|

市场调查报告书

商品编码

1906141

马来西亚瓷砖:市场份额分析、行业趋势与统计、成长预测(2026-2031)Malaysia Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

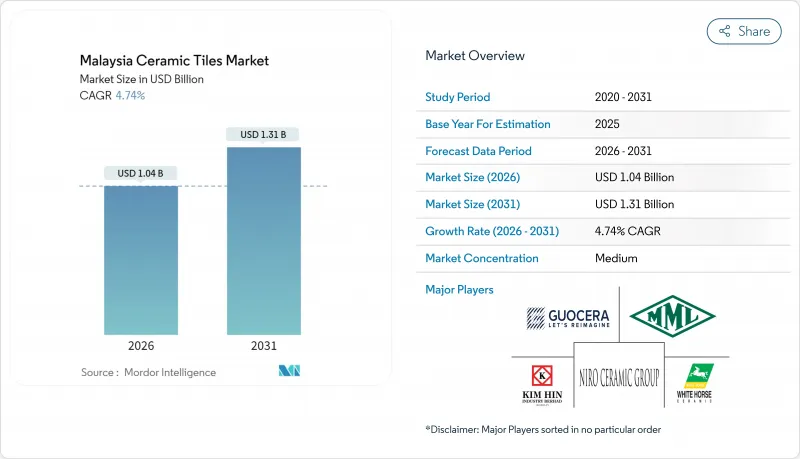

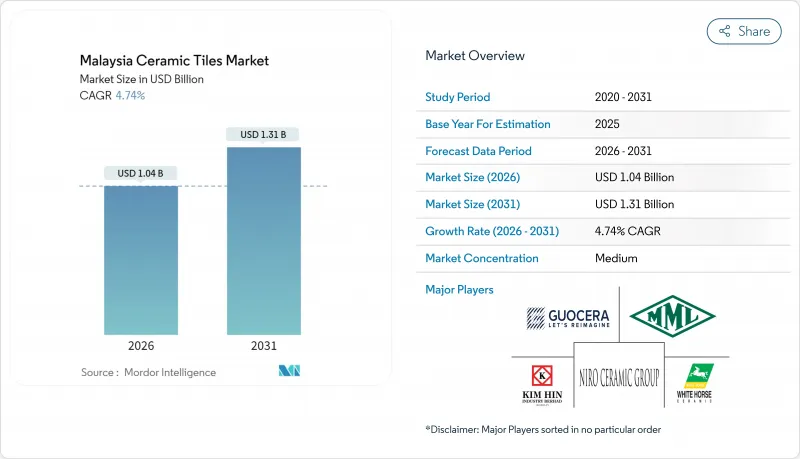

2025年马来西亚瓷砖市场价值9.9亿美元,预计到2031年将达到13.1亿美元,高于2026年的10.4亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.74%。

这些数据表明,马来西亚瓷砖市场是一个稳定、中等增长的建材领域,其前景日益受到巴生谷大型企划、沙巴和砂拉越基础设施建设以及零售通路快速数位化的影响。预计2024年将签署价值马币亿令吉的建筑合同,创历史新高,这将推动住宅和商业应用领域对瓷砖的下游需求。技术的快速应用,尤其是在配备喷墨列印技术的大型瓷砖生产线上的应用,正在推动瓷砖的优质化,而政府的经济适用住宅配额制度则确保了基准需求。来自中国和越南进口产品的竞争压力迫使本地製造商透过永续性、先进的釉药技术和全通路分销策略来实现差异化。

马来西亚瓷砖市场趋势与分析

都市区中产阶级的需求日益增长

吉隆坡、雪兰莪和槟城居民可支配收入的成长持续推动人均地板材料支出,马来西亚瓷砖市场从中受益匪浅。家庭装饰性地面支出预计将从2018年的5.306亿马币增长至2022年的马币,并在2026年达到7.6亿马币,年复合增长率达4.4%。预计2024年住宅房地产交易量将成长6.2%,交易金额将成长14.4%,显示强劲的翻新需求将使高端陶瓷瓷砖成为市场青睐的对象。中产阶级买家更专注于开放式布局中瓷砖的耐用性和美观性,从而推高了每个计划的平均购买面积。人口结构的变化也促使零售商扩展其线上产品目录,因为都市区消费者在选择瓷砖图案之前越来越倾向于使用数位视觉化工具。

政府主导的经济适用住宅计划

联邦政府的「我的家园」(My Home)、「一人一马」(PR1MA)和「雪兰莪房屋」(Rumah Selangork)等项目指定厨房、浴室和公共区域使用瓷砖,从而确保製造商获得稳定的订单量。 「我的家园」计画为开发商提供每套房屋高达马币的补贴,直接为瓷砖采购开闢了建筑管道。森那美地产的「种子家园」(Seed Homes)计划展示了私人建设公司如何响应国家目标,为经济适用房提供耐用的瓷砖地面。标准化的设计和单元尺寸使供应商能够透过批量采购协议降低成本,从而在价格压缩的情况下保持利润率。经济适用住宅法规也强制要求在地采购,保护国内企业免受马来西亚瓷砖市场进口价格竞争的影响。这些项目通常指定潮湿区域和人流量大的区域使用瓷砖,从而确保在经济週期中保持稳定的基准需求。经济适用住宅计划的标准化特性带来了批量采购的优势,在保持价格竞争力的同时,有望提高瓷砖供应商的利润率。

天然气和电力成本波动

瓷砖窑炉在超过摄氏1150度的高温下消耗大量天然气,这使得生产商极易受到现货价格突然飙升的影响。对于通体磁砖生产线而言,公用事业成本已占出厂价的30%以上,而数位印刷机的电价上涨也进一步推高了成本。预计到2035年,东南亚将占全球能源需求成长的25%,马来西亚的瓷砖工厂将面临持续的成本不确定性。由于缺乏避险工具,中小企业被迫在利润率下降和因价格传导而导致马来西亚瓷砖市场销售量下滑之间做出选择。石化燃料约占该地区能源需求的80%,这种持续依赖使其面临全球大宗商品价格波动的风险。仅靠提高营运效率无法完全应对这项挑战。高能耗的磁砖生产在用电高峰期面临特别严峻的挑战,因为此时公用事业公司会实施基于需求的收费系统。这迫使製造商优化生产计划,以适应能源成本週期。

细分市场分析

预计到2025年,陶瓷瓷砖将占马来西亚陶瓷砖市场收入的41.62%,并在2031年之前以5.15%的复合年增长率成长。因此,陶瓷瓷砖仍然是马来西亚陶瓷砖市场健康状况的关键指标。这一增长主要得益于陶瓷瓷砖低于0.5%的吸水率,使其即使在马来西亚潮湿的气候下也具有很高的耐用性。干压成型和数位釉药技术的进步使得瓷砖能够呈现出与天然石材直接竞争的大理石纹理效果,从而刺激了高端住宅的升级需求。

釉药瓷砖仍然是住宅浴室墙面的重要选择,而无釉药工业瓷砖则广泛应用于工业设施和交通枢纽的地板材料,这些场所对防滑性能要求极高。小批量烧製、可客製化颜色的马赛克瓷砖在酒店业中占据了一席之地,常用于装饰墙面和泳池区域。其他装饰性产品,例如手绘娘惹风格瓷砖,因其将传统图案与现代几何纹样相结合,在精品开发商中保持着较高的利润率。随着暹罗水泥运作产能扩张项目的投产,预计大尺寸陶瓷瓷砖的供应将有所缓解,从而支撑马来西亚瓷砖市场长期的优质化趋势。

到2025年,地砖将占马来西亚瓷砖市场58.72%的份额,这主要得益于零售商场和独栋住宅对耐用性的需求。吉隆坡新建公寓的平均占地面积预计将在2023年至2025年间增长6%,从而推动绝对需求的成长。同时,墙砖预计将以4.84%的复合年增长率成长,在所有应用领域中增速最高,这主要得益于浴室翻新中对卫生易清洁表面的优先考虑。屋顶瓦将保持其独特的市场地位,这主要得益于一项研究表明,浅色陶瓷屋顶瓦在马来西亚的热带气候下可将最高温度降低高达16摄氏度,从而降低13.14%的年度能源成本。

马来西亚的墙壁材料瓷砖市场正受益于喷墨纹理技术,该技术能够模仿壁纸,同时避免热带浴室常见的潮湿问题。在屋顶领域,研究表明,浅色瓷砖可使阁楼温度降低摄氏16度,从而减少13.14%的年度冷却成本。商业建筑重视低维护的填缝系统,并追求从墙面到地面连续统一的图案设计,以创造更协调的外观。因此,供应商将产品以多种规格包装,方便设计师在垂直和水平表面上应用相同的图案。这种模式在马来西亚瓷砖行业正日益普及。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 都市区中产阶级的需求日益增长

- 政府主导的低收入住宅计划

- 大尺寸磁砖板材的应用日益广泛

- 向环保、低碳瓷砖生产转型

- 利用数位喷墨印刷实现大规模客製化

- 加速大型政府资助的计划

- 市场限制

- 天然气和电力成本波动

- 来自低成本进口商品(中国、越南)的竞争

- 先进製造业技术纯熟劳工短缺

- 马来西亚中层建筑从业人员对建筑资讯模型(BIM)要求的采纳率低

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察市场最新趋势与创新

- 深入了解近期产业发展动态(新产品发布、策略性倡议、投资、合作、合资、扩张、併购等)

第五章 市场规模与成长预测

- 依产品类型

- 瓷质砖

- 釉药陶瓷砖

- 无釉陶瓷砖

- 马赛克瓷砖

- 其他(装饰瓷砖、图案瓷砖、手工瓷砖)

- 透过使用

- 地面

- 墙

- 屋顶材料

- 最终用户

- 住宅

- 商业

- 饭店业(饭店、度假村)

- 零售店

- 办公室和公共设施

- 卫生保健

- 教育设施

- 交通枢纽(机场、捷运、客运站)

- 其他商业用户

- 依建筑类型

- 新建工程

- 维修和更换

- 透过分销管道

- 磁砖和石材专卖店

- 居家装潢和DIY专卖店

- 线上零售

- 直接向承包商销售

- 按地区

- 北马来西亚

- 马来西亚中部(巴生谷)

- 南马来西亚

- 马来西亚东海岸

- 东马(沙巴和砂劳越)

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Guocera Holdings Sdn Bhd

- White Horse Ceramic Industries Sdn Bhd

- Niro Ceramic Group

- Kim Hin Industry Berhad

- Yi-Lai Industry Berhad(Alpha Tiles)

- Seacera Group Berhad

- Malaysia Mosaic Sdn Bhd(MML)

- Claytan Group

- Venus Ceramic Industry Sdn Bhd

- Perfect Ceramic Tiles Sdn Bhd

- RAK Ceramics PJSC

- Kajaria Ceramics Ltd

- Siam Cement Group(SCG Tiles)

- Mohawk Industries Inc.

- Roca Tile Group

- Dongpeng Ceramic Co., Ltd.

- Johnson Tiles(Norcos plc)

- Somany Ceramics Ltd

- Monalisa Group Co., Ltd.

- Panaria Group Industrie Ceramiche SpA

第七章 市场机会与未来展望

The Malaysia ceramic tiles market was valued at USD 0.99 billion in 2025 and estimated to grow from USD 1.04 billion in 2026 to reach USD 1.31 billion by 2031, at a CAGR of 4.74% during the forecast period (2026-2031).

These figures position the Malaysia ceramic tiles market as a stable, mid-growth building-materials arena whose outlook is increasingly influenced by Klang Valley megaprojects, Sabah-Sarawak infrastructure upgrades, and rapid digitalization in retail channels. A record RM 183.7 billion worth of construction contracts was awarded in 2024, reinforcing downstream demand for tiles in both residential and commercial settings. Rapid technology adoption, especially large-format porcelain slab lines equipped with ink-jet printing, supports premiumization, while state-led affordable-housing quotas safeguard baseline volume. Competitive pressures from Chinese and Vietnamese imports are forcing local manufacturers to differentiate through sustainability credentials, advanced glazing, and omnichannel distribution strategies.

Malaysia Ceramic Tiles Market Trends and Insights

Rising Urban Middle-Class Demand

Rising disposable incomes in Kuala Lumpur, Selangor, and Penang continue to lift per-capita floor-covering expenditures, making the Malaysia ceramic tiles market a prime beneficiary. Household spending on decorative surfaces climbed from RM 530.6 million in 2018 to RM 640.2 million in 2022, and is projected to reach RM 760.0 million by 2026, a 4.4% CAGR. Transaction volumes for residential property grew 6.2%, with values up 14.4% in 2024, signaling robust renovation activity that favors premium porcelain formats. Middle-class buyers place higher value on durability and aesthetic coherence across open-plan layouts, driving up average square-meter purchases per project. The demographic trend also pushes retailers to widen online catalogs as urban consumers increasingly prefer digital visualization tools before selecting tile patterns.

Government-Led Affordable Housing Projects

Federal schemes such as MyHome, PR1MA, and Rumah Selangorku specify ceramic tiles for kitchens, bathrooms, and common areas, ensuring predictable order volumes for manufacturers. MyHome offers developers up to RM 30,000 per unit, unlocking a construction pipeline that directly feeds tile procurement. Sime Darby Property's Seed Homes initiative shows private builders aligning with state goals to supply budget apartments furnished with durable tile surfaces. Because designs and unit sizes are standardized, suppliers capture cost efficiencies through bulk purchase agreements, protecting margins despite compressed price points. Affordable-housing rules also compel local sourcing, shielding domestic players from import price warfare in this segment of the Malaysia ceramic tiles market. These programs typically specify ceramic tiles for wet areas and high-traffic zones, ensuring consistent baseline demand regardless of economic cycles. The standardized nature of affordable housing projects enables bulk procurement advantages, potentially improving profit margins for ceramic tile suppliers while maintaining competitive pricing structures.

Volatile Natural-Gas & Electricity Costs

Tile kilns consume large volumes of natural gas at temperatures exceeding 1,150 °C, leaving producers highly exposed to spot-price spikes. Utility bills already account for more than 30% of ex-factory cost on full-body porcelain lines, and electricity charges for digital printers add upward pressure. With Southeast Asia expected to represent 25% of global energy-demand growth by 2035, Malaysian plants face continued cost unpredictability. Smaller companies lack hedging instruments, forcing them either to absorb margin erosion or pass on price increases that risk volume loss in the Malaysia ceramic tiles market. The region's continued reliance on fossil fuels, which meet nearly 80% of energy demand, creates ongoing exposure to global commodity price volatility that manufacturers cannot fully control through operational efficiency improvements. Energy-intensive ceramic tile production faces particular challenges during peak demand periods when utility companies implement demand-based pricing structures, forcing manufacturers to optimize production scheduling around energy cost cycles.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Large-Format Porcelain Slabs

- Shift Toward Eco-Friendly Low-Carbon Tile Production

- Competition from Low-Cost Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain accounted for 41.62% of 2025 revenue in the Malaysia ceramic tiles market, while the segment is projected to accelerate at a 5.15% CAGR through 2031. The Malaysia ceramic tiles market size for porcelain therefore, remains the primary barometer of industry health. These gains rest on porcelain's sub-0.5% water-absorption rate, making it more durable in Malaysia's high-humidity climate. Advancements in dry-pressing and digital glazing now permit marble-look finishes that compete directly with natural stone, persuading upscale homeowners to upgrade.

Glazed ceramic tiles retain importance in mass-housing bathroom walls, whereas unglazed technical porcelain targets industrial and transit flooring where slip resistance is critical. Mosaic tiles secure niche value in hospitality accent walls and pools, capitalizing on bespoke color blends enabled by small-batch firing. Decorative "others," including hand-painted Nyonya-style tiles, command high margins among boutique developers who marry heritage motifs with modern geometry. As capacity expansions by Siam Cement Group come online, the supply of large-format porcelain is expected to ease, supporting the Malaysia ceramic tiles market's long-term premiumization trend.

Floor installations held a 58.72% share of the Malaysia ceramic tiles market in 2025, anchored by durability needs in retail malls and landed houses. Average floor areas per new condominium in Kuala Lumpur rose 6% between 2023 and 2025, lifting absolute volume demand. Wall applications, however, are penciled in for a 4.84% CAGR, the fastest within overall applications, as bathroom remodels prioritize hygienic, easy-wipe surfaces. Roofing applications maintain a specialized market position, particularly benefiting from research demonstrating that lighter-colored ceramic roof tiles can reduce peak temperatures by up to 16°C and achieve 13.14% annual energy cost savings in Malaysia's tropical climate.

The Malaysia ceramic tiles market size for wall coverings is benefiting from ink-jet textures that mimic wallpaper without the moisture issues common in tropical bathrooms. On the roofing side, research shows lighter-colored ceramic tiles can reduce attic temperatures by 16 °C and cut annual cooling bills by 13.14%. Commercial sectors appreciate low-maintenance grout systems, prompting wall-to-floor continuity to improve design coherence. Consequently, suppliers package multi-format SKUs that allow designers to run identical graphics across vertical and horizontal planes, an approach gaining traction in the Malaysia ceramic tiles industry.

The Malaysia Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores, DIY Stores, Online Retail, Direct Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Guocera Holdings Sdn Bhd

- White Horse Ceramic Industries Sdn Bhd

- Niro Ceramic Group

- Kim Hin Industry Berhad

- Yi-Lai Industry Berhad (Alpha Tiles)

- Seacera Group Berhad

- Malaysia Mosaic Sdn Bhd (MML)

- Claytan Group

- Venus Ceramic Industry Sdn Bhd

- Perfect Ceramic Tiles Sdn Bhd

- RAK Ceramics PJSC

- Kajaria Ceramics Ltd

- Siam Cement Group (SCG Tiles)

- Mohawk Industries Inc.

- Roca Tile Group

- Dongpeng Ceramic Co., Ltd.

- Johnson Tiles (Norcos plc)

- Somany Ceramics Ltd

- Monalisa Group Co., Ltd.

- Panaria Group Industrie Ceramiche S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Urban Middle-Class Demand

- 4.2.2 Government-Led Affordable Housing Projects

- 4.2.3 Increasing Adoption of Large-Format Porcelain Slabs

- 4.2.4 Shift Toward Eco-Friendly Low-Carbon Tile Production

- 4.2.5 Digital Ink-Jet Printing Enabling Mass Customization

- 4.2.6 Acceleration of Government-Funded Infrastructure Megaprojects

- 4.3 Market Restraints

- 4.3.1 Volatile Natural-Gas & Electricity Costs

- 4.3.2 Competition From Low-Cost Imports (China, Vietnam)

- 4.3.3 Skilled-Labour Shortages In Advanced Manufacturing

- 4.3.4 Slow Diffusion of Building-Information-Modelling (Bim) Requirements In Malaysia's Mid-Tier Architectural Community

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 Northern Malaysia

- 5.6.2 Central Malaysia (Klang Valley)

- 5.6.3 Southern Malaysia

- 5.6.4 East Coast Malaysia

- 5.6.5 East Malaysia (Sabah & Sarawak)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Guocera Holdings Sdn Bhd

- 6.4.2 White Horse Ceramic Industries Sdn Bhd

- 6.4.3 Niro Ceramic Group

- 6.4.4 Kim Hin Industry Berhad

- 6.4.5 Yi-Lai Industry Berhad (Alpha Tiles)

- 6.4.6 Seacera Group Berhad

- 6.4.7 Malaysia Mosaic Sdn Bhd (MML)

- 6.4.8 Claytan Group

- 6.4.9 Venus Ceramic Industry Sdn Bhd

- 6.4.10 Perfect Ceramic Tiles Sdn Bhd

- 6.4.11 RAK Ceramics PJSC

- 6.4.12 Kajaria Ceramics Ltd

- 6.4.13 Siam Cement Group (SCG Tiles)

- 6.4.14 Mohawk Industries Inc.

- 6.4.15 Roca Tile Group

- 6.4.16 Dongpeng Ceramic Co., Ltd.

- 6.4.17 Johnson Tiles (Norcos plc)

- 6.4.18 Somany Ceramics Ltd

- 6.4.19 Monalisa Group Co., Ltd.

- 6.4.20 Panaria Group Industrie Ceramiche S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 Smart Anti-Microbial Glazed Tiles With Iot Sensors

- 7.2 Carbon-Neutral Kiln Technologies Leveraging Hydrogen Fuel