|

市场调查报告书

商品编码

1644317

英国弹性地板覆盖材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United Kingdom Resilient Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

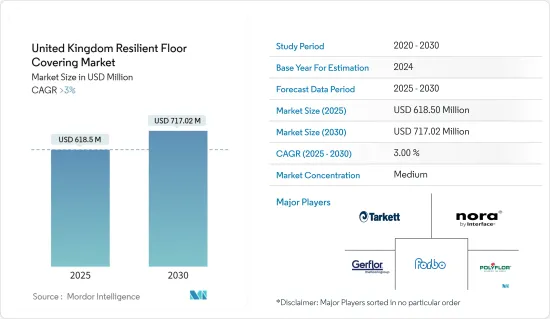

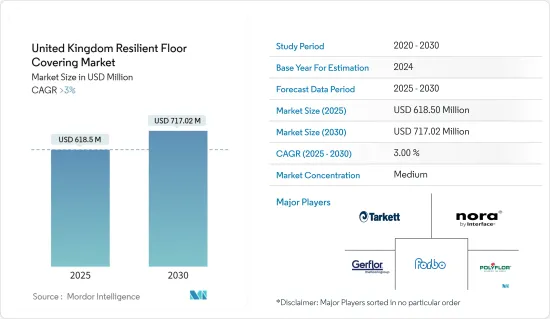

英国弹性地板覆盖材料市场规模估计和预测到 2025 年将达到 6.185 亿美元,预计到 2030 年将达到 7.1702 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率将超过 3%。

弹性地板材料製造商使用各种原材料来製造产品,从基于石化产品的合成聚合物(如乙烯基、橡胶和聚烯)到天然材料(如天然橡胶和油毡)。在英国,弹性地板覆盖材料是成长最快的市场之一,上年度弹性地板覆盖材料的需求量超过 3,350 万平方公尺。技术的进步使得乙烯基地板迅速普及,取代油毡成为住宅和商业用途的主要弹性地板覆盖材料。

乙烯基地板覆盖材料被推销并定位为一种现代材料,使其成为现代、技术日益先进的建筑的首选。透过采用新技术和创新,领先的弹性地板覆盖材料产品製造商正致力于开发独特的工艺来重新利用製造过程中产生的废弃物,以减少对环境造成的破坏。生活方式和家居装饰偏好的改变是推动全国弹性地板覆盖材料市场发展的趋势。

英国弹性地板覆盖材料市场趋势

预计商业终端用户领域将占据市场的大部分份额

弹性地板覆盖材料市场大致分为住宅和商业终端用户。在研究期间,住宅部分占据了市场的大部分份额。然而,该地区旅游业和酒店业的不断加强正在刺激新酒店、餐厅、豪华别墅和宾馆的建设。弹性地板覆盖材料提供了更美观的外观。它还耐磨、耐用且价格低廉,是酒店业的理想选择。此外,欧洲各地的都市化和商业部门的扩张预计将推动该地区新办公大楼的建设。

扩大地板覆盖材料市场

乙烯基地板材料细分市场占据了弹性地板覆盖材料市场的大部分份额,预计将继续超过所有其他产品细分市场。豪华乙烯基瓷砖尤其吸引了顾客的注意,并扩大了英国住宅领域弹性地板覆盖材料物的覆盖范围。

英国弹性地板覆盖材料物产业概况

英国弹性地板覆盖材料市场较为分散。该报告介绍了英国弹性地板覆盖材料市场的主要国际参与者。就市场占有率而言,Tarkett SA、Forbo Flooring Systems、Gerflor Ltd.、Nora Systems GmbH 和 Polyflor Ltd. 是一段时间内主导该市场的主要企业。然而,中小企业也凭藉技术进步和产品创新赢得新契约并进入新市场,增加了市场占有率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 改建和翻新的增加推动了市场

- 市场限制

- 来自其他地板选择的竞争阻碍了市场的发展。

- 市场机会

- 对环保和永续地板选择的需求不断增加

- 豪华乙烯基瓷砖的采用率不断提高

- 价值链/供应链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 深入了解业界正在使用的最新技术

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 乙烯基弹性地板材料

- 油毡弹性地板材料

- 玻璃纤维弹性地板材料

- 软木弹性地板材料

- 橡胶弹性地板材料

- 按最终用户

- 住宅

- 商业的

- 按分销管道

- 家装中心

- 专卖店

- 在线的

- 其他分销管道

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Tarkett Ltd

- Forbo Flooring UK Ltd.

- Nora Flooring Systems UK Ltd.

- Gerflor Ltd.

- Polyflor Ltd.

- Altro Ltd.

- Amtico International

- Cellecta Ltd.

- Mohawk Industries Inc.

- Techfloor Services Ltd*.

第七章 未来市场趋势

第八章 免责声明和出版商

The United Kingdom Resilient Floor Covering Market size is estimated at USD 618.50 million in 2025, and is expected to reach USD 717.02 million by 2030, at a CAGR of greater than 3% during the forecast period (2025-2030).

Resilient flooring manufacturers use a range of feedstock materials to make their products: from synthetic petrochemical-based polymers, including vinyl, rubber, and polyolefin, to natural materials, such as natural rubber and linoleum. In the United Kingdom, resilient floor covering is one of the fastest-growing markets, and the demand for resilient flooring demand was more than 33.5 million square meters during the previous year. Technological improvements drove the rapid adoption of vinyl floors, replacing linoleum as the predominant resilient floor covering in residential and commercial applications.

Vinyl floor covering was marketed and positioned as a modern material and became an appropriate choice for the emerging technologically sophisticated modern buildings. Through the adoption of emerging technology and innovation, the leading manufacturers of resilient flooring products are focusing on developing unique processes to recycle their production waste back into their manufacturing process to reduce the damage caused to the environment. The changing lifestyles and home decor preferences are the trends that are driving the resilient floor-covering market across the country.

UK Resilient Floor Covering Market Trends

Commercial End-User Segment is Forecasted to Grab a Major Share of the Market

The resilient floor covering market can be broadly categorized as the residential and commercial end-user. The residential segment has grabbed the major share of the market during the study period. However, the strengthening tourism and hospitality industry in the region is driving the construction of new hotels, restaurants, premium villas, and guest houses. Resilient floor coverings offer enhanced aesthetically pleasing appearances. These also offer high abrasion and resistance, long durability, and come at low prices, making them more suitable for the hospitality industry. The urbanization and the expanding business segments across Europe are also forecasted to increase the construction of new office buildings in the region.

Increase in Floor Covering Market

It is expected that the vinyl floor covering segment, which accounts for a large part of the resilient flooring market, will continue to perform better than all other product segments. Even though the residential share is comparatively less than the commercial segment of the market, it is slowly experiencing a solid growth rate, especially the luxury vinyl tiles, which are grabbing more customer attention and are expanding the scope of resilient floor coverings in the residential segment in the United Kingdom.

UK Resilient Floor Covering Industry Overview

The United Kingdom resilient floor covering market is fragmented. Major international players active in the resilient floor-covering market in the United Kingdom are covered in this report. Regarding market share, Tarkett S.A., Forbo Flooring Systems, Gerflor Ltd., Nora Systems GmbH, and Polyflor Ltd are the main players that have been dominating this market for some time now. Nevertheless, small to medium-sized companies are gaining market share through securing new contracts and entering new markets as a result of technological advances and innovation in their products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Renovation and Remodeling Activities is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Competition from Other Flooring Options is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Growing Demand for Eco-Friendly and Sustainable Flooring Options

- 4.4.2 Increasing Adoption of Luxury Vinyl Tiles

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Latest Technologies Used in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Vinyl Resilient Flooring

- 5.1.2 Linoleum Resilient Flooring

- 5.1.3 Fiberglass Resilient Flooring

- 5.1.4 Cork Resilient Flooring

- 5.1.5 Rubber Resilient Flooring

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Home Centers

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Tarkett Ltd

- 6.2.2 Forbo Flooring UK Ltd.

- 6.2.3 Nora Flooring Systems UK Ltd.

- 6.2.4 Gerflor Ltd.

- 6.2.5 Polyflor Ltd.

- 6.2.6 Altro Ltd.

- 6.2.7 Amtico International

- 6.2.8 Cellecta Ltd.

- 6.2.9 Mohawk Industries Inc.

- 6.2.10 Techfloor Services Ltd*.