|

市场调查报告书

商品编码

1851012

弹性地板材料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Resilient Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

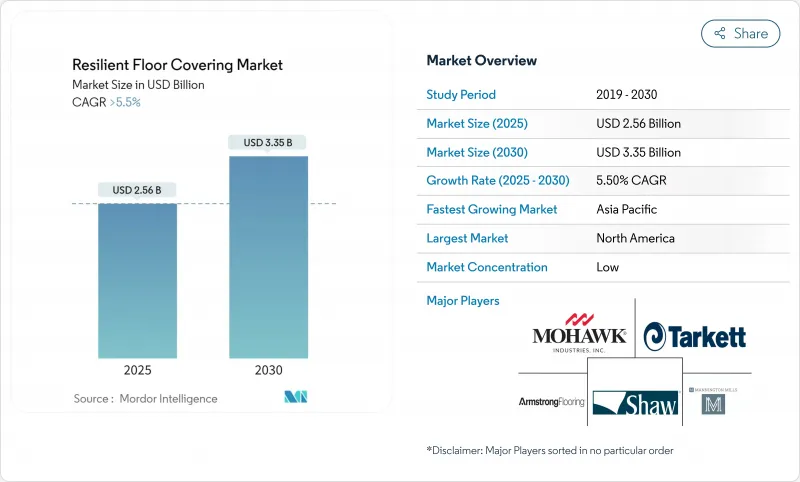

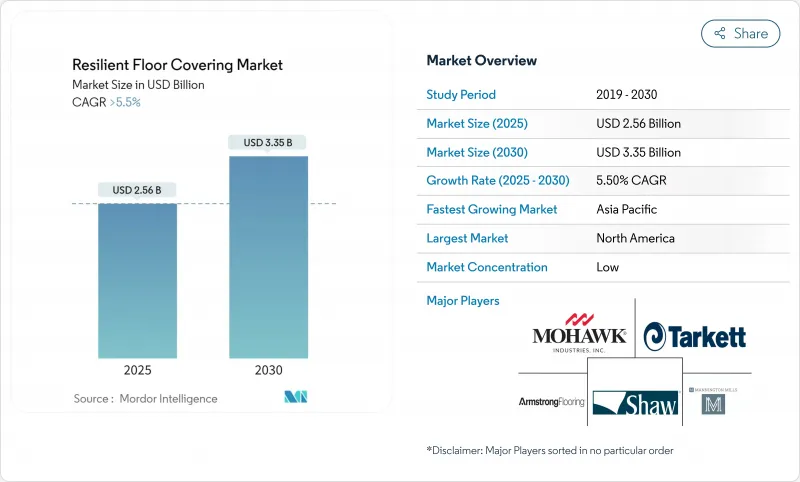

预计到 2025 年,弹性地板材料市场价值将达到 25.6 亿美元,到 2030 年将达到 33.5 亿美元,复合年增长率为 5.5%。

稳定的需求主要得益于住宅升级改造,例如采用豪华乙烯基瓷砖(LVT);亚太地区医疗保健建设项目数量不断增长;以及产品持续创新,使弹性地板材料在与瓷砖、复合地板和实木地板的竞争中保持优势。数位印刷、暂存器压纹和刚性芯材工程等技术拓展了设计选择,并提高了抗衝击性。美国环保署发布了DINP塑化剂的风险评估草案,指出在某些使用条件下可能对人体健康构成潜在风险。供应链向北美和欧洲近岸生产的转移降低了关税和前置作业时间的影响,从而更便于管理本地库存。气候主导的建筑标准强调防水性和易清洁性,进一步推动了弹性地板材料市场的发展,使其成为更广泛的装饰材料产业中一个可靠的成长领域。

全球弹性地板材料市场趋势与洞察

家居装修中LVT的快速普及

房屋翻新仍然是LVT地板的主要需求驱动力。屋主选择LVT地板的原因在于其逼真的外观、经济实惠的价格以及防潮性能,这些优势使得开放式布局更加便捷,能够轻鬆连接厨房、餐厅和起居室。数位印刷技术能够以低成本呈现媲美天然材料的清晰木纹和石纹图案,而卡扣式设计则无需使用黏合剂,从而缩短了安装时间。即使在2024年房屋开工量放缓的情况下,LVT地板依然展现出强大的市场韧性,成功取代地毯和复合地板,占据了市场份额。在美国、德国、法国和澳洲等国的更换计划推动下,这项因素将至少在2027年之前大幅推动弹性地板材料市场的发展。

亚太地区医疗建筑需要卫生、防滑的地板。

中国、印度、印尼和越南正在建造的医院和诊所需要无缝、无孔的地板,以抑制微生物生长并实现严格的感染控制。供应商目前正将整合式包覆细节、热封接缝和嵌入式抗菌层结合,以满足不断变化的卫生标准。亚洲各国政府为加护病房的专用地板材料提供补贴,因而带动了稳定的竞标量。光是在印度,到2028年就计画新增2,000多张公共床位,医疗保健建设正持续推动弹性地板材料市场的发展。

PVC原物料价格波动对利润率带来压力。

聚氯乙烯)成本随石油和能源市场波动,扰乱价格表并挤压净利率,尤其对于缺乏后向整合的生产商更是如此。 2024年的价格上涨迫使大型商业竞标迅速重新报价,并加剧了与经销商的紧张关係。儘管欧洲大力推广生物基PVC以及北美积极推行回收计画在一定程度上缓解了这个问题,但不可预测的原料成本仍持续拖累弹性地板材料市场的盈利。

细分市场分析

豪华乙烯基瓷砖是弹性地板材料市场中最通用的产品,占总需求的30.23%。凭藉其高清图案、低维护成本和极具竞争力的价格,它持续主导。石材复合材料的成长速度更快,年复合成长率达8.33%,这得益于其坚固的芯材,能够最大限度地减少在不平整基材上的透印现象,并能承受更大的衝击力。木塑复合材料儘管价格溢价抑制了销售量持续下降。亚麻油毡、橡胶和软木等小众替代品约占总销量的15%,这得益于永续性声誉和特殊的隔音性能。

SPC的石灰石加固背衬为安装人员提供了尺寸稳定的地板,能够承受温度变化,从而支持阳光充足地区和玻璃幕墙高层建筑的计划。製造商运作混合生产线,在同一班次中交替生产LVT和SPC地板,以保持库存平衡和快速的订单週期。量贩店正在推广RigidCore地板易于清洁、抗凹陷和低使用寿命成本等优点,从而提高其知名度并加速其在弹性地板材料市场的份额成长。

到2024年,胶黏式地板将占总销售量的46.89%。这是因为医院、超级市场和学校等场所,由于滚动设备和高人流会产生悬浮式地板无法承受的剪切力,因此需要永久性黏合。焊接接缝还能形成整体式覆盖层,方便清洁卫生。然而,随着承包商寻求更短的安装时间和更低的人事费用,卡扣式地板正以7.79%的复合年增长率成长。只需轻轻按压边缘即可锁定,安装人员一天最多可铺设100平方米,从而减少繁忙家庭的停工时间,并加快商业设施的整修。免胶式地板透过摩擦力和周边胶带固定较重的地砖,适用于资料中心和需要地板下方电缆接入的办公室。多样化的安装方式保持着并行成长的趋势,并增强了弹性地板材料市场的整体适应性。

区域分析

在严格的室内空气品质法规、维修补贴以及鼓励闭合迴路回收的循环经济指令的推动下,欧洲占全球销售额的31.99%。德国和法国正透过社会住宅维修来支撑需求,而斯堪地那维亚的市政当局则在学校推广使用生物基亚麻油毡。 Tarkett的ReStart®计画回收场外废弃材料,为区域材料回收提供蓝图。维修支出依然强劲,节能补贴鼓励居住者密封建筑围护结构并添加低VOC表面材料,从而促进弹性地板材料在现有基层上的快速铺设。

亚太地区成长最快,复合年增长率达9.19%,这主要得益于特大城市住宅大楼的建设、医院的扩建以及居民可支配收入的提高。光是在中国,数百万平方公尺的弹性地板就被用于公立医院和大型零售商场。印度的城市住房计画需要经济高效的防水解决方案,以应对季风带来的潮湿气候。日本和韩国则需要优质的隔音层来配合轻型钢骨建筑。在东协地区,印尼、泰国和越南的基础设施建设正在推动弹性地板的消费,建筑商正从瓷砖转向易于使用的卡扣式地板,从而进一步巩固了弹性地板材料市场的规模增长势头。

北美约占全球销售额的四分之一,关税促使生产迅速回流至北美。乔治亚和安大略省的新生产线为当地分销商提供支持,缩短了运输时间并确保了供应。加拿大各省正在为区域设施指定低挥发性有机化合物(VOC)产品,墨西哥也在自由贸易框架下扩大产能,以满足国内住宅和出口需求。该地区老旧住宅存量的维修持续进行,SPC板材常被用于解决地下室和一层扩建部分的历史遗留潮湿问题。单户多用户住宅和轻型商业建筑的需求多元化,正在增强北美弹性地板材料市场的结构稳定性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- LVT材料在家庭维修中的快速普及

- 亚太地区医疗建筑需要卫生、防滑的地板。

- 对防水型SPC/WPC的需求,用于防风雨外壳

- 利用数位印刷和EIR后整理製程提升美观度。

- 低挥发性有机化合物(VOC)法规推动了环保标籤弹性材料的普及。

- 回收油毡圆片和PVC有助于提升环保形象

- 市场限制

- PVC原物料价格波动对利润率带来压力。

- 对亚洲LVT征收反倾销税

- 氯化塑胶的环境调查

- 熟练安装人员短缺导致故障率上升

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 豪华乙烯基瓷砖(LVT)

- 干书(黏合剂)

- 点击锁定浮动

- 鬆散地

- 乙烯基片材

- 乙烯基复合地砖(VCT)

- 石材复合材料(SPC)/硬质芯材

- 塑木复合材料(WPC)

- 油布

- 橡皮

- 软木

- 豪华乙烯基瓷砖(LVT)

- 按安装类型

- 黏合剂类型

- 浮动/点击锁定

- 鬆散地

- 按最终用户行业划分

- 住宅

- 商业的

- 医疗机构

- 教育设施

- 零售商店和超级市场

- 饭店及休閒

- 总公司

- 工业/製造业

- 透过分销管道

- 离线

- 专卖店

- 居家装潢和DIY连锁店

- 在线的

- 离线

- 地区

- 北美洲

- 加拿大

- 美国

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美洲

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚(新加坡、马来西亚、泰国、印尼、越南、菲律宾)

- 亚太其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- 北欧国家(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Mohawk Industries Inc.

- Tarkett SA

- Shaw Industries Group Inc.

- Armstrong Flooring LLC(AHF Products)

- Mannington Mills Inc.

- Gerflor Group

- Forbo Flooring Systems

- Interface Inc.

- LG Hausys(LX Hausys)

- Nora Systems GmbH

- Polyflor Ltd(James Halstead)

- Engineered Floors LLC

- Karndean Designflooring

- Responsive Industries Ltd.

- CFL Flooring

- Beaulieu International Group

- Parterre Flooring Systems

- Novalis Innovative Flooring

- Milliken & Company

- Fatra as

- IVC Group(BerryAlloc)

- Upofloor(Kahrs Group)*

第七章 市场机会与未来展望

The resilient floor covering market is valued at USD 2.56 billion in 2025 and is forecast to reach USD 3.35 billion by 2030, reflecting a 5.5% CAGR.

Consistent demand stems from luxury vinyl tile (LVT) upgrades in homes, an expanding healthcare construction pipeline in Asia-Pacific, and steady product innovation that keeps resilient flooring competitive against ceramics, laminate, and hardwood. Digital printing, embossed-in-register texturing, and rigid-core engineering have expanded design choices and improved impact resistance, while PVC-free options strengthen environmental credentials without eroding performance. The U.S. Environmental Protection Agency issued a draft risk evaluation for DINP plasticizer, citing potential human-health risks under certain use conditions. Supply-chain shifts toward near-shore production in North America and Europe are reducing tariff exposure and lead times, making localized inventory easier to manage. Climate-driven building codes that emphasize water resistance and easy sanitation further reinforce adoption, positioning the resilient floor covering market as a reliable growth segment within the wider finishes sector.

Global Resilient Floor Covering Market Trends and Insights

Rapid Adoption of LVT in Residential Remodels

Home renovation remains the primary demand engine for LVT. Homeowners choose the product for realistic visuals, affordability, and resistance to moisture that simplifies open-plan layouts connecting kitchens, dining areas, and family rooms. Digital printing creates sharp wood and stone graphics that rival natural materials at lower price points, while click-lock profiles shorten installation time by eliminating adhesives. Even when housing starts stalled in 2024, LVT grew in share by displacing carpet and laminate, demonstrating resilience in downturns. The driver sustains significant lift for the resilient floor covering market through at least 2027, particularly in replacement projects across the United States, Germany, France, and Australia.

Healthcare Build-out in Asia-Pacific Requiring Hygienic, Slip-Resistant Floors

Hospitals and clinics under construction across China, India, Indonesia, and Vietnam demand seamless, non-porous sheets that resist microbial growth and enable strict infection control. Suppliers now combine integrated cove-rise detailing, heat-welded seams, and embedded antimicrobial layers to comply with evolving health standards. Asian governments subsidize specialty flooring for critical-care wards, creating steady tender volumes. With more than 2,000 public-sector bed additions scheduled through 2028 in India alone, healthcare construction contributes consistent momentum to the resilient floor covering market.

PVC Feed-stock Price Volatility Compressing Margins

Polyvinyl chloride costs fluctuate with oil and energy markets, disturbing price lists and squeezing margins, especially for producers lacking backward integration. Spikes in 2024 forced rapid re-quotations on large commercial bids, straining distributor relationships. Europe's push toward bio-attributed vinyl and North America's recycling programs create partial buffers, yet unpredictable input costs continue to drag on profitability across the resilient floor covering market.

Other drivers and restraints analyzed in the detailed report include:

- Waterproof SPC/WPC Demand for Climate-Resilient Housing

- Digital Printing and EIR Finishes Elevating Aesthetics

- Anti-Dumping Tariffs on Asian LVT

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Luxury vinyl tile holds 30.23% of overall demand and remains the most versatile offering in the resilient floor covering market. High-definition graphics, low maintenance, and competitive pricing underpin its continued leadership. Stone Plastic Composite is expanding more quickly, advancing at an 8.33% CAGR on the strength of rigid cores that minimize telegraphing over uneven substrates and withstand heavier impacts. Wood Plastic Composite stays relevant at the upper end of residential due to its softer underfoot feel and superior acoustics, though price premiums suppress volume. Conventional vinyl sheet persists in operating theaters and education corridors, where welded seams improve hygiene. Vinyl composition tile continues to decline as institutional buyers shift to no-wax surfaces. Niche alternatives-linoleum, rubber, and cork-collectively equal about 15% of turnover, driven by sustainability ratings and specialized acoustic needs.

SPC's limestone-reinforced spine gives installers a dimensionally stable plank that tolerates heat swings, supporting projects in sun-belt markets and glass-walled high-rises. Manufacturers run hybrid production lines capable of alternating LVT and SPC on a single shift, maintaining balanced inventories and responsive order cycles. Mass-market retailers advertise easy cleanup, dent resistance, and low lifetime cost, expanding rigid-core visibility and accelerating its share gains inside the resilient floor covering market size hierarchy.

Glue-down methods control 46.89% of the 2024 volume because permanent adhesion remains critical in hospitals, supermarkets, and schools, where rolling equipment and high foot traffic impose shear loads that floating floors struggle to support. They also facilitate welded seams that form monolithic coverings, easing sanitation protocols. However, Click-lock planks grow at 7.79% CAGR as contractors seek shorter build programs and reduced labor expense. Locking edges engage with light tapping, letting installers cover up to 100 m2 in a day, cutting downtime for busy households and fast-tracking commercial renovations. Loose-lay formats, comprising heavier tiles secured by friction and perimeter tape, cater to data centers and offices where under-floor cable access is imperative. The variety of installation choices sustains parallel growth tracks and enhances the overall adaptability of the resilient floor covering market.

The Resilient Floor Covering Market is Segmented by Product (Luxury Vinyl Tile (LVT), Vinyl Sheet, and More), by Installation Type (Glue-Down, and More), by End-User (Residential, Commercial), by Distribution Channel (Offline and Online), and by Geography (North America, South America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe contributes 31.99% of worldwide revenue, sustained by stringent indoor-air regulations, retrofit subsidies, and circular-economy directives that incentivize closed-loop recycling. Germany and France anchor demand with social-housing upgrades, while Scandinavian municipalities choose bio-based linoleum for schools. Tarkett's ReStart(R) program captures site offcuts and end-of-life material, demonstrating a regional blueprint for material recovery. Refurbishment spending remains brisk as energy-efficiency grants reward occupants who seal building envelopes and add low-VOC surfaces, favoring resilient flooring's quick installation over existing substrates.

Asia-Pacific represents the fastest growth at 9.19% CAGR, underpinned by megacity residential towers, hospital expansions, and expanding disposable income. China alone absorbs millions of square meters of resilient sheets for public hospitals and large-format retail malls. India's urban housing missions require cost-effective, waterproof solutions that stand up to monsoon humidity. Japan and South Korea request premium acoustic layers to complement lightweight steel construction. Across ASEAN, infrastructure pipelines in Indonesia, Thailand, and Vietnam lift consumption as builders pivot from ceramic tiles to easier-to-handle click-lock planks, reinforcing the scale-out trajectory of the resilient floor covering market.

North America generates roughly a quarter of global sales, and tariff actions have triggered rapid on-shoring. New lines in Georgia and Ontario support local distributors, trimming shipping times and safeguarding supply. Canadian provinces specify low-VOC products for provincial facilities, while Mexico builds capacity to serve domestic housing and export opportunities under free-trade frameworks. The region sees consistent renovation fueled by aging housing stock, with SPC planks often chosen to resolve historic moisture issues in basements and ground-floor extensions. Demand diversification across single-family, multifamily, and light commercial enhances the structural stability of the resilient floor covering market size in North America.

- Mohawk Industries Inc.

- Tarkett S.A.

- Shaw Industries Group Inc.

- Armstrong Flooring LLC (AHF Products)

- Mannington Mills Inc.

- Gerflor Group

- Forbo Flooring Systems

- Interface Inc.

- LG Hausys (LX Hausys)

- Nora Systems GmbH

- Polyflor Ltd (James Halstead)

- Engineered Floors LLC

- Karndean Designflooring

- Responsive Industries Ltd.

- CFL Flooring

- Beaulieu International Group

- Parterre Flooring Systems

- Novalis Innovative Flooring

- Milliken & Company

- Fatra a.s.

- IVC Group (BerryAlloc)

- Upofloor (Kahrs Group)*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of LVT in Residential Remodels

- 4.2.2 Healthcare Build-out in Asia-Pacific Requiring Hygienic, Slip-Resistant Floors

- 4.2.3 Waterproof SPC/WPC Demand for Climate-Resilient Housing

- 4.2.4 Digital Printing & EIR Finishes Elevating Aesthetics

- 4.2.5 Low-VOC Regulations Fueling Eco-Labelled Resilient Materials

- 4.2.6 Circular Linoleum & PVC Take-Back Boosting Green Certifications

- 4.3 Market Restraints

- 4.3.1 PVC Feed-stock Price Volatility Compressing Margins

- 4.3.2 Anti-Dumping Tariffs on Asian LVT

- 4.3.3 Environmental Scrutiny of Chlorinated Plastics

- 4.3.4 Skilled-Installer Shortage Elevating Failure Rates

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.1.1.1 Dry-Back (Glue-Down)

- 5.1.1.2 Click-Lock Floating

- 5.1.1.3 Loose-Lay

- 5.1.2 Vinyl Sheet

- 5.1.3 Vinyl Composition Tile (VCT)

- 5.1.4 Stone Plastic Composite (SPC) / Rigid Core

- 5.1.5 Wood Plastic Composite (WPC)

- 5.1.6 Linoleum

- 5.1.7 Rubber

- 5.1.8 Cork

- 5.1.1 Luxury Vinyl Tile (LVT)

- 5.2 By Installation Type

- 5.2.1 Glue-Down

- 5.2.2 Floating / Click-Lock

- 5.2.3 Loose-Lay

- 5.3 By End-User Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Healthcare Facilities

- 5.3.2.2 Education Buildings

- 5.3.2.3 Retail & Supermarkets

- 5.3.2.4 Hospitality & Leisure

- 5.3.2.5 Corporate Offices

- 5.3.2.6 Industrial & Manufacturing

- 5.4 By Distribution Channel

- 5.4.1 Offline

- 5.4.1.1 Specialty Stores

- 5.4.1.2 Home Centers & DIY Chains

- 5.4.2 Online

- 5.4.1 Offline

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Spain

- 5.5.4.5 Italy

- 5.5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.4.8 Rest of Europe

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East & Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Mohawk Industries Inc.

- 6.4.2 Tarkett S.A.

- 6.4.3 Shaw Industries Group Inc.

- 6.4.4 Armstrong Flooring LLC (AHF Products)

- 6.4.5 Mannington Mills Inc.

- 6.4.6 Gerflor Group

- 6.4.7 Forbo Flooring Systems

- 6.4.8 Interface Inc.

- 6.4.9 LG Hausys (LX Hausys)

- 6.4.10 Nora Systems GmbH

- 6.4.11 Polyflor Ltd (James Halstead)

- 6.4.12 Engineered Floors LLC

- 6.4.13 Karndean Designflooring

- 6.4.14 Responsive Industries Ltd.

- 6.4.15 CFL Flooring

- 6.4.16 Beaulieu International Group

- 6.4.17 Parterre Flooring Systems

- 6.4.18 Novalis Innovative Flooring

- 6.4.19 Milliken & Company

- 6.4.20 Fatra a.s.

- 6.4.21 IVC Group (BerryAlloc)

- 6.4.22 Upofloor (Kahrs Group)*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment