|

市场调查报告书

商品编码

1630368

北美塑胶瓶市场:份额分析、产业趋势、成长预测(2025-2030)North America Plastic Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

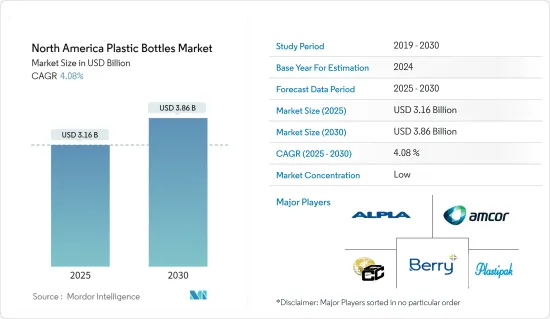

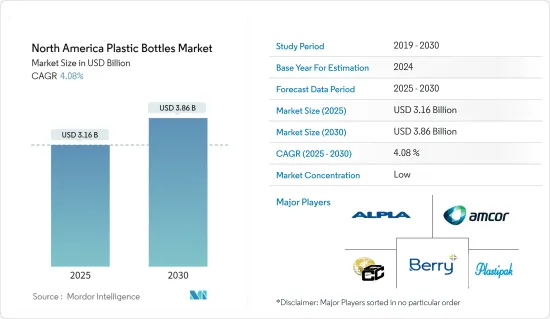

预计2025年北美塑胶瓶市场规模为31.6亿美元,预计2030年将达38.6亿美元,预测期间(2025-2030年)复合年增长率为4.08%。

从市场规模来看,预计将从2025年的33.6亿吨成长到2030年的40.5亿吨,预测期间(2025-2030年)复合年增长率为3.80%。

主要亮点

- 对包装饮料和药品的需求正在强劲增长。消费者的健康意识日益增强,对健康饮品的需求也不断增加。这使得个人更容易获得瓶装水,从而推动市场成长。

- 根据饮料行销公司和国际瓶装水协会2023年3月发布的报告,瓶装水在2022年成为最受欢迎的饮料,约占所有饮料消费的25%。

- 碳酸软性饮料 (CSD) 产业的宝特瓶使用量激增,该产业在北美已达到饱和状态。百事可乐、可口可乐和 Keurig Dr. Pepper 的北美汽水部门销售额持平。根据可口可乐年报估计,这三家公司在北美市场占有80%以上的市场占有率。因此,对碳酸饮料塑胶瓶的需求预计将推动市场成长。

- PET广泛用于食品和饮料包装,因为它对水蒸气、气体、稀酸、石油和酒精具有很高的抵抗力。它还易于回收并随着时间的推移保持其抵抗力。卓越的耐用性、坚固性和稳定性使其成为食品级产品(例如单独尺寸的饮料容器和瓶盖)的安全选择。

主要亮点

- 根据地球日组织者编制的资料,美国每分钟售出约100万个宝特瓶,包装饮用水市场的需求预计将增加。

- 然而,北美地区的塑胶回收率并未显着增长,人们对塑胶使用的担忧日益加剧。在美国,收集用于回收的消费后瓶子中大约 65% 是宝特瓶。然而,只有 30% 的宝特瓶和水壶被回收。 宝特瓶的回收效率高度依赖回收基础设施。预计这将在预测期内对该地区的市场成长产生负面影响。

北美塑胶瓶市场趋势

宝特瓶饮料的需求预计将增加

- 由于瓶装水和非酒精饮料的需求不断增加,宝特瓶瓶市场的饮料领域预计将扩大。瓶装水的需求是由消费者对高品质饮用水的倾向所推动的,特别是担心饮用受污染的自来水后感染疾病、瓶装水的便携性以及便利性。

- 用于包装瓶装水的塑胶瓶市场正在增加全球消费者对包装饮用水的需求,因为它比其他包装选择更具成本效益,具有更长的保质期,并且更易于使用。

- 大多数瓶装水公司使用塑胶容器来包装其产品。根据国际瓶装水协会(IBWA)统计,塑胶容器占瓶装水市场的97.3%。根据 Beverage Marketing Corporation 2023 年 5 月发布的报告,近年来美国瓶装水销售额不断成长,从 2018 年的 138.5 亿美元增加到 2023 年的 159 亿美元。预计在预测期内,对瓶装水的需求将会增加,从而加强对塑胶瓶的需求。

- PET 塑胶瓶是软性饮料的热门选择,因为它们为生产商和客户提供了许多好处。大约 70% 的软性饮料首选 PET 塑胶瓶,包括碳酸饮料、非碳酸饮料、稀释饮料、果汁和瓶装水。随着全部区域碳酸饮料销量的成长,对塑胶瓶盖和瓶盖的需求也将增加。

- 现今消费者「忙碌」的生活方式需要轻巧、易于使用的包装。能量饮料市场的扩大也支持了市场的成长。

- 根据 Monster Beverage 报告(2024 年 1 月),美国能量饮料销售额将从 2017 年的 1,101.05 美元增长到 2023 年的 15.99 亿美元。销售单位数量的增加自动被认为对市场成长有正面影响。

预计加拿大需求稳定

- 近年来,由于消费者对环保包装的环境效益的认识不断提高,永续包装解决方案受到关注。由于其可回收性和循环潜力,PET 已成为追求环保包装材料的重要树脂。 40 多家加拿大製造商最近宣布了《加拿大塑胶公约》,承诺在 2025年终回收或堆肥加拿大 50% 的塑胶包装。

- 製药业是加拿大最具创新性的产业之一。它在过去 10 年里经历了显着的增长。根据 Statcan 的数据,2023 年加拿大药品销售额成长 11.3%,高于 2022 年的 8.5%。随着这种成长,防篡改塑胶药瓶将出现强劲的需求,因为它们与人们对经济高效且可靠的包装解决方案的偏好产生共鸣。

- 此外,美容和个人护理製造商正致力于在加拿大化妆品和个人护理市场推出新产品,以满足消费者对天然化妆品不断增长的需求。例如,2023年,太郎製药推出了新型洁净标示天然化妆品护肤瓶Bee RX。这种持续的技术创新有望在未来为塑胶瓶开闢多种途径。

- 塑胶瓶是一种经济高效的软性饮料包装解决方案,主要由于其重量轻,可降低储存和运输成本。专为碳酸饮料设计的宝特瓶树脂品质卓越。

- 根据美国农业部对外农业服务局的数据,2018 年至 2023 年加拿大市场的软性饮料销量成长了 14%。预计市场将确认在预测期内对塑胶瓶的需求将保持相同或成长的成长率。

- 该地区的几家製造商正在推出用于软性饮料和其他饮料的环保塑胶瓶。例如,已宣布从2024年初开始,加拿大可口可乐公司销售的所有500毫升起泡饮料瓶将由100%再生塑胶製成。该公司是加拿大率先推出多种 100% 再生塑胶瓶装气泡饮料的公司之一。由 100% 再生塑胶製成的瓶子创造并维持了塑胶包装的循环经济。

北美塑胶瓶产业概况

北美塑胶瓶市场是细分的,有几个主要参与者。从市场占有率来看,目前该市场由几家大型企业主导。这些拥有主导市场份额的公司专注于扩大基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。我们将介绍市场的一些最新趋势。

- 2024 年 5 月,主要企业ALPLA 推出了一款由聚对苯二甲酸乙二醇酯 (PET) 製成的新型可回收酒瓶。这种创新包装可减少 50% 的碳排放,并节省高达 30% 的成本。目前,这款瓶子有 750 毫升和 1 公升两种规格,由奥地利葡萄酒生产商 Wegenstein 使用,该公司既是测试客户,也是共同开发合作伙伴。

- 2023 年 8 月,Berry Global 为其新的永续奢侈品牌推出了创新的 rPET 瓶。我们利用技术力和丰富经验,实现了 NEUE Water 创始人 Michael Lowers 的独特设计愿景。非常规的扁平形态对宝特瓶使用的传统注射拉伸吹塑成型(ISBM) 製程提出了挑战。然而,Berry 巧妙地改进了技术,无缝地整合了这项创新设计。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 增加回收和其他具有成本效益的措施增强了需求

- 瓶装水产业需求的增加提振了市场

- 市场问题

- 关于塑胶使用的环境问题

- 贸易场景

- 进出口资料

- 贸易分析(前5名进出口国家)

第六章 市场细分

- 按树脂

- 聚乙烯(PE)

- 聚对苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 其他树脂(聚苯乙烯、PVC、聚碳酸酯等)

- 按最终用户产业

- 食物

- 饮料

- 瓶装水

- 碳酸饮料

- 酒精饮料

- 果汁和能量饮料

- 其他饮料

- 药品

- 个人护理和洗护用品

- 工业的

- 家用化学品

- 画

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美洲

第七章 竞争格局

- 公司简介

- ALPLA Group

- Amcor Group GmbH

- Container Corporation of Canada

- Plastikpak Holding Inc.

- Berry Global

- Comar LLC

- TricorBraun Canada

- Cole-Parmer Instrument Company LLC

- Sailor Plastics Inc.

- Bramalea Bottle Inc.

- Triumbari Corp.

- CoastPak Industrial Co.

- 竞争对手分析 -新兴企业与老牌公司

第 8 章 回收与永续性景观

第9章市场的未来

The North America Plastic Bottles Market size is estimated at USD 3.16 billion in 2025, and is expected to reach USD 3.86 billion by 2030, at a CAGR of 4.08% during the forecast period (2025-2030). In terms of market size, the market is expected to grow from 3.36 billion tonnes in 2025 to 4.05 billion tonnes by 2030, at a CAGR of 3.80% during the forecast period (2025-2030).

Key Highlights

- The demand for packaged beverages and pharmaceutical drugs has been increasing strongly. Consumers are becoming increasingly health-conscious, and the demand for healthy beverages is rising. This has made bottled water more accessible to individuals, aiding the market's growth.

- According to a report published in March 2023 by the Beverage Marketing Corporation and the International Bottled Water Association, bottled water was the most popular drink in the United States in 2022, accounting for about 25% of all beverage consumption.

- The usage of plastic bottles surged in the carbonated soft drinks (CSD) sector, which has reached saturation in North America. Pepsi, Coca-Cola, and Keurig Dr Pepper have reported flat sales from their carbonated soft drink division in North America. As per the estimates made by Coca-Cola in its annual report, these three companies hold a market share of more than 80% in the North American market. Thus, the demand for plastic bottles for CSD drinks is expected to drive the market's growth.

- PET is widely used in food and beverage packaging because of its high resistance to water vapor, gases, dilute acids, oils, and alcohol. It is also easily recyclable and maintains its resistance over time. Its exceptional durability, robustness, and steadfastness make it a safe choice for food-grade products such as individual-sized drink containers and closures.

- According to data produced by Earth Day Organizers, around 1 million plastic bottles are sold in the United States every minute, and the demand for packaged drinking water is expected to increase in the market.

- However, in North America, the plastic recycling rate shows no significant growth, and the concerns relating to the use of plastic are growing. In the United States, PET bottles make up roughly 65% of the post-consumer bottles collected for recycling. Yet merely 30% of plastic bottles and jugs find their way to the recycling process. The efficiency of recycling plastic bottles hinges significantly on the recycling infrastructure. This is expected to have a negative impact on the market's growth in the region during the forecast period.

Key Highlights

North America Plastic Bottles Market Trends

Demand for Bottled Beverages is Expected to Increase

- With the rising demand for bottled water and non-alcoholic beverages, the beverage segment in the plastic bottle market is expected to expand. The demand for bottled water is attributed to customers' predisposition to want high-quality drinking water, specifically, their concern about contracting diseases after drinking tainted tap water and the portability and convenience of bottled water.

- The market for plastic bottles for bottled water packaging is driven by the rising demand for packaged drinking water among consumers across the world because they are more cost-effective than other packaging options, have a longer shelf life, and are easy to use.

- Most bottled water companies package their products using plastic containers. According to the International Bottled Water Association (IBWA), plastic containers comprise 97.3% of the bottled water market. According to a report published by the Beverage Marketing Corporation in May 2023, the sale value of bottled water in the United States grew in the last few years, from USD 13.85 billion in 2018 to USD 15.90 billion in 2023. This demand for bottled water is expected to increase during the forecast period, bolstering the demand for plastic bottles.

- PET plastic bottles are a commonly selected option for soft drinks because of their many advantages to producers and customers. PET plastic bottles are the preferred packaging choice for approximately 70% of soft drinks, including carbonated beverages, still and dilutable drinks, fruit juices, and bottled water. With the growth of carbonated soft drink sales across the region, the demand for plastic caps and closures would also rise.

- The "on-the-go" lifestyle of today's consumers demands lightweight and user-friendly packaging. Also, the growing market for energy drinks is driving the market's growth.

- According to a report by Monster Beverage (January 2024), the unit sales of energy drinks in the United States amounted to USD 1,599 million in 2023, up from USD 1,101.05 million in 2017. The rising unit sales would automatically positively impact the market's growth.

Canada is Expected to Witness Stable Demand

- Sustainable packaging solutions have gained traction in recent years owing to rising consumer awareness regarding the environmental benefits of eco-friendly packaging. PET has emerged as an integral resin in the pursuit of eco-friendly packaging materials due to its recyclability and potential for circularity. More than 40 Canadian manufacturers have recently announced the "Canada Plastics Pact," which is a commitment to recycling or composting 50% of Canada's plastic packaging by the end of 2025.

- The pharmaceutical sector is one of the most innovative industries in Canada. Over the past decade, it has experienced significant growth. According to Statcan, there was an 11.3% annual change in sales of pharmaceuticals in Canada during 2023, up from 8.5% in 2022. With such growth, plastic pharma bottles equipped with tamper-resistant features resonate with the preference for cost-efficient yet dependable packaging solutions that would witness robust demand.

- Furthermore, beauty and personal care manufacturers are focusing on launching new products in the Canadian cosmetics and personal care market to cater to the rising consumer demand for natural cosmetic products. For instance, in 2023, Taro Pharmaceutical Inc. launched Bee RX, a new clean-label, natural cosmetic skincare bottle. Constant innovations like this are expected to create several avenues for plastic bottles in the upcoming period.

- Plastic bottles offer a cost-effective packaging solution for soft drinks, primarily due to their lightweight nature, reducing storage and shipping costs. The resins in these bottles, specifically designed for carbonated beverages, are of superior quality.

- According to the USDA Foreign Agricultural Service, the Canadian market witnessed a 14% growth in sales of soft drinks in Canada between 2018 and 2023. With the same or increasing growth rate during the forecast period, the market is expected to witness demand for plastic bottles.

- Several manufacturers across the region are launching eco-friendly plastic bottles for soft drinks and other beverages. For instance, from the start of 2024, all 500 ml sparkling beverage bottles sold by the Coca-Cola Company in Canada were announced to be made with 100% recycled plastic. The company is among the first to launch multiple sparkling beverages in 100% recycled plastic bottles across Canada. Bottles made with 100% recycled plastic create and sustain a circular economy for plastic packaging.

North America Plastic Bottles Industry Overview

The North American plastic bottles market is fragmented and has several major players. In terms of market share, few of the major players currently dominate the market. These players, with a prominent share of the market, are focusing on expanding their customer base. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. Some of the recent developments in the market are:

- May 2024: ALPLA, a key firm in plastic packaging, unveiled a new recyclable wine bottle crafted from polyethylene terephthalate (PET). This innovative packaging slashes carbon footprints by as much as 50% and offers potential cost savings of up to 30%. Currently, the bottles, offered in 750ml and one-liter sizes, are being used by Austrian wine producer Wegenstein, marking them as both a pilot customer and a collaborative development partner.

- August 2023: Berry Global unveiled an innovative rPET bottle for a new sustainable luxury brand. Leveraging its technical prowess and extensive experience with recycled plastics, Berry brought to life the original design vision of NEUE Water's founder, Michael Lowers. The unconventional flat shape posed challenges to the traditional injection stretch blow molding (ISBM) process used for PET bottles. However, Berry adeptly modified the technology to integrate the novel design seamlessly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Recycling and Other Cost-effective Initiatives are Bolstering the Demand

- 5.1.2 Increasing Demand from the Bottled Water and Beverage Industry Aids the Market

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns Regarding the Use of Plastics

- 5.3 Trade Scenario

- 5.3.1 EXIM Data

- 5.3.2 Trade Analysis (Top 5 Import-Export Countries)

6 MARKET SEGMENTATION

- 6.1 By Resin

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Resins (Polystyrene, PVC, Polycarbonate, etc.)

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.2.1 Bottled Water

- 6.2.2.2 Carbonated Soft Drinks

- 6.2.2.3 Alcoholic Beverages

- 6.2.2.4 Juices and Energy Drinks

- 6.2.2.5 Other Beverages

- 6.2.3 Pharmaceuticals

- 6.2.4 Personal Care and Toiletries

- 6.2.5 Industrial

- 6.2.6 Household Chemicals

- 6.2.7 Paints and Coatings

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ALPLA Group

- 7.1.2 Amcor Group GmbH

- 7.1.3 Container Corporation of Canada

- 7.1.4 Plastikpak Holding Inc.

- 7.1.5 Berry Global

- 7.1.6 Comar LLC

- 7.1.7 TricorBraun Canada

- 7.1.8 Cole-Parmer Instrument Company LLC

- 7.1.9 Sailor Plastics Inc.

- 7.1.10 Bramalea Bottle Inc.

- 7.1.11 Triumbari Corp.

- 7.1.12 CoastPak Industrial Co.

- 7.2 Competitor Analysis - Emerging vs. Established Players