|

市场调查报告书

商品编码

1683429

德国地板材料:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Germany Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

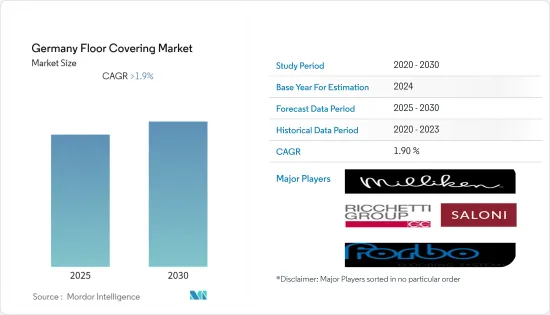

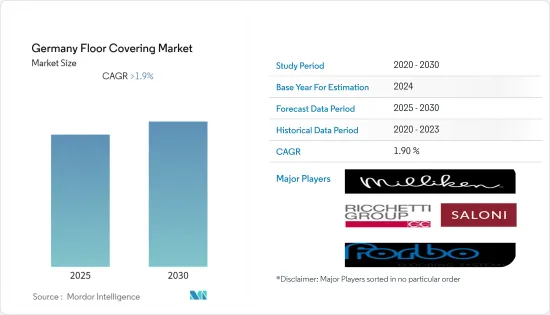

预计预测期内德国地板材料市场的复合年增长率将超过 1.9%。

德国在西欧地板材料市场占有很大的份额。由于经济放缓导致房地产和建设活动低迷,地板材料市场在研究期间趋于成熟并实现稳步增长。市场主要受整修驱动,通常受「自己动手做」(DIY)传统所主导。因此大多数消费群组更喜欢易于安装且不需要花费大量时间的产品。儘管纯线上趋势正在塑造该国的分销管道,但去商店的趋势仍然主导着市场,因为大多数消费者更喜欢去专卖店与专家交谈、透过推荐寻求建议并在购买前亲自查看产品。由于 COVID-19,该行业经历了明显的经济放缓,影响了地板材料市场,预计在预测期的最初几年将需要很长时间才能恢復。预计英国和西班牙等其他西欧主要国家也将出现类似的趋势。德国地板材料市场比较分散,几家主要企业拥有多样化的高品质产品。报告中介绍的几家主要企业在整个欧盟,尤其是西欧占有较高的市场占有率。

德国地板材料市场的趋势

德国建筑业成长推动市场

德国建筑业持续成长,目前已成为欧盟最大的建筑业。该部门收益与前一年同期比较1.8%。声学和预製建筑系统等细分领域的高度专业化正在推动市场成长,并推动该国整体地板材料市场的发展。该行业的收益份额不断增加,2015年仅住宅和非住宅建筑就创造了6000万美元的收入。

弹性地板材料市场日益重要

在调查期间,德国出现了大规模弃用传统地板材料的趋势。随着老龄人口逐渐增加,年轻一代正在寻找更现代的解决方案。明亮的色彩组合并且能够轻鬆融入室内装饰变得越来越重要。此外,预计预测期内该数字还会成长。随着德国社会的发展,人们对地板材料,尤其是地毯的兴趣明显下降。此外,地板产业呈现负成长趋势。

德国地板材料产业概况

本报告涵盖了在德国运营的主要企业的竞争格局。许多主要市场参与者在全球范围内运营,并在许多欧洲国家拥有强大的市场。德国地板材料市场是行业领导者的集合,他们采用各种策略,借助快速的技术进步来提高生产能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 主要市场交付品

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 德国地板材料市场的趋势

- 价值链分析

- 波特五力分析

- 技术创新

- COVID-19 对地板材料市场的影响

第五章 市场区隔

- 按材质

- 地毯和块毯

- 弹性地板材料

- 乙烯基地板材料

- 其他弹性地板材料

- 非弹性地板材料

- 地板

- 陶瓷地板材料

- 超耐磨地板

- 石材地板材料

- 按分销管道

- 承包商

- 专卖店

- 家装中心

- 其他分销管道

- 按最终用户

- 住宅装修

- 商业的

- 建造者

第六章 竞争格局

- 公司简介

- Milliken Flooring

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Porcelanosa Group

- Forbo Flooring GmbH

- PolyFlor

- Parador

- Egetaepper A/S

- German Flooring

- Nora Systems GmbH*

第七章 市场机会与未来趋势

第八章 免责声明

The Germany Floor Covering Market is expected to register a CAGR of greater than 1.9% during the forecast period.

Germany constitutes a major share in the floor covering market in the Western European Union. The market for floor coverings is mature and recorded stable growth during the study period, owing to the slowdown of economy, which led to weak real estate and construction activities. The market is majorly driven by refurbishments, which are usually led by do it yourself (DIY) traditions. Thus, the majority consumer group prefers products that are easy to install and do not involve more timelines. Even though a progression of dedicated online players is shaping the distribution channel in the country, a trend of going to the store is still dominating the market, as most consumers are still preferring going to a specialist store, in order to speak to an expert to seek help through recommendations and to physically witness the product before making a purchase. Due to COVID-19, the industry is experiencing a strong slowdown in the economy, thus affecting the market for floor coverings, and it is estimated to take much time to recover during the initial years of the forecast period. This trend is projected to be the same in the other major Western European countries, like the United Kingdom and Spain. The floor covering the market in Germany is fragmented, due to the presence of several key players with a diversified portfolio of high-quality products. Several key players mentioned in the report accounted for a high market share across the European Union, especially in the Western Europe.

Germany Floor Covering Market Trends

Growing Construction Industry in Germany is Driving the Market

The construction industry in Germany has been growing and contributes the largest share in the European Union. The revenue from the sector is recording an average growth rate of 1.8% year on year. The high level of specialization in niches, for example, the fields of acoustic and prefabricated construction systems are helping the market to grow, and they are driving the market for floor covering across the country. The industry generated USD 60 million alone from the construction of residential and non-residential buildings during 2015, and it has been recording increasing shares of revenue.

The Resilient Floor Covering Segment is Gaining More Significance

A major shift from the traditional floor coverings was observed in Germany during the study period. With the gradual increase in the aging population, the younger generation is looking for more modernized solutions. The vibrant color combinations, which easily get on with the interiors, are gaining more significance. Furthermore, they are estimated to grow during the forecast period. With the evolving German society, there is significant loss of interest, especially in flooring types, such as carpets. Furthermore, the wooden flooring segment recorded a negative growth trend.

Germany Floor Covering Industry Overview

The report covers the competitive landscape of the major players operating in the country. Most of the key players of the market have a global presence and a strong market in many of the European countries. The floor covering market in Germany is a combination of players who are leading the industry by adopting various strategies, in order to increase their production capacities with the help of rapidly changing technology advancements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Key Deliverables of the Market

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Trends in Germany Floor Covering Market

- 4.5 Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.7 Technological Innovations

- 4.8 Impact of COVID - 19 on Floor Covering Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Carpet and Area Rugs

- 5.1.2 Resilent Flooring

- 5.1.2.1 Vinyl Flooring

- 5.1.2.2 Other Resilient Flooring

- 5.1.3 Non-resilent Flooring

- 5.1.3.1 Wood Flooring

- 5.1.3.2 Ceramic Flooring

- 5.1.3.3 Laminate Flooring

- 5.1.3.4 Stone Flooring

- 5.2 By Distribution Channel

- 5.2.1 Contractors

- 5.2.2 Specialty Stores

- 5.2.3 Home Centers

- 5.2.4 Other Distribution Channels

- 5.3 By End User

- 5.3.1 Residential Replacement

- 5.3.2 Commercial

- 5.3.3 Builder

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Milliken Flooring

- 6.1.2 Saloni Ceramic SA

- 6.1.3 Gruppo Ceramiche Ricchetti SpA

- 6.1.4 Porcelanosa Group

- 6.1.5 Forbo Flooring GmbH

- 6.1.6 PolyFlor

- 6.1.7 Parador

- 6.1.8 Egetaepper A/S

- 6.1.9 German Flooring

- 6.1.10 Nora Systems GmbH*