually. The automobile is one of the largest industries in Europe. A lot of technological innovations in the automobile industry occur in this area. Inertial sensors are an essential part of automobiles currently. They are used in various systems ranging from ABS to air-bag deployment and even in anti-theft features. The automotive industry growth in this region will help the inertial systems market to grow.

- The advancement of the global lifestyle has resulted in the need for equipment with greater ease of use. This has enabled motion-sensing technology, which uses inertial sensors extensively. This is a key driving factor in this market and will play an important role in defining the market for the next few years.

- Moreover, the unprecedented rise in unmanned vehicles in the region across various applications in both civilian and defense applications has also increased the need for complex navigational systems that include inertial sensors. The rapid advancement in technology has made sensors both accessible and affordable, making their use abundant in day-to-day devices.

- However, inertial navigation systems (INS) tend to have high failure rates and repair costs, resulting in high maintenance costs for these systems. Such factors might restrict the growth of the market.

- The Covid-19 pandemic significantly impacted the aerospace and defense industries in the region, with many companies in commercial aviation experiencing disruption in production and slowing demand owing to the lockdowns imposed during the initial months of the outbreak. However, the inclination of growth toward defense and aerospace post-pandemic, combined with the technological advancements in navigation systems, is expected to create a positive outlook for the market in the coming years.

Europe Inertial Systems Market Trends

Defense segment expected to account for a significant market

- Inertial systems utilize the outputs from accelerometers, gyroscopes, or magnetometers, to measure the motion and orientation of objects they are attached to on one, two, or three axes. These outputs can be used for various tactical and defense applications, including position tracking and navigation.

- Moreover, the IMU-equipped INS forms the backbone for the navigation and control of many military vehicles, such as crewed aircraft, missiles, submarines, etc. For defense applications, IMUs can be used for stabilization and control applications like aircraft flight surfaces, antenna and weapons platforms, and camera and sensor gimbals.

- The rising expenditures in defense in the region also create significant demand for the market. For instance, per the annual Defence Data report published by the European Defence Agency (EDA), total European defense spending reached a record high in 2021, marking a further 6% increase on the previous year and the seventh year of consecutive growth.

- Also, in September 2022, Collins Aerospace was awarded a multi-million-pound program as part of the United Kingdom's Weapons Sector Research Framework (WSRF) to develop a navigation-grade Inertial Measurement Unit (IMU) for use in future complex weapons platforms.

- In collaboration with the Defence Science Technology Laboratory (DSTL), Collins aimed to develop a tactical grade or 'Class A' IMU using Micro-Electro-Mechanical Systems (MEMS) technology to advance the UK's Ministry of Defence (MOD) initiatives. Used for guidance and navigation on a broad range of multi-domain platforms, the new MEMS-based IMU was expected to ensure the desired performance while targeting a smaller form factor and lower cost than the RLG (Ring Laser Gyro) and FOG (Fibre Optic Gyro) solutions.

Emergence of MEMS Technology will drive the Market

- Large size and high costs significantly constrained the large-scale adoption of inertial systems. There has been a paradigm shift in inertial systems manufacturing techniques after the turn of the century.

- The emergence of Micro Electro Mechanical Systems (MEMS) technology resulted in the miniaturization of mechanical and electro-mechanical elements in sensors and semiconductors through micro-fabrication and micro-machining techniques. MEMS has now become a fundamental part of future navigation systems.

- The growth in this technology has been driven by the growing pressure on contract manufacturers to reduce the size of inertial systems to make them suitable for broader applications. MEMS greatly supported the rapid increase in portable devices, as it offered enhanced capabilities within a small unit. The inertial MEMS market forecast predicts a dramatic rise in the volume of inertial MEMS devices over the coming years.

- The advancements in MEMS technology are not just restricted to niche and research-grade applications; several commercial-grade inertial systems have also been made available in the market. These devices are integrated with GPS-aiding tools to provide comprehensive navigation solutions.

- The surge in demand for electric vehicles in the region also creates significant opportunities for the market, as MEMS-based sensors are becoming increasingly essential for EVs. Inertial sensors are one of the most frequently used sensors in the EV industry. MEMS-based accelerometers can measure either static or dynamic vibration acceleration in EVs. Similarly, MEMS-based gyroscopes use vibrating objects and identify the change of angles.

Europe Inertial Systems Industry Overview

The Europe Inertial Systems Market is moderately fragmented due to the presence of various inertial systems solution providers. However, the vendors consistently focus on product development to enhance their visibility and presence. The companies are also undergoing strategic partnerships and acquisitions to gain market traction and increase their market share.

- July 2022 - Honeywell and Civitanavi Systems announced a collaboration to develop inertial measurement units (IMU), attitude heading reference systems and inertial navigation systems for commercial and defense applications.

- May 2022 - Analog Devices, Inc. (ADI) launched a three-axis MEMS accelerometer designed for various healthcare and industrial applications, including vital signs monitoring, hearing aids, and motion-enabled metering devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Inclination of Growth toward Defense and Aerospace

- 5.1.3 Technological Advancements in Navigation Systems

- 5.2 Market Restraints

- 5.2.1 Operational Complexity, coupled with High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Civil Aviation

- 6.1.2 Defense

- 6.1.3 Consumer Electronics

- 6.1.4 Automotive

- 6.1.5 Energy & Infrastructure

- 6.1.6 Medical

- 6.1.7 Other Applications

- 6.2 By Component

- 6.2.1 Accelerometer

- 6.2.2 Gyroscope

- 6.2.3 IMU

- 6.2.4 Magnetometer

- 6.2.5 Attitude Heading and Navigation System

- 6.2.6 Other Components

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell Aerospace Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Analog Devices Inc.

- 7.1.5 Thales Group

- 7.1.6 Rockwell Collins Inc.

- 7.1.7 Moog Inc.

- 7.1.8 Fairchild Semiconductor (ON Semiconductors)

- 7.1.9 VectorNav Technologies

- 7.1.10 STMicroelectronics NV

- 7.1.11 Safran Group (SAGEM)

- 7.1.12 InvenSense Inc

- 7.1.13 Meggitt PLC

8 Vendor Market Share Analysis

- 8.1 Vendor Positing Analysis (Inertial Systems)

- 8.2 Vendor Market Share (High-End Inertial Systems)

- 8.3 Vendor Market Share (MEMS Industry)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219