|

市场调查报告书

商品编码

1683108

亚太地区塑胶瓶和容器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia-Pacific Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

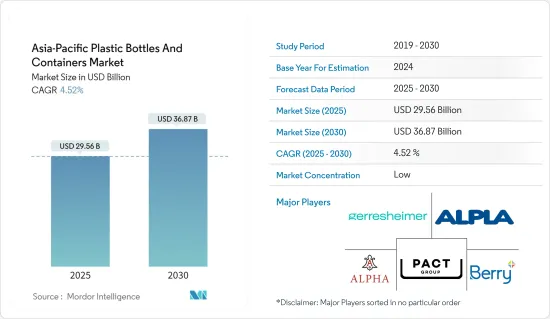

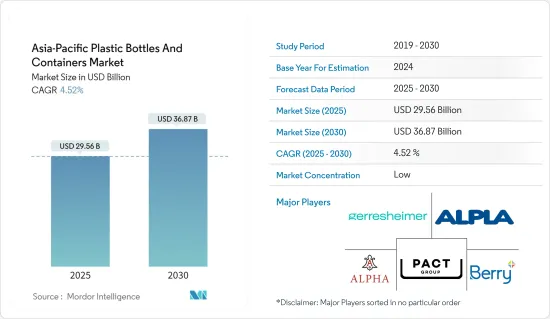

亚太地区塑胶瓶和容器市场规模预计在 2025 年为 295.6 亿美元,预计到 2030 年将达到 368.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.52%。

在产量方面,市场预计将从 2025 年的 2,050 万吨增长到 2030 年的 2,563 万吨,预测期内(2025-2030 年)的复合年增长率为 4.57%。

主要亮点

- 塑胶包装比其他产品更受消费者欢迎,因为塑胶材料重量轻、不易破碎、更易于物料输送。甚至大型製造商也倾向于使用塑胶包装,因为其生产成本低。此外,聚对苯二甲酸乙二酯(PET)和高密度聚苯乙烯(HDPE)等聚合物的引入扩大了宝特瓶的应用范围。市场对宝特瓶的需求日益增加。

- 由聚对苯二甲酸乙二醇酯、聚丙烯和聚乙烯製成的塑胶瓶和容器由于重量轻且易于回收,被广泛使用并受到最终用户的青睐。塑胶材料的成本效益以及对包装加工食品和各种食品和饮料产品的依赖可能会在预测期内对研究市场产生影响。

- 塑胶因其轻质特性而越来越多地被采用,因为轻质塑胶包装可以在运输包装货物时节省能源并减少排放。塑胶的轻量化特性是其市场拓展的一大优势。与玻璃等其他材料相比,玻璃比塑胶重得多,因此在运输过程中需要移动更多。

- 市场成长的另一个推动力是其在该地区各个行业的应用范围不断扩大。例如,在製药业,塑胶瓶是锭剂、糖浆和胶囊的可靠包装选择,因为它们具有防潮性能,可以保持产品的稳定性。在个人护理和化妆品行业,塑胶瓶因其耐用性和美观而成为包装洗髮精、护髮素、乳液和乳霜的理想选择。

- 然而,随着对塑胶污染的担忧日益加剧,製造商和消费者开始转向其他具有环保特性的包装材料。由于铝和玻璃具有较高的可回收性,其消费采用率可能会增加。预计这将阻碍该市场的成长。

- 同时,亚太地区经济成长持续向好、人口结构变化不断活跃,对地区发展产生重大影响。超级市场和大卖场等有组织的零售业的成长正在增加对包装商品的需求。这些商店需要大规模包装来满足消费者的多样化需求,从而推动整个市场的发展。

亚太地区塑胶瓶和容器市场趋势

聚对苯二甲酸乙二醇酯(PET)占据主要市场占有率

- PET 塑胶瓶已成为笨重且易碎的玻璃瓶的广泛替代品,因为它们可以为矿泉水和其他饮料提供可重复使用的包装,并允许更经济的运输过程。

- PET 的高透明度和天然的二氧化碳阻隔性能使其用途广泛,易于吹製成瓶并形成其他形状。可透过着色剂、紫外线防护剂、氧气阻隔剂/清除剂和其他添加剂来增强 PET 的性能,以开发出满足品牌特定需求的瓶子。

- PET 已成为该地区瓶子製造商的主要包装材料之一。 PET 具有适应各种形状和尺寸的多功能性,是传统玻璃和金属容器无与伦比的替代品,使其成为包装行业非常理想的选择。

- 聚对苯二甲酸乙二醇酯(PET)瓶在各种产品领域越来越受欢迎。由于成本低、重量轻以及印刷技术的发展, 宝特瓶越来越受到高端消费者的欢迎。

- 根据永续化学品公司 Indorama Ventures 的报告,亚洲对再生聚对苯二甲酸乙二醇酯 (RPET) 的需求预计将从 2018 年的 60 万吨稳步增长至 2023 年的 100 万吨左右。

- 此外,2023 年 9 月,Indorama Ventures Public Company Limited 宣布已回收了 1,000 亿个消费后宝特瓶。此举转移了 210 万吨废弃物,减少了 290 万吨二氧化碳排放,并为建立 PET 循环经济做出了贡献。 Indorama Ventures 承诺投入超过 10 亿美元用于废旧宝特瓶废弃物收集。

- PET 回收的未来与技术进步密切相关,这些技术进步会使回收过程更有效率、经济高效且环保。收集、加工并将消费后 PET 产品转化为新包装材料的能力为减少对原始材料的依赖和减轻环境废弃物提供了巨大的机会。

预计中国将占较大市场占有率

- 中国是世界主要塑胶生产国和消费国之一。据经合组织称,预计未来40年中国塑胶使用量将大幅增加,到2060年将达到2.0312亿吨以上。由于食品饮料、製药和个人护理行业越来越依赖由PET(聚对苯二甲酸乙二醇酯)、HDPE(高密度聚苯乙烯)和其他聚合物製成的宝特瓶和容器,中国的塑胶生产和出口备受关注。

- 根据国际贸易中心(ITC)的资料,美国是中国塑胶製品最大的出口目的地。 2023年中国将向美国出口塑胶製品2.926亿吨,与前一年同期比较增加8.00%。由于塑胶贸易具有较高的潜在成长机会,预计未来几年该国对塑胶的需求将会增加。

- 中国正在经历向永续和环保实践的转变,以推广塑胶再生。因此,可口可乐等饮料公司已将再生塑胶作为减少环境影响策略的一部分。

- 2024年4月,美国饮料公司可口可乐在香港推出了由回收聚对苯二甲酸乙二醇酯 (rPET) 製成的可口可乐原味瓶、无糖可口可乐和可口可乐 Plus 瓶。

- 中国敦促商店和快递公司减少「不合理」的塑胶包装,到2025年将都市区垃圾焚烧率从目前的每天58万吨提高到每天80万吨左右。预计这些发展将增加该国对可回收塑胶包装的需求。

亚太地区塑胶瓶及容器产业概况

亚太地区塑胶瓶和容器市场分散,主要参与者包括 Gerresheimer AG、Pact Group Holdings Limited、Alpla Group、Berry Global Inc. 和 Alpha Packaging Pvt。有限公司。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 10 月—Manjushree Technopack 与 Ganesha Ecosphere Group 的瓶到瓶级回收部门签署了合作协议,共同开发和供应利用再生塑胶的食品和非食品级包装产品。此次伙伴关係旨在帮助品牌遵守新的(塑胶废弃物管理)PWM 规则,同时支持印度政府到 29 财年用再生塑胶取代高达 60% 的原生塑胶的雄心勃勃的目标。此次伙伴关係也旨在帮助建立循环经济并加速采用 100%回收宝特瓶瓶。

- 2023 年 12 月 - 澳洲 Pact Group 与 Cleanway 废弃物 Management、朝日饮料公司和可口可乐欧洲太平洋合作伙伴合作,在墨尔本开设了一家宝特瓶回收工厂。 Circular Plastics Australia(PET)工厂将消费后宝特瓶转化为高品质食品级树脂,用于製造新的再生 PET 饮料瓶和其他包装产品。该厂每小时生产 2.5 吨 rPET 树脂的能力,即每年生产 20,000 吨。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- 越来越多地采用轻量化包装方法

- 人口和生活方式的变化

- 市场限制

- 人们对塑胶使用的环境问题的担忧日益加剧

第六章 市场细分

- 按原料

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他成分

- 按最终用户产业

- 饮料

- 瓶装水

- 碳酸饮料

- 乳类饮料

- 其他饮料

- 食物

- 化妆品

- 药品

- 家居用品

- 其他行业

- 饮料

- 按国家

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 东南亚

第七章 竞争格局

- 公司简介

- Gerresheimer AG

- Pact Group Holdings Limited

- Alpla Group

- Berry Global Inc.

- Alpha Packaging Pvt. Ltd

- Mauser Packaging Solutions(Bway Holding Corporation)

- Greiner Packaging International GmbH

- Retal Industries Limited

- Zhejiang Xinlei Packaging Co. Ltd

- Shenzhen Zhenghao Plastic & Mold Co. Ltd

- Manjushree Technopack Limited

第八章投资分析

第九章:市场的未来

The Asia-Pacific Plastic Bottles And Containers Market size is estimated at USD 29.56 billion in 2025, and is expected to reach USD 36.87 billion by 2030, at a CAGR of 4.52% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 20.50 million metric tons in 2025 to 25.63 million metric tons by 2030, at a CAGR of 4.57% during the forecast period (2025-2030).

Key Highlights

- Plastic packaging has become popular among consumers over other products, as plastic material is lightweight and unbreakable, making it easier to handle. Even major manufacturers prefer to use plastic packaging, owing to the lower cost of production. Moreover, the introduction of polymers, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE), is expanding the applications of plastic bottles. The market has been witnessing an increasing demand for PET bottles.

- Plastic bottles and containers made of polyethylene terephthalate, polypropylene, and polyethylene are widely used as the material is lightweight and easily recyclable, making it the preferred choice among the end-users. The cost-effective nature of plastic material and dependence on packaged, processed food and various beverages will influence the studied market over the forecast period.

- Plastics have been increasingly adopted due to their lightweight properties because lightweight plastic packaging can preserve energy in transporting packed goods and lower emissions. The lightweight properties of plastic are the primary advantage of expanding the market. Compared to other materials, such as glass, which is much heavier than plastic, more trips are required while transporting.

- The market's growth can also be attributed to the expanding range of applications across diverse industries in the region. For instance, within the pharmaceutical industry, plastic bottles offer a reliable packaging option for tablets, syrups, and capsules due to their moisture-resistant properties that maintain product stability. In personal care and cosmetics, plastic bottles are an ideal option for packaging shampoos, conditioners, lotions, and creams, owing to their durability and visual appeal.

- However, with growing concerns about plastic pollution, manufacturers and consumers are also inclining themselves toward other packaging materials that offer environment-friendly properties. The consumption of aluminum and glass might witness rising adoption rates owing to their high recyclability. This is expected to hinder the growth of the market studied.

- Nevertheless, the Asia-Pacific region has experienced improved and better economic growth and dynamic demographic changes that have significantly influenced the region's development. The growth of organized retail, including supermarkets and hypermarkets, has heightened the demand for packaged goods. These outlets require extensive packaging to cater to the diverse needs of consumers, driving the overall market.

Asia-Pacific Plastic Bottles And Containers Market Trends

Polyethylene Terephthalate (PET) Segment Holds Major Market Share

- Plastic bottles made from PET are widely replacing heavy and fragile glass bottles since they offer reusable packaging for mineral water and other beverages, allowing a more economical transportation process.

- With its clarity and natural CO2 barrier properties, PET has wide applications and is easily blown into a bottle or molded into any other shape. PET properties can be improved with colorants, UV blockers, oxygen barriers/scavengers, and other additives to develop a bottle to match a brand's specific needs.

- PET has become one of the vital packaging materials among bottle manufacturers across the region. PET's versatility in accommodating different shapes and sizes has provided unparalleled alternatives to conventional glass and metal containers, making it a highly desirable choice in the packaging industry.

- Polyethylene terephthalate (PET) bottles are gaining a presence in various product areas. Low cost, low weight, and ongoing developments in printing technology have led to PET bottles gaining popularity among premium consumers.

- As per the report of Indorama Ventures, a sustainable chemical company, the demand for recycled polyethylene terephthalate (RPET) in Asia is expected to increase constantly from 0.6 million metric tons in 2018 to approximately 1 million metric tons in 2023.

- Further, in September 2023, Indorama Ventures Public Company Limited notified that it had recycled 100 billion post-consumer PET bottles. This has diverted 2.1 million tons of waste, preserved 2.9 million tons of carbon footprint, and helped in establishing a circular economy for PET. Indorama Ventures spent more than USD 1 billion on the waste collection of used PET bottles.

- The future of PET recycling closely revolves around technological advancements that make the process more efficient, cost-effective, as well as environmentally friendly. The ability to collect, process, and transform used PET products into new packaging materials provides an immense opportunity to reduce dependency on virgin resources, therefore mitigating environmental waste.

China Expected to Hold Significant Market Share

- China is one of the major producers and consumers of plastic globally. According to the OECD, China's plastics use is projected to grow considerably over the next four decades, reaching more than 203.12 million metric tons by 2060. The growing dependence on plastic bottles and containers made using PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), and other polymers for food & beverage, pharmaceutical, and personal care industries has increased the focus on the production and export of plastics from China.

- According to data from the International Trade Center (ITC), China's largest export of plastic products is to the United States of America. China exported 292.6 million tons of plastic products to the USA in 2023, which was 8.00% higher than the previous year. The high potential growth opportunity in plastic trade is expected to increase the country's demand for plastic in the coming years.

- China is witnessing a shift in its focus on sustainable and eco-friendly practices to promote recycled plastic. This has resulted in beverage manufacturers such as Coca-Cola using recycled plastic as part of their strategy to reduce their environmental footprint.

- In April 2024, Coca-Cola Company, a United States-based beverage company, launched Coca-Cola Original, Coca-Cola No Sugar, and Coca-Cola Plus bottles made from recycled polyethylene terephthalate (rPET) in Hong Kong.

- China has been prompting merchants and delivery companies to reduce "unreasonable" plastic wrapping and increase garbage incineration rates in cities to about 800,000 tons per day by 2025, up from 580,000 tons currently. Such developments are expected to increase the country's recyclable plastic packaging demand.

Asia-Pacific Plastic Bottles And Containers Industry Overview

The Asia Pacific Plastic Bottles and Containers market is fragmented with the presence of major players like Gerresheimer AG, Pact Group Holdings Limited, Alpla Group, Berry Global Inc., and Alpha Packaging Pvt. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - Manjushree Technopack entered into a collaboration agreement with the bottle-to-bottle grade recycling division of Ganesha Ecosphere Group to co-develop and supply food and non-food grade packaging products made of recycled plastics. The partnership sets to serve the brands in complying with the new (Plastic Waste Management) PWM rules while supporting the Indian government's ambitious target of replacing up to 60% of virgin plastic with recycled plastic by FY29. The partnership also aims to help create a circular economy and accelerate the adoption of 100% recycled plastic bottles.

- December 2023 - Pact Group, an Australia-based company, in partnership with Cleanway Waste Management, Asahi Beverages, and Coco-Cola Europacific Partners, opened a PET bottle recycling plant in Melbourne. The Circular Plastics Australia (PET) plant will convert used plastic bottles into high-quality food-grade resin, which will be used to make new recycled PET beverage bottles and other packaging products. The facility is equipped to produce 2.5 tons of rPET resin per hour and 20,000 tons of rPET resin each year.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Changing Demographic and Lifestyle Factors

- 5.2 Market Restraints

- 5.2.1 Growing Environmental Concerns Over the Use of Plastics

6 MARKET SEGMENTATION

- 6.1 By Raw Materials

- 6.1.1 Polyethylene Terephthalate (PET)

- 6.1.2 Polypropylene (PP)

- 6.1.3 Low-Density Polyethylene (LDPE)

- 6.1.4 High-Density Polyethylene (HDPE)

- 6.1.5 Other Raw Materials

- 6.2 By End-user Vertical

- 6.2.1 Beverages

- 6.2.1.1 Bottled Water

- 6.2.1.2 Carbonated Soft Drinks

- 6.2.1.3 Dairy-based

- 6.2.1.4 Other Beverages

- 6.2.2 Food

- 6.2.3 Cosmetics

- 6.2.4 Pharmaceuticals

- 6.2.5 Household Care

- 6.2.6 Other End-user Verticals

- 6.2.1 Beverages

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerresheimer AG

- 7.1.2 Pact Group Holdings Limited

- 7.1.3 Alpla Group

- 7.1.4 Berry Global Inc.

- 7.1.5 Alpha Packaging Pvt. Ltd

- 7.1.6 Mauser Packaging Solutions (Bway Holding Corporation)

- 7.1.7 Greiner Packaging International GmbH

- 7.1.8 Retal Industries Limited

- 7.1.9 Zhejiang Xinlei Packaging Co. Ltd

- 7.1.10 Shenzhen Zhenghao Plastic & Mold Co. Ltd

- 7.1.11 Manjushree Technopack Limited