|

市场调查报告书

商品编码

1640333

亚太地区人力资源管理软体市场:份额分析、产业趋势和成长预测(2025-2030 年)Asia-Pacific Workforce Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

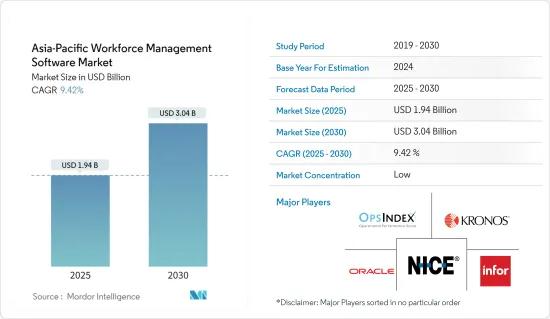

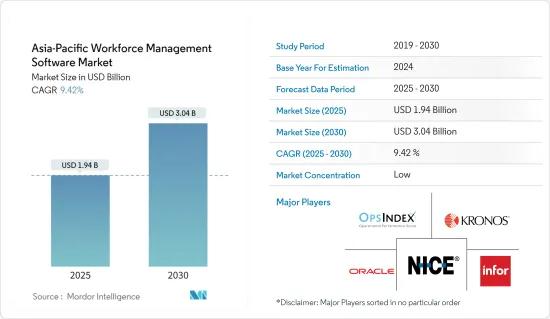

亚太地区人力资源管理软体市场规模预计在 2025 年为 19.4 亿美元,预计到 2030 年将达到 30.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.42%。

透过有效管理工作计画、业务流程、人事费用和人才管理,人力资源管理软体在提高组织绩效方面发挥着至关重要的作用。

主要亮点

- 亚太地区是世界领先的商品生产区之一,部分原因在于其作为主要出口区的地位。一系列产品在印度、中国、韩国、印尼、日本和澳洲生产。该地区被誉为技术纯熟劳工的宝库。众所周知,这里生产软体、汽车、食品製造、药品、化妆品、机械、服饰和许多其他产品。就生产和先进能力而言,劳动力非常重要。

- 自动化流程的普及使得员工转向自助服务技术。这些技术在维持指挥链的同时,也提高了职场的透明度和沟通能力。

- 人工智慧在人力资源管理软体领域的应用也变得越来越广泛。许多公司正在使用人工智慧来减少招聘、僱用、规划和追踪时间等耗时的任务。

- 该地区拥有数百万医生、工程师、技术人员等。为了将如此大量受过教育的工人转变为熟练的劳动力,需要一个管理系统。生产力是任何组织成功的关键。企业和产业都在努力降低成本、提高生产力并简化业务流程。为了实现这一目标,我们正在采用更为复杂的技术。

- 软体即服务评估的重点是根据您目前的痛点衡量功能集,并找到与供应商的良好匹配。然而,实施新的人力资源管理软体可能是一个昂贵且耗时的过程,必须毫不拖延地进行,才能充分实现任何组织所寻求的利益。

- COVID-19 指出了各个领域 WFM 解决方案的重要性,尤其是对医疗保健工作者而言。强调了保持护理人员参与度的良好做法的必要性,为医疗保健部门提供了一系列 WFM 解决方案,同时还为安排任务、预测体检和提供全职护理(而非兼职人员)提供支持。排班和准时人员配备也很重要。

亚太地区人力资源管理软体市场趋势

云端运算正在不断壮大

- 银行、保险和金融服务业正走向客户友善、服务导向的环境,传统的分店业务业务正被上门服务所取代。上门银行概念的兴起,导致该领域人手短缺,原因是日程繁忙,时间不足,加上市场竞争加剧,为了避免失去领先地位,管理变得至关重要。

- 如今,上门服务和家庭银行服务的范围已经远远超出了传统的现金提领和DD请求;它现在涵盖了从添加帐户持有人、验证身份(KYC)、收集文件、接收现金/支票到接受新客户的所有内容。

- 该行业的人力资源管理软体解决方案提供了多种改变游戏规则的优势,可实现无缝运作并确保成功管理劳动力,这对于实现客户满意度至关重要。

- 产业面临的主要问题之一是缺乏及时的可追溯性,而市场上供应商提供的解决方案(例如 Deliforce 的银行销售追踪软体)并未解决此问题。以 Deliforce 的银行销售追踪软体为例。管理层可以使用该软体来即时追踪现场的所有劳动力。

- 据印度品牌股权基金会称,到2023财年,印度银行资产将达到约2.9兆美元。在此期间,与私营部门和外资银行相比,公共部门银行的资产份额最高。

中国占最大市场占有率

- 中国是多种商品的最大生产国之一。该地区生产的商品种类繁多,从汽车到软体、从无人机到食品。劳动力对于生产如此多种类的商品至关重要。预计这也将有助于该地区劳动力管理软体市场的成长。

- 推动这一快速成长的是越来越多的中小型企业,它们为劳动力软体及其管理解决方案的开发和采用做出了重要贡献。

- 此外,中小企业的投资预计将对该地区的成长产生积极影响。由于中国对该地区的成长做出了重大贡献,中小企业正在投资增加采用云端基础的技术解决方案进行劳动力管理。

- 中国是该地区最重要的电子商务市场之一。该领域的就业成长是采用劳动力管理解决方案的主要驱动力。此外,随着越来越多的新零售商带着创新理念进入大众市场领域,劳动力管理的需求也将增加。

亚太地区人力资源管理软体产业概况

亚太地区的劳动力管理市场高度分散,有 IBM 公司、 Oracle、ADP、Krones Incorporated 和 Workday Inc. 等参与者。这些公司正在透过大量研发投资来扩大其市场,以实现亚太地区人力资源管理市场的永续性数位化。

- 2023 年 12 月,NICE Systems Ltd 宣布完成 LiveVox 的收购。 NICE 市场领先的平台 CXone 与 LiveVox 独特的 AI 驱动推广功能相结合,打造出市场上唯一互动中心的平台,为提供卓越的 AI 驱动 CX 奠定了基础。

- 2023 年 4 月, Oracle宣布更新 Oracle Fusion Cloud Human Capital Management (HCM) 中的员工体验平台 Oracle ME。最近的发展包括新的人工智慧应用程序,这些应用程式将学习、技能发展和职业流动性融入个人化体验,实现自我学习、洞察职业发展机会并将技能发展与业务目标相结合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 中小企业越来越多地采用分析解决方案和 WFM 将推动市场成长

- 劳动力优化和云端基础的需求推动市场成长

- 市场挑战

- 实施和整合问题阻碍市场

- 评估新冠肺炎对产业的影响

第六章 市场细分

- 类型

- 劳动力调度和劳动力分析

- 考勤管理

- 绩效与目标管理

- 缺勤和休假管理

- 其他软体(疲劳管理、任务管理等)

- 部署模式

- 本地

- 云

- 按最终用户产业

- BFSI

- 消费品和零售

- 车

- 能源和公共产业

- 卫生保健

- 製造业

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 印尼

- 泰国

- 其他亚太地区

- 亚太地区

第七章 竞争格局

- 公司简介

- Active Operations Management International LLP

- NICE Systems Ltd.

- Oracle Corporation

- Infor Group

- Kronos Incorporated

- Reflexis Systems Inc.

- Workday Inc.

- Blue Yonder Group Inc.

- ServiceMax Inc.

- IBM Corporation

- SAP SE

- ADP LLC

- Sage Group plc

第八章投资分析

第九章:市场的未来

The Asia-Pacific Workforce Management Software Market size is estimated at USD 1.94 billion in 2025, and is expected to reach USD 3.04 billion by 2030, at a CAGR of 9.42% during the forecast period (2025-2030).

By allowing effective administration of work schedules, business processes, labour costs and talent management, workforce management software has an important role to play in improving organisational performance.

Key Highlights

- The Asia Pacific region is one of the world's largest producers of goods, and this is due to its position as a major exporter. Different products are manufactured by India, China, South Korea, Indonesia, Japan, and Australia. The region is known for its skilled labour. It's known for software, cars, food production, medicines, cosmetics, machinery, clothes and many other products produced here. The workforce is very critical in terms of production and advanced capabilities.

- Employees are increasingly using self service technologies, which can be reached from any location and with no major obstacles, as a result of increasing use of automation based processes. Such technologies are enabling more transparency and communication in the workplace, while preserving a chain of command.

- In the field of workforce management software, use of AI is also becoming more widespread. Several businesses are using artificial intelligence to reduce the time consuming tasks, such as recruitment and hiring, planning and tracking times.

- There are millions of physicians, engineers, technicians, etc. in this region. Converting such a large number of educated workers into a skilled workforce requires a management system. The key to success in any organization is productivity. Enterprises and industry are working towards cost reduction, productivity improvement as well as improving business process efficiency. In order to achieve this objective, they adopt more sophisticated technologies.

- The focus of most software-as-a-service evaluation revolves around measuring feature set against any current problem areas and finding a vendor for working well with. However, the implementation of new workforce management software can be an expensive and time intensive process that must be carried out without delay in order to make full use of the benefits which any organisation is seeking.

- COVID-19 has pointed out the importance of WFM solutions in a variety of sectors, especially for healthcare workers. The need for some good practice to keep nursing staff engaged has been highlighted and, while offering the healthcare sector a range of WFM solutions, applications like scheduling tasks and predicting censuses, scheduleting and staffing nurses on time as opposed to parttime workers have also been underlined.

Asia-Pacific Workforce Management Software Market Trends

Cloud to Witness Significant Growth

- The banking, insurance industry and financial services has been increasingly moving toward a customer-friendly service-oriented environment where the introduction of doorstep services have taken over the traditional branch banking practices. The emergence of the concept of doorstep banking on the rise resulting in hectic schedules and paucity of time along with the fierce competition in the market in order to ensure that a lead is not gobbled up by the rival company, has made the management of the workforce extremely crucial in the sector.

- At present, the scope of doorstep services or home banking has gone far beyond the traditional cash withdrawal/DD request and now comprises other customized services that range from adding a nominee, verifying identity (KYC), collecting documents, cash/cheque pickups to the opening of a new account and delivering credit cards.

- The workforce management software solutions for the industry offer multiple benefits that can make a significant difference in the sector, offering seamless operations, thereby ensuring the successful management of the workforce, which is crucial for achieving customer satisfaction.

- One of the main problems facing the industry is a lack of timely traceability, and solutions provided by vendors on the market are aimed at addressing this problem, for instance banking sales tracking software from Deliforce. The administration can track the entire field workforce with this software and will be able to do so in realtime.

- According India Brand Equity Foundation, the assets of banks in India amounted to about 2.9 trillion USD in financial year 2023. During this period, public sector banks accounted for the highest share in assets compared to private and foreign sector banks.

China to hold the Largest Market Share

- China's one of the biggest producers of different goods. There are many varieties of goods produced in this region from cars to software, unmanned aerial vehicles as well as food products. The workforce is very important in the production of such a large range of goods. This will also contribute to the growth of the region's labour management software market.

- This rapid growth rate is driven by a more significant number of small and medium sized enterprises, which make an essential contribution to the development and implementation of workforce software and their management solutions.

- Moreover, the investments of SMEs are anticipated to have a positive impact on growth in this region. As China is a major contributor to regional growth, SMEs are investing in increasing the adoption of cloud based and technological solutions for workforce management.

- China is one of the most important e commerce markets in this region. Increasing employment in this sector is a major driver of the adoption of workforce management solutions. The need for workforce management will also increase as more and more new retailers move from novel concepts into the mass market sector.

Asia-Pacific Workforce Management Software Industry Overview

The Asia-Pacific workforce management market is highly fragmented due to the presence of players like IBM Corporation, Oracle, ADP, Krones Incorporated, and Workday Inc. They are upscaling the market with substantial R&D investments, driving toward the sustainability and digitization of the Asia-Pacific Workforce Management Market.

- In December 2023, NICE Systems Ltd has announced the closing of the acquisition of LiveVox. The combination of NICE's market leading platform CXone, with LiveVox's unique AI driven proactive outreach capabilities create the market's only interaction centric platform, the fundamental cornerstone to deliver superior AI driven CX.

- In April 2023, Oracle announced the updation to Oracle ME, the employee experience platform within Oracle Fusion Cloud Human Capital Management (HCM). Recent updates include new AI-powered apps that combine learning, skill development, and career mobility in a personalized experience, enabling self-directed learning, insight into career development opportunities, and skill development aligned with business objectives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Analytical Solutions and WFM by SMEs is Driving the Market Growth

- 5.1.2 Demand for Optimized and Cloud-Based Workforce to Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 Implementation and Integration Concerns Hindering the Market

- 5.3 Assessment of COVID-19 impact on the industry

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Workforce Scheduling and Workforce Analytics

- 6.1.2 Time and Attendance Management

- 6.1.3 Performance and Goal Management

- 6.1.4 Absence and Leave Management

- 6.1.5 Other Software (Fatigue Management, Task Management, etc.)

- 6.2 Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 End-User Vertical

- 6.3.1 BFSI

- 6.3.2 Consumer Goods and Retail

- 6.3.3 Automotive

- 6.3.4 Energy and Utilities

- 6.3.5 Healthcare

- 6.3.6 Manufacturing

- 6.3.7 Other End-User Industries

- 6.4 Geography

- 6.4.1 Asia-Pacific

- 6.4.1.1 China

- 6.4.1.2 India

- 6.4.1.3 Japan

- 6.4.1.4 Australia

- 6.4.1.5 South Korea

- 6.4.1.6 Indonesia

- 6.4.1.7 Thailand

- 6.4.1.8 Rest of Asia Pacific

- 6.4.1 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Active Operations Management International LLP

- 7.1.2 NICE Systems Ltd.

- 7.1.3 Oracle Corporation

- 7.1.4 Infor Group

- 7.1.5 Kronos Incorporated

- 7.1.6 Reflexis Systems Inc.

- 7.1.7 Workday Inc.

- 7.1.8 Blue Yonder Group Inc.

- 7.1.9 ServiceMax Inc.

- 7.1.10 IBM Corporation

- 7.1.11 SAP SE

- 7.1.12 ADP LLC

- 7.1.13 Sage Group plc