|

市场调查报告书

商品编码

1640415

资料中心冷却:市场占有率分析、产业趋势与统计、成长预测(2025-2031)Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

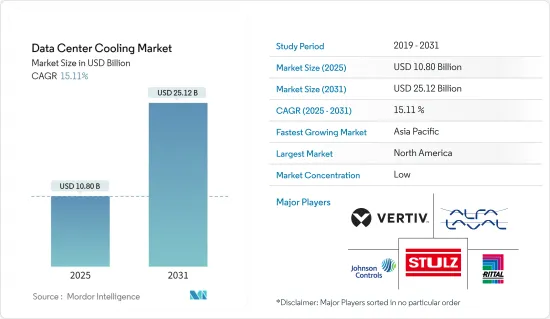

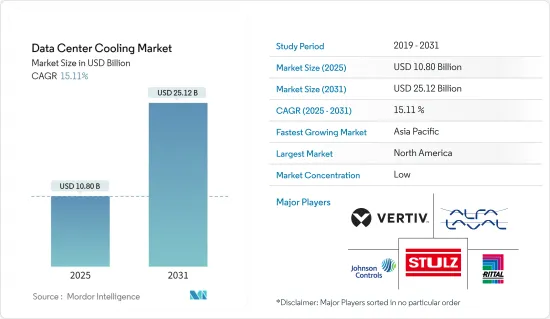

资料中心冷却市场规模预计在 2025 年为 108 亿美元,预计到 2031 年将达到 251.2 亿美元,预测期内(2025-2031 年)的复合年增长率为 15.11%。

主要亮点

- 人工智慧和媒体应用的高运算需求正在推动全球资料中心的部署。这些资料中心消耗大量电力并产生大量热量,进一步增加了对各种高效冷却系统的需求。

- 随着数位化的提高导致电脑效能的提高以及对更多整合式小型晶片的需求,资料中心冷却市场预计将大幅成长。资料中心的设计和冷却需求主要由用于 AI 工作负载的强大电脑硬体驱动。製造商正在推出更大的硅晶片,以优化人工智慧和高效能运算工作负载的效能。人工智慧和高效能运算环境中强大的GPU的使用凸显了资料中心对冷却技术的需求。

- OTT 和串流媒体服务的使用日益增长导致资料增加,从而刺激了市场发展。此外,Disney+Hotstar、Hulu和Netflix等线上串流服务的资料消耗增加预计将推动资料中心冷却系统的需求。

- 市场参与者正致力于扩大其全球企业发展和服务范围,以增加消费群。例如,2024 年 3 月,智慧电源管理公司伊顿宣布了一项北美扩展计划,为希望快速满足机器学习、边缘运算和人工智慧日益增长的需求的组织提供创新的模组化资料中心解决方案。宣布将于2024 年3 月发布在伊顿的 SmartRack 模组化资料中心主要将 IT 机架与冷却和服务机柜结合,为设备负载高达 150kW 的关键 IT 设备创建效能最佳化的资料中心解决方案。

- 预计该市场的成长将受到对多功能适应性需求的不断增长和全球电力短缺的阻碍。此外,使用效率低下的冷却系统设计(例如过时的基础设施和不理想的布局)会导致能源效率降低和营运成本增加,而能源价格上涨会使冷却成本过高。因素之一时期。

资料中心冷却市场趋势

资讯科技和通讯领域有望实现最高成长

- 资讯科技产生的资料的急剧增长需要高效的资料中心,这反过来又推动了对先进冷却解决方案的需求。随着资料中心不断扩展以适应日益增长的工作负载和储存需求,产生的热量成为一个重大问题,从而产生了对有效冷却解决方案的需求。

- 云端储存的采用率每年都在增加。为了提供更有效率的工作流程,微软、AWS 和Google等云端储存供应商正在扩大云端中可用的储存量。这些公司正在投资超大规模交易。因此,由于云端储存供应商能够增加容量,软体即服务 (SaaS) 的扩展预计将增加对资料中心冷却系统的需求。

- 浸入式冷却可采用单相或双相解决方案。单相浸入式冷却将伺服器置于封闭的底盘中,并允许机架安装或独立设计。另一方面,双相浸入式冷却将伺服器浸入液体中,但液体在冷却过程中会发生变化。当液体升温和凝结时,水迴路和热交换器会带走热量。透过 2P 浸入式冷却,容纳伺服器的金属储存罐内的介电冷却液在安全的冷却系统中沸腾和冷凝,大大提高了传热效率。

- 2023 年 5 月,KT Cloud 与瑞士液体冷却解决方案供应商 Immersion 4 签署协议,在 KT Cloud 的资料中心引进下一代浸入式冷却技术。浸入式冷却是将资讯和通讯技术设备浸入不导电的介电溶液中来去除热量。这消除了资料中心伺服器机房中风冷系统可能出现的温度不平衡和风扇噪音。

亚太地区将迎来显着成长

- 预计亚太地区将在预测期内实现最快的成长率,这主要归功于网路基础设施的快速发展。该地区面临日益增长的资料生成需求,尤其是印度和中国等国家,这些国家的政府政策正在推动节能基础设施的发展。此外,人工智慧冷却管理和液体冷却系统等技术进步正在改变游戏规则并推动该地区的进一步应用。

- 中国和日本是最重要的国家之一,预计将凭藉物联网、机器学习和人工智慧等领域的持续技术创新和发展,大幅推动市场成长机会。此外,这些国家的资料中心数量正在迅速增长,政府在全部区域推行的绿色基础设施政策也推动了这些资料中心更好、更有效率的冷却。

- 例如,2024 年 4 月,在亚洲营运和开发高效能资料中心的公司 GDS 和专注于亚太房地产市场和其他高门槛全球市场的私募股权基金管理人 Gaw 宣布他们已经收购了GDS 100%的股份。 Capital Capital Partners已与GDS达成策略伙伴关係关係,将在日本东京建置一个40兆瓦(MW)的资料中心园区。

- 亚太地区的资料中心冷却市场主要受到资料消费和云端服务的快速成长的推动。随着企业扩展其数位基础设施,对高效冷却系统以维持最佳动作温度的需求也日益增加。此外,有关能源效率和环境永续性的严格法规正在推动创新冷却技术的采用。新兴经济体正在大力投资IT基础设施,对可靠、扩充性的冷却解决方案的需求进一步推动了市场的成长。

- 2023 年 12 月,澳洲云端服务供应商ResetData 开设了一个用于开拓性液冷资料中心和伺服器技术的测试和模拟实验室。这是亚太地区首批能够在液冷环境中试验工作负载的设施之一。此举使本地企业能够享受更生态和高效能的基础设施即服务(IaaS),这对于人工智慧和机器学习等要求苛刻的应用程式至关重要。

资料中心冷却产业概况

资料中心冷却市场在主要产业参与者之间的整合程度较低。着名的市场领导包括 Stulz GmbH、Alfa Laval AB、Schneider Electric SE、Johnson Controls Inc.、Vertiv Group Corp. 和 Asetek A/S。凭藉显着的市场占有率,这些行业巨头正在积极致力于扩大其在该全部区域的基本客群。他们的成长策略主要依靠旨在增加市场占有率和整体盈利的策略合作。此外,施耐德电机、江森自控和三菱电机欧洲公司等公司也提供液体和空气冷却产品。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 冷却的主要成本考量

- 从直流冷却角度分析与直流营运相关的主要成本开销

- 根据设计复杂性、PUE、优点、缺点和自然天气条件下的使用范围等关键因素,对每种冷却技术的成本和营运考虑进行比较研究

- 资料中心冷却的关键创新和发展

- 资料中心采用的主要节能技术

第五章 市场动态

- 市场驱动因素

- 全球范围内人工智慧和 HPC 工作负载的快速数位化和普及

- 绿色资料中心的出现

- 市场挑战

- 成本、调适要求和停电

- 全球供应链中断

- 市场机会

- 数位经济的成长与重点地区政府支持力道的加大

- 产业生态系统分析

第六章:全球资料中心现状

- 资料中心 IT 负载能力与麵积足迹分析(2017-2030)

- 目前全球资料中心热点及未来扩展前景分析

- 重点区域领先资料中心建置商及营运商分析

7. 印尼资料中心市场细分

- 按冷却技术

- 空气冷却

- 冷却器和节热器

- CRAH

- 冷却塔(涵盖直接冷却、间接冷却、两级冷却)

- 其他空气冷却技术

- 液体冷却

- 浸入式冷却

- 晶片间直接冷却

- 后门式热交换器

- 空气冷却

- 按类型

- 超大规模资料中心业者(自有和租赁)

- 企业(本地)

- 搭配

- 按行业

- 资讯科技和电讯

- 零售和消费品

- 卫生保健

- 媒体与娱乐

- 联邦政府

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第八章 竞争格局

- 公司简介

- Vertiv Co.

- Stulz GmbH

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Alfa Laval Corporate AB

- Fujitsu General Limited

- Johnson Controls Inc.

- Hitachi Ltd

- CoolIT Systems Inc.

- Liquid Stack Inc.

- Asetek Inc. A/S

- Asperitas

- Chilldyne Inc.

- Fujitsu Ltd

- Mikros Technologies

- KAORI HEAT TREATMENT Co. Ltd

- Lenovo Group Limited

第九章投资分析

第十章 市场机会与未来趋势

第 11 章:出版商

The Data Center Cooling Market size is estimated at USD 10.80 billion in 2025, and is expected to reach USD 25.12 billion by 2031, at a CAGR of 15.11% during the forecast period (2025-2031).

Key Highlights

- Due to the high computational needs of AI and media applications, data centers are being increasingly deployed worldwide. These data centers consume a massive amount of power, generating a significant amount of heat, further creating the need for various efficient cooling systems.

- The data center cooling market is expected to show substantial growth due to increased digitization, leading to greater computer performance and requiring a larger number of integrated small chips. The design of data centers and the need to cool them are mainly influenced by powerful computer hardware for AI workloads. Manufacturers are introducing large silicon chips to optimize the performance of artificial intelligence and high-performance computing workloads. The use of powerful GPUs in artificial intelligence and high-performance computing environments supports the need for data center cooling technologies.

- The increasing use of OTT and streaming services has led to a growth in data, fostering market development. Also, the increasing data from online streaming services such as Disney+ Hotstar, Hulu, and Netflix is expected to drive the demand for data center cooling systems.

- Market players are taking action to augment their consumer base by focusing on expanding their global footprint and service offerings. For instance, in March 2024, the intelligent power management company Eaton declared the North American launch of an innovative modular data center solution for organizations that are seeking to rapidly fulfill the increasing requirements for machine learning, edge computing, and AI. Eaton's SmartRack modular data centers primarily combine IT racks and cooling and service enclosures to build a performance-optimized data center solution for critical IT equipment with up to 150 kW of equipment load.

- The market's growth is expected to be hampered by the rising need for various adaptability requirements and power shortages worldwide. Also, the use of inefficient cooling system designs, such as outdated infrastructure or poorly optimized layouts, leading to energy inefficiencies and increased operational costs, and rising energy prices, which might make the cooling expenses prohibitive, are some of the factors that can restrain the market's growth during the forecast period.

Data Center Cooling Market Trends

The IT and Telecom Segment is Expected to Witness the Highest Growth

- The exponential growth of data generated by information technology significantly necessitates efficient data centers, driving demand for advanced cooling solutions. As data centers expand to accommodate increasing workloads and storage demands, the heat generated becomes a significant matter of concern, creating demand for effective cooling solutions.

- The adoption of cloud storage has been increasing over the years. To provide more efficient work processes, cloud storage providers such as Microsoft, AWS, and Google are expanding their capacity to store in the cloud. These companies make their investments in hyperscale transactions. As a result, the demand for data center cooling systems is expected to grow due to the expansion of Software-as-a-Service, enabling cloud storage providers to augment their capacity.

- Immersion cooling can be executed in a single-phase or two-phase solution. Single-phase immersion cooling encapsulates the server in a sealed chassis, and the design can be configured in a rackmount or standalone format. However, two-phase immersion cooling locations the server in the liquid, but the liquid transitions during the cooling process. As the fluid warms up and turns to condensation, the water circuit and heat exchanger withdraw the heat. In 2P immersion cooling, dielectric cooling fluid inside a metal holding tank contained with servers is boiled and condensed in a secured cooling system, exponentially growing heat transfer efficiency.

- In May 2023, KT Cloud signed a deal with Immersion 4, a Swiss provider of liquid cooling solutions, to install next-generation immersion cooling technology at KT Cloud data centers. Immersion cooling removes heat by immersing information and communications technology equipment in a dielectric solution where electricity does not flow. This eliminates the imbalance in server room temperatures and fan noise at data centers that can occur with an air-cooling system.

Asia-Pacific is Expected to Register Significant Growth

- Asia-Pacific is estimated to witness the fastest growth rate during the forecast period, mainly due to the rapid development of the network infrastructure. The demand for data generation is increasing in the region, and government policies are promoting more energy-efficient infrastructure, especially in countries like India and China. Also, advancements in technologies such as AI-driven cooling management and liquid cooling systems are reshaping the landscape, driving further adoption in the region.

- China and Japan are among the most important countries that are expected to fuel the market's growth opportunities, significantly based on their ongoing innovations and developments in domains like IoT, ML, and AI. Moreover, the rapidly growing number of data centers in these countries and the government policies to promote more environmentally sound infrastructure across the region are driving the need for better and more effective cooling solutions within these data centers.

- For instance, in April 2024, GDS, an operator and developer of high-performance data centers in Asia, and Gaw Capital Partners, a private equity fund management firm especially focusing on the real estate markets in Asia-Pacific and other high barrier-to-entry markets worldwide, signed a strategic partnership to build a 40 megawatts (MW) data center campus in Tokyo, Japan.

- The Asia-Pacific data center cooling market is primarily fueled by the exponential growth of data consumption and cloud services. As businesses expand their digital infrastructure, the demand for efficient cooling systems to maintain optimal operating temperatures increases. Additionally, stringent regulations regarding energy efficiency and environmental sustainability encourage the adoption of innovative cooling technologies. With emerging economies investing heavily in IT infrastructure, the need for reliable and scalable cooling solutions further fuels market growth.

- In December 2023, the Australian cloud service provider ResetData launched a test and simulation lab for its pioneering liquid-cooled data center server technology. This was one of the first facilities in Asia-Pacific capable of trialing workloads in a liquid-cooled environment. This step empowered local businesses to utilize a more ecological and high-performance Infrastructure-as-a-Service (IaaS) that is essential for strenuous applications like AI and machine learning.

Data Center Cooling Industry Overview

The data center cooling market exhibits a low level of consolidation among key industry players. Notable market leaders include Stulz GmbH, Alfa Laval AB, Schneider Electric SE, Johnson Controls Inc., Vertiv Group Corp., and Asetek A/S. These industry giants, boasting significant market shares, are actively engaged in expanding their customer base throughout the region. Their growth strategies primarily hinge on strategic collaborative efforts aimed at enhancing market share and overall profitability. Moreover, companies such as Schneider Electric SE, Johnson Controls Inc., and Mitsubishi Electric Europe BV offer both liquid and air-based cooling products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of the Key Cost Overheads Related to DC Operations with an Eye on DC Cooling

- 4.2.2 Comparative Study of the Cost and Operational Considerations Related to Each Cooling Technology Based on Key Factors Such as Design Complexity, PUE, Advantages, Drawbacks, and Extent of Utilization of Natural Weather Conditions

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Digitization and Adoption of AI and HPC Workload Around the Globe

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Challenges

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.2.2 Supply Chain Disruption Globally

- 5.3 Market Opportunities

- 5.3.1 The Growth of the Digital Economy and Increasing Government's Support across Major Regions

- 5.4 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN GLOBAL

- 6.1 Analysis of IT Load Capacity and Area Footprint of Data Centers (For the Period of 2017-2030)

- 6.2 Analysis of the Current DC Hotspots and Scope for Future Expansion Globally

- 6.3 Analysis of Major Data Center Contractors and Operators Across Major Regions

7 INDONESIA DATA CENTER MARKET SEGMENTATION

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH

- 7.1.1.3 Cooling Tower (Covers Direct, Indirect, and Two-stage Cooling)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-chip Cooling

- 7.1.2.3 Rear-door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Type

- 7.2.1 Hyperscalers (Owned and Leased)

- 7.2.2 Enterprise (On-premise)

- 7.2.3 Colocation

- 7.3 By End-user Vertical

- 7.3.1 IT and Telecom

- 7.3.2 Retail and Consumer Goods

- 7.3.3 Healthcare

- 7.3.4 Media and Entertainment

- 7.3.5 Federal and Institutional Agencies

- 7.3.6 Other End-user Verticals

- 7.4 By Region

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Co.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal GmbH & Co. KG

- 8.1.5 Alfa Laval Corporate AB

- 8.1.6 Fujitsu General Limited

- 8.1.7 Johnson Controls Inc.

- 8.1.8 Hitachi Ltd

- 8.1.9 CoolIT Systems Inc.

- 8.1.10 Liquid Stack Inc.

- 8.1.11 Asetek Inc. A/S

- 8.1.12 Asperitas

- 8.1.13 Chilldyne Inc.

- 8.1.14 Fujitsu Ltd

- 8.1.15 Mikros Technologies

- 8.1.16 KAORI HEAT TREATMENT Co. Ltd

- 8.1.17 Lenovo Group Limited