|

市场调查报告书

商品编码

1640669

中东和非洲劳动力管理软体:市场占有率分析、行业趋势和成长预测(2025-2030 年)MEA Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

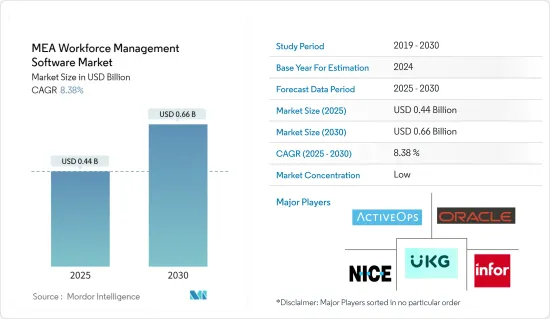

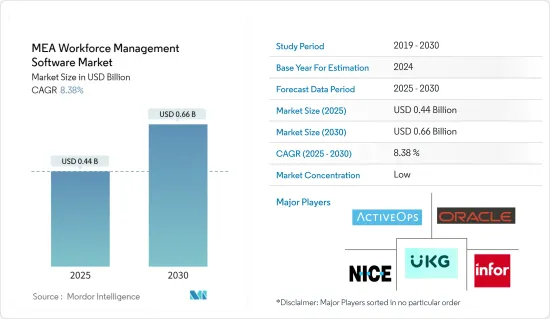

中东和非洲劳动力管理软体市场规模预计在 2025 年为 4.4 亿美元,预计到 2030 年将达到 6.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.38%。

主要亮点

- 人工智慧等先进技术的日益广泛使用正在推动劳动力管理市场的发展。中小企业对物联网的需求日益增长以及远端劳动力解决方案的日益普及将推动劳动力管理的需求。随着智慧型手机的普及率不断提高以及企业对劳动力分析的更加重视,劳动力管理行业预计将实现更盈利的成长。

- 透过利用人工智慧进行劳动力管理,公司可以评估现有员工的人才库,并利用历史技能资料来考虑技能邻近性、过去的经验和预期的职业道路。相匹配,同时提供平台供他们填补。员工可以更了解企业内通常无法接触到的各种计划和经验,同时还可以获得个人化建议,为他们提供合适的机会。例如,沙乌地阿拉伯计划在2030年向人工智慧投资200亿美元。这可能为市场参与者创造机会将人工智慧纳入其劳动力管理解决方案。

- 物联网和云端基础的解决方案的日益再形成,推动了劳动力管理软体的成长,增强了资料主导的决策能力,实现了远端劳动力管理,并为企业提供了扩充性和成本效益。市场。随着这些技术的发展,劳动力管理软体市场预计将经历进一步的成长和创新。

- 中东和非洲地区的中小型企业越来越多地采用分析解决方案和劳动力管理软体,从而推动了市场成长。随着越来越多的企业认识到这些技术的好处,未来几年对劳动力管理软体的需求预计将持续成长。

- 中东和非洲的劳动力管理软体市场可能会面临阻碍市场发展的若干实施和整合问题。资料安全和隐私是中东和非洲地区组织关注的主要议题。由于担心资料外洩和资料遵循问题,公司可能不愿意将员工和业务资料转移到云端基础的劳动力管理解决方案。

- 过去十年来,远距就业变得越来越普遍。然而,COVID-19 在短时间内大大加速了这一趋势,迫使各种规模的企业迅速实施该地区政府建议的自我隔离措施。远端劳动力管理软体已成为企业的重要工具,因为它可以帮助企业有效地处理远距劳动力以及由于疫情而需要更多人远距工作的需求。

- 国际货币基金组织表示,阿联酋经济从新冠疫情的影响中迅速復苏,在国内经济活动復苏、财政和外部盈余较高等因素的推动下,经济成长迅速强劲。根据国际货币基金组织的最新预测,今年阿联酋的GDP成长率预计将从去年的3.8%升至6%以上。儘管石油成本不断上升,且新冠疫情导致对家庭和企业的财政支持逐渐减少,但预算盈余仍在扩大。

中东和非洲劳动力管理软体市场趋势

劳动力调度和劳动力分析类型预计将占据较大的市场占有率

- 劳动力分析是从内部和外部来源收集与劳动力相关的资料,对其进行分析并将其转化为可操作的资讯。透过收集员工资料,劳动力分析能够帮助制定更好的人力资源策略业务决策,为与劳动力相关的选择提供投资报酬率证据,并改善整体业务成果。

- 劳动力分析关注的是工作本身,而非仅是人。劳动力分析追踪和分析员工业务,以改善工作流程,并使人力资源领导者能够做出资料主导的决策,从而提高员工的成功率和体验。

- 劳动力分析对组织的好处是它可以追踪员工绩效并建立基准值以实现目标并提高效率。收集和分析劳动力分析的最大好处之一是工作场所分析,它可以帮助及早发现对新职能或职位的需求并得出更好的招募标准。它还可以帮助您更快地识别合格的候选人,并在招募和入职过程中提供更多价值。劳动力分析有助于打破资料孤岛并将所有劳动力资料集中在一个地方。这可以提供更高的可视性、自助服务、更全面的资料集并改善决策者之间的沟通。

- 此外,劳动力分析可以帮助培养信任和透明的公司文化,让每位员工的贡献都得到认可和奖励。劳动力分析创建了资料轨迹,以便员工可以看到谁得到了认可以及原因。加强监测。劳动力分析允许企业领导者透过监控员工受僱前后流程的输入和输出来追踪设定的基准的进度。

- 劳动力调度解决方案已发展到可以自动化管理者在优化劳动力管理时以前面临的几个操作问题的程度。目前已有人工智慧解决方案可以处理更大的工作量、预测季节变化所带来的需求以及最佳地安排轮班工人。此外,这些解决方案还允许员工控制自己的程序并在需要时直接与其他员工轮班。

- 在重新定位劳动力管理软体市场中的应用程式时,劳动力调度和劳动力分析是基本考虑因素。它们在确保新环境中软体的安全性、合规性和效能方面发挥着至关重要的作用。 Nutanix 表示,改善安全态势和满足监管要求将成为 2023 年欧洲、中东和非洲地区迁移应用程式的主要驱动力,约有 44% 的受访者表示认同。其次是云端原生解决方案集成,占了43%的市场。

预计阿联酋将占据较大的市场占有率

- 阿拉伯联合大公国 (UAE) 各地的企业正在製定和实施雄心勃勃的转型蓝图,以确保其在数位世界中的相关性。该地区第三平台的使用十分广泛,其中云端、行动和社交技术的采用已变得十分普遍。

- 此外,该地区的 IT 产业本土企业也不断增多,他们不断创造解决方案来满足日益增长的本地需求。例如,2023 年 1 月,人力资源科技领域快速成长的独角兽 Darwinbox 与微软达成合作关係,为中东和北非 (Mena) 的组织提供在快速变化的职场中蓬勃发展所需的工具工作场所。我们宣布了合作伙伴关係。 Darwinbox 与微软产品生态系统的深度整合将成为合作的一部分,同时也将共同创新解决方案以提升员工体验。除了共同创新蓝图之外,微软还对 Darwinbox 进行了股权投资,以进一步实现其使组织能够整合整个员工生命週期的目标。

- 2022年12月,阿联酋综合电信公司(EITC)的子公司du宣布与诺基亚合作,加速提升员工技能并促进阿联酋的人才发展。作为协议的一部分,诺基亚将实施培训和发展员工的技术能力和知识转移的计划。

- 2023 年 1 月,DP World 旗下公司 ReplWorld Security 与 Transworld Group 建立策略合作伙伴关係,以增强其作为阿联酋领先的承包安全、设施管理和人力资源外包解决方案供应商的能力。两家公司将共同探索在印度半岛寻找、培养和培训技术纯熟劳工以招募海外人才的方法。

- 阿联酋的经济正在扩张,该地区的各个产业、劳动力和企业也不断扩张。该地区的城市正在发挥其潜力,出售这些自然资源所获得的资金有助于提高生活水准并恢復该地区的稳定。

- 该地区需要熟练的劳动力来管理该国的资源。此外,劳动力管理软体可以帮助该地区的城市提高各自行业的产量和收益。该地区最大的趋势之一是工业革命4.0,随着5G基础设施的快速扩张,数位转型预计将在预测期内大幅增加。根据OpenSignal的数据显示,2022年阿联酋的平均5G下载速度最快,为315.90Mbps。其次是卡达,速度为 275.90Mbps,沙乌地阿拉伯速度为 237.90Mbps。

中东和非洲劳动力管理软体产业概况

中东和非洲劳动力管理软体市场高度分散,主要企业包括 Active Operations、Management International LLP、NICE Systems Ltd、Oracle Corporation、Infor Group 和 Kronos Incorporated (UKG Inc.) Masu。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

2023 年 2 月,人力资源解决方案供应商 Workforce Africa 宣布在赖索托王国和加彭进一步扩张。 Workforce Africa 为全球企业提供人力资源服务,包括薪资、招募、评估、人力资源支援、社会福利、独立承包商管理和背景调查。扩张计画为跨国公司在非洲大陆的投资铺平了道路。

2022 年 10 月,DU Telecom 与Oracle Cloud Human Capital Management (HCM) 签署协议,以管理其在阿联酋的人力资源流程,包括招募、薪资和绩效管理。此次调整将使 DU Telco 能够在共用资料平台上标准化人力资源程序,从而改善组织的团队管理和人力资源服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 物联网 (IoT) 和云端基础的解决方案的日益普及推动了市场扩张

- 中小企业越来越多地采用分析解决方案和 WFM 将推动市场成长

- 市场挑战

- 实施和整合问题阻碍市场

第六章 市场细分

- 按类型

- 劳动力调度和劳动力分析

- 考勤管理

- 绩效与目标管理

- 缺勤和休假管理

- 其他软体(疲劳管理、任务管理等)

- 依部署方式

- 本地

- 云

- 按最终用户产业

- BFSI

- 消费品和零售

- 车

- 能源与公共产业

- 卫生保健

- 製造业

- 其他最终用户产业

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

第七章 竞争格局

- 公司简介

- Active Operations Management International LLP

- NICE Systems Ltd

- Oracle Corporation

- Infor Group

- Kronos Incorporated(UKG Inc.)

- Reflexis Systems Inc.

- SISQUAL

- Workday Inc.

- WorkForce Software LLC

- Blue Yonder Group Inc.

- ServiceMax Inc.

- Kirona Solutions Limited

- 7shifts

- IBM Corporation

- SAP SE

- ADP LLC

- Atoss Software AG

- Mitrefinch Ltd

- Sage Group PLC

- Roubler UK Limited Company

- Tamigo UK Ltd

第八章投资分析

第九章:市场的未来

The MEA Workforce Management Software Market size is estimated at USD 0.44 billion in 2025, and is expected to reach USD 0.66 billion by 2030, at a CAGR of 8.38% during the forecast period (2025-2030).

Key Highlights

- The increasing usage of advanced technology, such as artificial intelligence, drives the workforce management market. The growing need of small and medium-sized organizations for the Internet of Things and the ever-increasing popularity of remote workforce solutions will intensify the demand for workforce management. Smartphone penetration is increasing, and businesses focus more on human resource analytics, leading to more profitable growth prospects in the workforce management industry.

- Companies can utilize AI in workforce management to assess their existing employees' talent inventory and leverage historical skill data to match individuals with appropriate open positions advertised by managers while considering skills adjacency, prior experiences, and intended career paths. Workers receive better visibility into a diverse pool of projects and experiences available within their business that would otherwise be inaccessible due to the value-add of personalized recommendations that serve up appropriate opportunities. For example, Saudi Arabia will invest USD 20 billion in Artificial Intelligence by 2030. This may create an opportunity for the market players to incorporate AI in workforce management solutions.

- The increasing adoption of IoT and cloud-based solutions is reshaping the workforce management software market by enhancing data-driven decision-making, enabling remote workforce management, and providing scalability and cost-effectiveness for businesses. The workforce management software market will experience further growth and innovation as these technologies evolve and are expected to experience further growth and innovation.

- The growing adoption of analytical solutions and workforce management software by SMEs in the MEA region is driving market growth. As more businesses recognize the advantages of these technologies, the demand for workforce management software is expected to continue to rise in the coming years.

- The MEA workforce management software market may face several implementation and integration concerns hindering the market. Data security and privacy are critical concerns for organizations in the MEA region; businesses may hesitate to move their employee and operational data to cloud-based workforce management solutions due to data breaches and regulatory compliance concerns.

- Over the last decade, remote employment has become increasingly popular. Nevertheless, COVID-19 significantly accelerated this trend in a short time, compelling businesses of all sizes to rapidly adopt the self-isolation measures that governments in the region were advising. Because it can assist in effectively handling the remote workforce and the pandemic's requirement for more people to work remotely, remote workforce management software has emerged as a crucial tool for businesses.

- According to the IMF, the UAE economy recovered swiftly from the effects of COVID-19, with strong near-term economic growth supported by a pickup in domestic activity and high surpluses in the fiscal and external balances. According to the most recent IMF estimate, the UAE GDP growth is predicted to increase to above 6% in the current year from 3.8% last year. Fiscal surpluses have grown despite rising oil costs and a gradual reduction in fiscal support for households and businesses due to the COVID crisis.

MEA Workforce Management Software Market Trends

Workforce Scheduling and Workforce Analytics Type is Expected to Hold Significant Market Share

- Workforce analytics is gathering workforce-related data from internal and external sources, analyzing it, and transforming it into actionable information. By collecting employee data, workforce analytics enables users to make better strategic business decisions about personnel, provide ROI evidence for workforce-related choices, and improve overall business outcomes.

- Workforce analytics look at the work itself rather than just the people. It tracks and analyzes employees' work productivity to improve workflow and enable HR leaders to make data-driven decisions that enhance employee success and experience.

- The advantages of workforce analytics for organizations revolve around tracking employee performance to establish a baseline for meeting objectives and driving efficiency. The most significant benefits of collecting and analyzing workforce analytics include workplace analytics, which helps identify the demand for new functions and positions early on, resulting in better hiring criteria. It also aids in identifying qualified candidates more quickly and providing more value during the hiring and onboarding process. Workforce analytics helps to break down data silos and centralize all the workforce data in one place. This allows for increased visibility, self-service, a more comprehensive data set, and improved communication among decision-makers.

- Moreover, using workforce analytics can aid in developing a culture of trust and transparency in which individual employee contributions are recognized and rewarded. Workforce analytics leave a data trail for employees to see who is being recognized and why. It enhances monitoring. Workforce analytics enables business leaders to track progress against set benchmarks by monitoring the inputs and outputs of their pre-post-employee hiring processes.

- Workforce scheduling solutions have evolved to the point where they are automating multiple operational issues that managers previously faced when optimizing workforce management. Currently, AI-powered solutions are available to handle larger workloads, predict needs with changing seasons, and optimally create schedules for shift workers. Furthermore, these solutions allow employees to take control of their programs and switch shifts with other employees directly if necessary.

- Workforce scheduling and workforce analytics are fundamental considerations when relocating applications in the workforce management software market. They play an integral role in ensuring the software's security, compliance, and performance in a new environment. According to Nutanix software company, in 2023, in the Middle East and Africa (EMEA), improving security posture and meeting regulatory requirements is the top driver for relocation applications, with about 44 %of the respondents reporting the same. This is followed by integrating cloud-native solutions with a 43 % share.

United Arab Emirates is Expected to Hold Significant Market Share

- Companies all over the United Arab Emirates region are setting ambitious transformation roadmaps into practice to guarantee their relevance in the digital world. Third platform usage is spreading throughout the region, and embracing technologies like cloud, mobility, and social is becoming more common.

- Additionally, the area is witnessing an increase in the number of local players in the IT industries who are creating solutions to meet the rising local demand. For instance, in January 2023, To equip organizations in the Middle East and North Africa (Mena) with the necessary tools to thrive in the rapidly changing workplace, Darwinbox, the fastest-growing unicorn in the HR tech space, announced a partnership with Microsoft. Deep integrations between Darwinbox and the Microsoft product ecosystem will be a part of the cooperation, as will joint innovation of solutions to improve the employee experience. To advance its goal of enabling organizations to integrate their complete employee lifecycle, Microsoft has also made an equity investment in Darwinbox in addition to the co-innovation roadmap.

- In December 2022, the Emirates Integrated Telecommunications Company (EITC) subsidiary du announced a collaboration with Nokia to improve employee skill sets and quicken initiatives to promote talent development in the UAE. As part of the agreement, Nokia will implement programs to train and grow its employees' technological proficiency and knowledge transfer.

- In January 2023, To increase its capabilities as a top supplier of turnkey security, facility management, and human resources outsourcing solutions in the UAE, ReplWorld Security, a DP World company, entered into a strategic alliance with Transworld Group. The businesses will work together to find ways to hire people abroad by finding, developing, and training skilled workers in the Indian subcontinent.

- The United Arab Emirates economy is expanding, as are the region's sectors, labor force, and several businesses. The cities in this area have recognized their potential, and with the money generated from selling these natural resources, living standards are rising, and regional stability is returning.

- In this area, skilled labor is crucial for managing the nation's resources. Also, by using workforce management software, cities in the area can boost production and revenue from their respective industries. One of the biggest trends in the region has been the Industrial Revolution 4.0, and the digital transformation is anticipated to increase considerably over the forecast period along with the quickly expanding 5G infrastructure. According to OpenSignal, UAE had the fastest average 5G download speed in 2022 at 315.90 Mbps. Qatar and Saudi Arabia rounded out the next at 275.90 Mbps and 237.90 Mbps, respectively.

MEA Workforce Management Software Industry Overview

The Middle East and African Workforce Management Software Market is highly fragmented, with major players like Active Operations, Management International LLP, NICE Systems Ltd, Oracle Corporation, Infor Group, and Kronos Incorporated ( UKG Inc.). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In February 2023, Workforce Africa, the HR solutions provider, announced its further expansion in Lesotho and Gabon. The company provides HR services like compliant payroll management, recruitment, assessment, HR support, employee benefits, independent contractor management, background verification, and more to global businesses. The expansion plans will pave the way for international businesses investing across the African continent.

In October 2022, DU Telecom signed a contract with Oracle Cloud Human Capital Management (HCM) to manage its HR processes across the UAE, including recruitment, compensation, and performance management. Due to this adaption, DU Telco will standardize HR procedures on a shared data platform, improving the organization's team management and HR services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Internet of Things (IoT) and Cloud-based Solutions Expanding the Market

- 5.1.2 Growing Adoption of Analytical Solutions and WFM by SMEs Driving Market Growth

- 5.2 Market Challenges

- 5.2.1 Implementation and Integration Concerns Hindering the Market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Workforce Scheduling and Workforce Analytics

- 6.1.2 Time and Attendance Management

- 6.1.3 Performance and Goal Management

- 6.1.4 Absence and Leave Management

- 6.1.5 Other Softwares (Fatigue Management, Task Management, etc.)

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-user Vertical

- 6.3.1 BFSI

- 6.3.2 Consumer Goods and Retail

- 6.3.3 Automotive

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Manufacturing

- 6.3.7 Other End-user Verticals

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

- 6.4.4 Rest of Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Active Operations Management International LLP

- 7.1.2 NICE Systems Ltd

- 7.1.3 Oracle Corporation

- 7.1.4 Infor Group

- 7.1.5 Kronos Incorporated (UKG Inc.)

- 7.1.6 Reflexis Systems Inc.

- 7.1.7 SISQUAL

- 7.1.8 Workday Inc.

- 7.1.9 WorkForce Software LLC

- 7.1.10 Blue Yonder Group Inc.

- 7.1.11 ServiceMax Inc.

- 7.1.12 Kirona Solutions Limited

- 7.1.13 7shifts

- 7.1.14 IBM Corporation

- 7.1.15 SAP SE

- 7.1.16 ADP LLC

- 7.1.17 Atoss Software AG

- 7.1.18 Mitrefinch Ltd

- 7.1.19 Sage Group PLC

- 7.1.20 Roubler UK Limited Company

- 7.1.21 Tamigo UK Ltd