|

市场调查报告书

商品编码

1640614

北美惯性系统:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)NA Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

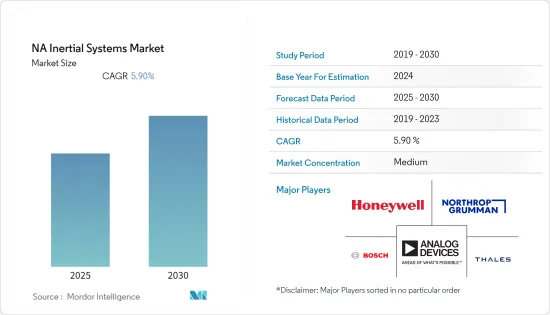

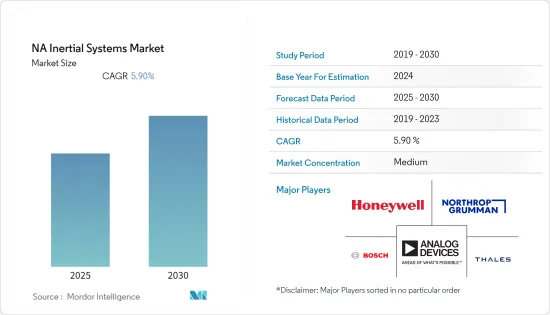

预计预测期内北美惯性系统市场复合年增长率为 5.9%。

主要亮点

- 惯性系统仪器包括陀螺仪、加速计、惯性测量单元、惯性导航系统和多轴感测器。本报告按应用领域对市场进行分类,并对每个领域内的每个部分进行详细分析。本文说明了航太、陆地、海洋和海底应用,并对每个领域进行了全面的市场分析。

- 美国是拥有潜水艇和军舰数量最多的国家之一。美国拥有约68艘潜舰和490多艘舰艇。美国也拥有建造船舶的大型造船厂。惯性系统对这些船舶和潜艇起着至关重要的作用。因此,由于国防部门潜艇和军舰产量的增加,以及贸易船舶的增加,惯性感测器市场预计在未来几年将会成长。

- 世界各地生活方式的改变使得对更易于使用的设备的需求日益增长,这使得大量使用惯性感测器的运动感应技术成为可能。这是推动市场发展的关键因素,并可能在未来几年发挥定义市场的关键作用。

- 北美惯性导航市场目前已经成熟。然而,对先进技术和低成本电子机械系统 (MEMS) 的需求正在推动市场成长。光纤陀螺仪(FOG)、环形雷射陀螺仪(RLG)和 MEMS 是该地区在航空、军事和海洋应用领域技术进步所采用的关键技术。

- 疫情导致商业活动暂时停止。流程中断导致系统零件短缺,并减少了石油储罐检查、管道检查、风力涡轮机检查和现场测绘等商务用无人驾驶车辆的需求。在封锁期间,全球各地的关键工业单位陷入停顿,影响了惯性导航系统组件的开发和市场成长。

北美惯性系统市场趋势

精度需求不断成长推动市场

- 高精度、高可靠性是此导航系统的最大特性。惯性导航系统与其他形式的导航系统相比具有明显的优势,因为它们不依赖外部辅助来确定运动物体的旋转和加速度。这些系统使用陀螺仪、加速计和磁力计的组合来确定车辆或移动物体的向量变数。

- 导航系统本质上适合用于具有挑战性的环境中车辆的综合导航、控制和引导。与GPS和其他类型的导航系统不同,惯性系统即使在困难的条件下也能保持其性能。惯性测量单元 (IMU) 非常适合计算导航系统的几个指标。这些系统不受辐射和干扰的影响。捷联惯性系统在惯性导航系统中比万向节系统更常用。由于采用了 MEMS 技术,因此它还具有成本效益。

- 随着人工智慧和机器学习等先进技术得到越来越广泛的应用,可使用感测器技术进行远端控制的先进无人驾驶汽车变得越来越普遍。无人水下航行器、无人飞行器和无人水面航行器正在采用这项新技术进行更新。在当今的战斗场景中,战术级装备的高度和方向等精确的位置参数至关重要。

- 惯性导航系统目前已商业性应用于民航机、无人机以及军事和防御单位。惯性导航系统是导航和控制系统不可分割的一部分。由于系统处理能力的不断进步,惯性导航系统还可以与其他导航系统互动。某些形式的惯性系统,例如磁力仪,广泛与其他惯性系统结合使用,以确定方向和磁场的存在。

- IMU 和 AHRS 等多轴系统用于确定移动车辆的高度、位置、加速度和速度。惯性系统结合了加速计、陀螺仪和磁力仪,使其成为为导航系统提供高精度的理想选择。

先进 IMU 的出现将推动市场成长

- IMU 在军事行动中的使用,尤其是无人驾驶飞行器 (UAV),正在促使各公司为这项技术开发先进的解决方案。因此,下一代 IMU 现在已在市场上广泛普及。例如,EMCORE 的 Systrom Donor Inertial 为可在极端气候下运作的无人机製造固态电子机械系统 (MEMS) IMU。

- SBG Systems 成立于法国,生产和销售用于无人机的 MEMS 惯性感测器。 Ellipse 2 Micro系列是该公司最小、最轻的IMU,旨在为无人系统提供精确的位置资料。惯性感测器技术的突破正在扩大IMU市场范围并加速其成长。

- 此前,汽车领域的IMU感测器仅限于导航系统。同时,汽车 IMU 感测器现在正用于各种其他车载应用,这需要更强大、性能更高、尺寸更小的感测器。因此,供应商正在努力满足不断变化的行业需求。

- ADAS 和安全气囊等系统的需求是推动汽车 IMU 感测器市场成长的主要因素。汽车安装 ADAS 系统是为了减少可能导致驾驶事故的人为错误。 ADAS 在长途旅行中尤其有用,因为疲劳是导致事故的主要原因。

- 预计美国和加拿大等新兴国家将成为最大的 ADAS 市场。汽车安装安全气囊是为了在发生事故时保护车内人员。这些安全气囊由安全气囊控制单元控制,该单元接收来自各种感测器的资料,包括车辆的 IMU 感测器。

北美惯性系统产业概况

北美惯性系统市场相当分散,存在各种惯性系统解决方案提供者。然而,供应商一直专注于产品开发,以提高其知名度和存在感。此外,各公司正在建立策略联盟和进行收购以获得市场吸引力并扩大市场占有率。

- 2023 年 2 月 - SBG Systems 宣布推出 Quanta Plus,这是一款以OEM形式提供的新一代 GNSS 辅助惯性导航系统 (INS)。该系统将战术级 MEMS IMU 与高性能 GNSS接收器相结合,即使在没有 GNSS 的环境中也能提供准确的位置和姿态资料。对于基于无人机的测量系统,Quanta Plus 可以轻鬆与 LiDAR 和其他第三方感测器整合。

- 2022 年 7 月 - Inertial Labs 推出了一款全新的 AI 平台,旨在为地面车辆驾驶人和机组人员提供高精度的位置、导航、时间、速度和航向信息,无论是在启用GNSS 还是未启用GNSS的环境中。该系统采用战术级基于 MEMS 的惯性测量单元 (IMU) 和多卫星群、多频率 GNSS 接收器,透过即时移动地图技术提供持续的情境察觉。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- MEMS技术的出现

- 国防和航太的成长趋势

- 导航系统的技术进步

- 市场限制

- 操作复杂,维护成本高

第六章 市场细分

- 按应用

- 民航

- 防御

- 家用电子电器

- 车

- 能源和基础设施

- 医疗

- 其他用途

- 按组件

- 加速计

- 陀螺仪

- IMU

- 磁力仪

- 姿态航向导航系统

- 其他组件

- 地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Honeywell Aerospace Inc.

- Northrop Grumman Corporation

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Thales Group

- Rockwell Collins Inc.

- Moog Inc.

- Fairchild Semiconductor(ON Semiconductors)

- VectorNav Technologies

- STMicroelectronics NV

- Safran Group(SAGEM)

- InvenSense Inc.

- Meggitt PLC

8.供应商市场占有率分析

- 供应商地位分析(惯性系统)

- 供应商市场占有率(高端惯性系统)

- 供应商市场占有率(MEMS 产业)

第九章投资分析

第十章 市场潜力

简介目录

Product Code: 55720

The NA Inertial Systems Market is expected to register a CAGR of 5.9% during the forecast period.

Key Highlights

- Inertial system equipment includes gyroscopes, accelerometers, inertial measurement units, inertial navigation systems, and multi-axis sensors. The report segments the market by area of application with an in-depth analysis of every segment in each area. Aerospace, land-based, marine, and sub-sea applications are explained with a comprehensive market analysis of each segment.

- The United States has one of the highest numbers of submarines and warships. It has around 68 submarines and more than 490 ships with the US Navy. It is also home to big shipping yards that make ships. Inertial systems are key to these ships and submarines. Thus, with the growing production of submarines and warships for the defense sector and ships for increasing trade, the inertial sensors market is estimated to grow in the coming years.

- The changes in lifestyles worldwide have resulted in the need for equipment with greater ease of use, enabled by the use of motion-sensing technology, which uses inertial sensors extensively. It is a key driving factor in the market and will play an important role in defining the market for the next few years.

- The North American inertial navigation market is now mature. However, the advanced technology and demand for low-cost micro-electro-mechanical systems (MEMS) are boosting the market's growth. The Fiber Optic Gyro (FOG), Ring Laser Gyro (RLG), and MEMS are the major technologies adopted in the region for technological advancements in aviation, military, and marine applications.

- Commercial operations have been temporarily halted due to the pandemic. Due to the disturbance in the process, system components are in short supply, and demand for unmanned vehicles for commercial operations such as oil tank testing, pipeline inspection, windmill inspection, and field mapping is down. Vital industrial units worldwide were shut down during the lockdown, which had an impact on the development of inertial navigation system components and the market's growth.

North America Inertial Systems Market Trends

Increasing Demand in Accuracy to Drive the Market

- A high level of accuracy and reliability are the prime features of a navigational system. Inertial navigational systems have a distinct advantage over other forms of navigation systems in terms of their lack of dependence on external aids to determine the rotation and acceleration of a moving object. These systems use a combination of gyroscopes, accelerometers, and magnetometers to determine the vector variables of a vehicle or a moving object.

- Navigational systems are inherently suited for use in integrated navigation, control, and guidance of vehicles in challenging environments. Unlike GPS and other kinds of navigation systems, inertial systems can retain their performance even under difficult conditions. Inertial measurement units (IMU) are well suited to calculate several metrics for navigational systems. These systems remain unaffected by radiation and jamming problems. Strapdown inertial systems find more usage in inertial navigation systems than gimbaled systems, as they are strapped to the moving object and offer better reliability and performance. They also provide cost-effectiveness as they are incorporated with MEMS techniques.

- As advanced technologies such as AI and machine learning become more widely adopted, advanced robotics cars that can be controlled remotely via sensor technology are becoming more common. Unmanned underwater vehicles, unmanned aerial vehicles, and unmanned ground vehicles are being updated with this new technology. In today's battle scenario, accurate position parameters, such as altitude and orientation of tactical-grade equipment, are important.

- Inertial navigation systems are now available for commercial use in private aircraft, UAVs, and military and defense units. They form an integral part of the navigational control systems. They can also interact with other navigational systems due to incremental advancements in the processing ability of the systems. Several forms of inertial systems, like magnetometers, are widely used to determine the orientation and presence of a magnetic field in conjunction with other inertial systems.

- Multi-axis systems like IMUs and AHRS are used to determine moving objects' altitude, position, acceleration, and velocity. Inertial systems are ideal for providing high accuracy in navigational systems by combining accelerometers, gyroscopes, and magnetometers.

Availability of Advanced IMUs to Favor Market Growth

- IMUs in military operations, particularly in unmanned aerial vehicles (UAVs), have spurred companies to develop advanced solutions for this technology. As a result, next-generation IMUs are widely available on the market. For example, EMCORE's Systron Donner Inertial makes solid-state micro-electromechanical systems (MEMS) IMUs for drones that can function in extreme climates.

- SBG Systems, established in France, creates and sells MEMS-driven inertial sensors for unmanned vehicles. The Ellipse 2 Micro Series is the company's smallest and lightest IMU, designed to give precise location data for unmanned systems. Such breakthroughs in inertial sensor technologies are broadening the scope and speeding up the growth of the IMU market.

- Previously, IMU sensors in the car sector were limited to navigation systems. On the other hand, the current use of automotive IMU sensors in various other automotive applications has necessitated the need for more robust sensors with high performance and small size. As a result, suppliers are attempting to meet the industry's ever-changing demands.

- The demand for systems like ADAS and airbags is a major driver of the automotive IMU sensors market's growth. ADAS systems are placed in cars to decrease human errors that might cause driving accidents. ADAS is especially useful for long rides when weariness is the leading cause of accidents.

- Developed countries, such as the United States and Canada, are expected to be the biggest ADAS markets. Airbags are included in automobiles to protect the occupants in the event of an accident. These airbags are controlled by an airbag control unit, which receives data from various sensors, including automotive IMU sensors.

North America Inertial Systems Industry Overview

The North American inertial systems market is moderately fragmented due to the presence of various inertial systems solution providers. However, vendors consistently focus on product development to enhance their visibility and presence. The companies are also undergoing strategic partnerships and acquisitions to gain market traction and increase their market share.

- February 2023 - SBG Systems released the Quanta Plus, a next-generation GNSS-aided inertial navigation system (INS) in OEM form. The system combines a tactical-grade MEMS IMU with a high-performance GNSS receiver to provide accurate position and attitude data even in GNSS-denied environments. In UAV-based survey systems, Quanta Plus is easily integrated with LiDAR or other third-party sensors.

- July 2022 - Inertial Labs released the CheetahNAV, a tactical-grade GNSS-Aided Inertial Navigation System (INS) designed to provide high-accuracy position, navigation, time, velocity, and orientation information to ground vehicle drivers and crews in both GNSS-enabled and GNSS-denied environments. The system includes a tactical-grade MEMS-based Inertial Measurement Unit (IMU) and an embedded multi-constellation and multi-frequency GNSS receiver and provides continuous situational awareness information via real-time moving map technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Inclination of Growth Toward Defense and Aerospace

- 5.1.3 Technological Advancements in Navigation Systems

- 5.2 Market Restraints

- 5.2.1 Operational Complexity and High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Civil Aviation

- 6.1.2 Defense

- 6.1.3 Consumer Electronics

- 6.1.4 Automotive

- 6.1.5 Energy and Infrastructure

- 6.1.6 Medical

- 6.1.7 Other Applications

- 6.2 By Component

- 6.2.1 Accelerometer

- 6.2.2 Gyroscope

- 6.2.3 IMU

- 6.2.4 Magnetometer

- 6.2.5 Attitude Heading and Navigation System

- 6.2.6 Other Components

- 6.3 Geography

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell Aerospace Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Analog Devices Inc.

- 7.1.5 Thales Group

- 7.1.6 Rockwell Collins Inc.

- 7.1.7 Moog Inc.

- 7.1.8 Fairchild Semiconductor (ON Semiconductors)

- 7.1.9 VectorNav Technologies

- 7.1.10 STMicroelectronics NV

- 7.1.11 Safran Group (SAGEM)

- 7.1.12 InvenSense Inc.

- 7.1.13 Meggitt PLC

8 Vendor Market Share Analysis

- 8.1 Vendor Positing Analysis (Inertial Systems)

- 8.2 Vendor Market Share (High-End Inertial Systems)

- 8.3 Vendor Market Share (MEMS Industry)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219