|

市场调查报告书

商品编码

1640423

战术惯性系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Tactical Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

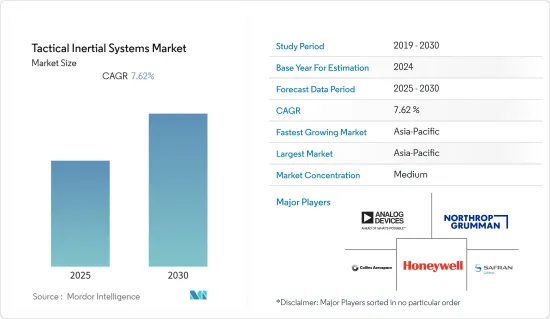

预计战术惯性系统市场在预测期间的复合年增长率为 7.62%。

主要亮点

- 战术惯性系统市场的成长主要受到契约製造製造商越来越大的压力,要求他们将惯性系统小型化,以适应广泛的战术性。

- MEMS 极大地支持了行动装置的快速普及,因为它们在小尺寸的单元中提供了增强的功能。战术惯性 MEMS 市场预测表明,未来五年惯性 MEMS 设备的数量将大幅增加。

- 近年来,无人驾驶飞机(有时称为无人驾驶飞行器 (UAV))的引入不断增加。这些飞行器在航太和国防领域有广泛的应用。惯性导航系统是此类车辆的重要组成部分。

- 然而惯性导航系统故障率较高,维修成本较高,导致系统维护成本较高。这些因素可能会限制市场成长。

- 新冠疫情对航太和国防工业产生了重大影响,许多商用航空业公司的停工导致生产中断和需求放缓。然而,疫情后国防和航太工业的成长倾向,加上导航系统的技术进步,预计将为未来几年的市场带来光明的前景。

战术惯性系统市场趋势

加速计预计将占据最大的市场占有率

- 传统的加速计是基于机械振动的原理。加速计的主要部件是一个由弹簧支撑的质量块。随着硅基产品和小型化技术的使用,加速计的结构迅速缩小。

- 目前市面上的 MEMS加速计由一个微观结晶结构组成,其顶部附有一个质量块,该质量块受到加速度力的作用并产生电压。

- 多年来,低频加速计在其应用领域已变得越来越流行。两家公司将利用 3D MEMS 技术,提供采用双列直插或双列扁平塑胶封装的加速器,并带有用于表面黏着技术和回流焊接焊接的引脚。它们采用硅胶进行环境保护,在潮湿环境和温度循环中提供卓越的性能和可靠性。

- 鑑于加速计在该行业的广泛应用,全球军事和国防费用的增加也是该领域发展的一个主要驱动力。例如,加速计通常用于测量爆炸的威力。它们也被纳入士兵佩戴和装甲车辆安装的设备中,可以量化爆炸力的影响。

- 此外,2022年3月,Honeywell推出了一款新型加速计-MV60电子机械系统 (MEMS)。 MV60 主要设计用于航太和国防应用,但也可用于工业和船舶应用,这些应用需要体积小、重量轻且运行时所需功率极小的高精度导航级加速计。

亚太地区占最大市场占有率

- 在目前的市场情况下,亚太地区是战术惯性系统最大的市场。由于中国、日本和印度等国家的产量很高,该地区对战术惯性系统的需求一直很强劲。

- 此外,这一成长是由于印度和中国等发展中经济体加大对国防领域的投资。中国和印度防务部门正在增加国防费用,并采购先进的军事用远程操作车辆。

- 此外,去年10月,印度国防部透露,计划透过快速通道程序在「购买(印度)」类别下采购106套惯性导航系统,并寻求印度积极参与采购过程。预计此类案例也将为市场提供强劲的成长动力。

- 此外,由于市场巨大的成长潜力,许多区域参与者正在扩大其产品线。例如,去年11月,日本Seiko Epson Corp.扩大了搭载高性能6轴感测器的惯性测量单元(IMU)的产品阵容,推出了新开发的标准型号「M-G366PDG」(M-G366)。型号“M-G330PDG”(M-G330)。

- 「M-G366」和「M-G330」可让您从「+-8G」和「+-16G」中选择加速度感测器的输出范围,并在整个输出范围内实现0.05%的非线性陀螺仪感测器,预计实现对运动的精确测量。

战术惯性系统产业概况

战术惯性系统市场的竞争适中。应用数量的增加、技术的进步以及航太和国防预算的增加是推动市场成长的主要因素。此外,对导引、控制、瞄准、精确导引弹药和其他武器的精度和校准的需求也在增加。

- 2022 年 12 月-Honeywell宣布已从其明尼阿波利斯製造工厂交付了第一百万个战术级惯性测量单元 (IMU)。这些 IMU 用途广泛,包括军事设备和无人机。

- 2022 年 9 月—柯林斯航空是英国武器领域研究框架(WSRF) 的一部分,这是一项耗资数百万英镑的计划,旨在开发导航级惯性测量单元(IMU),以用于未来复杂的武器平台。该合约要求该公司利用其(MEMS)技术打造战术级或「A 级」IMU。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 调查方法

- 研究阶段

第三章 市场分析

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

第四章 市场动态

- 市场驱动因素

- 国防和航太成长趋势

- 市场限制

- 操作复杂,维护成本高

第五章 技术简介

第六章 市场细分

- 按最终用户

- 航太和国防

- 海军陆战队/海军

- 依技术分类

- MEM

- 光纤陀螺仪 (FOG)

- 环形雷射陀螺仪 (RLG)

- 其他技术

- 按组件

- 加速计

- 磁力仪

- 陀螺仪

- 其他组件

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Analog Devices Inc.

- Northrop Grumman Corporation

- Safran Group(Colibrys Switzerland)Ltd

- Rockwell Collins Inc.

- Honeywell International Inc.

- Invensense Inc.(TDK Corporation)

- Ixbluesas

- Kearfott Corporation

- KVH Industries Inc.

- Thales Group

- Xsens Technologies BV

- Sparton Corporation

- Epson Europe Electronic

- Vector NAV

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 52801

The Tactical Inertial Systems Market is expected to register a CAGR of 7.62% during the forecast period.

Key Highlights

- The growth in the tactical inertial systems market is majorly driven by the increasing pressure on contract manufacturers to reduce the size of the inertial systems to make them suitable for a broad range of tactical applications.

- MEMS greatly supports the rapid increase in portable devices, as they offer enhanced capabilities within small unit sizes. The tactical inertial MEMS market forecast predicts a dramatic rise in the volume of inertial MEMS devices over the next five years.

- Also, recent years have seen an increasing deployment of aircraft that do not have a manned pilot on board, often termed unmanned aerial vehicles (UAV). These vehicles are finding widespread applications in the aerospace and defense sector. The inertial navigation system forms an essential component of such vehicles.

- However, inertial navigation systems tend to have high failure rates and repair costs, resulting in high maintenance costs for these systems. Such factors might restrict the growth of the market.

- The Covid-19 pandemic had a significant impact on the aerospace and defense industries, with many companies in commercial aviation experiencing disruption in production and slowing demand owing to the lockdowns imposed during the pandemic. However, the inclination of growth toward defense and aerospace post-pandemic, combined with the technological advancements in navigation systems, is expected to create a positive outlook for the market in the coming years.

Tactical Inertial Systems Market Trends

The Accelerometer Segment is Expected to Hold the Highest Market Share

- Traditional accelerometers were built on the principle of mechanical vibration. The principal components of an accelerometer are mass supported by springs. With the use of silicon-based products and miniaturization techniques, the accelerometer structure has shrunk rapidly.

- MEMS accelerometers sold in the current market scenario contain microscopic crystal structures with a mass attached to the top that gets stressed by accelerative forces, which causes a voltage to be generated.

- Over the years, low-g accelerators have gained traction for their applications. With the 3D MEMS technology, the companies offer accelerators assembled in a dual-in-line or dual-in-flat-line plastic package with pins for surface mount and re-flow soldering. They are environmentally protected with silicone gel, resulting in excellent performance and reliability in a humid environment and at temperature cycling.

- The rising military and defense expenditures worldwide also act as a critical driving force for the segment owing to the widespread use of accelerometers in this industry. For instance, accelerometers have been commonly used to measure explosions' power. They are also incorporated into soldier-worn and armored vehicle-mounted devices that can quantify the effects of explosive forces.

- Moreover, in March 2022, Honeywell launched a new accelerometer - its MV60 micro-electro-mechanical system (MEMS) - primarily designed for aerospace and defense but also has potential uses for industrial and marine applications that need high-precision, navigation-grade accelerometers that are small, lightweight and require little power to operate.

Asia-Pacific Accounts for the Largest Market Share

- Asia-Pacific is the largest market for tactical inertial systems in the current market scenario. The large production volume in countries such as China, Japan, and India keeps a constant demand for tactical inertial systems in the region.

- In addition, this growth is due to increased investment in the defense sector from growing economies, such as India and China. The defense sectors in China and India are increasing the defense spending and procurement of advanced remotely operated vehicles for military applications.

- Also, in October last year, the Ministry of Defence, Government of India revealed plans to procure 106 Inertial Navigation Systems through Fast Track Procedure under Buy (Indian) category and sought participation in the procurement process from prospective. Such instances are also expected to provide significant growth momentum to the market.

- Moreover, many regional players are expanding their product line due to the market's huge growth potential. For instance, in November last year, Japan-based Seiko Epson Corporation expanded its lineup of inertial measurement units (IMU) equipped with high-performance six-axis sensors by adding a newly developed standard model called the M-G366PDG (M-G366) and a basic model called the M-G330PDG (M-G330).

- The M-G366 and M-G330 are expected to allow the users to select an accelerometer output range of either +-8 G or +-16 G. Additionally, they offer 0.05% non-linearity in all output ranges of the gyroscopic sensors, enabling accurate measurement of movements.

Tactical Inertial Systems Industry Overview

The Tactical Inertial Systemes market is moderately competitive. Increasing applications, technological advancements, and rising aerospace and defense budgets primarily fuel the market's growth. Furthermore, the growth can be attributed to the increasing demand for accuracy and calibration in guidance, control and targeting, precision-guided armaments, and other weaponry.

- December 2022 - Honeywell announced that it had delivered its one millionth tactical-grade inertial measurement unit (IMU) from its manufacturing facility in Minneapolis. These IMUs are used in a wide range of applications, including military equipment and unmanned aerial vehicles.

- September 2022 - Collins Aerospace was awarded a multi-million-pound program as part of the United Kingdom's Weapons Sector Research Framework (WSRF) to develop a navigation grade Inertial Measurement Unit (IMU) for use in future complex weapons platforms. The agreement calls for constructing a tactical grade or 'Class A' IMU using the company's (MEMS) technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Methodology

- 2.2 Research Phases

3 MARKET ANALYSIS

- 3.1 Market Overview

- 3.2 Industry Attractiveness - Porter's Five Forces Analysis

- 3.2.1 Bargaining Power of Suppliers

- 3.2.2 Bargaining Power of Buyers

- 3.2.3 Threat of New Entrants

- 3.2.4 Threat of Substitute Products

- 3.2.5 Intensity of Competitive Rivalry

- 3.3 Value Chain Analysis

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Inclination of Growth in Defense and Aerospace

- 4.2 Market Restraints

- 4.2.1 Operational Complexity Coupled with High Maintenance Costs

5 TECHNOLOGY SNAPSHOT

6 MARKET SEGMENTATION

- 6.1 End User

- 6.1.1 Aerospace and Defense

- 6.1.2 Marine/Naval

- 6.2 Technology

- 6.2.1 MEMs

- 6.2.2 Fiber Optic Gyro (FOG)

- 6.2.3 Ring Laser Gyro (RLG)

- 6.2.4 Other Technologies

- 6.3 Component

- 6.3.1 Accelerometers

- 6.3.2 Magnetometers

- 6.3.3 Gyroscopes

- 6.3.4 Other Components

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle-East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Safran Group (Colibrys Switzerland) Ltd

- 7.1.4 Rockwell Collins Inc.

- 7.1.5 Honeywell International Inc.

- 7.1.6 Invensense Inc. (TDK Corporation)

- 7.1.7 Ixbluesas

- 7.1.8 Kearfott Corporation

- 7.1.9 KVH Industries Inc.

- 7.1.10 Thales Group

- 7.1.11 Xsens Technologies BV

- 7.1.12 Sparton Corporation

- 7.1.13 Epson Europe Electronic

- 7.1.14 Vector NAV

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219