|

市场调查报告书

商品编码

1626323

中东和非洲:塑胶瓶和容器市场占有率分析、产业趋势和成长预测(2025-2030)MEA Plastic Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

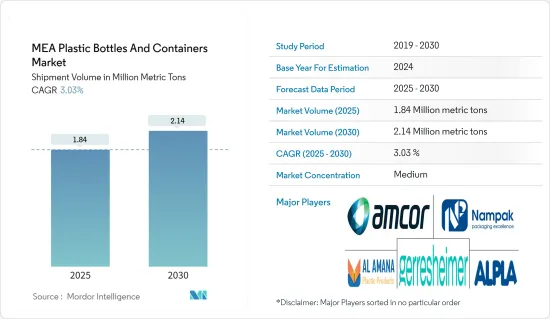

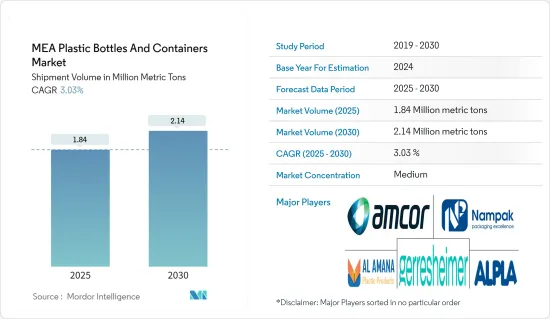

中东和非洲塑胶瓶和容器市场规模(以出货量为准)预计将从2025年的184万吨成长到2030年的214万吨,预测期间(2025-2030年)复合年增长率为3.03%。将会完成。

主要亮点

- 塑胶包装因其重量轻且易于处理而受到消费者的欢迎。同样,由于生产成本较低,各大製造商也更喜欢使用塑胶包装解决方案。此外,聚对苯二甲酸乙二醇酯(PET)和高密度聚苯乙烯(HDPE)聚合物的采用正在扩大塑胶瓶的应用。瓶装水和软性饮料市场对宝特瓶的需求不断增加。

- 该地区拥有强大的消费基础,推动了各种最终用户(主要是食品和饮料、製药和工业领域)对塑胶包装形式的需求。以都市区为基础的中东人口越来越受到全球文化的影响,导致对国际美食、即食食品和食品宅配平台的需求不断增长。这些现代化趋势刺激了对方便食品包装产品的需求。由于对宝特瓶和容器的持续需求,该地区的大规模生产也在有机增长。

- 此外,根据阿拉伯饮料协会 (ABA) 的数据,饮料业务是阿拉伯世界成长最快的业务之一。阿联酋市场提供的主要产品包括果汁、麦芽、非酒精饮料、软性饮料、水、运动饮料和甜酒。製造商正在积极投资该市场,并观察到该国的显着成长率。例如,西得乐最近为杜拜的一家宝特瓶公司安装了最快的单线。该生产线是为阿联酋水瓶製造商 Mai Dubai 创建的,是西得乐 Super Combi 解决方案的一部分。

- 预计市场将面临重大挑战,主要是由于环境问题日益严重而导致监管措施动态变化。该地区各国政府正在回应社会对塑胶包装废弃物,特别是塑胶包装废弃物的担忧,并实施法规以尽量减少环境废弃物并改善废弃物管理流程。

- 虽然中东和非洲的整体塑胶包装业务因疫情爆发而放缓,但瓶子和容器等塑胶包装选择重量轻、不易损坏且易于消费者使用,使其成为电器的热门商品产品。此外,由于生产成本较低,主要製造商更喜欢塑胶包装。

中东和非洲塑胶瓶和容器市场趋势

饮料业预计将显着成长

- 受该地区各国卫生署的主导的影响,对健康饮料的需求预计将增加。由于该地区许多国家都禁止饮酒,因此人们正在考虑将能量饮料和健康饮料等软性饮料作为替代品。此外,根据 2023 年 3 月发表的《世界旅游市场》报导,Z 世代消费者更喜欢新的饮料类别而不是酒精,例如无酒精调饮、大麻饮料、康普茶和新苏打水。

- 该地区对瓶装水的需求大幅增加。此外,消费者越来越意识到对健康饮食的需求。对瓶装水的需求不断增长预计将促进该地区瓶装水包装市场的成长。此外,包装水和其他软性饮料的宝特瓶也有大量需求。例如,Almarai 透过策略投资发展业务。

- 此外,生物分解性塑胶的出现预计也将影响不断增长的消费市场。西得乐表示,更健康产品和永续性的需求是影响中东和非洲PET包装产业的两大趋势。消费者的健康意识越来越强,转向更有营养的产品,远离含糖软性饮料。从长远来看,这些趋势可能会影响所研究市场的成长。

- 据包装设备製造商克朗斯称,中东和非洲的包装饮料消费量预计将从2021年的1,184亿公升增加到2024年的1,271亿公升。包装饮料的持续成长预计将在预测期内加强该地区对塑胶瓶的需求。

- 日本对塑胶的使用有严格的规定。这迫使製造商选择新的包装替代品,例如Oxo可分解塑胶。公司越来越关注将 PET 回收到饮料容器等食品级产品的紧迫性。例如,可口可乐公司计划在 2030 年之前在其容器中使用 50% 的回收 PET。

南非可望占较大市场

- 南非是中东和非洲的主要贡献者。由于可支配收入的增加和对偶尔饮酒的接受,市场正在扩大。由于都市化不断提高以及製造商产品推出数量增加,南非饮料市场的开发前景盈利。

- InterGest South Africa 表示,食品和饮料产业的电子商务领域正在崛起。 2021年,电子商务产业将成长约12.2%,市场规模约9,525万欧元(1.0444亿美元)。 2021年至2025年,食品饮料电商板块预计将以年均7.66%的成长。

- 此外,南非对奢华和体验式瓶装水的需求正在上升。由于需要清洁的饮用水,南非对瓶装水的需求量很大。水侍酒师的兴起和只提供最好的瓶装水的餐厅的兴起是这种优质化的明显征兆。一个典型的例子是位于约翰内斯堡海德公园的 KL Izakhaya 餐厅,该餐厅提供特殊的优质瓶装水菜单,每瓶起价为 650 南非兰特(35.42 美元)。

- 由于啤酒、葡萄酒和其他低度酒精饮料的优质化以及越来越多的富裕年轻人对酒精消费感兴趣,预计南非酒精饮料市场将在预测期内扩大。塑胶瓶作为啤酒和其他酒精饮料的替代包装形式越来越受欢迎。

- 南非拥有非洲大陆最大的化妆品和个人保健产品市场。虽然化妆品具有很大的价值,但它们也很容易腐烂。因此,包装材料的品质以及适当的包装、运输、储存和分销条件对于维持产品完整性至关重要。聚乙烯 (PE) 是一种高度耐用的塑料,以其耐化学性和成本绩效而闻名。源自石油聚合物的PE耐环境破坏,主要分为高密度聚苯乙烯(HDPE)和低密度聚乙烯(LDPE)。

- 据南非贸易和工业部称,化妆品和个人护理领域近年来一直呈成长趋势,预计将从2018年的31亿美元成长到2023年终的34亿美元。塑胶瓶引领化妆品包装市场。预计在预测期内,对旨在改善护肤和头髮护理等状况的产品的需求不断增长,将推动瓶子使用量的增长。

中东和非洲塑胶瓶及容器产业概况

中东和非洲的塑胶瓶和容器市场本质上是半固体的。主要参与企业包括 Amcor PLC、Graham Packaging Company、Plastipak Holdings Inc. 和 ALPLA Group。食品和饮料需求的增加预计将为塑胶瓶市场带来显着的成长机会。因此,许多公司将这个市场视为新兴市场。我想宣布一些最近的趋势。

- 2024 年 5 月 2024 年 5 月:Alpla 与安哥拉饮料巨头 Refriango 合作运作了第二家工厂,名为 Alpla Sopro。 Alpura 和 Refriango 正在应对安哥拉及其邻国对优质饮料和瓶装水日益增长的需求。全球包装专家 Alpla 表示,作为一项战略倡议,Refriango 维亚纳工厂的新工厂专注于「安全、实惠且可持续」的塑胶包装。透过此次扩张,两家公司的目标是提高效率和产能,同时最大限度地减少碳排放。

- 2023 年 2 月,Al Ain Water 在阿联酋推出了第一个 100% 再生聚对苯二甲酸乙二酯 (rPET) 瓶。正如执行长艾伦史密斯所说,如果正确回收和再利用,塑胶是一种宝贵的资源。该公司正在与阿联酋政府和其他相关人员密切合作,为 PET 包装创建收集、回收和再利用系统。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- 市场驱动因素

- 更多采用轻量化包装方法

- 对永续和创新食品包装产品的需求不断增长

- 市场问题

- 使用塑胶的环境问题

第五章市场区隔

- 按原料分

- 聚对苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他的

- 按最终用户产业

- 饮料

- 食物

- 化妆品

- 药品

- 家居用品

- 其他的

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

第六章 竞争状况

- 公司简介

- ALPLA Group

- Nampak Ltd

- Gerresheimer AG

- Amcor PLC

- Al Amana Plastic LLC

- Mpact Plastics

- Packnet SA

- Alpha Packaging

- Emirates Plastic Industries Factory

- Takween Advanced Industries

第七章 投资分析

第八章市场的未来

The MEA Plastic Bottles And Containers Market size in terms of shipment volume is expected to grow from 1.84 million metric tons in 2025 to 2.14 million metric tons by 2030, at a CAGR of 3.03% during the forecast period (2025-2030).

Key Highlights

- Plastic packaging is becoming popular among consumers as it is lightweight and easy to handle. Similarly, even major manufacturers prefer to use plastic packaging solutions owing to their lower production costs. Moreover, the introduction of polyethylene terephthalate (PET) and high-density polyethylene (HDPE) polymers is expanding the plastic bottling applications. The market is witnessing an increasing demand for PET bottles in the bottled water and soft drink markets.

- The region has a considerable consumer base that pushes the demand for plastic packing formats for different end users, mainly food and beverage, pharmaceutical, and industrial sectors. The urban-centric Middle Eastern population is increasingly influenced by global culture, leading to a heightened demand for international cuisines, ready-to-eat meals, and food delivery platforms. This trend toward modernization is fueling the demand for convenient food packaging products. With the constant demand for plastic bottles and containers, there is also an organic expansion for large-scale production in the region.

- Furthermore, the beverage business is one of the fastest growing in the Arab world, according to the Arab Beverages Association (ABA). The significant products offered at UAE's marketplaces include juices, malt, non-alcoholic beverages, soft drinks, water, sports drinks, and cordials. The manufacturers are actively investing in the market, observing significant growth rates in the country. For instance, recently, Sidel installed one of the fastest single lines for a PET bottle company in Dubai. The line was created for Mai Dubai, a water bottle manufacturer in the United Arab Emirates, and is one of Sidel's Super Combi solutions.

- The market is anticipated to be significantly challenged owing to the dynamic changes in regulatory measures, primarily due to increasing environmental concerns. Governments across the region are responding to public problems regarding plastic packaging waste, especially plastic packaging waste, and implementing regulations to minimize environmental waste and improve waste management processes.

- Although there has been slow down in the overall plastic packaging businesses in the Middle East and Africa owing to the breakout of the pandemic, plastic packaging options like bottles and containers have consequently become a popular choice for e-commerce products as it is lightweight and indestructible, making it easy for consumers to use. Also, major manufacturers prefer plastic packaging due to the low cost of production.

MEA Plastic Bottles And Containers Market Trends

The Beverages Segment is Expected to Witness Significant Growth

- The demand for health drinks is expected to increase, influenced by the campaigns led by the ministries of health in various countries in the region. Due to the ban on alcohol in many countries in the region, soft drinks, such as energy and health drinks, are considered substitutes. Also, according to the World Travel Market article published in March 2023, more than alcohol, Gen Z consumers prefer newer categories of drinks like mocktails, cannabis-infused drinks, kombucha, and new soda.

- The demand for bottled water increased significantly in the region. In addition, consumers are more conscious of the need for healthier diets. The increased demand for bottled water, in turn, is expected to augment the growth of the bottled water packaging market in the region. Moreover, there is a significant demand for PET bottles for water and other soft drinks packaging. For instance, Almarai developed its business through strategic investments.

- Moreover, the emergence of biodegradable plastics is also expected to impact the growing consumer markets. According to Sidel, the demand for healthier products and sustainability are the two biggest trends impacting the PET packaging industry in Middle East and Africa. Since consumers are becoming more health conscious, moving toward nutritional products and away from sugary soft drinks, etc. These trends can impact the growth of the studied market in the long term.

- According to packaging equipment manufacturer Krones, the consumption of packed beverages in Middle East and Africa is expected to increase from 118.4 billion liters in 2021 to 127.1 billion liters in 2024. This consistent growth of packaged beverages is expected to bolster the demand for plastic bottles in the region during the forecast period.

- Stringent regulations for the use of plastic are imposed in the country. This forces manufacturers to opt for new packaging alternatives, such as oxo-degradable plastics. Companies are increasingly focusing on the urgency of recycling PET into food-grade products, such as beverage containers. For instance, The Coca-Cola Company intends to use 50% recycled PET in its containers by 2030.

South Africa is Anticipated to Hold a Substantial Market

- South Africa is a major contributor to Middle East and Africa. The market is expanding due to rising disposable income and the acceptability of occasional drinking. The profitable prospect for developing the South African beverage market is being provided by increasing urbanization and manufacturers' growing launch of new products.

- According to InterGest South Africa, the e-commerce sector of the food and beverage industry is rising. In 2021, the e-commerce sector grew by approximately 12.2%, resulting in a market volume of approximately EUR 95.25 million (USD 104.44 million). From 2021 to 2025, the food and beverage e-commerce sector is expected to grow at an average annual rate of 7.66%.

- Moreover, in South Africa, bottled water is witnessing an increase in demand for high-end goods and experiences. Bottled water in South Africa is in high demand due to the need for clean drinking water. The rise of water sommeliers and restaurants serving only the best-bottled water are clear signs of this premiumization. A prime example is the KL Izakhaya restaurant in Hyde Park, Johannesburg, which offers a special menu of luxury bottled water with items starting at ZAR 650 (USD 35.42) a bottle.

- The market for alcoholic beverages in South Africa is anticipated to expand during the forecast period due to the country's premiumization of beer, wine, and other light alcoholic beverages and the rising number of affluent young adults becoming interested in alcohol consumption. The plastic bottle is becoming increasingly popular as an alternative packaging format for beer and other alcoholic beverages.

- South Africa boasts the continent's largest market for cosmetics and personal care products. While cosmetics hold significant value, they are also highly perishable. Therefore, the quality of packaging materials and the right conditions for packaging, transport, storage, and distribution are vital to preserving the product's integrity. Polyethylene (PE), a highly durable plastic, stands out for its chemical resistance and cost-effectiveness. Derived from petroleum polymers, PE is resilient against environmental hazards and is mainly categorized into high-density polyethylene (HDPE) and low-density polyethylene (LDPE).

- According to the Department of Trade and Industry, South Africa, the cosmetics and personal care sector has been increasing in the past few years, and it was forecasted to be valued at USD 3.4 billion by the end of 2023, up from USD 3.1 billion in 2018. Plastic bottles lead the cosmetics packaging market. The rising demand for products aimed at enhancing conditions like skin and hair care is projected to drive the growth of bottle usage during the forecast period.

MEA Plastic Bottles And Containers Industry Overview

The Middle East and Africa plastic bottles and containers market is semi-consolidated in nature. Some of the major players are Amcor PLC, Graham Packaging Company, Plastipak Holdings Inc., and ALPLA Group. Factors such as the increasing demand for food and beverages will provide considerable growth opportunities in the plastic bottle market. Therefore, many companies are seeing this market as an emerging market. Some of the recent developments are:

- May 2024: Alpla, in collaboration with Refriango, an Angolan beverage leader, inaugurated their second in-house facility, named Alpla Sopro. Alpla and Refriango are addressing the rising demand for premium beverages and bottled water in Angola and its neighboring nations. In a strategic move, the global packaging expert, this new plant, situated at Refriango's Viana site, emphasizes "safe, affordable, and sustainable" plastic packaging. With this expansion, both companies aim to boost efficiency and capacity, all while minimizing their carbon footprint.

- February 2023: Al Ain Water introduced the first locally produced 100% recycled polyethylene terephthalate (rPET) bottle in the United Arab Emirates. As per the Chief Executive Officer, Alan Smith, plastic is a valuable resource if recycled and reused correctly. The company is working closely with the government of the United Arab Emirates and other interested parties to create a collection, recycling, and reuse system for PET-based packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of Lightweight Packaging Methods

- 4.4.2 Rising Demand for Sustainable and Innovative Food Packaging Products

- 4.5 Market Challenges

- 4.5.1 Environmental Concerns Regarding the Use of Plastics

5 MARKET SEGMENTATION

- 5.1 By Raw Materials

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Low-Density Polyethylene (LDPE)

- 5.1.4 High Density Polyethylene (HDPE)

- 5.1.5 Other Raw Materials

- 5.2 By End-user Vertical

- 5.2.1 Beverages

- 5.2.2 Food

- 5.2.3 Cosmetics

- 5.2.4 Pharmaceuticals

- 5.2.5 Household Care

- 5.2.6 Other End-user Verticals

- 5.3 By Country

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ALPLA Group

- 6.1.2 Nampak Ltd

- 6.1.3 Gerresheimer AG

- 6.1.4 Amcor PLC

- 6.1.5 Al Amana Plastic LLC

- 6.1.6 Mpact Plastics

- 6.1.7 Packnet SA

- 6.1.8 Alpha Packaging

- 6.1.9 Emirates Plastic Industries Factory

- 6.1.10 Takween Advanced Industries