|

市场调查报告书

商品编码

1640366

欧洲位置分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

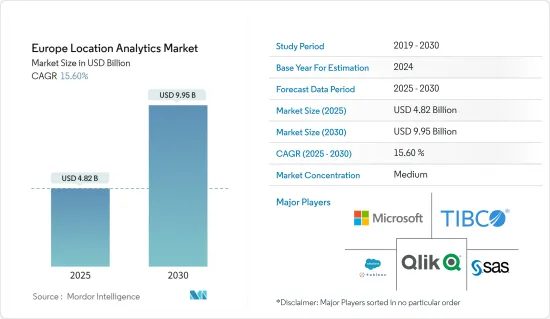

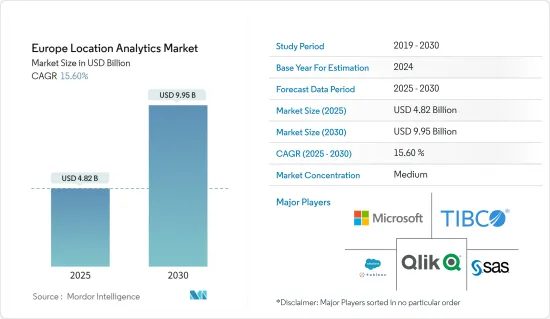

预计 2025 年欧洲位置分析市场规模为 48.2 亿美元,到 2030 年将达到 99.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.6%。

地理空间资料分析为资料添加位置和时间特征,使其更易于理解。位置分析提供可操作的信息,帮助公共和企业部门识别模式并做出战略决策。该地区的位置分析可能在城市规划、交通、自然灾害和公园保护等重要领域发挥作用。

主要亮点

- 随着人工智慧 (AI) 和机器学习 (ML) 的发展,位置分析市场预计将获得进一步发展。欧洲永续经济成长的下一个重大机会将来自其在太空卫星群的领导地位以及「欧洲数位策略」和「地球目的地」等国家倡议。因此,这些技术将用于非洲大陆都市区的空间发展。

- 随着 5G 的引入,准确的位置追踪得到了改善。 5G位置资讯透过使用毫米波和波束成形提高了准确性,从而提高了资料库指纹解析度。这也改善了室内地图绘製。使用者可以获得许多类型基础设施的 3D 室内地理空间视图,包括礼堂、机场、音乐厅、剧院、工厂、政府和公共建筑、购物中心和其他零售设施。人们也注意到,点级分配比位址级地理编码具有优势。

- 2023 年 8 月,欧洲测绘、地籍和土地登记机构的非营利协会欧洲地理协会 (EuroGeographics) 和国际製图协会 (ICA) 的成员建立了新的伙伴关係,以强调位置资讯的影响。高品质和可靠性是欧洲地理协会作为欧洲具有高公共价值的地理空间资讯国家权威机构会员资格的核心价值。

- 为了减轻 COVID-19 疫情的影响,欧洲资料保护委员会 (EDPB) 发布了接触者追踪软体和位置资料的使用指南。所有数位干预措施均受欧洲资料保护框架的约束,这意味着欧盟国家和当局在创建追踪工具或为 COVID-19 相关目的收集资料时有权依法采取行动。 。这些政府法规可能会对所研究的市场产生正面影响。

- 安全问题和隐私正在抑制市场成长。任何具有吸引人的用户介面的行动应用程式都可以随时提供有关用户位置的重要资讯。谷歌和其他重要的内容传送服务已明确表示他们不保留位置资讯。儘管如此,资料外洩仍然存在可能并可能导致危险的情况。

欧洲位置分析市场趋势

云端运算是市场驱动因素之一

- 云端处理系统非常适合智慧定位等动态应用,因为资料不断变化且容量可扩展。位置资料和影像的数量和复杂性需要更多的容量和频宽。

- 目前,80%的保险业务资料包含位置资讯。随着企业收集和保留越来越多的资料,对 GIS 的需求也迅速成长。借助灵活、可扩展、云端基础智慧定位以及按需解决方案的无限处理能力,保险公司现在可以解决以前无法解决的挑战。

- 本公司采用「计量收费」的云端处理服务订阅模式,该模式基于固定费率或系统使用情况。没有长期的软体授权合约或硬体资本投资,2023 年 10 月,亚马逊网路服务推出了AWS 欧洲主权云端。 AWS 欧洲主权云是面向欧洲的全新主权云,为受到严格监管的行业和公共部门客户提供更多选择和灵活性,以满足欧盟 (EU) 不断变化的资料驻留和弹性要求。 AWS 欧洲主权云端可让所有客户建立的元资料保留在欧盟境内。

- 由于云端处理的灵活性和扩充性,智慧定位解决方案可供无限数量的人使用。云端架构也透过全天候社群运算实现智慧协作,不受地点和时间的限制。 2023 年 7 月,云端基础智慧定位平台 Addresscloud 与地理空间资料和 AI 解决方案供应商 Skyblu 合作,为保险公司提供整个欧洲当地地址级风险资料。

零售是市场驱动因素之一

- 电子商务的成长给线下零售商带来了一些挑战。疫情期间,人们更喜欢网路购物,因此实体店重新开业后客流量有所下降。看来,如果企业想要在这场变革中生存下来,就需要更加关注并在合适的位置进行投资。透过专注于表现不佳的商店和市场,使用位置追踪软体的零售商可以了解其业务的哪些领域可以从进一步投资中受益。

- 远程办公的兴起以及人们在家中度过更多时间的现象导致了本地电子商务的成长。零售商可能会对订单履行进行大量投资。由于最后一哩配送和路边取货服务的流行,消费者越来越多地选择在线订购。这些服务的成功需要整合位置分析等技术。

- 据德国零售商贸易协会德国零售协会(HDE)称,55%的德国零售商打算在2022年的调查期间优先考虑行销和客户维繫工作。在预测期内,预计对行销、商业设备和电子商务的关注将推动市场发展,并使位置分析公司能够提供新的解决方案来满足客户需求。

- 汽车产业是另一个因智慧创新而蓬勃发展的产业,联网汽车成为该产业快速数位化的下一阶段。汽车零售商也开始评估位置分析。 Mavi 开发的 OnMyWay 应用程式可将精选的购物内容传送到客户的汽车仪表板上。 OnMyWay 支援付款的联网汽车的定位、订购、产品推荐、付款和取车协调功能满足了客户对即时购买的期望。

欧洲位置分析产业概况

由于公司数量众多,欧洲位置分析市场竞争适中。为了实现产品多样化、扩大地理范围并最终保持市场竞争力,公司正在实施产品创新、合併和收购等方法。

2022 年 1 月,麦当劳德国公司与柏林位置智慧定位新兴企业Targomo 合作,进一步在德国扩张。公司与人工智慧定位专家合作,深入了解事件并找出背后的原因。同样,此次合作也可能有助于麦当劳找到适合新店开幕的位置。

2022 年 4 月,房地产顾问公司 Reno 与欧洲领先的基于位置的公司 Place Sense 合作。 Place Sense 可以协助进行位置选择、房地产估价、租户组合、与竞争对手进行对标、衡量行销和广告活动等。

2022 年 12 月,OneSoil 与 Mapbox 合作推出了 OneSoil Map,这是资料视觉化和地图解决方案,使农民能够快速地视觉化和分析他们的田地。 OneSoil 测量和分析田间变异性,并制定自订的种子、肥料和喷药处方笺,以帮助农民获得更高的利润并保护环境。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 各行业越来越多地使用空间资料和分析

- 消费者对基于位置的应用程式的偏好日益增加

- 市场限制

- 资料隐私问题和日益严格的监管

第六章 市场细分

- 依地点类型

- 室内的

- 户外的

- 按部署

- 云

- 本地

- 按最终用户

- BFSI

- 零售

- 运输和物流

- 旅游与饭店

- 卫生保健

- 其他最终用户

- 按国家

- 德国

- 英国

- 法国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- SAS Institute Inc.

- Tableau Software LLC(Salesforce)

- TIBCO Software Inc.

- QlikTech International AB

- Google LLC

- TomTom International BV

- Esri Technologies Ltd

- HERE Technologies

- Alteryx Inc.

- Cisco Systems Inc.

- SAP SE

- Pitney Bowes Inc.

- Hexagon AB

- IBM Corporation

- Galigeo

- CleverAnalytics AS

- Lepton Software

第八章投资分析

第九章:市场的未来

The Europe Location Analytics Market size is estimated at USD 4.82 billion in 2025, and is expected to reach USD 9.95 billion by 2030, at a CAGR of 15.6% during the forecast period (2025-2030).

Geospatial data analytics, it adds features of place and time to data to make it more understandable. Location analytics is actionable information that assists both the public and corporate sectors in identifying patterns and making strategic decisions. Location analytics in the region would help in critical sectors such as urban planning, transportation, natural disasters, and park preservation, to name a few.

Key Highlights

- The location analytics market is anticipated to gain more traction with the development of Artificial Intelligence(AI) and Machine Learning (ML). The next major potential for Europe's sustainable economic growth will come from its dominance in space constellations and national efforts like Digital Strategy Europe and Destination Earth. Hence these technologies will be used in the spatial development of urban areas of the continent.

- Accurate location tracking has improved with the introduction of 5G. 5G location delivers improved precision and permits a higher fingerprint resolution in the database thanks to its usage of millimeter waves and beamforming. This has also improved indoor mapping. Users can get 3D indoor geospatial views of many infrastructure types, including auditoriums, airports, music halls, theaters, factories, buildings housing the government and the general public, malls, and other retail establishments. Also, it was noted, Point-level assignments provide advantages over address-level geocoding.

- In August 2023, Members of EuroGeographics, a non-profit organization for European National Mapping, Cadastral and Land Registration agencies, and the International Cartographic Association (ICA) established a new partnership to emphasize the impact of location. High quality and dependability are the core values of members of EuroGeographics, serving as the national authority for Europe's official high-value geospatial information.

- To lessen the COVID-19 pandemic's effects, the European Data Protection Board (EDPB) published guidelines for using contact tracking software and location data. All digital interventions are covered by Europe's data protection framework, which implies that EU nations and authorities must adhere to legal requirements while creating tracing tools or collecting data for COVID-19-related objectives. Such government regulations would have favorably impacted the market under investigation.

- Security Concerns and privacy are restraining the market growth. Every mobile app with an engaging user interface can provide the user with important information about his whereabouts at all times. Google and other crucial content delivery services are extremely clear about not keeping location information. Nonetheless, a data breach is still possible, which can lead to dangerous circumstances.

Europe Location Analytics Market Trends

Cloud Segment is One of the Factors Driving the Market

- Cloud computing systems are perfect for dynamic applications like Location Intelligence because the data is always changing, and capacity is scalable. More capacity and bandwidth are necessary due to the sheer volume and increasing complexity of location data and images.

- Nowadays, a location component is present in 80% of insurance business data. The need for GIS increases quickly as businesses collect and retain more data. Insurance companies may now address challenges that were previously out of their grasp thanks to the flexible and scalable cloud-based Location Intelligence solutions and the unlimited processing capacity of on-demand solutions.

- Businesses use "pay-as-you-go" subscription models for cloud computing services based on flat rates or system utilization. No long-term software license agreements or capital hardware investments are necessary, and also in October 2023, Amazon Web Services launched AWS European Sovereign Cloud. AWS European Sovereign Cloud would be a new, independent cloud for Europe that offers customers in highly regulated industries and the public sector further choice and flexibility to address evolving data residency and resilience requirements in the European Union (EU). AWS European Sovereign Cloud would allow customers to keep all metadata they create in the EU

- Location intelligence solutions can be accessed by an infinite number of people because of the flexibility and scalability of cloud computing. The cloud architecture also makes intelligent collaboration possible through round-the-clock community computing anywhere and in any time zone. In July 2023, Cloud-based location intelligence platform Addresscloud has partnered with geospatial data and AI solutions provider Skyblu to provide insurers access to address-level perils data for locations across mainland Europe.

Retail is One of the Factors Driving the Market

- The growth of e-commerce has presented several difficulties for offline retailers. Foot traffic in physical stores decreased following the resumption of business, as people preferred shopping online during the pandemic. Companies will need to invest in the correct location for their operations with greater attention if they want to survive this change. By spotlighting underperforming stores and marketplaces, retailers who use location-tracking software will learn which business areas can benefit from further investment.

- The rise of teleworking and people spending more time at home gained local e-commerce. Retailers will be making massive investments toward order fulfillment. Online orders from consumers are increasing due to the popularity of last-mile delivery and curbside pickup services. Integration of technologies like Location Analytics will be necessary to ensure the successful implementation of these services.

- For the research period of 2022, 55% of German retailers intended to prioritize marketing and customer retention initiatives, according to the German Retail Association (HDE), the trade association for German retailers. Over the projected period, it is anticipated that a focus on marketing, business equipment, and e-business would propel the market under study and enable location analytics companies to provide fresh solutions to cater to client wants.

- Automotive is another industry that is thriving with smart innovation as connected cars become the next phase of the industry's rapid digitalization. Retailers of automobiles are also beginning to value location analytics. OnMyWay App, which Mavi created, offers curated shopping to the dashboard of client automobiles. The location, ordering, product recommendations, payment, and pickup coordination capabilities of connected cars with OnMyWay payment capabilities satisfy the expectations of customers making an immediate purchase.

Europe Location Analytics Industry Overview

Due to the existence of numerous companies, the European location analytics market is moderatley competitive. To diversify their product offerings, broaden their geographic reach, and ultimately maintain their competitiveness in the market, the businesses are implementing methods including product innovation, mergers, and acquisitions.

In January 2022, McDonald's Germany teamed with Berlin-based location intelligence startup Targomo to expand further in the country. Companies collaborate with AI location experts to gain insight into the event and identify the reason behind the event. Similarly, this tie-up will help McDonald's to recognize favorable locations for the new establishment.

In April 2022, Real estate consultancy, Reno, partnered with Place Sense, the top location-based company in Europe. Place Sense can help with location selection, property value assessment, tenant mix, benchmarking against rivals, marketing and advertising activity measurement, and more.

In December 2022, OneSoil partnered with Mapbox to launch OneSoil Map, a data visualization and mapping solution that helps farmers quickly visualize and analyze fields.OneSoil measures and analyzes field variability and creates prescriptions for custom seed, fertilizer, and chemical applications, helping farmers achieve higher profits and environmental protection.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Spatial Data and Analytics in Various Industries

- 5.1.2 Growing Propensity of Consumers Toward Applications that Use Location Data

- 5.2 Market Restraints

- 5.2.1 Data Privacy Issues and Growing Regulations

6 MARKET SEGMENTATION

- 6.1 By Location Type

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Retail

- 6.3.3 Transportation and Logistics

- 6.3.4 Tourism and Hospitality

- 6.3.5 Healthcare

- 6.3.6 Other End User

- 6.4 By Country

- 6.4.1 Germany

- 6.4.2 United Kingdom

- 6.4.3 France

- 6.4.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 SAS Institute Inc.

- 7.1.3 Tableau Software LLC (Salesforce)

- 7.1.4 TIBCO Software Inc.

- 7.1.5 QlikTech International AB

- 7.1.6 Google LLC

- 7.1.7 TomTom International BV

- 7.1.8 Esri Technologies Ltd

- 7.1.9 HERE Technologies

- 7.1.10 Alteryx Inc.

- 7.1.11 Cisco Systems Inc.

- 7.1.12 SAP SE

- 7.1.13 Pitney Bowes Inc.

- 7.1.14 Hexagon AB

- 7.1.15 IBM Corporation

- 7.1.16 Galigeo

- 7.1.17 CleverAnalytics AS

- 7.1.18 Lepton Software