|

市场调查报告书

商品编码

1640709

药用塑胶瓶:市场占有率分析、行业趋势和成长预测(2025-2030 年)Pharmaceutical Plastic Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

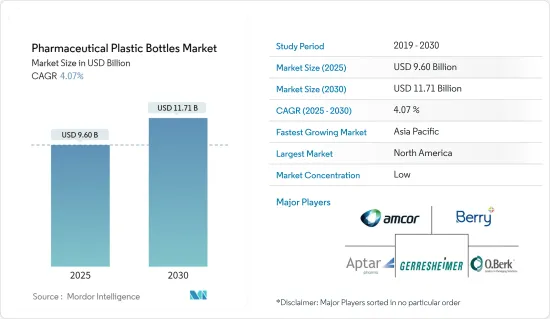

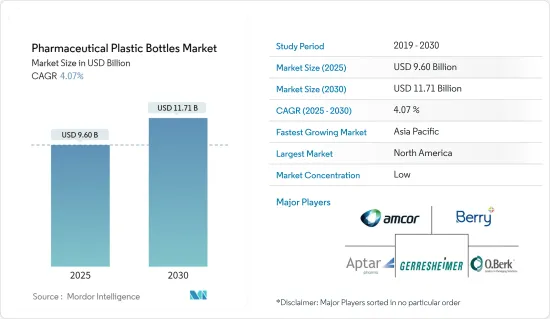

预计 2025 年医药塑胶瓶市场规模为 96 亿美元,预计到 2030 年将达到 117.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.07%。

预计在预测期内,用于储存和分销药品的药品包装需求不断增长将推动市场发展。

主要亮点

- 由于塑胶包装具有无与伦比的性能,製药业对塑胶包装的需求呈现显着增长。此外,其阻隔性、高尺寸稳定性、高衝击强度、抗变形、低吸水率、透明性、耐热性、阻燃性、延长保质期等特性也使其在医药领域的用途广泛扩展。

- 由于製药业越来越重视永续性,提高回收率并尽量减少对环境的影响,製药塑胶瓶市场正在不断扩大。技术进步和塑胶瓶在固态甚至液体口服药物中的使用日益增多,推动了药用塑胶瓶市场的成长。然而,原油价格的波动和各种法规导致的塑胶价格上涨可能会影响产品的消费并进一步阻碍研究市场的成长。

- 业界越来越多地使用塑胶瓶进行无菌填充和包装。市场供应商在各地区提供无菌瓶灌装包装服务。例如,LSNE 提供无菌滴管瓶填充服务。本公司拥有自动化填充线,可填充5ml、10ml标准多剂量三件瓶以及无菌多剂量瓶。

- 亚太地区是 PET 树脂和聚合物的重要生产中心,不存在供不应求的问题,从而推动了市场成长。中国是最大的宝特瓶生产国和消费国之一。

- 由于对药品和其他必需品的需求从未如此高涨,用于包装和运输这些产品的包装材料却出现短缺,导致供应链严重中断。然而,一些用于治疗新冠肺炎患者的药物的需求增加。这些药物包括麻醉剂、抗生素、肌肉鬆弛剂和仿单标示外用药。这导致向製药公司供应塑胶瓶。

医药塑胶瓶市场趋势

HDPE 细分市场成长率最高

- HDPE 用于製造多种不同类型的瓶子,包括无色瓶子,这些瓶子是半透明的,并具有优异的刚性和阻隔性。该材料还带有色素,可用于製药业包装光敏药物。这些材料适合包装保质期较短的产品。根据美国工业理事会预测,2021年美国树脂产量将达1,239亿磅,其中热塑性塑胶约占总产量的86%。当年产量最大的树脂是高密度聚苯乙烯(HDPE),产量为220亿磅。

- HDPE 还具有出色的耐化学性,用于包装各种化学物质和药品。事实证明,与不含颜料的 HDPE 材料相比,含颜料的 HDPE 瓶具有更好的抗应力开裂性。 HDPE吹塑成型应用比 PP 和 LDPE 材质更耐用且用途更广泛。与其他聚乙烯材料相比,它还具有更好的耐大多数溶剂性和更高的抗拉强度。

- HDPE 还具有一些更常见聚合物的高强度重量比,并且比 PP 更脆,因此主要用于大型商业容器。高密度聚乙烯 (HDPE) 在成型时仍保持较轻的重量,使其成为塑胶罐等较大容器的理想选择。

- 此外,市场多个参与者正在进行各种研究和开发工作。例如,2021 年 4 月,Advil 製造商葛兰素史克消费者保健公司 (GSK) 宣布承诺将其 8,000 多万瓶 Advil 瓶中的塑胶减少 20%。到 2022 年,我们计划从商店和网上销售的几乎所有瓶子中消除塑料,Advil 品牌易开瓶除外。新型阻隔树脂技术减少了模製和转化高密度聚苯乙烯(HDPE) 瓶所需的树脂量,同时保持了阻隔保护性能。

北美占据主要市场占有率

- 由于塑胶容器和瓶子的消费量和工业用途不断增加,美国塑胶瓶市场预计将呈现稳定的成长率。据美国塑胶工业委员会(PLASTICS)称,美国塑胶瓶的市场需求持续成长。

- 根据美国製药商业协会报道,美国医药市场正呈现上升趋势。到 2023 年,美国人预计在药品上的支出将在 6,350 亿美元至 6,550 亿美元之间。因此,美国是药品支出最多的国家。

- 此外,据美国製药商业协会称,美国医药市场正在崛起。到 2023 年,美国人预计在药品上的支出将在 6,350 亿美元至 6,550 亿美元之间。因此,它几乎肯定会成为药品支出最高的国家。

- 塑胶树脂及产品部门在 1,932 家机构僱用了 93,000 名员工。塑胶产品几乎用于所有现代产品,加拿大经济的大多数领域都需要塑胶产品,其中包装、建筑和汽车三大类占塑胶最终用途的 69%。

药用塑胶瓶产业概况

药用塑胶瓶市场主要由 Amcor Limited、Berry Plastics Group, Inc.Berry Plastics Group, Inc.、Aptar Pharma、Gerresheimer AG、Graham Packaging Company、Alpha Packaging、Alpack Plastic Packaging 等公司主导。参与者正在采用各种有机和无机策略(如併购、伙伴关係、新产品发布、协作等)来占领市场。

- 2021 年 12 月-Comal 宣布已收购射出射出成型和吹塑成型产品製造商 Omega Packaging。 Omega Packaging 的儿童防护封盖产品组合和精密模具製造能力推动了 Comal 的策略,即透过端到端客自订製造能力和扩大的产品系列。

- 2021 年 9 月 - Clearlake Capital Group 的投资组合公司 Pretium Packaging 同意从 Irving Place Capital 收购美国Alpha Packaging,收购金额未公开。 Alpha Packaging 和 Pretium Packaging 的合併将使两家公司能够为现有和新客户提供更广泛的先进包装解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 消费者对轻型药瓶的需求不断增加

- 医疗保健和药品支出的增加将推动市场成长

- 市场限制

- 原料成本上涨

- 对塑胶使用的环境担忧

第六章 市场细分

- 按原料

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 按类型

- 固态容器

- 滴管瓶

- 滴鼻剂瓶

- 液体瓶

- 口腔护理

- 其他类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor Limited

- Gerresheimer AG

- Berry Group Inc.

- Aptar Pharma

- O.Berk Company LLC

- Alpha Packaging

- Pro-Pac Packaging Ltd

- COMAR LLC

- Gil Plastic Products Ltd

- Drug Plastics Group

- Frapak Packaging

第八章投资分析

第九章 市场机会与未来趋势

The Pharmaceutical Plastic Bottles Market size is estimated at USD 9.60 billion in 2025, and is expected to reach USD 11.71 billion by 2030, at a CAGR of 4.07% during the forecast period (2025-2030).

The growing demand for the packaging in pharmaceuticals for the storage and delivery of medicines is expected to drive the market during the forecast period.

Key Highlights

- The demand for plastic packaging has witnessed significant growth in the pharmaceutical industry because of its unmatched ability. Additional features that led to increased adoption in pharma are barrier against moisture, high dimensional stability, high impact strength, resistance to strain, low water absorption, transparency, resistance to heat and flame, and extension of expiry dates.

- The market for pharmaceutical plastic bottles is growing due to growing sustainability concerns by increasing the recycling rate and minimizing the environmental impact in the pharmaceutical industry. Technological advancement and the rising application of plastic bottles in solid and even liquid oral medicines have added to market growth for pharmaceutical plastic bottles. However, the rise in the price of plastics due to fluctuating prices of crude oil and various regulations would reflect on the increase in the price of plastics, which may affect the consumption of the product and further hinder the growth of the market studied.

- Plastic bottles are increasingly used for aseptic filling and packaging in the industry. Market vendors provide aseptic bottle filling and packaging services in various regions. For instance, LSNE offers aseptic dropper bottle filling services. The company has an automated filling line capable of filling standard multi-dose three-piece bottles in 5 ml and 10 ml bottles and sterile multi-dose bottles.

- Asia-Pacific has a prominent base for the production of PET resin and polymers, which is also aiding the growth of the market with no issues of a supply shortage of raw material. China is one of the largest producing and consuming countries of PET bottles.

- With the increasing demand for medicine and other essential goods at an all-time high, a lack of available packaging to package and ship them further caused a significant interruption in supply chains. However, the demand increased for some medicines used in patients with COVID-19. These included some anesthetics, antibiotics, muscle relaxants, and some off-label medicines. This led to the supply of plastic bottles in the pharmaceutical companies.

Pharmaceutical Plastic Bottles Market Trends

HDPE Segment to Report the Highest Growth Rate

- HDPE is used to manufacture various types of bottles, and among those, un-pigmented bottles are translucent, with excellent stiffness and barrier properties. The material has a pigmented variety, which can package light-sensitive drugs in the pharmaceutical industry. These materials are suited for packaging products with a short shelf life. According to American Chemical Council, in 2021, the United States produced 123.9 billion pounds of resins, in which thermoplastics accounted for roughly 86% of total production. High-density polyethylene (HDPE) was the most produced resin that year, with an output of 22 billion pounds.

- HDPE also has excellent chemical resistance, which presents it as a valuable material for packaging various chemicals and medicinal products. Pigmented HDPE bottles are witnessed to have improved stress crack resistance than un-pigmented HDPE material. The blow-molding application of HDPE makes it more durable and more versatile than PP and LDPE materials. It also has excellent resistance to most solvents and high tensile strength compared to other forms of polyethylene materials.

- HDPE is also primarily used for larger containers in the commercial sector as it has a high strength-to-weight ratio in common polymers and is less brittle than PP. It maintains a lightweight nature in molding, making it suitable for larger containers, like plastic canisters.

- Further, there have been various research and development activities by multiple players in the market. For instance, in April 2021, Advil maker GSK Consumer Healthcare (GSK) announced a commitment to reducing the plastic in more than 80 million Advil bottles by 20%, which will result in a reduction of nearly 500,000 pounds of plastic in the environment. By 2022, Advil is expected to reduce plastic in nearly all bottles available in stores and online, except the brand's Easy Open bottles. The new barrier resin technology reduces the amount of resin required to mold and craft the high-density polyethylene (HDPE) bottles while maintaining barrier protection properties.

North America Accounts for a Significant Market Share

- The US plastic bottles market is estimated to grow at a steady rate, owing to the constantly increasing consumption and industrial applications of plastic-made containers and bottles. According to the Plastics Industry Association (PLASTICS), the market demand for plastic bottles continues to expand in the United States.

- According to Pharmaceutical Commerce, in the United States, the pharmaceutical market is on the rise. By 2023, it is expected that Americans would spend USD 635 to USD 655 billion on pharmaceuticals. As a result, the United States will be the country with the greatest pharmaceutical spending.

- Moreover, according to Pharmaceutical Commerce, in the United States, the pharmaceutical market is on the rise. By 2023, it is expected that Americans will spend USD 635 to USD 655 billion on pharmaceuticals. As a result, it will almost certainly be the country with the most significant pharmaceutical spending.

- The plastic resin and products sector employs 93,000 people across 1,932 establishments. With usage in almost every modern product, plastic products are in demand in Canada in most sectors of the economy, with three categories packaging, construction, and automotive accounting for 69% of plastic end use.

Pharmaceutical Plastic Bottles Industry Overview

The pharmaceutical plastic bottle market is fragmented with the presence of many players like Amcor Limited. Berry Plastics Group, Inc., Aptar Pharma, Gerresheimer AG, Graham Packaging Company, Alpha Packaging, and Alpack Plastic Packaging. The players have adopted various organic and inorganic strategies such as mergers & acquisitions, partnerships, new product launches, and collaborations to dominate the market.

- December 2021 - Comar announced that it acquired Omega Packaging, an injection, and blow-molded product manufacturer. Omega Packaging's line of child-resistant (CR) closures and precision mold-building capabilities advance Comar's strategy to serve healthcare customers with end-to-end custom manufacturing capabilities and an expanded product portfolio.

- September 2021 - Clearlake Capital Group portfolio company Pretium Packaging agreed to acquire US-based Alpha Packaging from Irving Place Capital for an undisclosed sum. Alpha Packaging and Pretium Packaging will allow the combined entity to offer a wide range of advanced packaging solutions to both firms' existing customer bases and new customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyer

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Lightweight Pharma Bottles by Consumers

- 5.1.2 Increasing Spending on Healthcare and Pharmaceutical to Augment the Market Growth

- 5.2 Market Restraints

- 5.2.1 Increasing Raw Material Costs

- 5.2.2 Environmental Concerns over Usage of Plastics

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polyethylene Terephthalate (PET)

- 6.1.2 Poly Propylene (PP)

- 6.1.3 Low-density Poly Ethylene (LDPE)

- 6.1.4 High-density Poly Ethylene (HDPE)

- 6.2 By Type

- 6.2.1 Solid Containers

- 6.2.2 Dropper Bottles

- 6.2.3 Nasal Spray Bottles

- 6.2.4 Liquid Bottles

- 6.2.5 Oral Care

- 6.2.6 Other Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 Saudi Arabia

- 6.3.6.2 United Arab Emirates

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Limited

- 7.1.2 Gerresheimer AG

- 7.1.3 Berry Group Inc.

- 7.1.4 Aptar Pharma

- 7.1.5 O.Berk Company LLC

- 7.1.6 Alpha Packaging

- 7.1.7 Pro-Pac Packaging Ltd

- 7.1.8 COMAR LLC

- 7.1.9 Gil Plastic Products Ltd

- 7.1.10 Drug Plastics Group

- 7.1.11 Frapak Packaging