|

市场调查报告书

商品编码

1641819

塑胶瓶:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Plastic Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

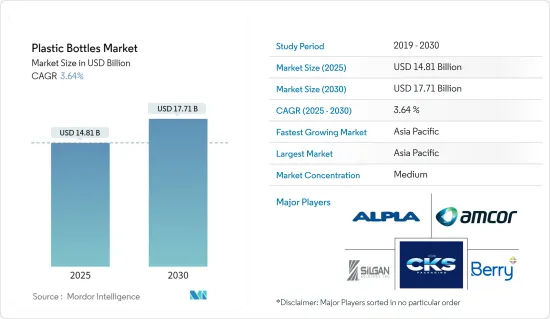

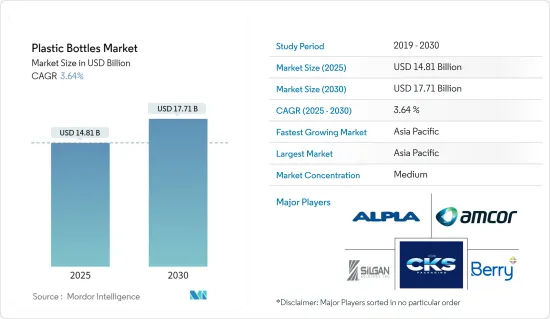

预计 2025 年塑胶瓶市场规模将达到 148.1 亿美元,预计到 2030 年将达到 177.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.64%。

就产量而言,预计将从 2025 年的 159.2 亿吨增长到 2030 年的 188.3 亿吨,预测期内(2025-2030 年)的复合年增长率为 3.42%。

塑胶包装重量轻且易于处理,因此越来越受到全球消费者的认可。领先的製造商倾向于塑胶包装解决方案,主要是因为其生产成本低廉。

关键亮点

- 製造商普遍青睐由聚对苯二甲酸乙二醇酯、聚丙烯和聚乙烯等材料製成的塑胶瓶。这些材料重量轻,不易破损,使物料输送更容易。此外,製造商也因为其成本效益而转向使用塑胶包装。由于对包装和加工食品以及多样化食品和饮料的依赖日益增加,预计预测期内塑胶瓶和容器市场将成长。

- PET 已成为该地区瓶子製造商的重要包装材料。它能够适应各种形状和尺寸,是传统玻璃和金属容器无与伦比的替代品,因此成为包装行业非常理想的选择。

关键亮点

- 根据全球包装连网平台PETnology的报告,预计2023年7月亚洲将主导全球PET产业产能扩充。

- 与其他塑胶包装产品相比,製造商更喜欢 PET,因为与其他塑胶产品相比,它在製造过程中浪费的原材料较少。 PET 是一种受欢迎的选择,因为它可回收,而且可以製成多种颜色和设计。随着消费者环保意识的不断增强,可再填充产品也应运而生,并在创造产品需求方面发挥了作用。

- 由于担心自来水受污染以及便携性固有的便利性,消费者越来越优先考虑高品质的饮用水,因此对瓶装水的需求正在飙升。人们对瓶装水的需求日益增长,加上非酒精饮料越来越受欢迎,预计将推动饮料行业的塑胶瓶市场的发展。

- 然而,人们对于其他具有环保特性的包装材料的使用趋势也日益增长。由于铝罐和玻璃瓶环保且可回收性高,因此在该地区被广泛使用。因此,消费者越来越多地从塑胶转向其他材料。

塑胶瓶市场趋势

饮料业预计将引领市场成长

- 由于对瓶装水和非酒精饮料的持续需求,饮料行业预计将成长。瓶装水的需求是由消费者对高品质饮用水的需求所推动的,尤其是由于消费者担心饮用受污染的自来水会生病,以及瓶装水的便携性和便利性。

- 此外,在许多已开发经济体和新兴经济体中,人们更喜欢瓶装水。瓶装水在商店和贩售各种饮料的地方有售。例如,国际瓶装水协会(IBWA)表示,与其他包装饮料相比,美国人更喜欢瓶装水。

- 根据饮料行销公司2023年5月发布的资料,2022年美国瓶装水数量达到159亿加仑,这数字在过去十年中每年持续成长。随着近年来瓶装水产量的增加,全国宝特瓶的需求量激增。

- 由于其耐用性和可回收性, 宝特瓶在水包装市场上比玻璃瓶和塑胶瓶更受欢迎。这一趋势表明,PET 因其重量轻、耐用且成本低廉,正成为越来越受欢迎的水包装介质。

- 由于人口成长和生活方式的改变,中国和印度的瓶装水消费量正在上升。这创造了对符合所有监管要求的各种规格的瓶子。

- 这也为企业提供了一个机会,可以在市场上创新不同形式的新瓶装水,并以独特的策略推广这些瓶装水,在市场上引起轰动。

- 例如,在印度,Wahter 于 2023 年 12 月推出了 ISI 认证的瓶装水。广告主可以以最低的成本为这种饮料打上品牌,他们可以设定品牌帐户,上传设计,并将其连结到标籤广告商的模板,以根据目标受众量身定制行销策略。可用品牌空间。

预计亚太地区将实现最高成长

- 减少一次性宝特瓶和包装的使用是亚太地区几个国家采取的重要措施之一。中国、印度和日本的医疗保健和製药业是世界上最大的市场,主要由人口老化所推动。

- 据印度药品生产商协会称,到 2047 年,该国医药市场规模预计将从 2022 年的 490 亿美元增至 4,500 亿美元。因此,这些公司对宝特瓶的需求可能会增加,为国内参与企业创造成长潜力。由于塑胶瓶的消费量和工业用途持续增加,印度的宝特瓶市场预计将稳定成长。

- 此外,印度是人口最多的地区中最强大的市场之一,新兴市场的发展和趋势推动了瓶装水消费的大幅成长。印度铁路餐饮和旅游有限公司推出了名为「Rail Neer」的宝特瓶水品牌,主要在火车上和火车站销售。随着宝特瓶消费量的增加和铁路行业的成长,该公司已将宝特瓶产量从 2021 年的 75.3 万瓶增加到 2023 年的 3.577 亿瓶。

- 在运送 1,000 加仑软性饮料时, 宝特瓶比玻璃瓶更节能,并且产生的固态废弃物重量比玻璃或铝容器更少。因此,该地区消费者偏好的变化正促使公司将碳酸饮料转向宝特瓶,并使用再生材料开发瓶子。

- 例如,在香港,作为减少环境足迹的努力的一部分,可口可乐公司宣布将于 2024 年 4 月推出其旗舰饮料可乐的 500 毫升宝特瓶,完全由再生塑胶製成。这家全球饮料公司宣布,在中国生产的所有 500 毫升瓶装原味可口可乐、无糖可口可乐和优质可口可乐都已改为 100% 再生聚对苯二甲酸乙二醇酯 (rPET)。

宝特瓶产业概况

塑胶瓶市场细分化,由几家领先的公司组成。从市场占有率来看,目前市场主要被少数几家大公司占据。这些占据市场主导份额的公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。我们将介绍一些最近的市场发展趋势。

- 2024年5月,主要企业ALPLA推出了一种由聚对苯二甲酸乙二醇酯(PET)製成的新型可回收葡萄酒瓶。这种创新包装可减少 50% 的碳排放,并节省高达 30% 的成本。奥地利葡萄酒生产商 Wegenstein 目前正在使用 750 毫升和 1 公升的瓶子,他们既是测试客户,也是共同开发伙伴。

- 2023 年 8 月,Berry Global 为其新的永续奢侈品牌推出了创新 rPET 瓶。利用技术力和在再生塑胶方面的丰富经验,我们实现了 NEUE Water 创办人 Michael Lowers 独特的设计愿景。这种非常规的扁平形状对宝特瓶使用的传统注拉吹塑成型(ISBM) 製程提出了挑战。但 Berry 巧妙地采用了这项技术,无缝整合了这项创新设计。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 扩大回收和成本效益措施推动需求

- 饮料行业需求的不断增长推动了市场

- 市场问题

- 关于塑胶使用的环境问题

- 贸易情景

- 进出口资料

- 贸易分析(前 5 名进出口国)

- 行业法规、政策和标准

- 技术状况

- 价格趋势分析

- 塑胶树脂(当前价格和历史趋势)

第六章 市场细分

- 按树脂

- 聚乙烯 (PE)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 其他树脂(聚苯乙烯、聚氯乙烯、聚碳酸酯等)

- 按最终用户产业

- 食物

- 饮料

- 瓶装水

- 碳酸饮料

- 酒精饮料

- 果汁和能量饮料

- 其他饮料

- 药品

- 个人护理及洗护用品

- 工业的

- 日用化学品

- 画

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 德国

- 义大利

- 英国

- 西班牙

- 波兰

- 北欧的

- 亚太地区

- 中国

- 印度

- 日本

- 泰国

- 澳洲和纽西兰

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 哥伦比亚

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 南非

- 奈及利亚

- 摩洛哥

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor Group GmbH

- ALPLA Group

- Silgan Holdings Inc.

- Berry Global Inc.

- CKS Packaging Inc.

- Comar LLC

- Alpack Plastic Packaging

- Cospack America Corporation

- Resilux NV

- Greiner Packaging

- Altium Packaging

- Plastikpak Holding Inc.

- Container Corporation of Canada

- Sailor Plastics Inc.

- 热图分析

- 竞争对手分析-新兴企业vs. 现有企业

第 8 章回收与永续性展望

第九章:未来展望

The Plastic Bottles Market size is estimated at USD 14.81 billion in 2025, and is expected to reach USD 17.71 billion by 2030, at a CAGR of 3.64% during the forecast period (2025-2030). In terms of production volume, the market is expected to grow from 15.92 billion tonnes in 2025 to 18.83 billion tonnes by 2030, at a CAGR of 3.42% during the forecast period (2025-2030).

Consumers globally increasingly favor plastic packaging due to its lightweight nature and ease of handling. Major manufacturers are gravitating toward plastic packaging solutions, primarily for their cost-effectiveness in production.

Key Highlights

- Manufacturers widely favor plastic bottles crafted from materials like polyethylene terephthalate, polypropylene, and polyethylene. These materials are lightweight and unbreakable, enhancing the ease of handling. Additionally, manufacturers lean toward plastic packaging due to its cost-effectiveness. Given the rising reliance on packaged and processed foods and diverse beverages, the market for plastic bottles and containers is poised for growth during the forecast period.

- PET has become a vital packaging material among bottle manufacturers across the region. Its versatility in accommodating different shapes and sizes has provided unparalleled alternatives to conventional glass and metal containers, making it a highly desirable choice in the packaging industry.

- According to a report by PETnology, a global packaging networking platform, in July 2023, Asia is expected to take the lead in global PET industry capacity expansions, driven by new construction and expansion initiatives set to take place after 2023.

- Manufacturers prefer PET over other plastic packaging products, as it has a minimum loss of raw material during the manufacturing process compared to other plastic products. Its recyclability and the feature of adding multiple colors and designs augment it to become a preferred choice. Refillable products have emerged with rising consumer awareness of the environment and have acted to create demand for the product.

- As consumers increasingly prioritize high-quality drinking water, driven by concerns over tainted tap water and the inherent convenience of portability, the demand for bottled water surges. This growing appetite for bottled water, alongside the rising popularity of non-alcoholic beverages, is set to propel the plastic bottle market within the beverage industry.

- However, there is a growing inclination toward other packaging materials that offer environment-friendly properties. The consumption of aluminum cans and glass bottles has been witnessing high adoption rates in the region owing to its eco-friendly nature and high recyclability. Thus, consumers have been increasingly moving toward other materials from plastic.

Key Highlights

Plastic Bottles Market Trends

The Beverages Segment is Expected to Drive the Market's Growth

- The beverage segment is anticipated to witness growth, owing to the never-ending demand for bottled water and non-alcoholic beverages. The demand for bottled water is credited to consumers' propensity for specifically demanding high-quality drinking water, owing to the fear of diseases as an aftermath of drinking polluted tap water and the ease of portability and convenience provided by bottled water.

- Further, in many developed and developing economies, people favor bottled water. Bottled water is sold in stores and places selling various drinks. For instance, the International Bottled Water Association (IBWA) stated that Americans favor bottled water over other packaged beverages.

- According to Beverage Marketing Corporation data published in May 2023, in 2022, the United States bottled water sales reached 15.9 billion gallons, marking a consistent annual increase over the past decade. With the rise in bottled water volume sales in recent years, the demand for plastic bottles surged nationwide.

- PET bottles are more prevalent in the water packaging market than glass and plastic bottles due to their durability and recyclability characteristics. The trend shows that lightweight, durable, and cost-effective PET is increasingly becoming the packaging medium of water.

- The consumption of water bottles is an increasing trend across China and India with the growing population and changing lifestyle, creating demand for different formats of bottles that are lightweight, easy to carry, and can be stored and fulfill all the regulation terms to cater to changing consumer trends toward sustainability.

- Companies also innovate different formats of bottled water, which are new in the market, and provide opportunities for the companies to promote the bottle with unique strategies to create market buzz.

- For instance, in India, Wahter introduced ISI-certified bottled water in December 2023, which can be branded by advertisers at the lowest cost, leveraging 80% of branding space where advertisers can set up an account for their brand, upload their design, and link it to the template of the label advertisers to tailor their marketing strategies to their target audience.

Asia-Pacific is Expected to Witness the Highest Growth

- One of the main initiatives across multiple countries in Asia-Pacific has generally been to cut down the usage of single-use plastic bottles and packaging. Companies might likely resort to plastic packaging to combat the pandemic's spread, putting the sustainability aspect away at this time.The healthcare and pharmaceutical sectors in China, India, and Japan are the world's largest markets, primarily driven by the aging population.

- According to the Organisation of Pharmaceutical Producers of India, the country's pharmaceutical market is expected to reach USD 450 billion by 2047, which is up from USD 49 billion in 2022. Hence, there is a possibility for growth for domestic players as they might experience an increase in demand for plastic bottles from these companies. The Indian plastic bottle market is estimated to grow steadily, owing to the continually increasing consumption and industrial applications of plastic-made bottles.

- Further, India is also one of the strong markets in the region with the highest population, and with a developing and trending outlook, there is a significant increase in the consumption of bottled water. Indian Railway Catering and Tourism Corporation Limited has launched a pet bottled water brand, "Rail Neer," which is majorly sold on trains and railway stations; with the rising consumption of water bottles and the growing railway sector, the corporation increased the production of the bottles in 2021 with 75.30 bottles produced which increased to 357.70 million bottles in 2023.

- PET bottles are more energy efficient than glass bottles while delivering 1000 gallons of soft drinks and contribute less solid waste by weight than glass and aluminum containers. Thus, companies are shifting to PET format for carbonated beverages and innovating bottles with recycled materials due to changing consumer preferences in the region.

- For instance, in Hong Kong, as part of its efforts to reduce its environmental footprint, the Coca-Cola Company announced the launch of 500 ml bottles made entirely from recycled plastic for its flagship drink, Coke, in April 2024. The global beverage company announced that all 500 ml bottles of Coca-Cola Original, Coca-Cola No Sugar, and Coca-Cola Plus in production in China have shifted to 100% recycled polyethylene terephthalate (rPET).

Plastic Bottles Industry Overview

The plastic bottles market is fragmented and consists of several major players. In terms of market share, few of the major players currently dominate the market. These players, with a prominent share of the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. Some of the recent developments in the market are:

- May 2024: ALPLA, a key firm in plastic packaging, unveiled a new recyclable wine bottle crafted from polyethylene terephthalate (PET). This innovative packaging slashes carbon footprints by as much as 50% and offers potential cost savings of up to 30%. Currently, bottles offered in 750 ml and one-liter sizes are being used by Austrian wine producer Wegenstein, marking them as both a pilot customer and a collaborative development partner.

- August 2023: Berry Global unveiled an innovative rPET bottle for a new sustainable luxury brand. Leveraging its technical prowess and extensive experience with recycled plastics, Berry brought to life the original design vision of NEUE Water's founder, Michael Lowers. The unconventional flat shape posed challenges to the traditional injection stretch blow molding (ISBM) process used for PET bottles. However, Berry adeptly modified the technology to integrate the novel design seamlessly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Recycling and Oher Cost-effective Initiatives are Bolstering the Demand

- 5.1.2 Increasing Demand from the Beverage Industry aids the Market

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns Regarding the Use of Plastics

- 5.3 Trade Scenario

- 5.3.1 EXIM Data

- 5.3.2 Trade Analysis (Top 5 Import-Export Countries)

- 5.4 Industry Regulations, Policies, and Standards

- 5.5 Technology Landscape

- 5.6 Pricing Trend Analysis

- 5.6.1 Plastic Resins (Current Pricing and Historic Trends)

6 MARKET SEGMENTATION

- 6.1 By Resin

- 6.1.1 Polyethylene (PE)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Other Resins (Polystyrene, PVC, Polycarbonate, etc.)

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.2.1 Bottled Water

- 6.2.2.2 Carbonated Soft Drinks

- 6.2.2.3 Alcoholic Beverages

- 6.2.2.4 Juices and Energy Drinks

- 6.2.2.5 Other Beverages

- 6.2.3 Pharmaceuticals

- 6.2.4 Personal Care and Toiletries

- 6.2.5 Industrial

- 6.2.6 Household Chemicals

- 6.2.7 Paints and Coatings

- 6.2.8 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 France

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 United Kingdom

- 6.3.2.5 Spain

- 6.3.2.6 Poland

- 6.3.2.7 Nordic

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Thailand

- 6.3.3.5 Australia and New Zealand

- 6.3.3.6 Indonesia

- 6.3.3.7 Vietnam

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Colombia

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Egypt

- 6.3.5.4 South Africa

- 6.3.5.5 Nigeria

- 6.3.5.6 Morocco

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 ALPLA Group

- 7.1.3 Silgan Holdings Inc.

- 7.1.4 Berry Global Inc.

- 7.1.5 CKS Packaging Inc.

- 7.1.6 Comar LLC

- 7.1.7 Alpack Plastic Packaging

- 7.1.8 Cospack America Corporation

- 7.1.9 Resilux NV

- 7.1.10 Greiner Packaging

- 7.1.11 Altium Packaging

- 7.1.12 Plastikpak Holding Inc.

- 7.1.13 Container Corporation of Canada

- 7.1.14 Sailor Plastics Inc.

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players