|

市场调查报告书

商品编码

1640525

欧洲黏合剂和密封剂:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Adhesives and Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

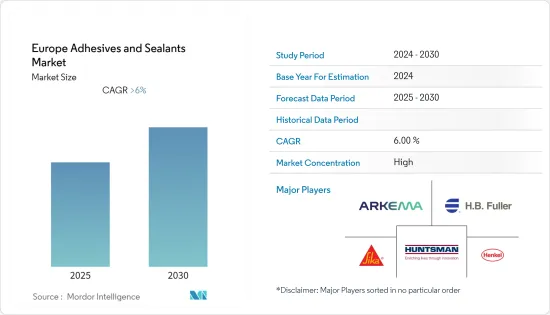

预计预测期内欧洲黏合剂和密封剂市场的复合年增长率将超过 6%。

主要亮点

- 对黏合剂和密封剂的需求主要受到建设产业和医疗保健基础设施不断增长的需求的推动。

- 然而,对化学品使用的环境问题的日益担忧可能会阻碍市场的成长。

- 预计包装终端用户领域将占据受调查市场的主导地位。然而,预计预测期内航太终端用户领域将成为该地区成长最快的领域。

- 生物基黏合剂的创新和发展以及向复合材料黏合剂黏合的转变可能会为该地区的黏合剂和密封剂市场提供机会。

- 德国是该地区最大的黏合剂和密封剂市场,消费主要由汽车、建筑、电子和包装等终端用户产业推动。

欧洲胶黏剂和密封剂市场的趋势

包装领域主导市场需求

- 在欧洲,包装产业是黏合剂和密封剂的最大消费产业。包装领域正见证着食品和饮料、化妆品、消费品和文具等终端用户应用的强劲需求。

- 此外,由于人口增长、对优质产品的需求、都市化和消费者的技术导向,对化妆品、食品和饮料的需求预计会增加,从而推动对包装行业的需求。

- 德国的回收能力大幅扩张,部分原因是中国禁止进口废弃塑胶包装,以及回收技术产业的成长。因此,再生塑胶包装製品使用量的增加也会导致黏合剂使用量的增加。此外,德国政府也设定了2025年实现90%家庭塑胶包装可回收或重复使用的目标,这将导致该国塑胶包装数量增加。德国包装产量预计将增加,到 2021 年将达到 2.0301 亿吨,而 2020 年为 1.952 亿吨,这将导致 2021 年黏合剂消费量约 8%。

- 新冠疫情爆发后,法国对零售电子商务的需求增加。预计 2021 年零售电商销售额将达到 927.1 亿美元,而 2020 年为 803.1 亿美元,2025 年将达到 1,432 亿美元。预计这将增加该国对包装产品的需求,从而在预测期内增加对包装黏合剂的需求。

- 同样,英国将在 2021 年生产约 190 万吨包装纸和纸板以及 530 万吨瓦楞纸板,从而增加该国对包装黏合剂的需求。

- 因此,推动包装行业成长的这种趋势可能会进一步促进该地区的黏合剂和密封剂消费。

德国占据市场主导地位

- 由于汽车产量显着增长、建设活动增加以及包装、航太和医疗保健等终端用户行业的增长,德国在粘合剂和密封剂消费方面占据该地区的主导地位。

- 德国拥有欧洲最大的建筑业。 2021年,德国政府在德国黑森州法兰克福-费兴海姆开始兴建费兴海姆数位园区,占地10.7公顷、总占地面积10万平方公尺,投资11.79亿美元。该建设计划预计将于2028年第四季完工。

- 德国是欧洲最大的电子商务市场之一,也是欧洲第二人口大国,这将推动包装製造市场的发展。与欧洲平均相比,德国的网路购物数量更多、网路使用者比例更高、年平均消费额也更高。 2021 年线上商品销售总额将达到约 991 亿欧元,高于 2020 年的 833 亿欧元。

- 国内包装生产主要由塑胶驱动,到 2021 年,塑胶将占包装产量的约 79%。此外,由于塑胶的可回收性不断提高,塑胶生产领域在预测期内可能会录得最快的成长率,即 3.32% 的复合年增长率。

- 德国是欧洲最大的医疗设备市场之一。 2021年,德国医疗设备市场价值约392亿美元,预计2022年将达到约419亿美元。因此,它可能会推动该国的黏合剂市场的发展。

- 因此,预计终端用户行业的此类趋势将在预测期内推动该国黏合剂和密封剂的消费。

欧洲黏合剂和密封剂产业概况。

欧洲黏合剂和密封剂市场正在整合,市场竞争良性。主要企业包括阿科玛集团、西卡股份公司、富乐公司、汉高股份公司和亨斯迈国际有限责任公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 德国建设产业需求不断成长

- 扩大包装行业的应用

- 限制因素

- 日益严重的环境问题

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 树脂专用黏合剂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- 乙烯-醋酸乙烯共聚物・

- 其他树脂

- 黏合剂(按技术分类)

- 热熔胶

- 反应性

- 溶剂型

- UV固化型

- 水性

- 树脂专用密封剂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 其他树脂

- 按最终用户产业

- 航太

- 车

- 建筑和施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

- 按地区

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Arkema Group

- Avery Dennison Corporation

- Beardow Adams

- Dow

- Dymax Corporation

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Jowat AG

- Mapei Inc.

- Tesa SE(A Beiersdorf Company)

- MUNZING Corporation

- Sika AG

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 生物基胶黏剂的创新与发展

- 向复合黏合的转变

简介目录

Product Code: 54250

The Europe Adhesives and Sealants Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The demand for adhesives and sealants is extensively driven by the growing demand from the construction industry and increasing healthcare infrastructure.

- However, the market growth is likely to be hindered by the rising environmental concerns regarding the usage of chemicals.

- In the studied market, the packaging end-user segment is expected to dominate the market. However, the aerospace end-user segment is expected to be the fastest-growing segment in the region during the forecast period.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials are likely to offer opportunities for the adhesives and sealants market in the region.

- Germany stands to be the largest market for adhesives and sealants in the region, where the consumption is driven by the end-user industries, such as automotive, construction, electronics, and packaging.

Europe Adhesives and Sealants Market Trends

Packaging Segment Dominates the Market Demand

- In Europe, the packaging segment is the largest consumer of adhesives and sealants. The packaging sector has been witnessing strong demand from end-user applications, such as food and beverages, cosmetics, consumer goods, stationery, and other end-user industries.

- Moreover, the demand for cosmetics and food and beverage products is expected to grow due to the growing population and demand for quality products, urbanization, and consumers inclining toward technology, hence, fueling the demand for the packaging industry.

- In Germany, the recycling technology sector grew as recycling capacities expanded dramatically, partly due to China's ban on importing waste plastic packaging. Therefore, increasing the use of recycled plastic packaging products increases the use of adhesives. In addition, the German government set a goal of having 90% of home plastic packaging recyclable or reusable by 2025, which will increase the plastic packaging in the country. Packaging production in Germany increased, reaching 203.01 million tons in 2021 compared to 195.2 million tons of production in 2020, thereby increasing the adhesives consumption volume by around 8% in 2021 compared to 2021.

- In France, post-COVID-19 pandemic, the demand for retail e-commerce sales increased. The retail eCommerce revenue increased in 2021, reaching USD 92.71 billion compared to USD 80.31 billion in 2020, and is likely to reach USD 143.2 billion by 2025. This increases the demand for packaging products in the country and is expected to increase the demand for packaging adhesives over the forecast period.

- Similarly, the United Kingdom produced around 1.9 million tons of packaging paper and paperboard and 5.3 million tons of corrugated board in 2021, thereby increasing the demand for packaging adhesives in the country.

- Hence, such trends driving the growth of the packaging industry is likely to further fuel the consumption of adhesives and sealants in the region.

Germany to Dominate the Market

- Germany dominates the region in the consumption of adhesives and sealants, owing to the presence of prominent automotive production, rising construction activities, and growth in the packaging, aerospace, and healthcare end-user industries in the country.

- Germany has the largest construction industry in Europe. In 2021, the German government initiated the construction of the Digital Park Fechenheim on a 10.7ha area, with a gross floor area of 100,000 m2, in Frankfurt-Fechenheim, Hesse, Germany, with an investment of USD 1,179 million. The construction project is expected to be completed by Q4 2028.

- Germany is one of the biggest e-commerce markets in Europe and has the second largest population in Europe, which will drive the packaging production market. Compared to Europe's average, Germany has a high number of online shoppers, the percentage of people using the internet, and the average annual spending. Total sales of goods sold online reached around EUR 99.1 billion in 2021, an increase compared to EUR 83.3 billion in 2020.

- Packaging production is majorly driven by plastics in the country, which nearly accounts for around 79% of the packaging produced in 2021. In addition, with the advancement of plastic recyclability, the plastic production segment is likely to register the fastest growth rate of around 3.32% CAGR during the projected period.

- Germany is one of the largest markets for medical devices in Europe. In 2021, the German medical devices market accounted for about USD 39.2 billion and is expected to reach about USD 41.9 billion in 2022.Thus, it will likely to drive the market for adhesives in the country.

- Hence, such trends in end-user industries are expected to drive the consumption of adhesives and sealants in the country over the forecast period.

Europe Adhesives and Sealants Industry Overview

Europe Adhesives and Sealants Market is consolidated in nature, with much healthy competition in the market. The major companies are Arkema Group, Sika AG, H.B. Fuller Company, Henkel AG & Co. KGaA, and Huntsman International LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in Germany

- 4.1.2 Growing Usage in the Packaging Industry

- 4.2 Restraints

- 4.2.1 Rising environmental concerns

- 4.2.2 Other Restrains

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

- 5.5 Geography

- 5.5.1 France

- 5.5.2 Germany

- 5.5.3 Italy

- 5.5.4 Russia

- 5.5.5 Spain

- 5.5.6 United Kingdom

- 5.5.7 Rest Of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Avery Dennison Corporation

- 6.4.4 Beardow Adams

- 6.4.5 Dow

- 6.4.6 Dymax Corporation

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Huntsman International LLC

- 6.4.10 Jowat AG

- 6.4.11 Mapei Inc.

- 6.4.12 Tesa SE (A Beiersdorf Company)

- 6.4.13 MUNZING Corporation

- 6.4.14 Sika AG

- 6.4.15 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Towards Adhesive Bonding for Composite Materials

02-2729-4219

+886-2-2729-4219