|

市场调查报告书

商品编码

1643135

欧洲瓷砖:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

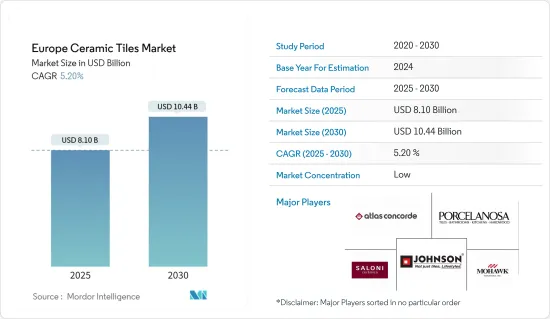

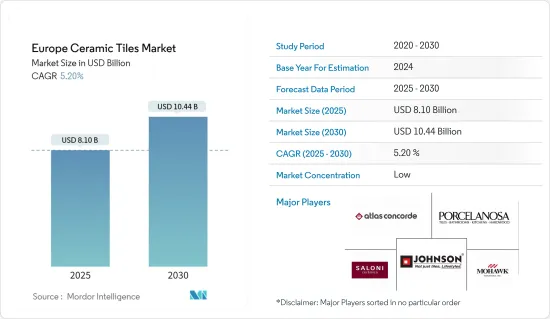

预计2025年欧洲瓷砖市场规模为81亿美元,预计2030年将达到104.4亿美元,预测期内(2025-2030年)的复合年增长率为5.2%。

欧洲瓷砖市场是建筑业的重要组成部分,每年价值数十亿欧元。其产品种类繁多,包括陶瓷、瓷器和其他类型的瓷砖,可用于住宅、商业和工业建筑的各种用途。该市场依赖各种工业矿物来配製坯体、釉药、雕刻品和颜料。这些原料来自国内或从其他欧洲国家或欧盟以外进口。供应链效率至关重要,因为它直接影响矿产资源的可用性,从而为瓷砖製造商提供竞争优势。此外,依赖有限的供应源可能会导致某些原材料的供应面临重大风险。

瓷砖的需求与建设产业密切相关,因为瓷砖通常用于住宅、商业和工业建筑。都市化、人口成长和经济发展等因素推动了建设产业的整体成长,从而推动了对瓷砖的需求。此外,室内设计和建筑趋势正在影响消费者对瓷砖的偏好,创造新的设计、颜色和纹理以满足市场需求。

欧洲瓷砖市场的趋势

住宅市场占瓷砖市场最大份额

瓷砖的主要终端用户是住宅领域。这一主导地位归功于新建住宅和改建住宅对瓷砖的强劲需求。瓷砖固有的多功能性、耐用性和美观性使其成为住宅地板材料、墙壁覆盖物和其他各种应用的首选。

想要使生活空间现代化的住宅通常会选择瓷砖,因为它多功能且美观。这种趋势在厨房和浴室的装修中尤其明显,瓷砖因其耐用性和防水性而受到重视。

永续和节能住宅的兴起推动了对瓷砖的需求,瓷砖因其环保特性而受到青睐。这些瓷砖由天然材料製成,具有热品质性能,有助于节省住宅能源。此外,在政府住宅政策和低利率的支持下,住宅房屋建设迅速扩张,推动了整个欧洲对瓷砖的需求。

义大利主导欧洲瓷砖市场

义大利以其高品质的瓷砖而闻名,以其耐用性、美观性和工艺性而闻名。义大利瓷砖通常由天然黏土、沙子和长石製成。政府推出的各项住宅和基础设施发展倡议正在刺激建设产业。政府对永续建筑实践的承诺也推动了对以环境永续性和能源效率而闻名的瓷砖的需求。

这是因为酒店和度假村经常使用瓷砖,因为它们耐用且美观。此外,义大利拥有领先的瓷砖製造商,以其设计专业知识和技术创新而闻名。这些製造商提供各种高品质、设计精良的瓷砖,吸引消费者。

欧洲瓷砖行业概况

欧洲瓷砖市场比较分散。技术进步和产品创新正在帮助中小企业赢得新契约并进入新市场,从而扩大其市场占有率。为了有效地接触客户,公司正在优化其分销管道,包括透过经销商、零售商和线上平台扩大覆盖范围。市场的主要企业包括 Mohawk Industries、Atlas Concorde SpA、Johnson Tiles 和 Porcelanosa Group。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 基础建设进展

- 对永续和环保产品的需求不断增加

- 市场限制

- 原料成本波动

- 市场机会

- 大尺寸隔热砖的需求不断增加

- 东欧尚未开发的市场潜力

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 深入了解业界正在使用的最新技术

- COVID-19 市场影响

第五章 市场区隔

- 依产品类型

- 釉药

- 瓷

- 无刮痕

- 其他产品类型

- 按应用

- 地砖

- 墙砖

- 其他磁砖

- 依建筑类型

- 新建筑

- 更换和翻新

- 按最终用户

- 住宅

- 商业的

- 按地区

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 比利时

- 波兰

- 其他欧洲国家

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Mohawk Industries Inc.

- Atlas Concorde SpA

- Johnson Tiles

- Porcelanosa Group

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Crossville Inc.

- Grupo Lamsoa

- Blackstone Industrial(Foshan)Ltd

- Siam Cement Group

- RAK Ceramics

- China Ceramics Co. Ltd

- NITCO

- Centura Tile Inc.

第七章 市场趋势

第八章 免责声明及发布者

The Europe Ceramic Tiles Market size is estimated at USD 8.10 billion in 2025, and is expected to reach USD 10.44 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

The European ceramic tiles market is a significant part of the construction industry, valued at billions of euros annually. It is characterized by a wide range of products, including ceramic, porcelain, and other types of tiles used for various applications in residential, commercial, and industrial construction. The market relies on diverse industrial minerals to formulate bodies, glazes, engobes, and pigments. These raw materials are sourced domestically or imported from other European countries or outside the European Union. Efficiency in the supply chain is vital as it directly impacts the accessibility of mineral resources, thereby serving as a competitive advantage for tile manufacturers. Moreover, dependence on a limited number of sources can pose a critical supply risk for certain raw materials.

The demand for ceramic tiles is closely linked to the construction industry, as tiles are commonly used in residential, commercial, and industrial buildings. Factors such as urbanization, population growth, and economic development contribute to the overall growth of the construction industry, driving the demand for ceramic tiles. Additionally, interior design and architecture trends influence consumer preferences for ceramic tiles, leading to new designs, colors, and textures to meet market demand.

Europe Ceramic Tiles Market Trends

The Residential Segment Accounts For the Largest Share of the Ceramic Tiles Market

The residential sector is the predominant end user of ceramic tiles. This leading position stems from the robust demand for ceramic tiles in both new residential constructions and renovation endeavors. The inherent versatility, durability, and aesthetic charm of ceramic tiles render them a favored option for flooring, wall finishes, and various other applications in homes.

Homeowners are modernizing their living spaces, often choosing ceramic tiles for their versatility and aesthetic appeal. This trend is especially noticeable in kitchen and bathroom renovations, where ceramic tiles are valued for their durability and water resistance.

The rise in sustainable and energy-efficient housing is driving the demand for ceramic tiles, which are favored for their eco-friendly characteristics. These tiles, made from natural materials, offer thermal mass properties that contribute to home energy conservation. Additionally, the rapid expansion of new residential construction, supported by governmental housing initiatives and low interest rates, is boosting the demand for ceramic tiles across Europe.

Italy Dominates the European Ceramic Tiles Market

Italy is renowned for its high-quality ceramic tiles, which are known for their durability, beauty, and craftsmanship. Italian ceramic tiles are often made from natural clay, sand, and feldspar materials. The construction industry is stimulated by various government initiatives for housing and infrastructure development. The government's commitment to sustainable building practices has also increased the demand for ceramic tiles, which are known for their environmental sustainability and energy efficiency.

Italy's thriving tourism and hospitality industries further contribute to the demand, as hotels and resorts often use ceramic tiles for their durability and aesthetic appeal. Additionally, Italy is home to leading ceramic tile manufacturers known for their design expertise and technological innovations. They offer a wide range of high-quality, design-oriented tiles that attract consumer interest.

Europe Ceramic Tiles Industry Overview

The European ceramic tiles market is fragmented. Technological advancements and product innovations are enabling mid-sized and small companies to increase their market presence by securing new contracts and entering new markets. Companies are optimizing their distribution channels to reach customers efficiently, which may involve expanding their reach through distributors, retailers, and online platforms. Key players in the market include Mohawk Industries, Atlas Concorde SpA, Johnson Tiles, and Porcelanosa Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Infrastracture Development

- 4.2.2 Growing Demand for Sustainable and Eco-friendly Product

- 4.3 Market Restraints

- 4.3.1 Fluctuating Raw Material Cost

- 4.4 Market Opportunities

- 4.4.1 Growing Demand for Large-Format Cermic Tiles

- 4.4.2 Untrapped Market Potential in Eastern European Countries

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Latest Technologies Used in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Product Types

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Tiles

- 5.3 By Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement & Renovation

- 5.4 By End-User Type

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Russia

- 5.5.6 Belgium

- 5.5.7 Poland

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mohawk Industries Inc.

- 6.2.2 Atlas Concorde SpA

- 6.2.3 Johnson Tiles

- 6.2.4 Porcelanosa Group

- 6.2.5 Saloni Ceramic SA

- 6.2.6 Gruppo Ceramiche Ricchetti SpA

- 6.2.7 Crossville Inc.

- 6.2.8 Grupo Lamsoa

- 6.2.9 Blackstone Industrial (Foshan) Ltd

- 6.2.10 Siam Cement Group

- 6.2.11 RAK Ceramics

- 6.2.12 China Ceramics Co. Ltd

- 6.2.13 NITCO

- 6.2.14 Centura Tile Inc.*