|

市场调查报告书

商品编码

1684065

地板树脂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Flooring Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

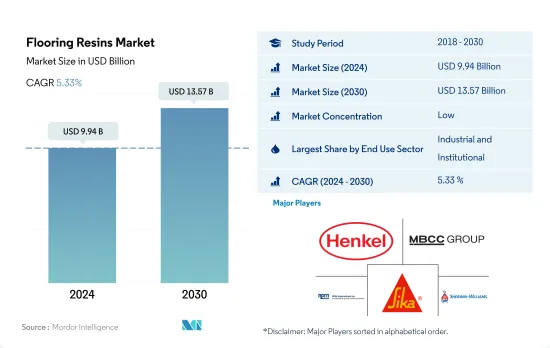

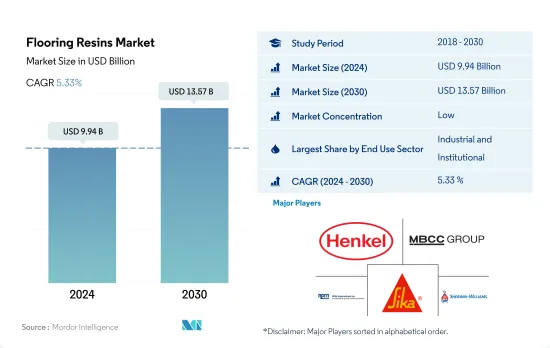

地板树脂市场规模预计在 2024 年为 99.4 亿美元,预计到 2030 年将达到 135.7 亿美元,预测期内(2024-2030 年)的复合年增长率为 5.33%。

购物中心、中心和办公室的需求不断增长可能会推动地板树脂的需求

- 2022年,全球地板树脂消费量成长率为3.08%,这得益于工业/机构和商业建筑领域需求的成长。到 2023 年,地板树脂市场预计将占全球建筑化学品市场的约 11.09%。

- 到 2022 年,工业和机构部门将占据 87.89% 的市场份额,成为地板树脂的主要消费领域。这一增长是由新建占地面积的显着扩张所推动的。例如,预计到2030年全球工业占地面积将比2023年增加20.1亿平方英尺。这一增长主要归因于工业、教育和医疗保健建设投资的增加。尤其是美国,预计2026年将在新工业建筑上投资475.9亿美元。因此,预计2030年工业领域对地板树脂的需求将比2023年增加35.9亿美元。

- 预计商业领域将引领地板树脂消费,预测期内复合年增长率将达 6.87%。预计到 2030 年,全球商业占地面积将增加 25 亿平方英尺,这主要得益于对购物中心、办公室和其他商业空间的需求激增,尤其是在开发中国家。例如,印尼计划在2025年建成6个购物中心计划,总面积达29.2万平方公尺。由于这些趋势,全球商业领域对地板树脂的需求预计将从 2023 年的 5.88 亿美元增加到 2030 年的 9.36 亿美元。

印度和日本控制亚太地区成长最快的地板树脂市场

- 2022 年北美对地板树脂的需求与前一年相比增幅最大。 2022 年该地区的需求与 2021 年相比增加了 5.74%。预计这一趋势将在 2023 年持续下去。因此,与 2022 年相比,预计 2023 年基础设施终端使用者领域对地板树脂的整体需求将成长最多。

- 以中国和印度为首的亚太地区占据全球地板树脂市场的主导地位。 2022年,光是这两个国家就占该地区总需求的77%。亚太地区地板树脂消费的主要驱动力是工业、机构,其次是商业。值得注意的是,印度预计将成为该地区成长最快的市场,预测期内(2023-2030 年)的复合年增长率为 7.5%。

- 欧洲是全球第二大地板树脂消费国,其中大多数已开发国家对地板树脂的需求量庞大。德国是该地区最大的地板树脂消费国,占2022年总需求的近17%。环氧树脂和聚氨酯基地板树脂占欧洲产品组合的80%以上。

- 以印度和日本为首的亚太地区预计将见证地板树脂市场最快的成长,预测期内(2023-2030 年)的复合年增长率为 6.13%。特别是,预计印度和日本的需求将快速成长,预测期内的复合年增长率分别为 7.53% 和 7.09%。

地板树脂市场的全球趋势

亚太地区大型办公大楼建设计划激增,将推动全球专用商业占地面积成长

- 预计2022年全球商业建筑占地面积将与前一年同期比较去年小幅成长0.15%。欧洲表现突出,增幅达 12.70%,这得益于欧洲大力推行节能办公大楼,以实现 2030 年二氧化碳排放目标。随着员工重返办公室,欧洲公司正在重新签订租约,刺激 2022 年新办公大楼建设面积达到 450 万平方英尺。预计这一势头将在 2023 年持续下去,全球成长率预计为 4.26%。

- 新冠疫情造成劳动力和材料短缺,导致商业建筑计划取消和延迟。然而,随着停工缓解和建设活动恢復,2021 年全球新增商业占地面积飙升 11.11%,其中亚太地区以 20.98% 的成长率领先。

- 展望未来,全球新增商业占地面积的复合年增长率将达到4.56%。预计亚太地区的复合年增长率将达到 5.16%,超过其他地区。这一成长背后的驱动力是中国、印度、韩国和日本商业设施建设计划的活性化。尤其北京、上海、香港、台北等中国主要城市的甲级办公室建设正在加速。此外,印度计划于 2023 年至 2025 年间在七大城市开设约 60 家购物中心,总面积约 2,325 万平方英尺。总合到 2030 年,亚太地区的这些措施将比 2022 年增加 15.6 亿平方英尺的新零售占地面积。

预计南美洲的住宅将出现最快的成长,这得益于政府加大对经济适用住宅计画的投资,这将推动全球住宅产业的发展。

- 2022年,全球新建住宅占地面积与2021年相比减少了约2.89亿平方英尺。这是由于土地稀缺、劳动力短缺以及建筑材料价格不可持续的高企造成的住宅危机。这场危机对亚太地区造成了严重影响,2022 年新占地面积与 2021 年相比下降了 5.39%。不过,2023 年的前景更加光明,预计全球新建占地面积将比 2022 年增长 3.31%,这要归功于政府投资,这些投资可以为 2030 年之前 30 亿人建造新的经济适用住宅提供资金。

- 新冠疫情造成经济放缓,导致大量住宅建设计划取消或延后,2020年全球新建占地面积较2019年下降4.79%。随着2021年限制措施的解除,住宅计划被压抑的需求得到释放,2021年全球新建占地面积较2020年增长11.22%,其中欧洲增幅最高,为18.28%,其次是南美洲,2021年较2020年增长17.36%。

- 预测期内,全球住宅新占地面积预计复合年增长率为 3.81%,其中南美洲的复合年增长率最快,为 4.05%。巴西政府宣布将于 2023 年实施「Minha Casa Minha Vida」等计画和倡议,并实施多项监管改革,计画投资 19.8 亿美元为低收入家庭提供经济适用住宅。

地板树脂产业概况

地板树脂市场较为分散,前五大公司占29.36%的市占率。该市场的主要企业有:汉高股份公司、MBCC 集团、RPM 国际公司、西卡股份公司和宣伟公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用途趋势

- 商业

- 工业/设施

- 基础设施

- 住宅

- 重大基础设施计划(目前和已宣布)

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用途部门

- 商业

- 工业/设施

- 基础设施

- 住宅

- 子产品

- 丙烯酸纤维

- 环氧树脂

- 聚天门冬胺酸

- 聚氨酯

- 其他树脂类型

- 地区

- 亚太地区

- 按国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 按国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东和非洲

- 按国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

- 按国家

- 加拿大

- 墨西哥

- 美国

- 南美洲

- 按国家

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Akzo Nobel NV

- Henkel AG & Co. KGaA

- KCC Corporation

- MBCC Group

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50002018

The Flooring Resins Market size is estimated at 9.94 billion USD in 2024, and is expected to reach 13.57 billion USD by 2030, growing at a CAGR of 5.33% during the forecast period (2024-2030).

Rise in demand for shopping malls and centers and offices is likely to drive the demand for flooring resins

- In 2022, the global consumption value of flooring resins registered a 3.08% growth rate, driven by heightened demand from the industrial and institutional and commercial construction sectors. In 2023, the flooring resins market was expected to grow by approximately 11.09% of the global construction chemicals market.

- With a dominant share of 87.89% in 2022, the industrial and institutional sector emerged as the leading consumer of flooring resins. This surge can be attributed to a notable expansion in new construction floor areas. For instance, the global industrial floor area is expected to rise by 2.01 billion square feet by 2030 compared to 2023. This uptick is primarily fueled by increased investments in industrial, education, and healthcare construction. Notably, the United States is anticipated to spend a staggering USD 47.59 billion on new industrial buildings by 2026. Consequently, the demand for flooring resins in the industrial sector is projected to rise by USD 3.59 billion in 2030 compared to 2023.

- The commercial sector is poised to be the frontrunner in flooring resin consumption, registering a robust CAGR of 6.87% during the forecast period. The global commercial floor area is expected to expand by 2.50 billion square feet by 2030, led by surging demand for shopping malls, offices, and other commercial spaces, particularly in developing nations. For instance, Indonesia is slated to witness the completion of six shopping mall projects, adding up to a total area of 292 thousand square meters by 2025. These trends indicate that the global flooring resin demand in the commercial sector is projected to increase from USD 588 million in 2023 to USD 936 million in 2030.

India and Japan managing the flooring resins market to grow the fastest in the Asia-Pacific region

- The demand for flooring resins in 2022 increased the most in North America compared to the previous year. The region registered a 5.74% growth in demand in 2022 compared to 2021. The trend was expected to continue in 2023. Thus, the overall demand for flooring resins was estimated to increase the most in the infrastructure end-user sector in 2023 compared to 2022.

- Asia-Pacific, spearheaded by China and India, dominates the global flooring resins market. In 2022, these two nations alone accounted for a staggering 77% of the region's total demand. Commercial usage, following industrial and institutional, is the primary driver of flooring resin consumption in the Asia-Pacific. Notably, India is poised to be the region's fastest-growing market, registering a CAGR of 7.5% during the forecast period (2023-2030).

- Europe is the world's second-largest consumer of flooring resins and has the highest number of developed countries contributing to such high demand. Germany is the region's most extensive flooring resins consumer, accounting for nearly 17% of the total demand in 2022. Epoxy and polyurethane-based flooring resins comprise more than 80% of Europe's portfolio.

- Asia-Pacific, driven by India and Japan, is expected to witness the most rapid growth in the flooring resins market, registering a CAGR of 6.13% during the forecast period (2023-2030). Specifically, India and Japan are expected to record surging demand, registering CAGRs of 7.53% and 7.09%, respectively, during this period.

Global Flooring Resins Market Trends

Asia-Pacific's surge in large-scale office building projects is set to elevate the global floor area dedicated to commercial construction

- In 2022, the global new floor area for commercial construction witnessed a modest growth of 0.15% from the previous year. Europe stood out with a significant surge of 12.70%, driven by a push for high-energy-efficient office buildings to align with its 2030 carbon emission targets. As employees returned to offices, European companies, resuming lease decisions, spurred the construction of 4.5 million square feet of new office space in 2022. This momentum is poised to persist in 2023, with a projected global growth rate of 4.26%.

- The COVID-19 pandemic caused labor and material shortages, leading to cancellations and delays in commercial construction projects. However, as lockdowns eased and construction activities resumed, the global new floor area for commercial construction surged by 11.11% in 2021, with Asia-Pacific taking the lead with a growth rate of 20.98%.

- Looking ahead, the global new floor area for commercial construction is set to achieve a CAGR of 4.56%. Asia-Pacific is anticipated to outpace other regions, with a projected CAGR of 5.16%. This growth is fueled by a flurry of commercial construction projects in China, India, South Korea, and Japan. Notably, major Chinese cities like Beijing, Shanghai, Hong Kong, and Taipei are gearing up for an uptick in Grade A office space construction. Additionally, India is set to witness the opening of approximately 60 shopping malls, spanning 23.25 million square feet, in its top seven cities between 2023 and 2025. Collectively, these endeavors across Asia-Pacific are expected to add a staggering 1.56 billion square feet to the new floor area for commercial construction by 2030, compared to 2022.

South America's estimated fastest growth in residential constructions due to increasing government investments in schemes for affordable housing to boost the global residential sector

- In 2022, the global new floor area for residential construction declined by around 289 million square feet compared to 2021. This can be attributed to the housing crisis generated due to the shortage of land, labor, and unsustainably high construction materials prices. This crisis severely impacted Asia-Pacific, where the new floor area declined 5.39% in 2022 compared to 2021. However, a more positive outlook is expected in 2023 as the global new floor area is predicted to grow by 3.31% compared to 2022, owing to government investments that can finance the construction of new affordable homes capable of accommodating 3 billion people by 2030.

- The COVID-19 pandemic caused an economic slowdown, due to which many residential construction projects got canceled or delayed, and the global new floor area declined by 4.79% in 2020 compared to 2019. As the restrictions were lifted in 2021 and pent-up demand for housing projects was released, new floor area grew 11.22% compared to 2020, with Europe having the highest growth of 18.28%, followed by South America, which rose 17.36% in 2021 compared to 2020.

- The global new floor area for residential construction is expected to register a CAGR of 3.81% during the forecast period, with South America predicted to develop at the fastest CAGR of 4.05%. Schemes and initiatives like the Minha Casa Minha Vida in Brazil announced in 2023 with a few regulatory changes, for which the government plans an investment of USD 1.98 billion to provide affordable housing units for low-income families, and the FOGAES in Chile also publicized in 2023, with an initial investment of USD 50 million, are aimed at providing mortgage loans to families for affordable housing and will encourage the construction of new residential units.

Flooring Resins Industry Overview

The Flooring Resins Market is fragmented, with the top five companies occupying 29.36%. The major players in this market are Henkel AG & Co. KGaA, MBCC Group, RPM International Inc., Sika AG and The Sherwin-Williams Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Sub Product

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyaspartic

- 5.2.4 Polyurethane

- 5.2.5 Other Resin Types

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 By Country

- 5.3.1.1.1 Australia

- 5.3.1.1.2 China

- 5.3.1.1.3 India

- 5.3.1.1.4 Indonesia

- 5.3.1.1.5 Japan

- 5.3.1.1.6 Malaysia

- 5.3.1.1.7 South Korea

- 5.3.1.1.8 Thailand

- 5.3.1.1.9 Vietnam

- 5.3.1.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 By Country

- 5.3.2.1.1 France

- 5.3.2.1.2 Germany

- 5.3.2.1.3 Italy

- 5.3.2.1.4 Russia

- 5.3.2.1.5 Spain

- 5.3.2.1.6 United Kingdom

- 5.3.2.1.7 Rest of Europe

- 5.3.3 Middle East and Africa

- 5.3.3.1 By Country

- 5.3.3.1.1 Saudi Arabia

- 5.3.3.1.2 United Arab Emirates

- 5.3.3.1.3 Rest of Middle East and Africa

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Henkel AG & Co. KGaA

- 6.4.4 KCC Corporation

- 6.4.5 MBCC Group

- 6.4.6 Nippon Paint Holdings Co., Ltd.

- 6.4.7 PPG Industries, Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 Sika AG

- 6.4.10 The Sherwin-Williams Company

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219