|

市场调查报告书

商品编码

1651036

非弹性地板覆盖材料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Non-Resilient Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

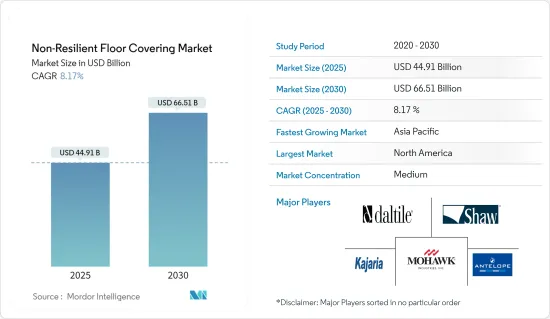

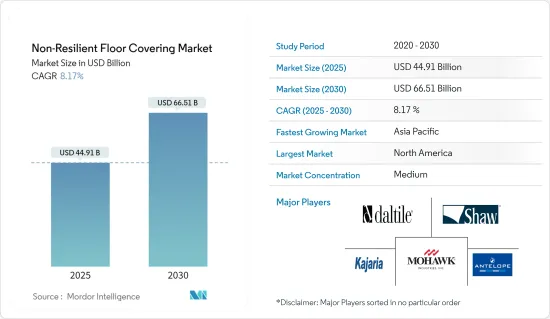

非弹性地板覆盖材料物市场规模预计在 2025 年为 449.1 亿美元,预计到 2030 年将达到 665.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.17%。

市场经历了显着的成长,预计在预测期内将继续扩大。这个市场包括各种有机硬地板材料,包括陶瓷和陶瓷瓷砖、硬木(实木和工程木)、层压板、天然石材、板岩和砖块。预期强劲的成长主要是由于新住宅和商业建筑的建设活动增加(特别是在新兴经济体中),以及全球住宅上涨导致住宅改建活动激增。陶瓷和石材产品供应商越来越多地利用线上零售通路和采矿技术的进步来降低天然和人造石材的价格,从而进一步推动产业成长。

防水、易于清洁、增强舒适度和耐用性等因素进一步推动了对非弹性地板覆盖材料产品的需求。其中,陶瓷砖市场由于其众多优势,预计在预测期内将迅速扩张。在如此有利的市场动态下,相关人员有充足的机会利用技术进步,扩大其线上零售业务,并创新其产品以满足不断变化的消费者偏好,确保市场持续成长和竞争。

非弹性地板覆盖材料市场趋势

磁砖市场引领市场

瓷砖广泛应用于新建住宅和住宅维修。此外,瓷砖也用于商业用途,如购物中心、工作场所和办公空间。陶瓷地板材料是弹性地板材料市场的主要推动力。在亚太地区,来自美国、墨西哥、中国和义大利等已开发国家的陶瓷地板产品的需求日益增加。陶瓷地板产品的需求正在增长,因为它们可以复製木材和石材的表面效果。供应商正在利用数位印刷技术的进步来提供具有多种设计美感的瓷砖。

亚太地区是成长最快的地区

亚太地区对来自美国和义大利等已开发国家的陶瓷地板产品的需求日益增加。陶瓷地板产品需求量很大,因为它们可以复製木材和石材的表面效果。供应商正在利用数位印刷技术的进步来提供具有多种设计美感的瓷砖。

非弹性地板覆盖材料物产业概况

该报告介绍了在非弹性地板覆盖材料市场运营的大型国际公司。市场较为分散,规模较大的参与者占较大的市场占有率。然而,随着技术进步和产品创新,中小企业透过赢得新契约和开拓新市场来增加其在市场上的份额。主要公司包括 China Ceramics、Mohawk Industries Inc.、Kajaria Ceramic、Shaw Industries, Inc. 和 Dal Tiles。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 市场限制

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 创新洞察

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 磁砖地板

- 石砖地板

- 强化磁砖地板

- 木地板磁砖

- 其他的

- 按分销管道

- 合约

- 专卖店

- 家装中心

- 其他的

- 按最终用户

- 住宅

- 商业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 澳洲

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 南美洲

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Mannington Mills, Inc.

- Shaw Industries, Inc.

- Mohawk Industries, Inc.

- Ceramic Saloni

- China Ceramics

- Kajaria Ceramics

- Porcelanosa Group

- RAK Ceramics

- Dal Tiles

- Crossville Inc.

第七章 市场机会与未来趋势

第八章 免责声明及发布者

The Non-Resilient Floor Covering Market size is estimated at USD 44.91 billion in 2025, and is expected to reach USD 66.51 billion by 2030, at a CAGR of 8.17% during the forecast period (2025-2030).

The market is experiencing significant growth, with projections indicating continued expansion during the forecast period. This market includes various organic hard surface flooring materials such as ceramic and porcelain tiles, hardwood (both solid and engineered), laminates, natural stone, slate, and bricks. The anticipated high growth is driven by increasing activities in new home and commercial construction, particularly in developing economies, as well as a surge in homeowner remodelling due to rising residential property prices globally. Suppliers of ceramic and stone products are increasingly leveraging online retail channels and technological advancements in mining to lower prices of natural and manufactured stones, thereby further fuelling industry growth.

The demand for non-resilient flooring products is further driven by factors such as water resistance, ease of cleaning, enhanced comfort, and durability. Among these, the ceramic tiles segment is poised for rapid expansion over the forecast period, buoyed by the multitude of benefits they offer. With such favourable market dynamics, opportunities abound for stakeholders to capitalize on technological advancements, expand online retail presence, and innovate product offerings to meet evolving consumer preferences, ensuring sustained growth and competitiveness in the market.

Non-Resilient Floor Covering Market Trends

Ceramic Tile Segment Drives the Market

Ceramic tiles are extensively used in new residential and home improvement activities. Furthermore, ceramic tiles are used in commercial applications like malls, shopping centers, and work and office spaces. Ceramic flooring is the main driver of the resilient floor covering market. In the Asia-Pacific region, there is an increase in the demand for ceramic flooring products from developed countries, such as the United States, Mexico, China, and Italy. The ability of ceramic flooring products to replicate wood and stone finishes is fueling the demand. The vendors are leveraging the advancements in digital printing technology to provide ceramic tiles with a wide range of design aesthetics.

Asia Pacific is the Fastest Growing Region

In the Asia-Pacific region, there is an increase in the demand for ceramic flooring products from developed countries, such as the United States and Italy. The ability of ceramic flooring products to replicate wood and stone finishes is fuelling the demand. The vendors are leveraging the advancements in digital printing technology to provide ceramic tiles with a wide range of design aesthetics.

Non-Resilient Floor Covering Industry Overview

The report covers major international players operating in the non-resilient floor-covering market. The market is fragmented, with major players capturing a larger market share. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Major players include China Ceramics Co. Ltd, Mohawk Industries Inc., Kajaria Ceramic, Shaw Industries, Inc., and Dal Tiles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technology Innovation

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ceramic Tiles Flooring

- 5.1.2 Stone Tiles Flooring

- 5.1.3 Laminate Tiles Flooring

- 5.1.4 Wood Tiles Flooring

- 5.1.5 Others

- 5.2 By Distribution Channel

- 5.2.1 Contract

- 5.2.2 Specialty Stores

- 5.2.3 Home Centers

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 USA

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 Italy

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 India

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 Egypt

- 5.4.4.3 UAE

- 5.4.4.4 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Colombia

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Mannington Mills, Inc.

- 6.2.2 Shaw Industries, Inc.

- 6.2.3 Mohawk Industries, Inc.

- 6.2.4 Ceramic Saloni

- 6.2.5 China Ceramics

- 6.2.6 Kajaria Ceramics

- 6.2.7 Porcelanosa Group

- 6.2.8 RAK Ceramics

- 6.2.9 Dal Tiles

- 6.2.10 Crossville Inc.*