|

市场调查报告书

商品编码

1643158

欧洲 MOOC:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe MOOC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

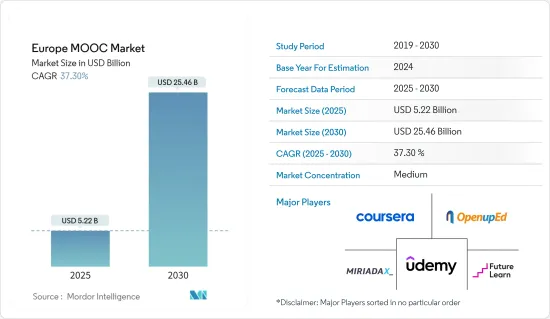

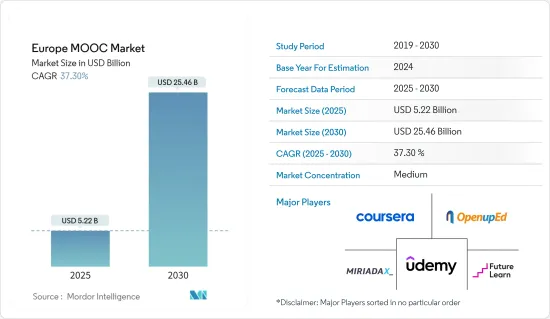

预计2025年欧洲 MOOC 市场规模为 52.2 亿美元,到 2030 年将达到 254.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 37.3%。

随着线上教育平台利用人工智慧和机器学习技术提供个人化的学习体验,个人化和自适应学习的趋势正在上升。

主要亮点

- MOOC 平台被欧洲多所大学、学校和其他公共和商业组织广泛使用,提供一系列课程,包括硕士课程和证书课程。例如,2022年4月,七所欧洲大学宣布计划在EUNICE伙伴关係关係下推出一项创新的世界研究MOOC。

- 大规模开放式线上课程(MOOC)是高等教育中越来越流行的学习方法。欧洲 MOOC 联盟 (EMC) 致力于推动有关这些 MOOC 以及欧洲线上教育其他进展的讨论。 EMC 正在製定倡议,推动大学内数位化学习和 MOOC 的使用,为教育机构提供将这些实践融入经营模式所需的工具。因此,越来越多的大学和其他教育机构正在使用 MOOC 提供开放教育,作为继续教育或继续专业发展计划的一部分,或作为本科或研究生课程的一部分。

- 此外,技术进步、消费者和商业需求的变化、成本降低和收益可能性都促进了 MOOC 的流行。大规模开放线上课程(MOOC)近年来引起了媒体、企业和学术界的极大关注。

- 此外,欧洲 MOOC倡议的发展也涉及一些重要议题,例如对学分奖励、基础设施、经营模式的关注,以及最后如何充分适应当地文化背景、特定的教育需求、差距和要求的问题。

- 然而,一些组织认为,使用 MOOC 作为培训和教学工具存在重大障碍,包括製作线上课程的成本高昂、采用 MOOC 平台的相关支出,以及一些员工需要具备数位技能。自学路线和认为 MOOC 能有效服务于热门话题而非核心商业竞争力的信念正在阻碍製作和提供 MOOC 的大学的发展。许多参与者也表示对保密的担忧是一个障碍。

- 在 COVID-19 疫情期间,各垂直行业大规模开放线上课程 (MOOC) 的发展对大规模开放式线上课程 (MOOC) 市场产生了积极影响。 MOOC 的使用范围已逐渐扩大,可用于多种目的,包括职业变更、补充学习、企业数位学习和培训、专业发展以及大学准备。在后疫情环境下,由于消费者对各类媒体平台的使用量激增,广播和媒体技术市场预计将迅速扩张。

欧洲 MOOC 市场趋势

可扩展学习平台的需求不断增加

- 可扩展的学习不仅仅意味着更多的书籍、数位学习课程或影片观看。可扩展学习需要有系统地在整个公司收集、吸收和传播新资讯。能够扩展学习的组织最有能力适应变化、应对天气干扰并进行创新。公司可以做的最重要的事情之一是製定可扩展的学习计划,这将是预测期内的关键竞争优势。

- 随着您的业务成长而扩展您的远距学习平台,从而实现其扩充性。它能够适应不断变化的业务需求,例如培训更多的人员、提供更多的培训资源以及处理更大量的资料。

- 此外,欧洲数位学习市场占有率日益增长的份额得益于学习管理系统 (LMS) 解决方案。在教育中采用 LMS 系统的主要优势在于它充当一个集中平台,最终用户可以从一个地方管理所有学习资源,而不必依赖多个外部驱动器。

- 此外,数位学习内容供应商的扩张可能会改善欧洲市场的前景。新冠肺炎疫情促使学术和专业培训师推出线上培训和教育计画。随着对可靠的数位学习平台的需求快速增长,对类似合格的内容供应商的需求也在快速增长。

- 根据欧盟统计局的数据,2022年,参加线上课程(任何科目)的使用者比例最高的是荷兰,为35.33%,其次是芬兰,为30.66%。欧盟27国占所有参加线上课程个人的16.42%。如此庞大的数字可能会激励市场相关人员增加投资,让更多客户获得欧洲奖学金。

英国市场正在快速成长

- 随着英国大学摆脱对高等教育体验造成极大损害的限制和强制转向远端教育,越来越明显的是,他们正在对线上教学进行更具策略性的思考。

- 作为与MOOC平台结合开展的学位课程的一个样本,MOOC主要用于更具策略性的目的。因此,期望从此类合作中获得投资回报的机构必须提供更昂贵的学分服务,例如学位或微证书。

- 此类MOOC平台协议的理由在品牌认知度和声誉方面可能较不规范。一些英国教育机构拥有足够强大的品牌,只要他们付出努力,就能在线上教育市场上竞争。然而,许多地方并没有意识到这一点,或缺乏资源来做到这一点。

- 一些组织透过关键伙伴关係关係提高了其在该国的品牌影响力,预计这将在预测期内显着提高市场成长率。例如,2022年9月,伦敦大学成员之一的伦敦政治经济学院(LSE)宣布在edX、2U, Inc.的全球线上学习平台上推出其首批两个MicroBachelors®课程,分别是统计学和数学基础课程,以及其第一个大规模开放线上课程「大学预科数学简介」。伦敦政经学院表示,已扩大与 2U 的学位合作关係,并成为首批推出 edX 微证书的机构之一,为学生提供灵活、可迭加的途径,以获得完全在线的学士学位。

- 此外,根据高等教育标准局的数据,2021/22 年,欧盟共有 21,120 名学习者在英格兰的高等教育机构进行远距教学。同时,在欧盟以外,共有 91,785 名学习者参加了远距学习模式。预计线上学习趋势的上升将在预测期内推动市场成长。

欧洲 MOOC 行业概况

欧洲 MOOC 市场适度整合,拥有多家知名参与者。领先的企业正在采用产品创新和伙伴关係等策略来保持竞争优势。市场参与者包括 Coursera、FutureLearn、OpenupEd 和 Miriadax。

2022年12月,总部位于荷兰的全球高等教育平台世界大学系统(GUS)收购了数位学习平台FutureLearn。世界大学系统 (GUS) 将授予 FutureLearn 其人工智慧主导的职业管理解决方案的使用权,以丰富 FutureLearn 的产品线,并为学生提供内容、认证、指导和职业机会。

2022 年 7 月,IE 大学在 Coursera 上的大规模开放线上课程 (MOOC) 宣布学生人数已突破 100 万人。 IE 大学现在是 Coursera 上註册人数超过一百万的五所欧洲大学之一。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 可扩展学习平台的需求不断增加

- 提供各种课程

- 市场限制

- 该地区完成率较低

- 营运问题

- 欧洲主要采用趋势和首选课程主题分析

- 在欧洲推广 MOOC 的联邦倡议和工作小组

- 欧洲XMOOC与CMOOC分析

- 欧洲 MOOC 的发展

第六章 市场细分

- 按主题

- 科技

- 商业

- 科学

- 其他主题

- 按国家

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 荷兰

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Coursera Inc.

- FutureLearn Limited(Global University Systems(GUS))

- OpenupEd

- Miriadax

- Desire2Learn Corporation

- Federia

- Kandenze.com

- Simplilearn

- Udemy, Inc.

- Pluralsight Inc.

第八章投资分析

第九章:市场的未来

The Europe MOOC Market size is estimated at USD 5.22 billion in 2025, and is expected to reach USD 25.46 billion by 2030, at a CAGR of 37.3% during the forecast period (2025-2030).

As online education platforms use AI and machine learning technology to provide individualized learning experiences, there is an increasing trend toward personalized and adaptive learning.

Key Highlights

- The MOOC platform is widely used by several European universities, schools, and other public and commercial organizations that offer a variety of courses, including Master's-level programs as well as certification courses. For instance, in April 2022, seven European Universities announced plans to begin an Innovative MOOC on Global Studies under the EUNICE partnership.

- Massive open online courses (MOOCs) are becoming increasingly popular as a learning method in higher education. The European MOOC Consortium (EMC) is helping to drive the conversation around these and other European online education advancements. EMC creates initiatives to promote digital learning and MOOC usage within universities and gives institutions the tools they need to integrate these practices into their business models. As a result, more colleges and other educational institutions use MOOCs to offer open education as a component of their continuing education and continuing professional development programs or as part of the curriculum for undergraduate and graduate degrees.

- Further, technology advancements, shifting consumer and company demands, and the potential to cut costs and make money have all contributed to the proliferation of MOOCs. Massive Open Online Courses (MOOCs) have significantly gained a lot of media, corporate, and academic attention in recent years.

- Moreover, the growth of MOOC initiatives in Europe is related to several critical issues, including credit-awarding, infrastructure, and business model concerns, as well as, last but not least, the issue of appropriate adaptation to the local cultural context, specific educational needs, gaps, and necessities.

- However, several organizations claimed that in addition to the high cost of creating online courses and the expenditures associated with the MOOC platform employed, there are also significant hurdles to using MOOCs as a tool for training and education, including the need for digital skills among some staff members. Self-directed learning route policies and the notion that MOOCs effectively serve trendy topics rather than key business competencies are hindering the growth of universities producing and delivering MOOCs. Many of the participants also cited confidentiality concerns as a hindrance.

- The development of industry-vertical massive open online courses (MOOCs) during the COVID-19 epidemic had a favorable effect on the massive open online course (MOOC) market. A rise in the use of MOOCs for various objectives, including job change, supplemental learning, corporate eLearning and training, professional development, and college preparation, among others, was observed. In the post-pandemic environment, due to the surge in consumer usage of various media platforms, the market for broadcast and media technologies is anticipated to experience rapid expansion.

Europe MOOC Market Trends

Increasing demand for scalable learning platform

- Scalable learning encompasses more than merely increasing the number of books, e-learning courses, and video views. Scalable learning necessitates a systematic approach to gathering, assimilating, and disseminating new information across the company. An organization that can scale learning would be better equipped to adapt to change and innovate through disruption. One of the most important things a business can do is to create a scalable learning plan, as this would be their primary competitive advantage in the forecast period.

- The expansion of a remote learning platform parallel to the growth of the business constitutes its scalability. It is the capacity to adapt to shifting business requirements, such as training more personnel, providing more training resources, and handling more significant amounts of data.

- Moreover, the expansion of Europe's e-learning market share would be supported by Learning Management System (LMS) solutions. The primary benefit of employing LMS systems in education is that they may function as a centralized platform to support end-users in centralizing all of their learning resources rather than relying on several external drives.

- Further, the expansion of e-learning content suppliers would improve the outlook for the European market. The COVID-19 epidemic has compelled academic and professional trainers to launch online training and education programs. The need to have similarly qualified content suppliers is increasing, even as the requirement for solid e-learning platforms is expanding rapidly.

- According to Eurostat, in 2022, the rate of users doing an online course (of any subject) was reported to be highest in the Netherlands, with 35.33% of total individuals, followed by Finland, with 30.66%. The EU-27 countries totaled 16.42% of total individuals accessing online courses. Such significant values would drive the market players to increase investments in driving a considerable range of customers to access European studies.

United Kingdom to Witness Significant Growth in the Market

- The trend is becoming more and more evident that United Kingdom universities are thinking much more strategically about online education as the institutions transition from a period of constraints and forced migrations to remote teaching that have significantly damaged the higher education experience.

- As sampler courses for degrees that are given in collaboration with MOOC platforms, MOOCs are mainly used for more strategic purposes. Any institution expecting a return on investment from these collaborations must thus provide credit-bearing, more expensive services, such as degrees and micro-credentials.

- This reason for MOOC platform agreements may be rather irregular regarding brand recognition or reputation. Several United Kingdom institutions have a strong enough brand to compete in the online education market if they make an effort to do so. Still, many are unaware of this or lack the resources to do so correctly.

- Few organizations are increasing their brand presence in the country through significant partnerships, which are anticipated to increase the market growth significantly during the forecast period. For instance, in September 2022, A member of the University of London, the London School of Economics and Political Science (LSE) announced the launch of its first two MicroBachelors(R) programs in Statistics Fundamentals and Mathematics, as well as its first Massive Open Online Course, An Introduction to Pre-University Mathematics, on edX, a global online learning platform from 2U, Inc. LSE, mentioned that it is one of the first institutions to broaden its degree relationship with 2U to introduce a set of edX micro-credentials that offer students a flexible, stacking pathway towards earning a fully online undergraduate education.

- Furthermore, according to HESA, in 2021/22, the England HE provider recorded 21,120 learners in the distance learning mode within the EU region. While 91,785 learners were recorded outside the EU region registered in distance learning mode. Such growing online learning trends would drive market growth during the forecast period.

Europe MOOC Industry Overview

The European MOOC market is moderately consolidated due to the presence of many prominent players in the market. The key players are adopting strategies, such as product innovation and partnerships, to stay ahead of the competition. Some of the players in the market are Coursera, FutureLearn, OpenupEd, and Miriadax.

In December 2022, Global University Systems (GUS), a global higher education platform based in the Netherlands, acquired the digital learning platform FutureLearn. Global University Systems (GUS) would grant FutureLearn access to its AI-driven career management solution to diversify FutureLearn's product line and connect students to content, accreditation, mentorship, and career opportunities.

In July 2022, Coursera's Massive Open Online Courses at IE University announced that it had surpassed more than a million students (MOOCs). IE University is now one of the five European universities that have exceeded the milestone of one million Coursera enrollments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand for scalable learning platform

- 5.1.2 Availability of wider varieties of courses across streams

- 5.2 Market Restraints

- 5.2.1 Low Completion Rates in the Region

- 5.2.2 Operational issues

- 5.3 Analysis of the key adoption trends and preferred course topics in Europe

- 5.4 Federal Initiatives and Working Groups promoting MOOC in Europe

- 5.5 Analysis of XMOOC and CMOOC in Europe

- 5.6 Evolution of MOOC in Europe

6 MARKET SEGMENTATION

- 6.1 By Subject

- 6.1.1 Technology

- 6.1.2 Business

- 6.1.3 Science

- 6.1.4 Other Subjects

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 France

- 6.2.3 Germany

- 6.2.4 Italy

- 6.2.5 Spain

- 6.2.6 Netherlands

- 6.2.7 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coursera Inc.

- 7.1.2 FutureLearn Limited (Global University Systems (GUS))

- 7.1.3 OpenupEd

- 7.1.4 Miriadax

- 7.1.5 Desire2Learn Corporation

- 7.1.6 Federia

- 7.1.7 Kandenze.com

- 7.1.8 Simplilearn

- 7.1.9 Udemy, Inc.

- 7.1.10 Pluralsight Inc.