|

市场调查报告书

商品编码

1640478

欧洲劳动力管理软体市场:份额分析、产业趋势和成长预测(2025-2030 年)Europe Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

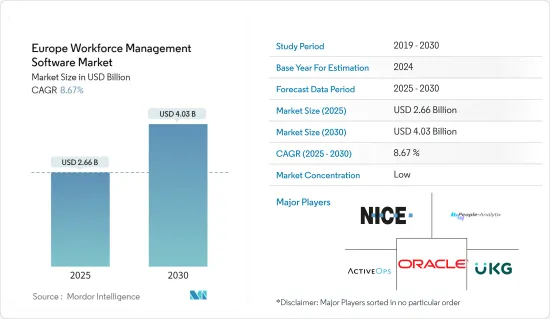

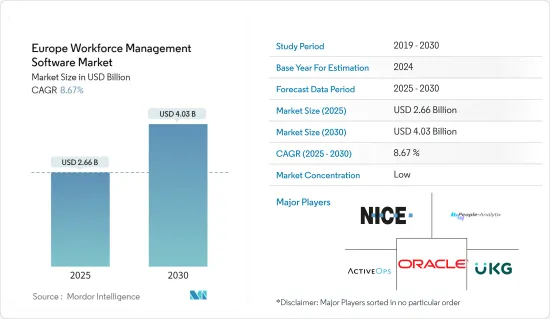

欧洲劳动力管理软体市场规模预计在 2025 年为 26.6 亿美元,预计到 2030 年将达到 40.3 亿美元,预测期(2025-2030 年)的复合年增长率为 8.67%。

这一成长是由提高生产力以保持竞争优势的需求以及与劳动力相关的标准日益复杂所推动的,这使得企业必须依靠 IT 解决方案来确保合规性。

主要亮点

- 鑑于职场的不断发展,透过维护电子表格和记录每项活动的记录来管理员工队伍已经变得非常耗时、繁琐且容易出错。劳动力管理软体可以有效管理工作计画、业务流程、人事费用和人才管理,进而优化组织绩效。它还结合了分析和资料深入挖掘功能,为更好地管理人力资本提供更深入的见解。

- 过去十年,远距工作趋势一直稳定成长。然而,COVID-19 的影响在短时间内急剧加速了这一趋势,迫使全部区域。由于疫情迫使更多人远距工作,远端劳动力管理软体对于企业来说变得至关重要,因为它可以帮助企业有效地管理远端劳动力。

- 私人公司透过私有云端提供劳动力管理解决方案,以提供多层次的实体和逻辑安全功能。许多企业领导者转向基于云端基础的劳动力管理的主要原因之一是希望获得统一的解决方案。这包括销售团队、入境行销软体、行销自动化软体、劳动力管理软体和业务分析工具等服务,以深入了解您企业的商业、业务和财务方面。

- 大多数 SaaS 评估专注于根据您目前的痛点衡量功能集并找到表现良好的供应商。但实施新的劳动力管理软体可能是一个昂贵且耗时的过程,需要正确完成才能获得任何组织所寻求的利益。

欧洲劳动力管理软体市场趋势

物联网 (IoT) 和云端基础的解决方案的日益普及将推动市场成长

- 技术主导的劳动力管理系统提高了整体绩效管理和分析能力。物联网 (IoT) 就是这样一种技术,它可以提高业务效率,从而提高员工绩效,并将所有相关人员聚集在一个地方,以监督和简化所有行动。物联网的应用范围从资产管理到劳动力自动化框架,以实现最高的工作效率。

- 各行业的企业之间的竞争日益激烈,并将在刺激欧洲成长和创造就业方面发挥关键作用。在欧洲,SD Worx 去年 10 月进行的一项调查发现,目前有六成的公司正在使用人力资源和人才分析来深入了解人才短缺和缺勤等领域。此外,21% 的受访者表示他们希望在明年使用这些工具,比去年增加了 15%。

- 根据欧洲法院(ECJ)的一项裁决,现在欧洲各地的雇主都必须记录员工的出勤情况。因此,欧洲法院裁定,成员国必须要求雇主建立记录每日工作时间的製度。这些规定增加了对工作时间追踪软体的需求。

- 物联网被认为是办公室、家庭和工业领域最受欢迎的技术之一,各种合作和伙伴关係正在为劳动力管理市场的成长注入动力。根据 Good Companies 的报告,大约 34% 的欧洲企业正在其业务流程中使用物联网,另有 12% 的企业计划很快这样做。此外,正如欧盟委员会所指出的,许多本地公司正在选择云端处理,如图所示。

- 例如,欧洲领先的诊断服务供应商 Unilabs 在去年 5 月为其瑞士业务选择了基于云端的 ATOSS 劳动力管理。不同州的所有 62 个地点都将连结到该软体。该计划旨在将员工纳入工作时间管理流程,为研究所带来更灵活的工作安排,同时提高与工作时间相关的所有事项的透明度。

英国可望占据主要市场占有率

- 全国各地企业/组织对适应性和灵活性的需求不断增长,以及组织对提高工作效率和改善员工体验的日益关注,预计将推动英国地区研究市场的成长。

- 私部门的就业也在增加,迫使许多组织,特别是人力资源部门,采用劳动力管理解决方案来管理各种职能。

- 製造业、旅游和运输业以及零售业正在迅速扩张,并在这些管理软体系统的采用率方面引领市场,从而推动了所研究市场的成长。此外,提高生产力对于任何组织的成功至关重要。公司努力提高员工生产力、降低成本并提高业务流程的效率。

- 疫情带来的远距办公转变正在支持英国对公共云端服务日益增长的需求。英国企业正在转向云端服务来实现远距工作环境中所需的劳动力和业务流程的自动化。

- 尤其是医疗保健产业,在实施劳动力调度软体方面投入了大量资金。例如,2021 年 1 月,护理部长宣布拨款 1,030 万美元支持 38 个 NHS 信託机构进行数位化转变组织,使工作人员能够花更多时间与病患相处。该投资是3570万美元国家基金的一部分,用于为所有 NHS 医生、护士和其他临床工作人员建立电子排班系统。

- 去年 3 月,英国政府启动了一系列软体和云端服务合同,总价值可能达到 50 亿英镑(65.8 亿美元)。在 GCloud13 的支持下,中央政府采购机构皇家商业服务局 (CCS) 已针对同名蓬鬆计算模型下的几种技术发布了竞标。

- 此外,该国正在推出许多新的劳动力管理解决方案。例如,去年 6 月,人力资源和薪资服务供应商SD Worx 推出了其欧洲市场领先的劳动力管理解决方案,为英国企业提供支援。 SD Worx 成为英国第一家提供完全整合劳动力管理 (WFM) SaaS 解决方案的薪资和人力资源供应商,该解决方案具有独立 WFM 产品的所有功能。

欧洲劳动力管理软体产业概况

欧洲劳动力管理软体市场的竞争格局非常活跃。市场上没有主导者,需要增强凝聚力。不断变化的终端用户行业需求正在推动市场创新。

- 2022 年 7 月 - SD Worx 收购位于克罗埃西亚萨格勒布的人力资源科技公司 HRPRO。透过此次收购,SD Worx 将其本地业务扩展到 18 个欧洲国家并进入东南欧市场,该公司认为该地区具有巨大的成长潜力,可以增强薪资核算和人力资源软体产品组合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 物联网 (IoT) 和云端基础的解决方案的日益普及将推动市场成长

- 中小企业越来越多地采用分析解决方案和 WFM 将推动市场成长

- 市场挑战

- 实施和整合问题阻碍市场

第六章 市场细分

- 依部署方式

- 本地

- 云

- 按组织规模

- 中小企业

- 大型企业

- 按类型

- 劳动力调度和劳动力分析

- 考勤管理

- 绩效与目标管理

- 缺勤和休假管理

- 其他软体(疲劳管理、任务管理等)

- 按最终用户产业

- 卫生保健

- BFSI

- 製造业

- 消费品和零售

- 其他最终用户产业

- 按国家

- 英国

- 法国

- 德国

- 西班牙

- 比荷卢

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Active Operations Management International LLP

- NICE Systems Ltd.

- Oracle Corporation

- Ultimate Kronos Group

- People-Analytix AG

- Avature Company

- Talentsoft AG

- WorkForce Software LLC

- Workday Inc.

- Atos Software AG

- Quinyx AB

- IBM Corporation

- SAP SE

- ADP LLC

- Reflexis Systems Inc.

- SISQUAL Workforce Management Lda

- Zucchetti SpA

- Anviz Global Inc.

- Calabrio Inc.

- Tamigo UK Ltd.

- SD Worx Group NV

- MYOB(Roubler)UK Limited Company

- Sage Group PLC

- Mitrefinch Ltd.

第八章投资分析

第九章:市场的未来

The Europe Workforce Management Software Market size is estimated at USD 2.66 billion in 2025, and is expected to reach USD 4.03 billion by 2030, at a CAGR of 8.67% during the forecast period (2025-2030).

The growth is primarily driven by the need for improved productivity to maintain competitive advantage and the growing complexity of workforce-related standards, making it imperative for firms to rely on IT solutions to ensure compliance.

Key Highlights

- Given the evolving workplace nature, managing the workforce by maintaining spreadsheets and registers for all activities became highly time-consuming, cumbersome, and prone to errors. Workforce management software is essential in optimizing organizational performance by enabling effective administration of work schedules, business processes, labor costs, and talent management. Embedded with analytics and drill-down features for the data, it provides even deeper insights for better human capital management.

- The trend toward remote work is steadily growing for the past decade. However, the COVID-19 effect dramatically accelerated this trend in a brief period, forcing companies, irrespective of their size, to adapt quickly to the self-isolation measures that governments across the region were recommending. With the pandemic requiring more people to work remotely, remote workforce management software became essential for companies, as this software can help manage the remote workforce efficiently.

- Various companies offer workforce management solutions through the private cloud to provide multi-level physical and logical security features. One of the primary reasons for the inclination of many business leaders toward cloud-based workforce management is the desire to get in one solution. It may include services like salesforce, inbound marketing software, marketing automation software, workforce management software, and business analytical tools to achieve insights into commercial, operational, and financial aspects.

- Most software-as-a-service evaluations focus on measuring feature sets against any current problem areas and finding a vendor to work well. However, implementing new workforce management software can be an expensive and time-consuming process, one that needs to be performed right to reap the benefits that any organization seeks.

Europe Workforce Management Software Market Trends

Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market

- A technology-driven workforce management system improves overall performance management and analytics. The internet of things(IoT) is one such technology that increases the efficiency of operations, thereby increasing workforce performance to bring together all stakeholders on a single platform to supervise and streamline all actions. The applications of IoT range from asset management to automated frameworks of the workforce to bring out the best work rate.

- The competition among companies in every sector is becoming so intense and should play an important part in stimulating growth and job creation in Europe. In Europe, a survey by SD Worx in October last year shows that six out of ten companies today use HR and people analytics to gain insights into areas such as staff shortages and absenteeism. Also, 21% of those surveyed indicated they would like to start using these tools in the coming year, a 15% increase from last year.

- Employers across Europe are now obliged to track their employees' time and attendance following a ruling by the European Court of Justice (ECJ). As a result, the ECJ ruled that member states must oblige employers to set up a system for the daily recording of working time. Such regulation increased the demand for workforce management software.

- IoT is considered one of the most trending technologies being used in offices, homes, and industries, and various collaborations and partnerships are gaining momentum for market growth in workforce management. As per the report by Good firms, around 34% of organizations in Europe are using IoT for their business processes, and another 12% are planning to do so shortly. Further, as indicated by the European Commission, many regional enterprises opt for cloud computing, as shown in the graph.

- For instance, in May of the previous year, Unilabs, Europe's leading diagnostics service provider, opted for ATOSS workforce management in the cloud for its activities in Switzerland. All 62 sites in different cantons will be linked to the software. The project aims to integrate employees into the working time management processes and achieve more flexible duty scheduling in the laboratories while creating greater transparency in all matters revolving around working hours.

United Kingdom is Expected to Hold Significant Market Share

- The increasing demand from businesses/organizations across the country for adaptability and flexibility and the organization's rising focus on increasing workforce productivity and improved employee experience are expected to drive the studied market growth in the United Kingdom region.

- Employment in the private sector is also increasing, forcing many organizations, especially human resource management departments, to adopt workforce management solutions to manage various functions.

- The Manufacturing, Travel & Transport, and Retail sectors are expanding rapidly, leading the market in terms of the adoption rate of these management software systems, thus driving the studied market growth. Further, good productivity is crucial for the success of any organization. Enterprises are striving hard to enhance the productivity of their employees, reduce costs, and improve business process efficiency.

- The continued transition to remote working brought on by the pandemic helped to sustain the growing demand for public cloud services in the UK. To automate labor and business processes necessary for remote work environments, businesses in the UK are increasingly turning to cloud services.

- The country is witnessing significant investment in the deployment of workforce scheduling software, especially in the healthcare sector. For instance, in January 2021, the Minister of Care announced USD 10.3 million to support digital shift organizing across 38 NHS trusts, allowing staff to spend more time with patients. The investment is part of a USD 35.7 million national fund for all NHS doctors, nurses, and other clinical staff on e-rostering systems.

- In March last year, the UK government initiated an agreement series for software and cloud services that could total up to GBP 5 billion (USD 6.58 billion). The tender for several technologies under the fluffy eponymous computing model is released by the central government procurement authority Crown Commercial Services (CCS) under the aegis of G-Cloud 13.

- The country is also witnessing the launch of many new workforce management solutions. For instance, in June previous year, SD Worx, an HR and payroll services provider, empowered UK businesses with the launch of its European market-leading workforce management solution. SD Worx became the first UK Payroll and HR provider to offer a fully integrated workforce management (WFM) SaaS solution with all the capabilities of a stand-alone WFM product.

Europe Workforce Management Software Industry Overview

The competitive landscape for the European workforce management software market is very dynamic. The market needs to be more cohesive without any dominant player. The evolving needs of the end-user industries are driving innovations in the market.

- July 2022 - SD Worx acquired HRPRO, an HR tech company located in Zagreb, Croatia. With this acquisition, SD Worx will expand its local presence to 18 European countries and enter Southeastern Europe, where it sees a lot of growth potential in strengthening its payroll & HR software portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions is Expanding the Market

- 5.1.2 Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth

- 5.2 Market Challenges

- 5.2.1 Implementation and Integration Concerns Hindering the Market

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Size of Organization

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Type

- 6.3.1 Workforce Scheduling and Workforce Analytics

- 6.3.2 Time and Attendance Management

- 6.3.3 Performance and Goal Management

- 6.3.4 Absence and Leave Management

- 6.3.5 Other Software (Fatigue Management, Task Management, etc)

- 6.4 By End-user Industry

- 6.4.1 Healthcare

- 6.4.2 BFSI

- 6.4.3 Manufacturing

- 6.4.4 Consumer Goods and Retail

- 6.4.5 Other End-user Industries

- 6.5 By Country

- 6.5.1 United Kingdom

- 6.5.2 France

- 6.5.3 Germany

- 6.5.4 Spain

- 6.5.5 Benelux

- 6.5.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Active Operations Management International LLP

- 7.1.2 NICE Systems Ltd.

- 7.1.3 Oracle Corporation

- 7.1.4 Ultimate Kronos Group

- 7.1.5 People-Analytix AG

- 7.1.6 Avature Company

- 7.1.7 Talentsoft AG

- 7.1.8 WorkForce Software LLC

- 7.1.9 Workday Inc.

- 7.1.10 Atos Software AG

- 7.1.11 Quinyx AB

- 7.1.12 IBM Corporation

- 7.1.13 SAP SE

- 7.1.14 ADP LLC

- 7.1.15 Reflexis Systems Inc.

- 7.1.16 SISQUAL Workforce Management Lda

- 7.1.17 Zucchetti SpA

- 7.1.18 Anviz Global Inc.

- 7.1.19 Calabrio Inc.

- 7.1.20 Tamigo UK Ltd.

- 7.1.21 SD Worx Group NV

- 7.1.22 MYOB (Roubler) UK Limited Company

- 7.1.23 Sage Group PLC

- 7.1.24 Mitrefinch Ltd.